Used Little Of Own Money

The New York Times, which conducted an analysis of regulatory reviews, court records, and security filings, found otherwise, however. It reported in 2016 that Trump “put up little of his own money, shifted personal debts to the casinos and collected millions of dollars in salary, bonuses, and other payments.

“The burden of his failures,” according to the newspaper, “fell on investors and others who had bet on his business acumen.”

Smart Annual Subscribe Now And Get 12 Months Free

Note: Subscription will be auto renewed, you may cancel any time in the future without any questions asked.

- Unlimited access to all content on any device through browser or app.

- Exclusive content, features, opinions and comment hand-picked by our editors, just for you.

- Pick 5 of your favourite companies. Get a daily email with all the news updates on them.

- Track the industry of your choice with a daily newsletter specific to that industry.

- Stay on top of your investments. Track stock prices in your portfolio.

Donât Miss: Diy Bankruptcy Chapter 13

Bankruptcy Statistics In The United States

52% of people who file for bankruptcy are male.

According to Debt.org, men are only slightly more likely to go bankrupt than women. The most common reason men go bankrupt is because they lost a job, and the most common reason women go bankrupt is divorce.

64% of people who file for bankruptcy are married.

Personal bankruptcy statistics show that most debtors are married. Many file for joint bankruptcy to make the process easier. For comparisons sake, 17% of debtors are single, 15% are divorced, and 3% are widowed.

Recent studies show that 36% of people who file for bankruptcy have only a high school education.

In addition, 20% of debtors have a bachelors degree or higher, and 29% have some college education. Those whove gone to college but havent graduated are at a particular risk because of mounting student loan debt.

60% of people who file for bankruptcy earn less than $30,000 a year according to the most recent data available.

Unsurprisingly, bankruptcy rates are the highest among those who earn the least. Stats also show that only 9.2% of those who report making more than $60,000 annually go bankrupt.

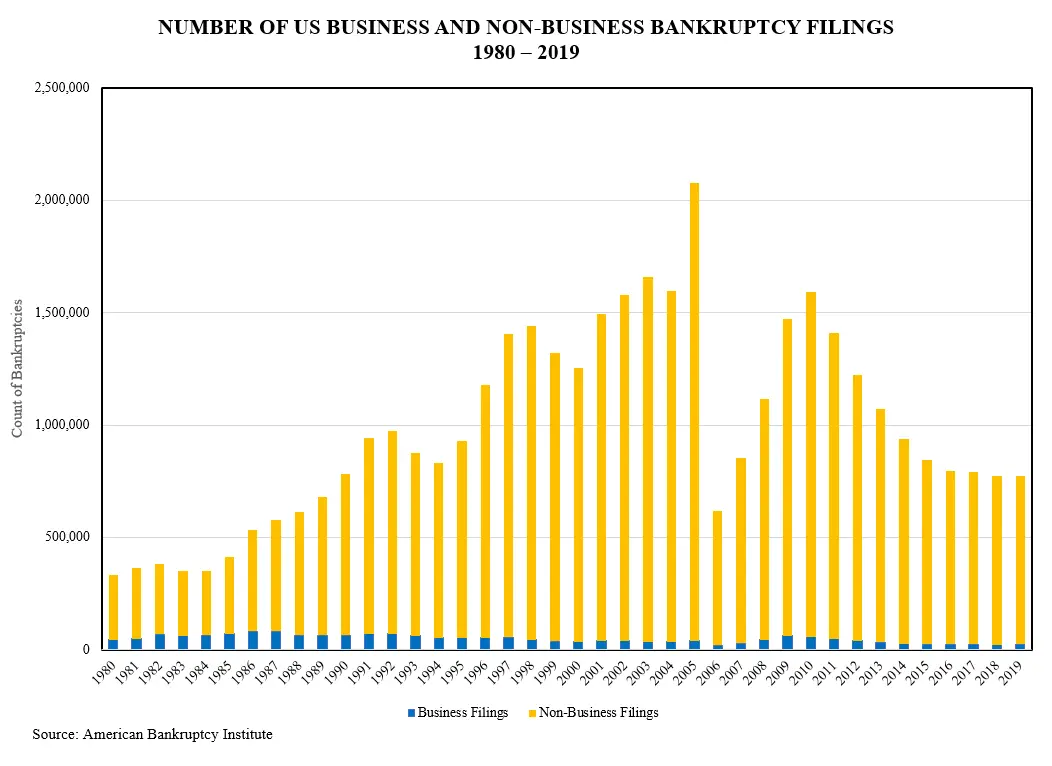

327,371 is the number of year-to-date national bankruptcy filings for May, 2019.

