Apply To Hm Land Registry

You need to send HM Land Registry either:

- an application for the cancellation of a Form J restriction, if you own your property with someone else

You must include a copy of your court order.

HM Land Registry Bankruptcy UnitSeaton CourtPlymouthPL6 5WS

All forms sent will be destroyed once the registers are updated. You can send copies if you write I certify that this is a true copy of the original together with your signature on the first page.

When Does The Discharge Occur

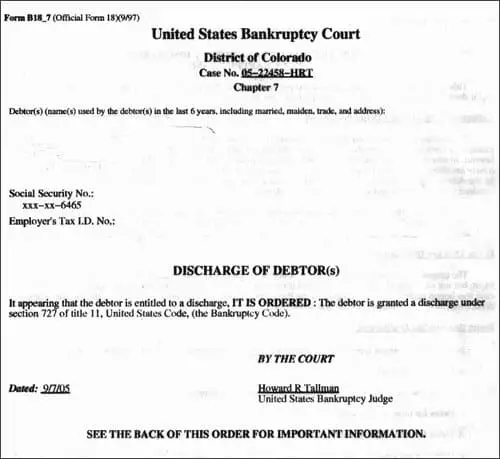

The timing of the discharge varies, depending on the chapter under which the case is filed. In a chapter 7 case, for example, the court usually grants the discharge promptly on expiration of the time fixed for filing a complaint objecting to discharge and the time fixed for filing a motion to dismiss the case for substantial abuse . Typically, this occurs about four months after the date the debtor files the petition with the clerk of the bankruptcy court. In individual chapter 11 cases, and in cases under chapter 12 and 13 , the court generally grants the discharge as soon as practicable after the debtor completes all payments under the plan. Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing. The court may deny an individual debtor’s discharge in a chapter 7 or 13 case if the debtor fails to complete “an instructional course concerning financial management.” The Bankruptcy Code provides limited exceptions to the “financial management” requirement if the U.S. trustee or bankruptcy administrator determines there are inadequate educational programs available, or if the debtor is disabled or incapacitated or on active military duty in a combat zone.

When Does Bankruptcy Discharge Happen

The timing of a discharge in a bankruptcy case depends on the chapter you file. If you filed for Chapter 7 bankruptcy, the court generally grants you a discharge three to six months after the date you filed the petition to the bankruptcy court.

Under Chapter 13 bankruptcy, the court can grant the bankruptcy discharge papers as soon as you complete the payments under the plan. This usually occurs three to five years after the date of filing.

But filing a petition for a bankruptcy discharge does not guarantee that you will be awarded one. The court can deny you, especially if there are anomalies present, as described in the Bankruptcy Code. These include failure to provide necessary tax documents, concealment of property, failure to complete personal financial management courses prescribed by the court, fraudulent acts, and failure to account for the loss of assets.

Recommended Reading: B Stock Phone Number

What Does Filing Chapter 7 Bankruptcy Do

Chapter 7 bankruptcy is the most common type of bankruptcy people file. It is the âliquidationâ form of bankruptcy that provides for the sale of a debtorâs property to pay creditors. However, in more than 90 percent of cases, the filer is able to keep all of their belongings. Property and personal belongings valued up to a certain amount are generally protected through bankruptcy by exemptions. Exemption schemes that vary by state, although some states allow their residents to use the federal bankruptcy exemptions. Exempt property includes a certain amount of equity in real estate , cars, and other personal property, as well as retirement accounts and certain types of income and benefits, like Social Security.

Not only can you keep most or all of your belongings despite filing for bankruptcy, but Chapter 7 can also discharge your nonpriority unsecured debts. After receiving a successful Chapter 7 discharge, you will no longer owe credit card debt, medical bills, or other eligible debts. Creditors of discharged debts can never legally attempt to collect those debts from you again. This can give you breathing room to get your financial affairs back in order so that you can pay your other, nondischargeable debts and move on with your life.

Can A Creditor Attempt To Collect A Discharged Debt

Debt collectors cant try to collect debts that have been discharged in a bankruptcy case. In addition, debt collectors arent permitted to attempt debt collection while a bankruptcy case is pending.

If you believe a creditor has violated the courts prohibition of contacting you about a discharged debt, consider asking an attorney about your legal options. If a creditor tries to collect on a discharged debt, a debtor can report this to the bankruptcy court and request that their case be reexamined. A judge can punish a creditor whos found to have violated the no-contact rule.

