A Few Words Of Caution

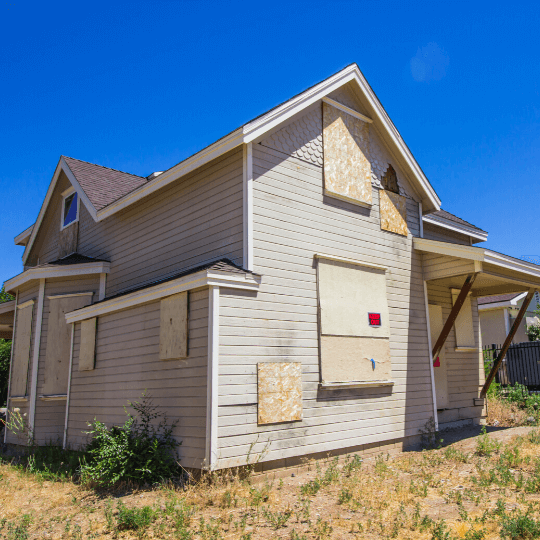

Distressed properties are generally sold as-is, as in what you see is what you get. There are no warranties so make sure a certified inspector looks over the property before you make an offer. You need to know how much it will cost to make the place habitable or flippable.

Lenders typically clear the title before listing a foreclosure, but its wise to hire a title company to research and cure title problems before closing on the property.

Its also a good idea to have your financing lined up before making a bid. But even if you offer cash, dont expect a deal on a bank-owned property to proceed quickly. Multiple pairs of eyes must review the deal and respond to your offer. It could take weeks, so be patient.

For more details about buying foreclosed properties, check the Foreclosure Buyers Guide in Zillows Foreclosure Center.

MORTGAGE CALCULATOR

Can You Get Your House Back After Foreclosure

Did you know that you may be able to regain ownership of your house even after the foreclosure sale date? Many states allow for this under a process called âstatutory redemption.â Under this rule, you have a limited amount of time to pay the foreclosure sale price , and you are usually allowed stay in your home during the redemption period, whether itâs 30 days or two years.

Avoiding Default On A California Mortgage Loan

Short of repaying what you owe, which is likely not possible, there are a few things you may try after being warned of a potential foreclosure on your home.

- Seek a loan modification from the lender. In order to avoid the expense of a foreclosure, your bank may be willing to restructure your loan.

- Seek a forbearance. During difficult times, like a pandemic, you may have other legal options provided by California law and federal law. You may ask for forbearance from lenders. This would allow you to take a break from your payments while rebuilding your finances. You must still start repaying all of the money you owe after a forbearance period is over.

Recommended Reading: How To Find Bankruptcy Filings In Texas

The Types Of Foreclosure Sale

Finding a foreclosed home depends on where exactly it is in the foreclosure process. Properties in the early stages of foreclosure or offered in a short sale may still be owned by the original homeowner or held by a bank or government.

Here are five types of foreclosure and the approaches to buying:

Why Do Homes Go Into Foreclosure

When a person buys a home, the bank that lends the money for it undertakes a rigorous process to make sure the borrower can afford to pay. About 70% of mortgages last for 30 years, and unforeseen circumstances can cause someones financial situation to change dramatically.

Many homeowners found that out during the COVID-19 pandemic. Loss of a job or reduction in income led more homeowners to fall three months or more behind on mortgage payments than had since 2010, the height of the Great Recession. By June 2021, 15 months into the pandemic, 1.9 million Americans were still three months or more behind on mortgage payments. But it doesnt take a global pandemic to dramatically change financial circumstances.

Major reasons for foreclosures are:

- Job loss or reduction in income

- Debt, particularly credit card debt

- Medical emergency or illness resulting in a lot of medical debt

- Divorce, or death of a spouse or partner who contributed income

- An unexpected big expense

- Moving without being able to sell the home

- Natural disaster

Also Check: Can You Apply For Bankruptcy Online

Is Foreclosure Good Or Bad

Hence, if you prepay your loan and foreclose it, it will result into saving a lot which you could have paid on the interest. End of any loan definitely gives a positive psychological impact on the borrower. It brings a sense of relief and foreclosing a higher interest loan is definitely a morale booster.

Purchase Your New Home

Read your inspection and appraisal results then decide if the home in question is really right for you and whether youre okay with buying a home as-is. Contact your mortgage lender to finalize your loan if you have the money or skills to make any needed renovations. Your real estate agent will help you submit your offer and prepare you for closing.

Find a local pro.

Also Check: How To Buy Homes From Banks

Track The Foreclosure Process To Learn About Surplus Funds

Because you don’t know whether a foreclosure sale will generate surplus funds, it’s a good idea to track the foreclosure process as it goes along. Take note of the foreclosure sale date, which will be in the foreclosure documents you receive.

After the auction, contact the trustee or officer that sold the property. This information, including the trustee or officer’s name and phone number, should also be in the paperwork you received during the foreclosure and in your local newspaper’s legal section where the sale notice was published. Call your loan servicer if you can’t figure out who conducted the sale or how to contact that person.

Then, ask the trustee or officer if the auction resulted in excess proceeds.