American Bankruptcy Institute statistics also show the number of Chapter 7 and Chapter 13 filings so far204,910 compared to 119,293 in the same period last year. There is a 3% decrease from May compared to April.

You May Like: Fizzics Group Llc

Why Do People File Bankruptcy

Every bankruptcy filerâs situation is a bit different. But, there are some common triggers for bankruptcy. Life events that frequently contribute to bankruptcy filings include:

-

Job loss: One study published by the Federal Reserve Board showed that households were about 2.5 times as likely to file for bankruptcy in the year following a job loss.

-

Medical bills: In a study published by Harvard Law professor Elizabeth Warren in 2007, 29% of survey respondents cited medical bills as the reason for their bankruptcies, and 57% said theyâd had problems with medical debt.

-

Illness: In response to a separate question, more than 40% of respondents to the same survey cited loss of income due to illness.

-

Divorce: Many studies, including the CES report mentioned above, confirm a link between divorce and bankruptcy, though experts disagree as to whether there is a cause-effect relationship and if so, which event is the trigger.

Another element that likely impacts bankruptcy filings is student loan debt. Student loan debt is less studied in connection with bankruptcy, since this type of debt usually isnât dischargeable. But, the increased financial burden of student loan debt can still trigger a personal bankruptcy filing.

Chapters Of The Bankruptcy Code

Entities seeking relief under the Bankruptcy Code may file a petition for relief under a number of different chapters of the Code, depending on circumstances. Title 11 contains nine chapters, six of which provide for the filing of a petition. The other three chapters provide rules governing bankruptcy cases in general. A case is typically referred to by the chapter under which the petition is filed. These chapters are described below.

Read Also: Can You Rent An Apartment After Chapter 7

Measures Of Economic Freedom

The index uses five broad areas to score economic freedom for each country:

Trump Hotels And Casino Resorts

A holding company for three casinos, Trump Hotels and Casino Resorts went bankrupt in November 2004. The casino was under a $1.8 billion debt, and the association decided to sell some stake to the bondholders. However, the holding company emerged from bankruptcy within a year in 2005 with a new name- Trump Entertainment Resorts Inc. However, the company was still in debt, which pushed Trump to give up his CEO title and sell most of the stocks to the bondholder.

Read Also: Paying Off Chapter 13 Plan Early

Before Doing Anything Else Decide If Filing Bankruptcy Is Right For You

Before jumping in, you need to determine whether filing bankruptcy will help you. Bankruptcy is a powerful debt relief tool that’s helped many people, but you’ll have to decide if it makes sense for your financial situation.

A bankruptcy discharge does not wipe out certain non-dischargeable debts like most student loans, child support obligations, alimony, and recent tax debts. If you have any cosigners, they will not be protected by your personal bankruptcy.

If you have great credit when your Chapter 7 bankruptcy is first filed, your . Most people are able to rebuild their credit and have a better score within a year of getting their bankruptcy discharge.

Anyone can file Chapter 7 bankruptcy without a lawyer. Here is an overview of the steps you’ll need to take to obtain your fresh start.

The Variables Of The Reports

Researchers disagree on the evidence for medical bills causing bankruptcies. The biggest problem in answering this question is that those filing for bankruptcy aren’t required to state the reason.

As a result, estimates are based on surveys. Therefore, the answer will depend on how researchers phrase their questions, and how the survey respondents define the cause of their bankruptcy.

A variety of factors cause bankruptcies. Many people with medical debt have other debts as well. They may also have a lower income, little savings, or have lost a job.

Medical debts are generally unexpectedmany Americans live paycheck to paycheck due to the cost of living, low wages, or living beyond their means. A sudden medical bill causes havoc in the financial lives of struggling people.

Almost a third of the respondents surveyed by KFF claimed they weren’t aware that a particular hospital or service wasn’t part of their plan. One-in-four found that their insurance denied their claims.

Many insured people are not aware that their policies have limits. High deductibles and co-payments can cause high debts, and annual/lifetime limits can cause an insurance plan to run out. Some insurance policies and companies will deny claims or cancel the insurance policy.

