Check Your Credit Report

Check your credit report every few months to be aware of the factors influencing your credit score. Compare each entry in the report to your own financial records to ensure that debt balances and account histories are accurate. Dispute any inaccurate or fraudulent listings in your report as quickly as possible to avoid negative impacts. Personally contact any companies that have legitimately listed defaults or missed payments, and work with them to establish repayment plans to avoid further negative reports. Read More:How Long Does a Foreclosure Stay on Your Credit Report?

Recovering From A Bankruptcy

Youre likely dealing with a multitude of financial, and perhaps personal, problems immediately following a bankruptcy. You may want to start by focusing on those, and when youve got a little breathing room, you can start taking steps to improve your credit as well.

In fact, even if you somehow magically got your credit score to jump up to a perfect 850 in a month, the bankruptcy could still affect your creditworthiness. A credit score is just one factor that creditors consider when reviewing your application and underwriting a loan or credit account. In some cases, regardless of your credit score, you may be automatically rejected for a credit card application if youve had a bankruptcy within the last couple of years.

How To Build Back Your Credit After Bankruptcy

Rebuilding your credit after filing for bankruptcy can seem daunting, but there are some steps you can take to help your credit history begin to recover:

- Make sure all payments are on time going forward. Sometimes, the bankruptcy court will allow you to keep certain accounts open. If you still have open and active accounts that were not included in bankruptcy, be sure to make every payment on time.

- Open a new account. If you are starting from scratch with no remaining open accounts, it can be difficult to qualify for new credit after bankruptcy. Consider opening a secured credit card, getting a , or asking a friend or family member to add you as an on their credit card. Making small purchases and then paying the balance in full each month will help build a positive payment history, which in time can help offset the negative impact of the bankruptcy.

- Check your credit report frequently. Stay on top of your credit situation by reviewing your credit report often. You can also request your free credit score from Experian, which will include a list of the top risk factors impacting your scores.

- Sign up for Experian Boost. Adding your on-time cellphone, utility and streaming service payments with Experian Boost can help you increase your credit score so you can start to rebuild after bankruptcy.

Read Also: How To Be A Bankruptcy Lawyer

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

How Long Can Bankruptcy Affect Your Credit Scores

Bankruptcy can affect your credit scores for as long as it remains on your credit reports. Thats because your scores are generated based on information thats found in your reports.

But the impact of bankruptcy on your credit scores can diminish over time. This means your credit scores could begin to recover even while the bankruptcy remains on your credit reports.

After the bankruptcy is removed from your credit reports, you may see your scores begin to improve even more, especially if you pay your bills in full and on time and use credit responsibly.

Don’t Miss: Does Bankruptcy Affect Renting An Apartment

How Many Points Does A Bankruptcy Affect Your Credit Score Instant Credit Boost

Im sure youve heard the term in the past. Its that 3 digit number that follows you & your financial life every where you go. You need it to get authorized for loans, credit cards, houses, home mortgages & more! And since you never ever truly see it, its generally out of sight, out of mind but this number is something that needs to be taken severe.

None of us like it, the truth that a credit score is so important to nearly everything we do economically is precisely why we said it has to be taken major. It can take years to develop a excellent score and only a day or more to bring the whole thing crashing down.

Fortunately, theres things you can do to secure and educate yourself on the topic. From tricks to provide you a near-instant increase to your score to understanding what a credit score even is from a fundamental level, were going to walk you through this step by step. Prepare yourself to take control of your financial flexibility at last!

To Remove A Bankruptcy From Your Credit Report Youll Need To Find Evidence That The Bankruptcy Was Reported Incorrectly Otherwise It Will Only Come Off After Seven Or 10 Years Depending On The Type Of Bankruptcy

Beyond the stress and inconvenience that comes with filing for bankruptcy, it can have a long-standing impact on your credit report and score.

Fortunately, that negative impact can be mitigated with the right help.

