Why There Wont Be A Flood Of Foreclosures Coming To The Housing Market

With the rapid shift thats happened in the housing market this year, some people are raising concerns that were destined for a repeat of the crash we saw in 2008. But in truth, there are many key differences between whats happening today and the bubble in the early 2000s.

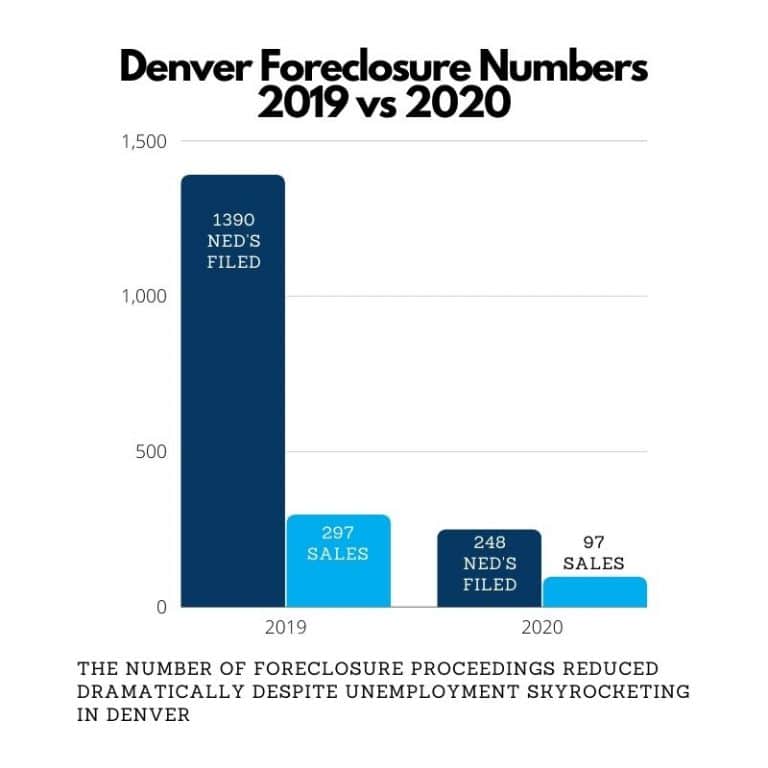

One of the reasons this isnt like the last time is the number of foreclosures in the market is much lower now. Heres a look at why there wont be a wave of foreclosures flooding the market.

Not as Many Homeowners Are in Trouble This Time

After the last housing crash, over nine million households lost their homes due to a foreclosure, short sale, or because they gave it back to the bank. This was, in large part, because of more relaxed lending standards where people could take out mortgages they ultimately couldnt afford. Those lending practices led to a wave of distressed properties which made their way into the market and caused home values to plummet.

But today, revised lending standards have led to more qualified buyers. As a result, there are fewer homeowners who are behind on their mortgages. As Marina Walsh, Vice President of Industry Analysis at the Mortgage Bankers Association , says:

For the second quarter in a row, the mortgage delinquency rate fell to its lowest level since MBAs survey began in 1979 declining to 3.45%. Foreclosure starts and loans in the process of foreclosure also dropped in the third quarter to levels further below their historical averages.

It Wont Be Like The Housing Crisis

Homebuyers who expect a situation thats the same as the housing crisis may be up for disappointment. People will likely have an out. Homeowners can get back on their feet by selling their homes. Some of them may even walk away with 30,000 to 40,000 equity with the way prices are right now.

Its not going to be like the housing crisis. And prices are not going to get severely depressed as we saw ten years ago people will have an out.

Real Signs For Future Red Flags

Mortgage delinquencies are the most telling sign for the rise or fall of future foreclosure filings. Right now, there is no reason to believe foreclosure starts will jump dramatically, given the national delinquency rate is sitting at a low 3.3% as of January 2022. Employment remains strong and the housing market is on fire, putting home equity levels at all-time highs. This means that the roughly 2 million delinquent households today have solid alternatives to avoid foreclosure.

But just because today’s numbers remain low doesn’t mean things can’t change. Inflation is a growing concern for Americans, as the cost of basic necessities like fuel, groceries, electricity, and property taxes quickly becomes more expensive. Budgets surely will tighten as a result, and it’s very possible we could see delinquencies increase in coming years.

