What Is The Difference Between A Chapter 7 And Chapter 13 Bankruptcy In California

A Chapter 7 bankruptcy is a debt-repayment option that involves the liquidation of assets and property. In contrast, a Chapter 13 bankruptcy allows individuals to pay off debts with the reduced risk of surrendering assets or liquidating property. The eligibility requirement for each option also varies. While individuals, sole proprietors, and business entities may file for a Chapter 7 bankruptcy, only individuals and sole proprietors may file for a Chapter 13 bankruptcy. In addition, a Chapter 7 bankruptcy typically takes 90 to 100 days to complete, while a Chapter 13 bankruptcy may take three to five years.

Official Instructions And Committee Reports

Instructions are easier to come by than they used to be. The official U.S. Court website now offers instructions with these forms.

In addition they offer a link to the congressional committee reports that were written at the time the forms were created and revised. These committee reports are not step-by-step instructions, but rather a broad description of the purpose of each form.

Ventura County Ca Legal Guides Shortcuts: Lawbyzipcom Lawbyzipcodecom Redirect To This Website Legalconsumercom

1. Learn what to do.2. Get help if you need it. 3. Get on with your life.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The sponsored attorney advertisements on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Your use of this website constitutes acceptance of the Terms of Use, Privacy Policy and Cookie Policy.

Don’t Miss: What Happens If You Declare Personal Bankruptcy

Before You File Your Case

Before you file for bankruptcy, you must do several things:

- Receive a briefing about credit counseling from an approved agency within 180 days before you file. You may have a briefing about credit counseling one-on-one or in a group, by telephone, or by internet.

- Find out which chapters of the Bankruptcy Code you are eligible for. For descriptions of each chapter, review the information contained in the notice, Notice Required by 11 U.S.C. § 342 for Individuals Filing for Bankruptcy , which is included in this booklet: Instructions for Individual Debtors .

Privacy Requirements For Filed Documents

To protect privacy of individuals, certain personal data identifiers as listed below must be edited out or otherwise deleted before a document is filed with the Court . The Court will not review filed documents to ensure personal data identifiers are removed.

Social Security/Tax Identification Numbers: If disclosure of an individuals Social Security number or Tax Identification number is required, only the last four digits of that number should be used. This does not apply to the Statement of Social Security Number .

Names of Minor Children: Only the initials of a child under the age of 18 can be included on a document.

Dates of Birth: Only the year of birth of an individual can be used.

Financial Account Numbers: Only the last four digits of a financial account number should be used.

Don’t Miss: Best Pallets To Buy

What Are California Bankruptcy Exemptions

California bankruptcy exemptions protect certain property and assets from liquidation during the debt repayment process. While some states allow debtors to choose between state or federal exemptions, California law only allows residents to choose between two sets of state exemptions: Code Section 703 or Code Section 704.

United States Bankruptcy Court

CM/ECF is a comprehensive electronic case management system which allows courts to accept filings electronically and provides access to filed documents over the Internet.

Registration:In order to file documents electronically for the United States Bankruptcy Court for the Central District of California, attorneys must first register online by completing an online registration form and either provide proof of proficiency in CM/ECF or complete an online training course.

Submission of Electronic Orders:Unless otherwise authorized by the Court, proposed orders must be lodged electronically using the Courts Lodged Order Upload program. LOU is accessible via CM/ECF. The procedures for using the courts LOU program are located in the Court Manual.

Pacer Access:Although there are no additional fees for filing documents over the Internet using CM/ECF, existing document filing fees still apply. Electronic access to court data will be available through the Public Access to Court Electronic Records program at the current rate. CM/ECF Users receive one free look at documents filed electronically in their cases and can print and download the documents at that time. For more information regarding these and other fees related to PACER access, please visit the PACER website.

CM/ECF Support:Please refer to the Procedures & Guides and QuickLinks for additional information. Questions may be directed to the Help Desk at or via email

Don’t Miss: Liquidation Pallets New Jersey

A Guide To Ninth Circuit Bankruptcy Judges In California

As part of an ongoing series distributed by the California State Bars Insolvency Law Committee , Asa S. Hami, Co-Chair of the ILC, has co-authored several profiles of bankruptcy judges across California along with other ILC members. Below is a quick guide to the judges backgrounds and judicial styles.

