Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

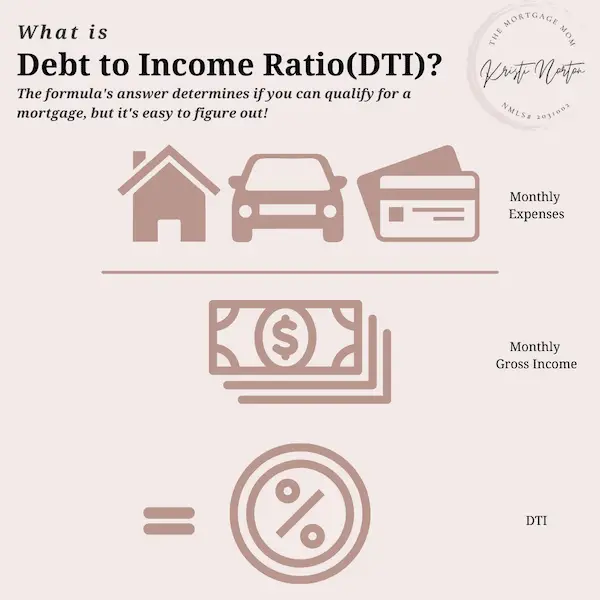

Divide That Total By Your Gross Monthly Income

Once you have an idea of what your monthly debt total is, divide it by your gross monthly income to determine your DTI ratio. Your gross monthly income is the amount of money you make each month before taxes. You can usually find your gross income on your paystubs or you can calculate it.

If you are a salaried employee, you can divide your yearly salary by 12 to find your gross monthly income. If you are paid hourly, multiply your hourly rate by the number of hours you work in a week and then multiply that number by 52 to get your yearly income, which you can divide by 12 to get your monthly gross income.

Once you know your monthly gross income, you should be able to use it to find your DTI. If you make $4,000 a month as your gross income and your total debts amount to $1,200, the formula to calculate your DTI would look like this:

= 0.3, or 30%

Can I Reduce My Dti Yes

Yes, there are several strategies that could help you reduce your DTI ratio. For example, if you focus on paying down your debt balances, you can also lower your DTI ratio.

Here are some potential ways to do this:

If you have reviewed your DTI ratio and decided to take out a personal loan, remember to consider as many lenders as possible to find the right loan for your needs.

This is easy with Credible: You can compare your prequalified rates from multiple lenders in two minutes without affecting your credit score.

Ready to find your personal loan? Credible makes it easy to find the right loan for you.