There is also a notable backlog of loans that were previously in forbearance that haven’t been addressed. These are loans that are in some type of active loss mitigation or completed loss mitigation efforts but still remain past due, and the ultimate outcome of the loans, either foreclosure, repayment of debt, or a long-term loss mitigation solution like a modification, isn’t known.

Liz Brumer-Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Read Also: How To File For Bankruptcy In Florida Yourself

Statistical Summary Of Ontario Agriculture

Number of farms with sales over $25,000 32,980 Number of farms with sales over $100,000 18,576 Number of farms with sales over $250,000 8,989 Farms reporting under 53 hectares 29,638 Farms reporting 53 to 161 hectares 21,279 Farms reporting 162 hectares and over 8,811

| Christmas tree area, woodland and wetland | 750,355 |

|---|---|

| Total area owned | 3,793,190 |

| Total area rented or crop shared | 1,673,043 |

| Farms reporting any hired labour | 24,013 |

|---|

Area Grown to Major Field Crops

| Item |

|---|

Number of Livestock and Poultry on Farms

| Item |

|---|

Manhattan Lis Pendens Closest To Pre

At the borough level, Manhattan continued to maintain the lowest foreclosure activity, with its 15 cases representing 31% of the total recorded in Q3 2019. That said, this was also the boroughs most active quarter for foreclosures since Q1 2020, when there were 38 cases.

In line with its slow pace of foreclosures , Manhattan didnt have any foreclosure superclusters. Here, zip 10025 which includes parts of Morningside Heights, Manhattan Valley and the Upper West Side had the largest concentration with three cases.

While Manhattan foreclosures were down 69% compared to Q3 2019, lis pendens in Manhattan were just 14% lower compared to the same period. Specifically, the borough totaled 102 lis pendens in Q3 of this year and 118 in Q3 2019. Compared to Q2, lis pendens were up 62%, increasing from 63 to 102 filings.

You May Like: Types Of Personal Bankruptcy

Theres No Better Time Than Now

Holding off on your home purchase may not be the smartest move right now. Many homebuyers may not be aware that the interest rates right now are some of the lowest weve seen in a while.

With these low-interest rates, theres no better time than now in purchasing your Florida home. And some of the homes that do end up foreclosed will be selling at slightly below market value. Thats why most lenders encourage homebuyers to start their home buying now.

So if you decided you were going to wait and see if your crystal ball was a little bit clearer than mine, good luck, youre going to miss out on all the little mortgage interest rates that are available right now.

Foreclosures Hitting Market 2022

Theres no telling what will actually happen, but yes, it is indeed likely that we are looking at the possibility of foreclosures hitting the market next year.

The spread of Covid-19 since 2020 has affected much of our daily lives. Many people have also lost their jobs because many industries were forced to close due to the pandemic. Since livelihoods were affected, some people may find it challenging to pay for their home loans.

Some homebuyers who were planning on purchasing a home may have decided to hold off on their purchases. Thats because theyre probably thinking that they can save a lot of money if they wait for the foreclosures to start hitting the real estate market.

If youre one of the homebuyers who thought along the same line as mentioned above, Samantha Outlaw of Reach Home Loans, one of Floridas leading mortgage lenders, says you should reconsider.

Heres her forecast on foreclosures in Floridas real estate market.

You May Like: How Long Until Bankruptcy Is Off Credit Report

Benefits Of Buying A Foreclosure

Foreclosures can offer serious savings, though.

Buying a foreclosure is a great option for people looking for houses who are unable to find ones within their budget, says Ben Fisher, a luxury real estate specialist at the Fisher Group in Long Beach, CA. The average price of a foreclosed home in the U.S. over the last five years has ranged from about $93,000 to $166,000, well below the national average.

Plus, the process of buying a foreclosure can be faster.

One of the tedious parts of a typical house purchase is the closing of the house, Fisher says. On average, a house takes 50 days to close. But closing on a foreclosure takes about 30 days on average.

The financial and time savings add up to equity.

Buying a foreclosure and then renovating it can allow you to increase the homes value and gain immediate equity, Fisher says. If you are a professional investor or just started investing in properties, this is a good way to take part in the business.