Read Also: How-soon-will-my-credit-score-improve-after-bankruptcy

Difficulties You May Face Before A Bankruptcy Falls Off Your Credit Report

Before a bakruptcy is removed from your credit report, you may face the following problems:

- Unsecured credit card applications will not be approved

- Loan applications will not be approved

- Payment of higher interest rates

- Payment of higher insurance premiums

- More difficult time finding a job

- More difficult time getting approved to rent an apartment

- Difficulty taking out a loan to buy a home

Consider Applying For A Secured Credit Card

After filing for bankruptcy, its unlikely that you will qualify for a traditional credit card. However, you may qualify for a secured credit card. A secured credit card is a credit card that requires a security depositthis deposit establishes your credit limit.

As you repay your balance, the credit card issuer usually reports your payments to the three credit bureaus. Repaying your balance on time can help you build credit. Once you cancel the card, a credit card provider typically issues you a refund for your deposit.

When shopping for secured credit cards, compare annual fees, minimum deposit amounts and interest rates to secure the best deal.

Also Check: When Did Donald Trump Declare Bankruptcy

How Long Does A Chapter 7 Bankruptcy Stay On Your Credit Report

After you file for a Chapter 7 bankruptcy, it remains on your for up to ten years and youre allowed to discharge some or all of your debts. When you discharge your debts, a lender cant collect the debt and youre no longer responsible for repaying it.

If a discharged debt was reported as delinquent before you filed for bankruptcy, it will fall off of your credit report seven years from the date of delinquency. However, if a debt wasnt reported delinquent before you filed for bankruptcy, it will be removed seven years from the date you filed.

How Long Will A Consumer Proposal Notice Remain On My Credit Report

Both TransUnion and Equifax have updated their retention policy regarding consumer proposals. Below is the most current data, as of 2019, from their websites:

TransUnion reports that

- The consumer proposal and all accounts reported as satisfied through the proposal will be removed from your file three years from the date you satisfied the proposal or six years after the date you defaulted on the account, whichever date comes first.

For more information on how long TransUnion keeps information on file see here.

Equifax states that:

- A consumer proposal will be removed from your Equifax credit report 3 years after youve paid off all the debts according to the proposal, or 6 years from the date it was filed, whichever comes first.

More information about retention periods for Equifax can be found here.

What does this mean?

The longest a consumer proposal will now remain on your credit report is 6 years from the date you file based on these new guidelines.

- If you complete your consumer proposal payments in five years, the notice will be removed one year later .

- If you complete your payments in two years, the notice will be removed five years from the date you filed.

- If you complete a lump sum proposal, the notice will be removed in roughly three years .

Recommended Reading: How Many Bankruptcies Has Donald Trump

Can You Get Credit After Bankruptcy

Although it may be harder to find a lender willing to offer you a competitive product, there are still ways to get credit after bankruptcy. Some types of credit you could receive include:

- Car financing. Chern says that its possible for a Chapter 7 debtor to finance a car the day after filing. Additionally, a Chapter 13 debtor may be able to finance a car while the repayment plan is still in effect, although the trustees permission is required after showing that the car is necessary to complete the debt repayment.

- Conventional mortgage. Most experts say that it will take 18 to 24 months before a consumer with re-established good credit can secure a mortgage loan after personal bankruptcy discharge. Credit-impaired borrowers should prepare to pay interest rates that are 2 points to 3 points over conventional rates.

- FHA-insured mortgage. Chapter 13 filers can get an FHA-insured mortgage if theyve made timely payments for one year and the debtor has received the courts permission. Debtors with a Chapter 7 bankruptcy discharge must wait at least two years after discharge and establish a history of good credit.

Chapter 7 Vs Chapter 13

Two of the most common types of consumer bankruptcies are Chapter 7 and Chapter 13 bankruptcies. With a Chapter 13 bankruptcy, you will repay a portion of your debts with a repayment plan. A Chapter 7 could completely wipe out your unsecured debts. From a credit perspective, the primary difference between the type of bankruptcy you declare is how long it could take for the bankruptcy to get removed from your credit reports:

- Bankruptcy filings, including Chapter 7 bankruptcies, must be removed from your credit reports 10 years after the filing date.

- However, credit agencies generally remove a Chapter 13 bankruptcy filing seven years after the filing date if you complete the repayment plan or the debt is discharged. If you dont complete the plan and the debt isnt discharged, the Chapter 13 bankruptcy may remain for up to 10 years.