Hire A Real Estate Agent

Most lenders hand foreclosed properties off to an REOagent who works with standard real estate agents to find a buyer.

Not every real estate agent has experience working with REO agents. A qualified foreclosure agent can help you search for foreclosures, navigate your states REO buying process, negotiate your price, order an inspection and make an offer. Research real estate agents in your area and connect with an agent who specializes in foreclosure sales.

Don’t Miss: How To Find Companies In Bankruptcy

How Long Does Foreclosure Take

A foreclosure that ends in the sale of the home can take around 7 months to complete when there are no delays or complications. Most foreclosures do have delays and take longer to finish.

Californias Homeowners Bill of Rights often gives you more time to seek a resolution to your mortgage issues other than foreclosure. A backlog of foreclosure cases in California courts can also push back your foreclosure date.

Financing Options For Foreclosed Homes

Private lenders tend to be skittish about financing foreclosure deals. However, several government-sponsored financing options are available for those who qualify:

- 203 loans from the Federal Housing Administration ,

- Fannie Maes HomePath ReadyBuyer program,

- The HomeSteps program through Freddie Mac.

Also Check: What Does Chapter 11 Bankruptcy Mean For Shareholders

What Is A Foreclosure

A foreclosure is the legal process where your mortgage company obtains ownership of your home . A foreclosure occurs when the homeowner has failed to make payments and has defaulted or violated the terms of their mortgage loan.

A foreclosure can usually be avoidedeven if you already received a foreclosure notice. See the chart to compare some other options: Short Sale and Mortgage Release . No matter the option, you must take action as soon as you can.

Phase : Notice Of Default

A notice of default is sent after the fourth month of missed payments . This public notice gives the borrower 30 days to remedy past due payments before formally starting the foreclosure process.

Most lenders will not send a notice of default until the borrower is 90 days past due . Thus, many times a borrower can fall behind a month or two without facing foreclosure.

Generally, federal law prohibits a lender from starting foreclosure until the borrower is more than 120 days past due.

Also Check: Do You Need A Bankruptcy Attorney

What Are The Advantages And Disadvantages Of Buying A Foreclosed Home

Price: You could get the property for substantially below market value. Time: You don’t have to spend weeks or months in negotiations like in pre-foreclosure purchases. Lack of competition: Most auctions require cash bids, and this requirement could amount to slimmer competition at this stage more than any other.

Stay In The Home Until The Eviction Process Begins

If you refuse to move out after the lender has given you a notice of default and the foreclosure process is complete, then the new owner will be forced to begin the eviction process against you. In some states, this procedure can begin once the notice of sale has been issued and the sale date has passed. In other states, the redemption period must expire first. So the amount of time that youâll have to vacate the premises varies by state and other circumstances. In some cases, the new owner may be able to fold an eviction lawsuit directly into the foreclosure proceedings, while in others a separate eviction lawsuit must be filed.

You will usually be given an eviction notice a few days before the actual eviction will be enforced so that you have time to vacate the premises before the eviction deadline is reached. If you donât leave during this window of time, then the new owner will have the sheriff come and forcibly evacuate everyone from the house, and movers will come and remove all of your possessions. To avoid this stress and embarrassment, itâs best for you to leave on your own terms before the eviction deadline hits.

Don’t Miss: How To Find A Good Bankruptcy Lawyer

How Long Does A Foreclosure Take

Heres a graphic that lays out the steps involved in the foreclosure and gives you an approximate timeline. This is the absolute fastest that a foreclosure can happen if you as the homeowner do not participate in the court case.

In Ohio, a foreclosure almost never happens this quickly, but even if it did you are looking at six months of time. You will know how fast your case is working its way through the court. If you participate by filing an answer.

Even if you dont have any reasons to dispute the foreclosure. If you file an answer you will get notices telling you when a judgment has been issued. When the sheriffs sale is scheduled and when the sale to a new owner has been confirmed.

Having this information will help you decide when you should move. Filing the foreclosure does not mean you are immediately evicted from your home. Even though you have not paid your mortgage you are still the owner of a home and you have the right to remain in your home until the sale to a new owner has been confirmed.

Staying in your home until a new owner has been confirmed will give you time to make other living arrangements and frankly, may give you time to put together the money you need to relocate.

Staying in your home will also help preserve the property and keep it from being vandalized, Maintaining more value for the sale and decreasing any deficiency. Just because your lender actually filed a foreclosure case does not mean that the ownership of your house will change.

Understand The Options For Buying A Foreclosed Home

There are two main ways to purchase a foreclosure:, at an auction or from a lender after they have failed to sell at auction.

Purchase Through Short Sale

A short sale occurs when the homeowner sells a home for less than what they owe on the mortgage because the value has declined. Foreclosure has not been completed. The homeowner still owns the home so you work through their REALTOR®.

When you buy a home in a short sale, the lender needs to approve your offer. You might spend a lot of time waiting for approval.

Purchase At Auction

Youll get a home faster at auction than you would if you negotiated with the bank or a seller. Homebuyers also have the opportunity to buy a property significantly below at auction. However, most auctions only accept cash payments, which means that youll need to have a significant amount of money ready for the purchase.