Who: Judge Neil Bason

Where: Central District of California, Los Angeles division

Background: Judge Bason grew up in Washington, D.C., and spent a year during college living in London. He enjoys studying history, and particularly about some of the men and women who had the greatest influences on the development of this nation.

Prior to Judge Basons appointment, he was special counsel at Duane Morris LLP and at Howard Rice Nemerovski Canady Falk & Rabkin, P.C., and served as law clerk to the Honorable Dennis Montali, United States Bankruptcy Judge in the Northern District of California and Chief Judge of the Bankruptcy Appellate Panel of the Ninth Circuit.

As a result of his experience in private practice, the Judge tries to move cases along in a timely manner. He frowns on needless procedural delays and has recently cracked down on some attorneys who consistently file late or frivolous pleadings. If an issue needs time to develop, then he will let that happen, but he makes every effort not to allow a case to linger needlessly.

Who: Judge Martin R. Barash

Where: Central District of California, Woodland Hills division

Who: Judge Meredith A. Jury

Who: Judge Thomas B. Donovan

Do I Qualify For A Chapter 7 Bankruptcy In California

To be eligible for a chapter 7 bankruptcy, a California resident must have an income that falls under the median income for California**. Residents who earn an annual salary higher than the states median will need to pass a mean test, which helps identify the debtors disposable income by subtracting all necessary living expenses from all sources of income.

Filing for a Chapter 7 bankruptcy is a highly complex process that involves multiple steps, some of which include:

- Meeting the eligibility requirements for a Chapter 7

- Completing a credit counseling program

- Filling out and filing the necessary bankruptcy forms

- Having assets evaluated by a trustee

Depending on the circumstances, bankruptcy laws in California provide exemptions for some assets such as a home.

In 2020, the median income for a California household was $75,277 representing a 4.84 increase from the previous year. The states median property value was $546,800 with a 54.8% homeownership rate.

Read Also: Us National Debt Gdp

Discharging Debts In Bankruptcy

A bankruptcy discharge releases a debtor from being personally responsible for certain types of debts. So, after a bankruptcy discharge, the debtor is no longer legally required to pay any debts that are discharged.

The discharge prohibits the creditors of the debtor from collecting on the debts that have been discharged. This means that creditors have to stop all legal action, telephone calls, letters, and other type of contact with the debtor. This prohibition is permanent for the debts that have been discharged by the bankruptcy court.

You cannot discharge all debts in bankruptcy. Some of the most common debts that you cannot get rid of in bankruptcy are debts from child or spousal support, most student loans, most tax debts, wages you owe people who worked for you, damages for personal injury you caused when driving while intoxicated, debts to government agencies for fines or penalties, and more.

What Is The Downside Of Filing For Bankruptcy In California

One of the immediate downsides to filing for bankruptcy is its impact on the subjects credit report. More often than not, filing for bankruptcy in California will result in a lower credit score*. Just how steep the drop is will depend on the individuals original credit score. A person with an average credit score of 680 could lose as much as 150 points, while people with an above-average score may lose almost 240 points. This effect can last for years. Depending on the type of claim, bankruptcy remains on a credit score for 7 to 10 years. Some of the other downsides to filing for bankruptcy include:

- Loss of real estate and personal property

- Difficulty getting new lines of credit or credit cards in California

- Difficulty securing mortgage

- May negatively affect the ability to secure new employment

- Possible denial of tax refunds for cases not covered by Californias Bankruptcy Exemptions Code

For people with low credit scores , filing for bankruptcy may result in a slight increase by boosting their debt-to-credit ratio.

You May Like: Wholesale Liquidation Pallets For Sale

Read Also: America’s Debt Clock

Transporte Pblico A United States Bankruptcy Court Central District Of California En Riverside

¿Te preguntas cómo llegar a United States Bankruptcy Court Central District of California en Riverside, Estados Unidos? Moovit te ayuda a encontrar la mejor manera de llegar a United States Bankruptcy Court Central District of California con indicaciones paso a paso desde la estación de transporte público más cercana.