What Does This Mean For Home Buyers

There has been a big uptick in foreclosure filings, but the reasons may surprise you.

The number of foreclosure starts which is when the first public foreclosure notice happens is up 219% since the start of the year, according to real estate data analytics firm ATTOM Data Solutions midyear 2022 U.S. foreclosure market report. Whats more, the number of properties that had foreclosure filings is up 153% from the same time period last year.

Fully 96% of major metro areas saw an annual increase in foreclosure filings, with foreclosure rates highest in Illinois, New Jersey and Ohio. And when it comes to the number of foreclosure starts, California topped the list, followed by Florida, Tennessee, Illinois and Ohio.

Foreclosure activity across the United States continued its slow, steady climb back to pre-pandemic levels in the first half of 2022, says Rick Sharga, executive vice president of market intelligence at ATTOM. While overall foreclosure activity is still running significantly below historic averages, the dramatic increase in foreclosure starts suggests that we may be back to normal levels by sometime in early 2023, says Sharga.

What does this uptick in foreclosures mean for the housing market?

What does this mean for buyers?

The advice, recommendations or rankings expressed in this article are those of MarketWatch Picks, and have not been reviewed or endorsed by our commercial partners.

You May Like: How To File Bankruptcy In Wisconsin Without A Lawyer

Expect A Foreclosure Spike In The Coming Months

Pandemic backlog of seriously distressed mortgages expected to fuel the increase, although bump-up will remain below historical average

Distressed mortgages dating back to the height of the pandemic are expected to fuel a jump in foreclosure activity over the next 12 months, although the foreclosure rate is still expected to remain below the pre-pandemic historical average, a new report from Auction.com contends.

The prediction by one of the nations leading marketplaces for distressed assets, is based on a survey of some 50 Auction.com clients, including private-sector mortgage servicers and government-sponsored enterprises . The survey, called the Seller Insights report, shows that nine in 10 mortgage servicers expect their foreclosure volume to increase over the next 12 months with 74% anticipating a slight increase, and 15% projecting a substantial increase.

The survey queried Auction.com clients about their expectations for outcomes of seriously delinquent mortgages many of which have lost the protections of forbearance programs enacted early on during the COVID-19 pandemic. That loss of forbearance protection is expected to be the primary driver of future foreclosures ahead of interest rate increases, regulatory factors, a recession or home-equity woes.

Presented by: Altisource

Bronx Foreclosure Sector Remains Sluggish With Only 19 Cases Year

After recording zero cases in Q2, the Bronx had 11 foreclosures in Q3 the lowest number among the five boroughs and an 84% contraction compared to Q3 2019 figures. In fact, of the five boroughs, foreclosures in the Bronx were consistently the lowest in the first three quarters of the year, recording a mere 19 cases year-to-date.

The boroughs tempered foreclosure sector was also evidenced by the lack of foreclosure clusters, with only one zip code seeing more than one: Zip 10471 which includes parts of Riverdale, Fieldston and North Fieldston was the setting for two cases in Q2.

Notably, lis pendens filings in the Bronx were also the lowest in NYC, with 53 cases in Q3 85% below Q3 2019 levels. Moreover, the Bronx was the only borough where pre-foreclosures dropped quarter-over-quarter, thereby bucking citywide trends of increasing pre-foreclosure filings.

You May Like: What Is A Good Bankruptcy Score

How The Foreclosure Rate In Arizona Compares To The Nation

- Samuel Stebbins, 24/7 Wall St. via The Center Square

Demand for single-family homes surged in the past two years, as the coronavirus pandemic prompted people to look for more living space. The increased demand, facilitated by low interest rates and coupled with supply constraints, led to soaring home prices.

But now the U.S. housing market appears to be coming back to earth, with some parts of the country showing early distress signs. Foreclosure filings — a measure of the health of housing markets at local, state, or national levels — are on the rise across the country.

According to Attom, a curator of land and property data, home foreclosure filings – which include default notices, bank repossessions, and scheduled auctions – are up 153% in the first half of 2022 compared to the same period last year.

In Arizona, foreclosures rose by 165.5%, from 1,208 in the first six months of 2021 to 3,207 in the first half of 2022. The foreclosure rate in the state of one in every 961 homes ranks as the 18th highest in the nation.

