Debt Held By Foreign Creditors

15. 26.16% of the US government debt was owned by foreign and international institutions in December 2021.

As of December 2021, the largest component of the US government debt 40.94% was owned by the federal reserve and government accounts. However, it is the foreign-held debt that could be a matter of concern. According to the national debt chart, 11.09% is held by mutual funds, 5.87% by depository institutions, 4.9% by state and local government, etc.

16. Japan is the largest holder of US treasury securities, valued at $1.3 trillion in May 2022.

Other countries with significant holdings are China , the United Kingdom , Ireland , and Luxembourg . The large foreign holdings of the national debt of the United States leave the country vulnerable in the event of a shock, such as a collapse in housing prices or an extreme national security breach. There are other concerns, as well, when foreign countries, including potentially antagonistic ones, hold a large portion of the countrys securities.

18. China has held more than $1 trillion in US national debt since 2010.

National Debt For Selected Years

| Fiscal year | |

|---|---|

| 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.

On June 25, 2014, the BEA announced: “n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 19402009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 19502010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures were revised back to 1947.

Fiscal years 19401970 begin July 1 of the previous year fiscal years 19802010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

19091930 calendar year GDP estimates are from MeasuringWorth.com Fiscal Year estimates are derived from simple linear interpolation.

Audited figure was “about $5,659 billion.”

Audited figure was “about $5,792 billion.”

Audited figure was “about $6,213 billion.”

Audited figure was said to be “about” the stated figure.

Audited figure was “about $7,918 billion.”

Audited figure was “about $8,493 billion.”

Tracking The Federal Deficit: August 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $173 billion in August, the eleventh month of fiscal year 2021. Because August 1 fell on a weekend this year, certain large federal payments that typically pay out on the first of the month were shifted into late July. If not for this timing shift, the August deficit would have been $233 billion$60 billion greater than reported. Monthly revenues rose 20% compared to last August, primarily due to increased income and payroll tax receipts. Spending increased by 4% year over year, driven by changes in pandemic response spending.

So far this fiscal year, the federal government has run a cumulative deficit of $2.7 trillion, the difference between $3.6 trillion in revenue and $6.3 trillion in spending. This deficit is 10% lower than over the same period in FY2020, but more than 150% larger than the FY2019 deficit at this point in the year.

Analysis of Notable Trends: With one month to go until the close of fiscal year 2021, the federal government is on track to record a somewhat smaller deficit than last year. The economic recovery has buoyed revenues, and the tapering of some large pandemic relief programs has slowed growth in outlays.

Also Check: What Are The Alternatives To Filing Bankruptcy

Fannie Mae And Freddie Mac Obligations Excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of Fannie Mae and Freddie Mac has made the U.S. government reluctant to incorporate them into its own books. When the two mortgage companies required bail-outs, White House Budget Director Jim Nussle, on September 12, 2008, initially indicated their budget plans would not incorporate the government-sponsored enterprise debt into the budget because of the temporary nature of the conservator intervention. As the intervention has dragged out, pundits began to question this accounting treatment, noting that changes in August 2012 “makes them even more permanent wards of the state and turns the government’s preferred stock into a permanent, perpetual kind of security”.

Tracking The Federal Deficit: January 2022

The Congressional Budget Office estimates that the federal government ran a surplus of $119 billion in January 2022, the fourth month of fiscal year 2022. Januarys surplus was the first recorded since September 2019, and it was the difference between $467 billion in revenues and $348 billion in spending. In comparison, last January, the federal government ran a $163 billion deficit. Additionally, both this year and last year, the timing of the New Years Day federal holiday shifted some payments that would have normally been due at the beginning of January into December. In the absence of these timing shifts, the federal government would have run a smaller monthly surplus in January 2022 of $95 billion.

Analysis of notable trends: In the first four months of FY2022, the federal government ran a deficit of $259 billion, $477 billion less than at this point in FY2021. It is noteworthy, however, that the cumulative deficit for FY2022 thus far compares favorably to that of FY2020 , prior to the onset of COVID-19.

Notably, net interest on the public debt rose 22% to $140 billion for the fiscal year to date, primarily reflecting the impact of rising inflation on adjustments to the principal of inflation-protected securities.