- Free to use, no hidden fees

- One simple form, easy to fill out and your info is protected

- More options, pick the loan option that best fits your personal needs

- Here for you. Our team is here to help you reach your financial goals

Recommended Reading: Liquidation Boxes For Sale

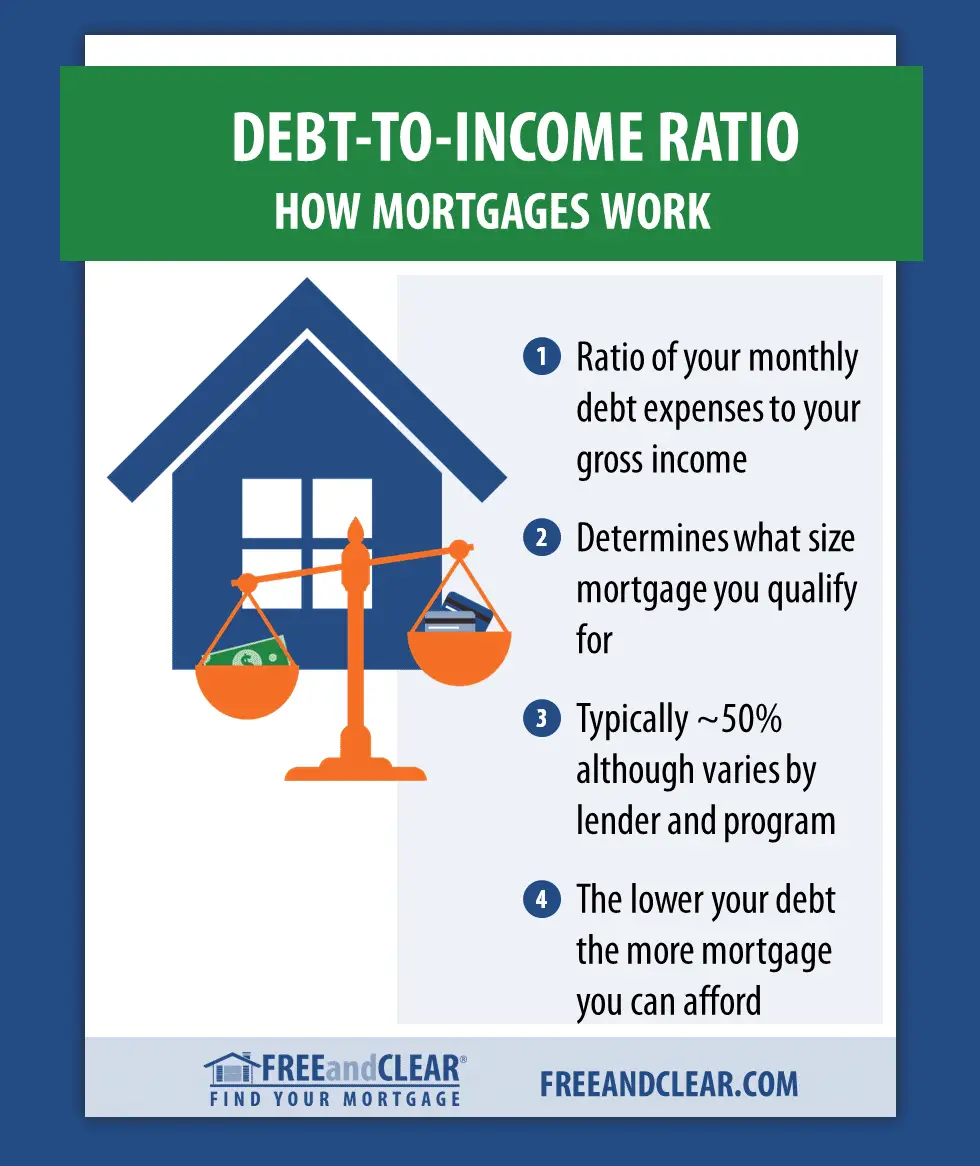

Why Is Dti Important

Your DTI is important to both you and lenders because it demonstrates that you have a good balance of debt and incoming funds. It proves to lenders that you are responsible with your money and that you can handle additional debt.

The Consumer Financial Protection Bureau requires that mortgage lenders examine your financial health before you take out a loan to assure that you can afford to repay the money. Calculating your DTI is one of a few ways they go about doing this. If your DTI percentage is low enough, you may qualify for a better loan than you would if you were responsible for more debt. On the other hand, if your DTI is too high, lenders may be unwilling to grant you a mortgage loan, so its important to make sure your DTI is within an acceptable range.

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

Recommended Reading: Chapter 7 Bankruptcy Petition

Lowering Your Dti Ratio For Better Success With Lenders

Whether youre a first-time homebuyer entering the real estate market or someone looking to take out a personal loan, theres a good chance that your lender will evaluate your DTI ratio.

A DTI ratio is a strong measure of financial health, as it indicates how much of your monthly income goes toward debt. When applying for a new loan, lenders will consider the likelihood of repayment when offering your rate and term length. The lower the DTI ratio, the higher likelihood you have of securing the best rate.

There are ultimately only two ways to lower your DTI ratio. You can either increase your income or lower your debt. Lowering your debt is often easier in the short term. Doing so also helps build credit.

If you have credit card balances causing high monthly debt payments, be sure to look into Tally. Tally is a credit card payoff app that automatically pays off your credit cards with a low-interest line of credit in the most efficient way possible. By doing so, you free up cash that you can use to pay off other debts, thereby lowering your DTI.

Refinance Your Current Loans

Depending on how high your DTI is, you might still be able to replace your current debt with a refinance loan. If you took out a loan when rates were higher, chances are theres a more affordable option today. For instance, if youre paying high interest on your current auto loan, you could refinance it to improve your monthly payments.

As a result, youll lower your debt-to-income ratio.

Recommended Reading: How To File Bankruptcy In Michigan

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

Who Benefits From The Higher Dti Ratio Limit

Borrowers who have strong credit scores and a steady income but live in expensive housing markets are likely to benefit the most from the DTI change, says Michael Fratantoni, chief economist with the Mortgage Bankers Association.

Thats because they otherwise wouldnt qualify for a conventional loan, and theyd have to take out a jumbo loan, he adds.

Jumbo loans are also called nonconforming loans because the loan amount exceeds the limits established by Fannie Mae and Freddie Mac.

While most properties in the U.S. have a loan limit of $548,250, some in higher-cost areas have a higher limit of $822,375, according to the Federal Housing Finance Agency.

That said, the average borrower wont suddenly have more access to mortgage credit because of a higher DTI ratio limit, Fratantoni says.

After all, he notes, lenders may also look at your credit payment history, FICO score, income and credit utilization to determine if you can repay your loan.

Don’t Miss: What Happens When A Corporation Files Bankruptcy

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

Should I Apply For A Home Loan With A High Dti

In limited instances, high debt-to-income ratios mean lenders may be less willing to give you a mortgage loan or may ask you to pay a higher interest rate for the loan, costing you more money. While you can still apply for and receive a mortgage loan with a high DTI, its best to look for ways to lower the ratio if possible so you can get a better interest rate.

Also Check: Can Sba Loans Be Discharged In Bankruptcy

What Is Considered A Good Debt

The lower the better.

A lower DTI implies you have plenty of income to meet your debt obligations. Again, that doesnt necessarily mean you can afford a loan since the ratio doesnt include a lot of typical monthly expenses.