According to five-year estimates from the U.S. Census Bureau’s 2020 American Community Survey, 63.3% of homeowners in Arizona are paying down a mortgage, the 20th largest share among states.

The typical household in the state has an income of $61,529 a year, and the typical home is worth $242,000. For context, the typical American household’s annual income is $64,994, and the national median home value is $229,800.

Foreclosures May Balance The Inventory Shortage

Houses on foreclosures by the end of 2022 may somewhat balance out the current shortage in the Florida housing inventory. The real estate market in Florida is currently experiencing a shortage of homes for sale.

A great demand for Florida properties right now, coupled with a low inventory of houses, mainly drives up home prices. And foreclosures in the future may not be such a bad thing.

I know everybody sees a foreclosure, and it has a negative stigma. People relate it to a depressed housing market. But it may even correct the current inventory constraints that were seeing and balance out the inventory shortage.

Read Also: How Does A Bankruptcy Trustee Find Hidden Assets

Job Market Affects Foreclosures

While job loss is a top reason for foreclosures, official unemployment rates by state from the Bureau of Labor Statistics dont correlate highly with the foreclosure rates currently. Since current official employment rates are so high in the United States, it is reasonable to assume that underemployment is a greater cause of foreclosures than full unemployment is in this specific economy.

The labor market has gone through massive changes during the pandemic, and one of those is people leaving the labor market voluntarily or working on a casual or part-time basis by choice. People choosing not to look for jobs or to be underemployed are at higher risk of foreclosure than are fully employed people, and they are also not reflected in unemployment figures.

Another labor-related cause of foreclosures that isnt reflected in unemployment numbers is the effect that holding back the minimum wage artificially has had on the labor market and on home-buying behavior.

Without cost-of-living increases in the minimum wage and the corresponding COL increases in higher-waged jobs, buyers are less likely to have a down payment saved before buying a house, so they are more likely to enter into larger and riskier mortgage contracts at higher interest rates. This increases the precarity of the market and the mortgage default rate, which leads to foreclosures.

Based on data from ATTOM, these are the 10 states with the highest rates of foreclosures from the first three months of 2022.

Nyc Foreclosures Up By Nearly 100 Cases For 49% Q

As New York City home sales slowed over the summer under the pressure of rising interest rates and fears of a recession, the foreclosure sector continued its gradual climb back to pre-COVID levels. And, as expected, foreclosures in NYC trended up. Specifically, NYC totaled 297 foreclosure cases in Q3 59% below Q3 2019 levels, but up 49% compared to Q2 of this year.

Similarly to the previous quarter, Queens was the largest contributor of foreclosures among the five boroughs. In fact, Queens 150 foreclosures represented a little more than half of the citys foreclosure activity in Q3. Conversely, Manhattan had the lowest number of cases once again, with only 15 foreclosures recorded in the entire borough.

Considering the activity in Queens foreclosure sector, its no surprise that the borough again claimed the highest concentration of foreclosures in one zip code: 11412 had 17 unique cases, while the Bronx had only one zip code where more than one case was filed and judged . In fact, NYCs top three zip codes by number of foreclosures were all located in Queens in Q2. Zip 11412 was followed by 11434 with 12 cases and 11413 with 10 cases, with the three zip codes forming the citys most concentrated foreclosure cluster.

Read Also: How To File Bankruptcy In Louisiana Without A Lawyer

Queens Claims More Than Half Of Citys Foreclosures As Cases Continue To Rise

In Q3, Queens continued to be the borough with the most active foreclosure sector, claiming more than half of the citys case volume. Not only that, but the boroughs 150 cases amounted to 55% of its foreclosure volume in Q3 2019 making Queens the borough where foreclosures have come closest to pre-pandemic levels.

With such an active foreclosure sector, it was expected that Queens would also claim the highest concentration of cases in one zip code. In fact, the borough claimed the citys top three zip codes by number of foreclosures with zips 11412, 11434 and 11413 , which among them had 39 cases in total.

Even so, Queens lis pendens remained significantly lower than pre-pandemic levels: Q3s 248 filings represented a 66% decrease compared to Q3 2019. And, while lis pendens did increase quarter-over-quarter, it was only by 8% the lowest quarter-over-quarter increase in lis pendens activity among the five boroughs.