Recommended Reading: Which Of These Statements Regarding Bankruptcy Is False

Definition Ofgeneral Government Debt

General government debt-to-GDP ratio measures the gross debt of the general government as a percentage of GDP. It is a key indicator for the sustainability of government finance. Debt is calculated as the sum of the following liability categories : currency and deposits debt securities, loans insurance, pensions and standardised guarantee schemes, and other accounts payable. Changes in government debt over time primarily reflect the impact of past government deficits.

Tracking The Federal Deficit: July 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $61 billion in July, the tenth month of fiscal year 2020. Although this Julys deficit was actually smaller than last Julys $120 billion deficit, the change does not represent an improved fiscal condition but a mere timing shift. The deadline for non-withheld individual and corporate income taxes, normally in April, was delayed until July of this year, causing an unusual spike in July revenue . Even this influx of taxes was overcome by monthly outlays that, at $624 billion, were 68% greater than last Julys. The cumulative budget deficit for FY2020 now stands at $2.8 trillion, more than triple the deficit at this point last year.

Analysis of notable trends: Stepping back from monthly fluctuations caused by the change in filing deadlines, total revenue so far this fiscal year is down 1% from this point last year. Revenues through this March had actually been 6% higher than through the same point last fiscal year, as higher individual and corporate earnings led to greater individual and corporate income tax receipts. Then the pandemic hit. From April through July, revenues are 10% lower than over same months last year, a combination of economic damage and legislation that gave individuals and corporations greater tax deductions.

Recommended Reading: Can You File Bankruptcy On Student Loans In Kentucky

Tracking The Federal Deficit: October 2018

Analysis of Notable Trends in October 2018:The Congressional Budget Office reported that the federal government generated a $98 billion deficit in October, the first month of Fiscal Year 2019. Octobers deficit is 56 percent higher than the deficit recorded a year earlier in October 2017. Total revenues increased by 7 percent , while spending increased by 18 percent , compared to a year earlier.

Tracking The Federal Deficit: December 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $143 billion in December, the third month of fiscal year 2021. This deficitthe difference between $346 billion of revenue and $489 billion of spendingwas made greater because January 3 fell on a Sunday, causing some payments normally made on that day to instead be made in December. If it were not for this timing shift, Decembers deficit would have been $96 billion, still $55 billion greater than that of December 2019. The deficit so far in fiscal year 2021 has climbed to $572 billion, which is $215 billion more than at this point last year. While revenues in these months were nearly unchanged from last year, outlays have grown by 16% .

Analysis of notable trends: December extended the pattern of fiscal year 2021, with little year-over-year change in revenue but a 17% rise in spending. Of all outlays, unemployment insurance benefitswhich totaled $3 billion last December but $28 billion this Decembercontributed the most to the spending increase. This has been a trend: Unemployment insurance benefits have caused almost 40% of greater cumulative spending from this point last year, soaring from $7 billion in the first three months of fiscal year 2020 to $80 billion so far this fiscal year. Decembers spending on Medicaid and Social Security benefits further added to the deficit.

Revenues rose 3% from last December, thanks to greater individual income and payroll tax receipts.

You May Like: How Many Times Can You File Bankruptcy In Tn

Us Debt Burden To Rise To 185% Of Gdp In 2052 Cbo Projects

The Federal Reserve building is pictured in Washington, D.C., U.S., August 22, 2018. REUTERS/Chris Wattie/File Photo

Register now for FREE unlimited access to Reuters.com

WASHINGTON, July 27 – The U.S. federal debt burden will reach 185% of economic output in 2052, the Congressional Budget Office projected on Wednesday, an improvement over last year’s long-term estimate but a projection marked by exponentially higher interest costs and weak population growth.

The CBO in 2021 had projected federal debt in 2051 at 202% of U.S. GDP output, with this year’s improvement due to a strong recovery from the COVID-19 pandemic. The estimates assume current tax and spending laws remain in place over the next 30 years.

The CBO estimated U.S. net interest outlays as a percentage of GDP to rise to 7.2% in 2052 versus 1.6% this year.

Register now for FREE unlimited access to Reuters.com

This is driven both by the growing size of the debt and higher interest rates over the next 30 years, the non-partisan fiscal referee agency said. The average interest rate on federal debt is expected to grow from 1.8% in 2022 to 3.1% in 2032 and 4.2% in 2052.