Moovit proporciona mapas gratuitos y direcciones en vivo para ayudarte a navegar por tu ciudad. Mira los horarios, las rutas, los servicios y descubre cuánto tiempo lleva llegar a United States Bankruptcy Court Central District of California en tiempo real.

¿Buscas la estación o parada más cercana a United States Bankruptcy Court Central District of California? Mira esta lista de paradas más cercanas a tu destino: Market FS 12th Orange FS 12th Lemon FS 12th Vine St Layover Riverside Metro Link SB Lat Riverside-Downtown Metrolink Station.

Puedes arribar a United States Bankruptcy Court Central District of California en Autobús o Tren. Estas son las líneas y rutas que tienen paradas cercanasAutobús: 1, 200, 215Tren: INLAND EMPIRE ORANGE COUNTY LINE, METROLINK 91-PERRIS VALLEY LINE

¿Quieres ver si hay otra ruta que te lleve allí antes? Moovit te ayuda a encontrar rutas y horarios alternativos. Obtén fácilmente instrucciones y direcciones desde United States Bankruptcy Court Central District of California con la aplicación Moovit o desde el sitio web.

United States Bankruptcy Court Central District Of California Reassignment Of Nothern And San Fernandeo Valley Division Chapter 13 Cases/judge Saltzmans Hearings

Effective February 11, 2019, Judge Martin R. Barashs pending San Fernando Valley Division Chapter 13 bankruptcy cases and related adversary proceedings will be reassigned to Chief Judge Maureen A. Tighe.

Also effective February 11, 2019, Judge Deborah J. Saltzmans pending Northern Division Chapter 13 bankruptcy cases and related adversary proceedings will be reassigned to Judge Martin R. Barash.

Following the reassignments, the judges initials at the end of the bankruptcy case and adversary proceeding numbers shall be changed to those to whom the matter was reassigned.

Judge Saltzman will be on extended leave tentatively starting in February 2019. For Judge Saltzmans cases that are not reassignedPN to other judges , parties may continue to useJudge Saltzmans self-calendaring instructions on the Courts website other judges will be handling the hearings. For questions regarding Judge Saltzmans cases, please contact Judge Saltzmans chambers at 213-894-3021.

UniCourt uses cookies to improve your online experience, for more information please see our Privacy Policy.By continuing to use this website, you agree to UniCourts General Disclaimer, Terms of Service, Cancellation and Refund Policy, Privacy Policy, and Public Records Policy. If you do not agree with these terms, then do not use our website and/or services.

Read Also: Will My Spouse’s Bankruptcy Affect Me

Federal Judicial District Established For The Central District Of California

The United States Trustee Program is the component of the U.S. Department of Justice that supervises the administration of bankruptcy cases. The United States Trustee for Region 16 serves the federal judicial district established for Central District of California. The regional office is located in Los Angeles, CA. The links on this site contain information about the regional office of the United States Trustee and the field offices within Region 16.

California Central District Bankruptcy Court Info

Step 4: Find the Federal Bankruptcy Court Serving Ventura County

Recommended Reading: What Happens When You Declare Bankruptcy In Texas

United States Bankruptcy Court Central District Of California

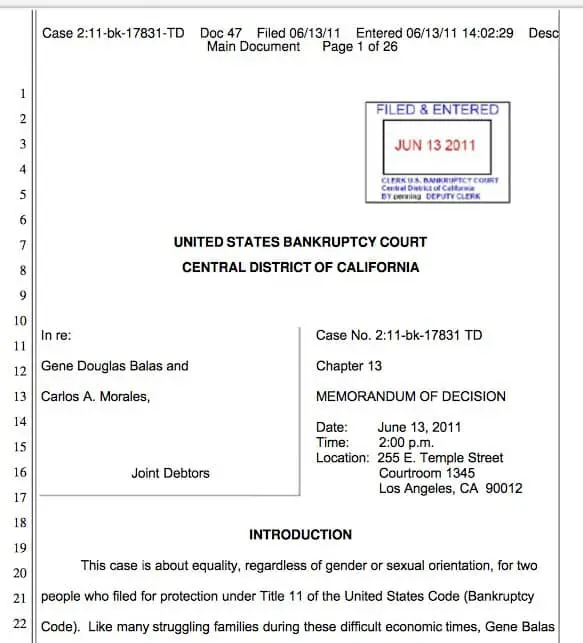

The United States bankruptcy court, Central District of California is the United States bankruptcy court in central California that is associated with the United States District Court for the Central District of California.