Read Also: Leasing A Car After Chapter 7

Take Bankruptcy Course 2

After filing your bankruptcy forms, you will need to complete a Debtor Education Course from an approved credit counseling agency. It can be completed online or by phone and typically takes at least 2 hours and costs between $10 – $50, unless youâre eligible for a waiver.

The purpose of the course is to educate you on making smart financial decisions going forward but does not provide legal advice about the bankruptcy process. Youâll learn how to prepare a budget and avoid incurring debt with high interest rates.

Youâre not eligible to receive your bankruptcy discharge and obtain a fresh start if you donât complete the course and file your certificate of completion from the credit counseling agency with the court.

Personal Bankruptcies By State

When consumers encounter financial hardship they cannot recover from on their own, bankruptcy allows them to resolve their debts and move on. The two primary forms of bankruptcy for individuals are Chapter 7, which entails liquidating assets to pay off debts, and Chapter 13, which creates a long-range payment plan to stave off property foreclosure. Bankruptcy is typically an option of last resort, as it can cause stress and long-term credit damage.

Analyzing Chapter 7 and 13 bankruptcies filed since March 2020 as published by the American Bankruptcy Institute, MoneyGeek has ranked states by their number of personal bankruptcies. To adjust for population differences, we’ve based our rankings on filings per 100,000 people.

Don’t Miss: How Many Times Did Donald Trump Declare Bankruptcy

How To Get Out Of Debt Keep The House Car Retirement Savings And Finally Get A Fresh Start

Filing Bankruptcy Cases Under Different Chapters

If youre filing under a different chapter the second time around, the following rules apply:

- Chapter 7 after Chapter 13 According to Title 11 Section §727 of the U.S. Code, if your first filing was under Chapter 13, you will not be granted a discharge under a Chapter 7 until at least six years has passed from the date you filed your Chapter 13.

- Chapter 13 after Chapter 7 According to Title 11 Section §1328 of the U.S. Code, if your first case was a Chapter 7, you only have to wait four years before filing a Chapter 13.

Filing for Bankruptcy for Reasons other than Discharge

Keep in mind that the time limits discussed only pertain to discharges, not to filings. There is no limit to amount of times you can actually file. While seeking a discharge of debts is the most common reason to file for bankruptcy, its not the only reason.

Some file for the automatic stay which prevents creditors from collecting on debts. Depending on your circumstances, this could help you stop collection efforts and catch up on your payments.

Running into Difficulties with Repeat Bankruptcy Filings

There may be no legal limit on how many times you can file for bankruptcy in Texas but the courts will take a good look at why the debtor is filing for a subsequent bankruptcy. First, lets review why bankruptcies were written into American law.

Discuss Your Options with a Bankruptcy Attorney

Expenses And Spin Are Equally High

There is no doubt that medical expenses, and therefore bills, are high. The KFF found that wage increases are not keeping up with rising health care costsmedical insurance premiums increased 54% while earnings have increased by only 26% since 2009.

Estimates have been different in the past due to the timing of the studies that were conducted, different methods, how the results were interpreted, and the reasons the results were being used.

Spin is a concept of using information in a manner that benefits the presenter, or parties associated with the presenter. The information presented in studies such as the ones cited can be manipulated in a way that makes the information, while not good, appear much worse.

With the right wording, it is possible to make these studies present information that can lead people to believe that nothing is wrong at all. For example, if you look at the data presented by The United States Courts, you’ll see that bankruptcy rates have dropped by 317,488 since 2006.

From this, you could infer that The Bankruptcy Abuse Prevention And Consumer Protection Act of 2005 has been effective. The Act may have been effective however, this statement does not take economic circumstances or the employment rates into consideration . With the right amount of spin, any information can be used in different ways.

Read Also: How Many Times Has Donald Trump Go Bankrupt

Personal Insolvencies By Industry

Between 29 November and 12 December 2021, 396 people entered into a new personal insolvency. Where we could identify the industry they worked in, the most common industries were:

- health care and social assistance

- construction

- retail trade.

Over this period, 96 of these people were involved in a business. The most common industries were:

- construction

- accommodation and food services

- retail trade.