If the auction does allow for financing through a mortgage, you want to make sure that you have a preapproval ready. Its important to realize that not all approvals are the same. We recommend a Verified Approval1 where your income and assets are verified.

By purchasing at an auction, you also agree to buy the home as-is without an appraisal or inspection. This means you take a big risk when you buy a foreclosed home at an auction. Speak with a real estate attorney if this is something youre interest in.

Purchase From A Lender

Also Check: How To Remove Bankruptcy After 7 Years

Why Foreclosed Homes Are Cheaper

The biggest selling point of a foreclosed home is, of course, its marked-down priceoften significantly lower than similar properties in the same area .

Most foreclosures are sold at a sizable discount from , with the exact amount varying from region to region. The seller may offer additional incentives such as a reduced down payment, lower interest rate, or the elimination of appraisal fees and some closing costs.

What makes these properties such a deal? If the residence is in the pre-foreclosure or short-sale stage, its owners are in a financial bind, and time is not on their side. They have to unload the property and get what they can while they can before they lose possession of it.

In short, these sellers arent negotiating from a position of strength and, while it may seem cruel to take advantage of their misfortune, a buyer can benefit.

The buyer can benefit even more if the property has been seized. The sheriffs office isnt interested in hanging onto a house, and banks dont want to be in the landlord business. Financial institutions typically want to rid themselves of foreclosed properties promptly. They need to get a reasonable priceThey have to answer to their investors and auditors. Still, buyers have an edge.

You should know that foreclosed homes are usually sold as is. If theres damage, repairs by the owner arent part of the equationbut, as used-car and vintage furniture aficionados know, as is translates into a discount.

Get Preapproved For A Mortgage

Unless you buy a home at a foreclosure auction, youll probably get a mortgage to fund your home purchase. Once youve found an agent and you get started looking at homes, youll want to get preapproved for a loan. A preapproval lets you know how much you can get in a home loan. Choose a lender and apply for a mortgage preapproval to narrow your search.

Recommended Reading: Can You Declare Bankruptcy And Keep Your Home

Loan Modification In Pre

A loan modification is a popular means to save your house when youre struggling to pay your monthly mortgage. You can request that your lender extend the length of your loan, so youre responsible for paying less each month. Lenders may also opt to lower the interest rate or allow you to tack your missed payments onto the end of your loan.

If it looks like a modification can be arranged, its in a lenders financial best interest to work with homeowners to keep them in their home. Then the bank doesnt have to go through the hassle of completing the foreclosure process, evicting the homeowners, and likely having to sell the home to get back its investment. If a loan modification deal is reached, then pre-foreclosure ends, and the homeowners go back to making regular payments on their loan.

Which Will Keep You In Your House Longer Foreclosure Or A Short Sale

Both foreclosures and short sales will result in the loss of your current home, but there are differences. Foreclosures can involve a long legal process, and that may give you some extra time in your home, but once the foreclosure is complete, you may be required to leave immediately. Short sales give you a bit more flexibility to negotiate the terms of the sale.

You May Like: How To File Bankruptcy In Georgia

How Will Foreclosure Hurt My Credit Score

A foreclosure is a severely negative credit event, knocking off 100 points or more from your credit score, according to FICO. Additionally, it stays on your credit report for seven years.

The missed payments prior to the foreclosure will also have a damaging effect on your credit. Because missed payments top the list of negative events, your credit score will suffer before the foreclosure process even begins.

Can The Sheriff Just Come And Set You Out

The answer is no, not without a special order called a writ of restitution. If you are still living in your home the new owner can request this writ without filing any new court papers. The sheriff will come and serve you with the writ tell you to vacate and tell you when he or she will come back to remove your stuff if you have not moved.

If you have been a part of the court case you will know when the sale takes place and when the sale is confirmed. So you will have a good idea of when you actually do need to move. I hope that by that time you will have been able to make other living arrangements.

Recommended Reading: How To Figure Dti For Mortgage

What Happens After The Foreclosure Sale Date

Created by FindLaw’s team of legal writers and editors| Last updated February 28, 2017

As a homeowner, the last thing you want to think about is losing your home. But as many people have found, itâs common to struggle with those hefty mortgage payments, especially if you lose your job or the housing market crashes. Even if you have fallen behind on your payments, you may be able to get back on track and save your home. However, if youâve exhausted your options and face foreclosure, itâs important to know what happens after the foreclosure sale date.

Foreclosure Process Step : Notice Of Default

If a borrower cant come up with the funds to pay what he or she owes, a lender will issue a notice of default. This form will be sent to the mortgagee in the mail via a certified letter, and it typically gives a homeowner 90 days to pay off the most recent bill.

This step marks the beginning of the formal and public foreclosure process, Zuetel says.

Theres still time to save your home after a notice of defaultif you can find the cash. One option is a mortgage reinstatement, whereby you reinstate your mortgage by making up all the missed payments at once, plus interest and lender fees. Youll then go back to paying your monthly bill as usual.

Recommended Reading: Pallet Items For Sale