The court has five different physical locations: in Los Angeles, Santa Barbara, Riverside, Woodland Hills, and Santa Ana.

A Hearings In The Central District Of California Will Likely Remain By Telephone And Zoom

After two years of holding 341a hearings remotely, it appears that 341a hearings will continue to be held by telephone or zoom.

Previously, back in the old world pre-pandemic, a Debtor would show up at a physical location with their picture ID and proof of their social security. The hearing would be called and they would amble up to the table. A recording would begin. They would physically meet with the Trustee and demonstrate this proof. They would then testify as to the veracity of the information in the petition.

The Trustee would then ask them questions in person about their petition. It could last 10 minutes, or it could last an hour. The Trustee would have anywhere from 45 to 90 hearings to go through in a day.

The hearings moved to telephonic or zoom, depending on the Trustee, when the pandemic started. At first there was a great deal of confusion as everyone got used to the new set up. As of today, it is working quite well. Whether a Trustee utilizes a telephone line or a zoom connection is up to the individual Trustee.

I general this has been very successful.

For Debtors, it is convenient because they no longer need to take a day off of work, or arrange childcare, to come to the hearing. Further, depending on your county, actually getting to the physical hearing room could in itself have been a challenge. Now, Debtors can call up on an iphone or use a computer with camera to appear.

Read Also: How Long Does Bankruptcy Stay On Public Record

When You File Your Case

There are several forms and documents that you must give the court at the time you file. Additional forms and documents must be filed no later than 14 days after you file your bankruptcy case, although they may be filed at the same time you file your case.

You must file the forms listed below on the date you open your bankruptcy case. For copies of the forms listed here, go here. :

-

Application to Have the Chapter 7 Filing Fee Waived . Use this form only if you are filing under chapter 7 and you meet the criteria to have the chapter 7 filing fee waived.

Can A Bankruptcy Be Expunged In California

Expungement is a legal process by which court records are erased or destroyed. The expungement procedure is more commonly seen in the criminal justice system to give certain ex-offenders access to housing, credit, immigration, and employment. Though bankruptcy is not a criminal act and the federal bankruptcy code does not explicitly state expungement procedures, judges have the right to issue orders at will in the fulfillment of their duties and the law. This includes an order of expungement. Although parties can file motions to expunge with the courts, it is mostly granted in limited situationswhen a bankruptcy case occurs because of fraud or identity theft, or when the debtor did not consent to the filing .

The judges also have the authority to remove certain materials classified as scandalous or defamatory from the public record to protect a party or prevent access to trade secrets and confidential business information.

Read Also: Bankruptcy Attorney In Tampa

Us Bankruptcy Court Central District Of California General Order 20

On December 8, 2020, Chief Judge Maureen A. Tighe issued General Order 20-12 In Re: COVID-19 Public Emergency Closure of All Courthouses Through January 8, 2021 in response to the ongoing COVID-19 pandemic and to more closely align with District Court operations in light of the United States District Court Order of the Chief Judge 20-179, entered on December 7, 2020, which closes all courthouses of the Central District of California and suspends all in-person Court operations effective December 9, 2020 at 5:00 p.m. through and including January 8, 2021.

Effective December 9, 2020 at 5:00 p.m., the Edward R. Roybal Federal Building and United States Courthouse in Los Angeles, the Riverside Division Courthouse, the Ronald Reagan Federal Building and United States Courthouse in Santa Ana, the San Fernando Valley Division Courthouse in Woodland Hills, and the Northern Division Courthouse in Santa Barbara will be closed to the public, and all in-person U.S. Bankruptcy Court operations are suspended through January 8, 2021. Individuals filing bankruptcy without an attorney may file by mail or through the Courts Electronic Self-Representation module. Please refer to General Order 20-12 for specific filing requirements.

Judges will hear all matters remotely through telephonic or by video service. Previously issued guidance regarding signatures and filing fees, Social Security Number Statements, mediations, and judges or courtesy copies, remains in place.