The credit reporting agencies may add new codes to the accounts that are affected by your bankruptcy to indicate that they were part of a bankruptcy, the type of bankruptcy, and what happened to the debt .

Read Also: How Many Times Trump Filed Bankruptcy

How Does Bankruptcy Affect My Credit Score

The impact of bankruptcy on a credit report can be devastating and entirely depends on your credit score prior to filing.

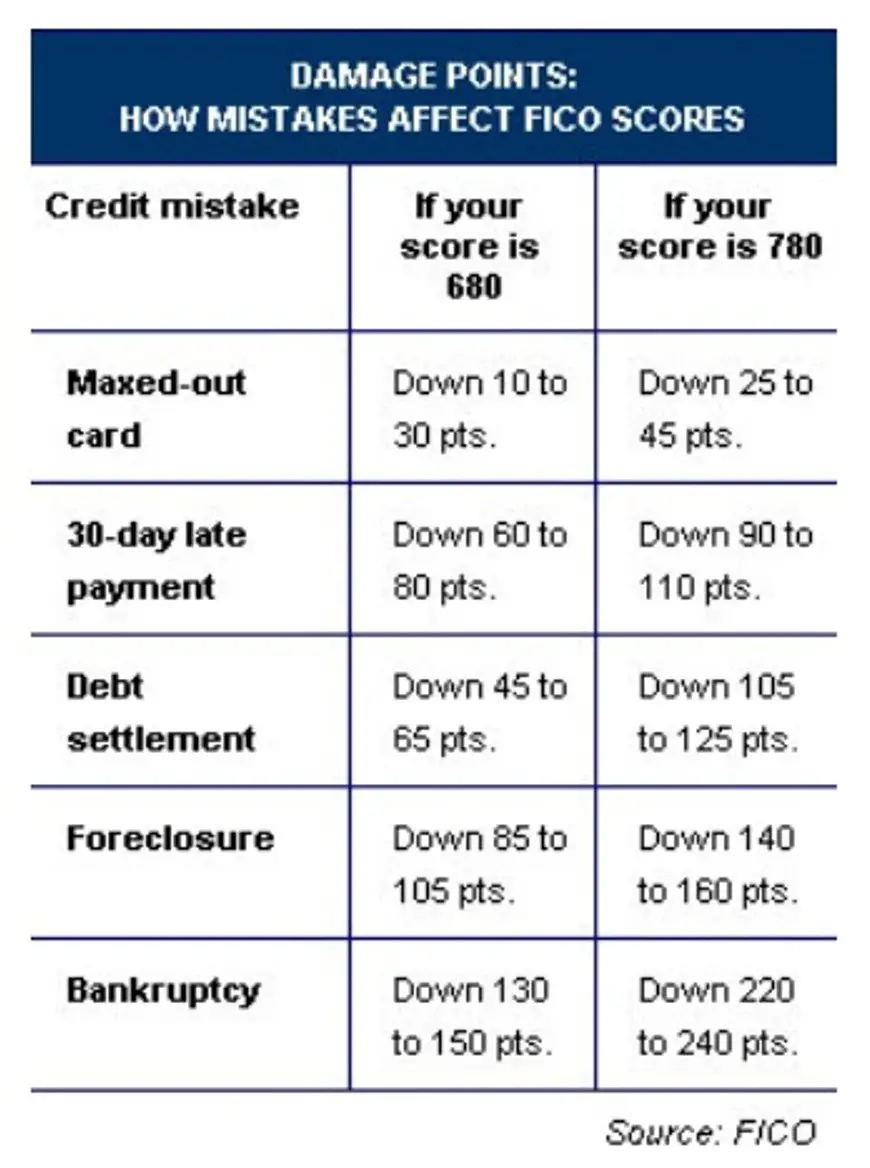

According to FICOs published Damage Points guidelines, the effects range from 130 to a 240 point drop. For example:

- A person with a 680 credit score would drop between 130 and 150 points.

- A person with a 780 credit score would drop between 220 and 240 points.

So, if your credit score was high, a bankruptcy would drop it instantly to the poor category. Starting with a good score, you likewise end up with a poor score, but your score does not plummet nearly as far.