The number of people who entered into a new personal insolvency fell from 409 between 15 November and 28 November to 396 between 29 November and 12 December. Over the same period, the number involved in businesses fell from 107 to 96.The number of new bankruptcies fell from 283 between 15 November and 28 November to 238 between 29 November and 12 December. Over the same period, debt agreements and personal insolvency agreements rose from 126 to 158.

Between 29 November and 12 December, there were 8 new temporary debt protections.

Our personal insolvency statistics include three types of personal insolvencies: bankruptcies, debt agreements and personal insolvency agreements.

Our business related personal insolvency statistics include people who:

- have traded as a sole trader, including as a contractor, sub-contractor or similar, or been involved in a partnership, and/or

- been a director/secretary or held a management role in a company.

Despite Holding Huge Assets Trump Needs Money More Than His Presidential Predecessors Ever Did But He Faces Multiple Barriers Of His Own Making

Find your bookmarks in your Independent Premium section, under my profile

Find your bookmarks in your Independent Premium section, under my profile

As Trump knows only too well, lawyers are expensive

What next for Donald Trump? World leaders dont, as a rule, go hungry upon leaving office. There are positions on corporate boards to take up, lucrative speaking engagements to be booked, handsome advances for books even if they dont sell quite as well as expected . The consulting opportunities are endless, as Tony Blair has proved. Theyre not always terribly savoury but that usually merits only passing attention.

Trump, however, is in the difficult position of needing the money more than any of his predecessors did, despite holding huge assets. He also faces barriers of his own making the insurrection he fomented the most obstructive of all to at least some of the perks former presidents typically enjoy. Many of the people who welcomed George W Bush and cut him a cheque when he wasnt painting wont want to associate with Trump.

His legal problems, meanwhile, are just beginning and legal experts consider the idea of Trump preemptively pardoning himself a non-starter. Besides, this would only cover federal, and not state, offences.

Also Check: Can I Buy A Car After Filing Bankruptcy

California Takes The Lead In Bankruptcy Filings For 2021

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Many people are likely unaware of how many entities declare bankruptcy each year. By the end of 2020, 529,106 Americans had filed for bankruptcy, and that number was nearly double that of seven years prior. However, the United States isn’t a monolith, and regions can be subject to vastly different financial circumstances than their neighbors. These factors can impact how much credit the average resident or business may need to take on, in addition to potentially making it difficult for them to keep up with their payments. Through looking at bankruptcy rates by state, we can get a better sense of where individuals and companies areand are notstruggling with debt.

General United States Bankruptcy Statistics

1. 62% of personal bankruptcies in the United States were due to medical expenses.

A study conducted by Harvard University has shown that, without doubt, the most significant of all US bankruptcy statistics is that nearly two-thirds of all bankruptcies were due to medical expenses. One of the most interesting figures to come out of this study was that 72% of the bankruptcy filings had come from people with some form of health insurance. While this was a shock, it also crushed the myth that medical bills only affect the uninsured.

Medical bankruptcy statistics show that people taken by a rare disease or some form of serious illness will be left with hundreds of thousands of dollars in medical bills. Medical bills of this size can easily wipe out any savings, equity accounts, and college funds and leave no other option but to go bankrupt. Eventually, a surge in the US bankruptcy rate is likely to happen.

Moreover, with advancements in technology, healthcare costs in the United States are at an all-time high. As new illnesses emerge and more people become patients, health insurance is becoming expensive and extremely confusing.

It is no secret that Americans face their greatest financial difficulties regarding medical care. Since 26% of Americans between the ages of 18 and 64 are struggling to pay their medical bills, its no wonder these bankruptcy filing statistics show that medical expenses cause more people to go bankrupt than anything else.

Also Check: Nortel Epiq

Hospital And Doctor Bills Can Be Written Off To Avoid Bankruptcy For Medical Bills

In some cases, theres no need to declare bankruptcy to eliminate medical debt, especially if this is the only debt and the debtor can make other regular payments, such as house or car payments, child support, and alimony. Moreover, medical creditors are better to work with compared to other debt creditors.

A public hospital or doctor of a Medicare or Medicaid patient will send a bill and wont bother them further. Those medical bills will stay in the billing department for as long as possible before being sent off to a collector and become medical debt collection.

Furthermore, some healthcare providers and doctors are willing to accept a tiny amount of the bill on an installment plan each month. Finally, the medical debt may not affect your credit score much since medical creditors seldom belong to credit reporting agencies.