Lenders prefer to see a DTI below 36%, especially when applying for a mortgage. That being said, you can have a DTI ratio above 36% and still be approved for a loan.

How? Because lenders will also look at other personal factors, such as credit history, credit score, loan-to-value and cash reserves. If you have a strong credit score or plenty of cash set aside, you could still qualify for a loan even if you have a high DTI.

How Can You Lower Your Dti

There are two ways to lower your DTI: you can pay down your debts or you can increase your income. If you can manage both, that would be ideal. There are a few ways to make paying off your debt more manageable. You can look into applying for a debt consolidation loan, which pays off your different debts and gives you just one monthly payment to worry about. You could also consider a home equity loan if you own your home.

It definitely pays to get out from under credit card debt sooner rather than later, as with the Federal Reserve’s interest rate hikes, it’s becoming more expensive. You can raise your income through seeking out a pay increase at work, finding a new job, or even adding a side hustle. Using a side hustle to get out of debt and put aside extra money may mean giving up some of your free time, but it might be worth it.

Being in debt can be scary, and if your DTI is less favorable than the average American’s, you might feel ashamed of that. But you’re in good company, and with some hard work and the right tools at hand, you can lower your DTI and improve your financial life.

Also Check: What Does Chapter 11 Bankruptcy Mean

Add Up Your Total Monthly Debt Payments

This should include your housing payments as well as any payments reported to the credit bureaus for example:

- Mortgage or rent payments

- Minimum credit card payments

- Alimony or child support payments

Keep in mind:

So while your DTI ratio might seem low, youll need to consider your entire financial situation to fully understand how much you can reasonably spend on a new loan.

Pay More Than The Minimum

Any time you owe a debt, if you can afford to pay more than the minimum it will help you chip away at the actual loan balance. By paying only the minimum, you are merely covering the interest on the loan and so your total debt doesnt shrink. Additionally, paying more than the minimum helps to improve your and minimize interest charges, too.

Also Check: What Are The Different Bankruptcy Options

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

Recommended Reading: What Is Your Credit Score After Bankruptcy

Your Dti When Refinancing

So youre about to Refinance your home- nice! There are many things to consider before moving forward. Most Borrowers tend to lose sleep over their credit scores, job history, amount of income, etc.. However, one of the most overlooked variables in determining mortgage eligibility is the Borrowers DTI . As a matter-of-fact, DTIs are the #1 reason Mortgage applications get rejected.

The DTI is determined using the following equation:

÷ monthly income = Your DTI

*The lower your DTI, the better chances you have of obtaining lower rates and getting your mortgage approved.

What Does Your DTI Tell Lenders?

A low debt-to-income ratio demonstrates a good balance between debt and income. In other words, if your DTI ratio is a lower figure For example, lets say your DTI is 15%, which means that 15% of your monthly gross income goes to debt payments each month. On the other hand, a higher DTI number can signal that an individual has too much debt for the amount of income earned each month.

Typically, borrowers with low debt-to-income ratios are likely to manage their monthly debt payments more effectively and have better chances of obtaining a better mortgage. As a result, banks and financial credit providers want to see low DTI ratios before issuing loans to a potential borrower. The preference for low DTI ratios makes sense since lenders want to be sure a borrower isnt fiscally overwhelmed by having too many debt payments relative to their income.

You Are Leaving Michigan First Credit Union

You are now leaving the Michigan First Credit Union website. External third-party websites will be presented in a new and separate content window. Michigan First Credit Union does not provide, and is not responsible for, the products and services, overall website content, accessibility, security, or privacy policies on any external third-party sites.

Don’t Miss: The Us Debt Clock

What Is Your Debt

One of the many things a lender considers about your home equity loan application is your debt-to-income ratio. Since this calculation compares what you earn to the total amount of debt youll have if youre approved, its a key indicator of your overall financial health. More specifically, your DTI ratio helps the lender estimate how much you can pay on a loan, after you make your existing payments.

Applicants whove kept their debt to a minimum relative to their earnings are more likely to get the loan theyre applying for, along with more favorable terms. Consider this example:

Pete and Melissa are a young couple looking to renovate their 19th century home. Together they make $15,000 per month before taxes. After approval, they will have $5,000 in monthly debt which puts their DTI at 33 percent, which is ten percentage points lower than a typical conventional maximum allowable debt for a home equity loan.

As a result of their low DTI and other positive indicators, Pete and Melissa received a home equity loan for the amount they requested and with favorable terms. However, a household with a borderline 43 percent DTI may have to accept a lower loan amount, a different loan length, or not be approved at all.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Does Filing For Bankruptcy Affect Credit

How To Calculate Your Debt

Lenders calculate your debt-to-income ratio by using these steps:

1) Add up the amount you pay each month for debt and recurring financial obligations . Dont include your current mortgage or rental payment, or other monthly expenses that arent debts .

2) Add your projected mortgage payment to your debt total from step 1.

3) Divide that total number by your monthly pre-tax income. The resulting percentage is your debt-to-income ratio.