The end result is still negative your and it will keep you from getting approved for new credit. The lower your initial score, the less drastic the impact.

How Does Bankruptcy Affect Your Credit Rating

Bankruptcy is likely to drop your credit score to the lowest possible rating at most Canadian credit bureaus. That means lenders, insurers, landlords, employers, and utility companies are less likely to extend you credit upon completion of your bankruptcy, but there are ways to rebuild your credit. To learn more about rebuilding your credit, please see .

Read Also: Northcarolinadebtrelief Org Review

Common Myths About How Bankruptcy Affects Credit

- Print icon

- Resize icon

Filing for bankruptcy is devastating to your credit and can cause your credit score to plummet more than 200 points. But for people in dire straits, bankruptcy is a last resort that can help them liquidate assets, discard or pay off debts, and get some financial relief.

If youre considering bankruptcy, you need to understand how it will affect your credit. This involves clearing up some common misconceptions about how bankruptcy affects your credit.

Myth No. 1: If you dont have negative information on your credit report before bankruptcy, you will have a higher postbankruptcy credit score than if your report contained negative information before filing.

The Truth: Positive payment history and a lack of negative information does very little to minimize the impact of a bankruptcy on your credit score. The presence of a bankruptcy, and the length of time the bankruptcy has been on your report, are the strongest determining factors

Myth No. 2: All bankruptcy information stays on your credit report for 10 years, without exception.

The Truth: Only the public record of a chapter 7 bankruptcy lasts for 10 years. All other bankruptcy references remain on your credit report for seven years, including:

- Trade lines that state account included in bankruptcy

- Third-party collection debts, judgments and tax liens discharged through bankruptcy

- Chapter 13 public record items

Once the above items start disappearing, you may see a bigger boost in your credit score.

Learn More About Consumer Proposal

We hope our guide to how does a consumer proposal affect my credit rating was helpful. As can be seen, a consumer proposal can be a good solution for many income-earning Canadians struggling to get out of debt. However each situation is different, so why not contact a Licensed Insolvency Trustee to arrange for a no-charge initial consultation to review all of your options including bankruptcy and consumer proposal in Ontario or anywhere else in Canada?

Read Also: Can You Rent An Apartment After Filing For Bankruptcy

Your Credit Score And Bankruptcy

According to FICOs damage points, the higher your starting score, the more points youll lose for filing for bankruptcy. For a person with a credit score of 680, filing for bankruptcy will lower your score by 130-150 points. For a person with a score of 780, filing for bankruptcy will cost you 220-240 points. The lower your score, the less it costs you.

To give some perspective, a foreclosure would cost you 85-105 points if your score was 680. If your score was 780, youre looking at a drop of 140-160 points.

So how much does bankruptcy affect your credit score? The answer depends on where you started. If your score was very low because of accounts in default, in collections, wage garnishment, or other credit events, bankruptcy might not have a very big impact at all. In addition, bankruptcy will wipe out those issues that are continually hurting your credit score and allow you to start rebuilding your financial track record.

Establish Two Or More New Lines Of Credit

There are two main types of credit available to consumers:

- Revolving Credit.Revolving credit is credit that is constantly available to use, and includes credit cards, lines of credit, and store cards. Lenders typically update your payment history on these sources of credit every month.

- Installment Credit. Installment credit is defined as a payment arrangement with a lender over a set period of time. This type of credit includes mortgages, car loans, chattel loans, and other types of loans. Unlike revolving credit, there is no capacity to borrow on demand, like there is with a revolving credit product. Installment credit can be pricey, as rates are based on your credit score.

An example of installment credit is a car loan, where the lender will approve a loan and record the car as collateral. The set payment of the loan will be reported to the credit bureau every month, and your credit score will begin to improve.

RRSP loans are also installment credit. Banks or lenders are often very approachable regarding these, as they get a good interest rate and their money is secure.

It is recommended that you open two or three credit accounts to rebuild your credit rating. Some sources state that at least one account should be installment credit, but it is possible to rebuild your credit with credit cards alone as long as your new payment history is perfect!

You May Like: How To Get Out Of Bankruptcy Chapter 13 Early

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.