While the 2022 budget deficit is expected to be significantly smaller as a share of the economy — 3.9% — than during the high COVID-19 pandemic spending years of 2020 and 2021, deficits grow significantly in subsequent years, reaching 11.1% of GDP in 2052.

Register now for FREE unlimited access to Reuters.com

United States Total Debt: % Of Gdp

Key information about United States Total Debt: % of GDP

- United States Total Debt accounted for 810.2 % of the country’s GDP in 2022, compared with the ratio of 820.1 % in the previous quarter.

- US Total Debt: % of GDP data is updated quarterly, available from Dec 1951 to Mar 2022.

- The data reached an all-time high of 856.1 % in Mar 2021 and a record low of 291.9 % in Mar 1952.

View United States’s Total Debt: % of GDP from Dec 1951 to Mar 2022 in the chart:

You May Like: Can You File Bankruptcy On Student Loans In Missouri

Tracking The Federal Deficit: June 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $88 billion in June 2022, the ninth month of FY2022. This deficit was the difference between $461 billion in receipts and $548 billion in spending and was roughly half the size of the deficit recorded in June 2021.This years June receipts were up by $11 billion compared to last year, as individual tax refunds declined $16 billion less than they were last June due in part to changes in tax-filing deadlines.

Analysis of notable trends: Over the first nine months of FY2022, the federal government ran a deficit of $514 billion23% the size of the deficit over the same period in FY2021 , and 69% of that recorded at this point in FY2019 , prior to the COVID-19 pandemic. Strong revenue growth and lower levels of spending contributed to the shrinking deficit. So far this year, revenues totaling $3.8 trillion were $779 billion greater than over the same period in FY2021. Individual income and payroll tax receipts largely drove this spike, increasing $690 billion as wages and salaries continued to increase amid a tight labor market. Corporate tax revenues also rose by $41 billion . Unemployment insurance receipts rose by $14 billion as states continued to replenish their trust funds, and customs duties and excise tax receipts went up by $16 billion and $11 billion respectively, reflecting an increase in imports and economic activity.

What The National Debt Means To You

The national debt level has been a significant subject of controversy for U.S. domestic policy. Given the amount of fiscal stimulus pumped into the U.S. economy over the past couple of years, it is easy to understand why many people are starting to pay close attention to this issue. Unfortunately, the manner in which the debt level is conveyed to the general public is usually very obscure. Couple this problem with the fact that many people do not understand how the national debt level affects their daily lives, and you have a centerpiece for discussion.

Also Check: How Does Chapter 13 Bankruptcy Work

Tracking The Federal Deficit: September 2021

The federal deficit for September 2021 was $59 billion, approximately $65 billion less than the deficit for September 2020. This deficit was the difference between revenues of $460 billion and spending of $519 billion. Although individual and corporate tax payments in September typically produce a large surplus, COVID-19 relief spending eclipsed them and led to a September deficit for the second year in a row.

Revenues increased by $87 billion in relation to the same month last year. The increase was mostly caused by a 23% rise in income and payroll taxes and a 71% increase in corporate income tax receipts.

Spending rose $22 billion year-over-year. Notably, spending by the Department of Education was 107% higher than in September 2020. An upward revision of $95 billion to the departments estimated net subsidy costs of loans and loan guarantees was driven partially by pandemic-related causesincluding the extension of pauses on the payment of loan principal and interest and the collection of loans in defaultand partially by re-estimates of how much the federal government would be repaid on its outstanding portfolio. Spending on refundable tax credits increased $21 billion year-over-year primarily due to the monthly advanced Child Tax Credit payments authorized by the American Rescue Plan earlier this year.

Tracking The Federal Deficit: March 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $191 billion in March 2022, the sixth month of fiscal year 2022. This shortfall was the difference between $315 billion in receipts and $506 billion in spending. The March 2022 deficit was $469 billion smaller than the March 2021 deficit, largely a result of the winding down of most pandemic relief spending that was in place during March 2021.

Analysis of notable trends: Halfway through fiscal year 2022, the cumulative deficit has fallen relative to last year and is now comparable to pre-COVID deficits. Through the first six months of FY2022, the federal government ran a deficit of $667 billion, 61% less than at the same point in FY2021 and in the ballpark of the FY2019 and FY2020 deficits, which stood at $691 billion and $743 billion, respectively.

Revenues remained strong, rising $418 billion from the same period in FY2021 to a total of $2.1 trillion during this fiscal year to date. Increases in individual income and payroll tax receipts rose by $357 billion and drove much of the overall surge in receipts. Higher total wages and salaries, especially among upper-income workers who are subject to higher tax rates, contributed to the increase in those tax revenues, as did the receipt of some payroll taxes that pandemic relief legislation authorized companies to defer from 2020 into 2021. Corporate income tax revenues rose by $22 billion year-over-year.

Don’t Miss: How Much Is Bankruptcy Chapter 7 In Ohio

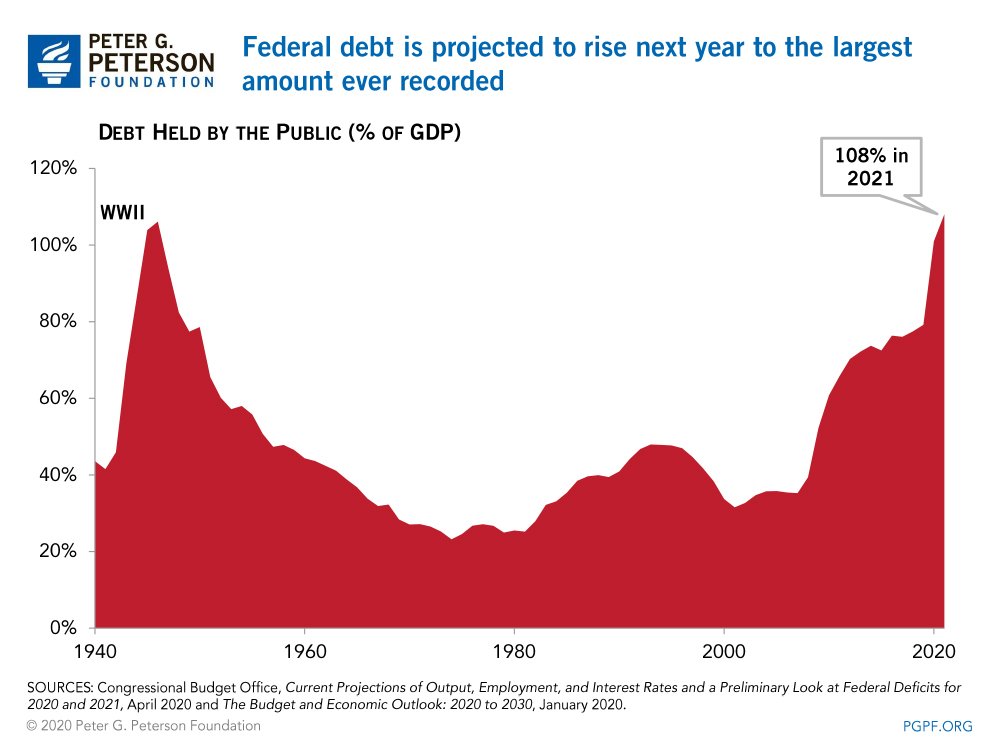

Why Is It Happening

The underlying conditions driving this unsustainable fiscal outlook existed well before the pandemic. Every fiscal year since 2002, the federal government has run a deficitmeaning spending exceeds its revenuesand added to its debt. Going forward, spending, including for Social Security, Medicare/Medicaid, and net interest on the debt, is projected to continue to outpace revenue by increasing amounts.

Demographic and other trendslike rising health care costsare putting pressure on declining Social Security and Medicare trust funds. Higher interest rates could also combine with rising debt to increase deficits going forward.

Learn more in our annual report:

Federal Debt Trends Over Time

The U.S. has steadily increased the federal debt since2001. Another way to view the federal debt over time is to look at the ratio of federal debt related to gross domestic product . This ratio has also increased over time. According to the most recentFinancial Report of the United States Government , the current fiscal policy is not sustainable.

Don’t Miss: How To Declare Bankruptcy In Missouri