You May Like: How Much To File Bankruptcy In Tennessee

What Is A Trustee Discharge

Once all tasks associated with the bankruptcy process have been completed, the Licensed Insolvency Trustee that was appointed to you when filing for bankruptcy will need to apply to be discharged. They will be required to file a formal report with the Office of the Superintendent of Bankruptcy and the court.

Several items will be addressed in the report, including any fees associated with filing bankruptcy, the trustees fees, how assets have been liquidated, and how creditors have been repaid.

Once the court determines that the trustee has completed all duties under the Bankruptcy and Insolvency Act, the trustee will be discharged.

How Does Filing Bankruptcy Affect Your Credit

Filing bankruptcy will affect your credit score for as long as it appears on your , though the negative impact does diminish over time. Chapter 13 bankruptcy stays there for seven years, while Chapter 7 is there for 10 years, and you should see your credit score recover throughout the years given you dont have any financial hiccups along the way.

Chapter 13 also has less of a blow because if you complete your repayment plan you will at least have established a track record of paying your bills.

If youre filing for bankruptcy, chances are your credit score wasnt that good to begin with. If it was good, it will plummet 100-200 points, regardless of which chapter you use.

Recommended Reading: How Do I File Bankruptcy And Keep My Car

Also Check: How To File Bankruptcy On Credit Cards Only

What Can The Debtor Do If A Creditor Attempts To Collect A Discharged Debt After The Case Is Concluded

If a creditor attempts collection efforts on a discharged debt, the debtor can file a motion with the court, reporting the action and asking that the case be reopened to address the matter. The bankruptcy court will often do so to ensure that the discharge is not violated. The discharge constitutes a permanent statutory injunction prohibiting creditors from taking any action, including the filing of a lawsuit, designed to collect a discharged debt. A creditor can be sanctioned by the court for violating the discharge injunction. The normal sanction for violating the discharge injunction is civil contempt, which is often punishable by a fine.

Types Of Bankruptcy Filings

Bankruptcy filings in the United States fall under one of several chapters of the Bankruptcy Code, including Chapter 7, which involves the liquidation of assets Chapter 11, which deals with company or individual reorganizations and Chapter 13, which arranges for debt repayment with lowered debt covenants or specific payment plans. Bankruptcy filing costs vary, depending on the type of bankruptcy, the complexity of the case, and other factors.

Read Also: Did The Nra File For Bankruptcy

What If I Need My Discharge Date But I Dont Have My Paperwork Anymore

If you had a bankruptcy discharge but you canât find your court order, you can look up your case and case number on PACER. PACER is a government website that has records from bankruptcy courts, district courts, and appellate courts in the United States. The word PACER stands for Public Access to Court Electronic Records. PACER is free if you spend under $30 a quarter. The charge is .10 per page you view. A discharge order is usually only two pages. You can sign up as a non-attorney and then search for your case to view your record. You can search bankruptcy records by your social security number, but only your last four digits are displayed.

If youâre not comfortable with filling out forms online and making queries, you can that handled your bankruptcy. A limited number of courts have voice access to case information, and PACER has a list for you. It would help to have your case number. You can find the number on an old bankruptcy document if you donât want to go online. Some clerks can give the date of discharge over the phone. A paper copy of your discharge could cost a few dollars. A certified copy of your bankruptcy order for discharge will be more expensive.

What Are Some Negative Consequences Of A Bankruptcy Discharge

When you clean your financial slate with a bankruptcy, youll have to deal with some credit-related consequences.

A bankruptcy will remain on your credit reports for up to either seven or 10 years from the date you file, depending on the type of bankruptcy. Since your credit scores are calculated based on the information in your credit reports, a bankruptcy will affect your credit scores as well. This can make it more difficult to buy a home or a car with a loan, or even get a new apartment rental. For more information, check out our article on what happens to your credit when you file for bankruptcy.

A discharged Chapter 7 bankruptcy and a discharged Chapter 13 bankruptcy have the same impact on your credit scores, though its possible a lender might look more favorably on one or the other.

Recommended Reading: Product Pallets For Sale

Can A Bankruptcy Discharge Be Denied

A judge can deny a bankruptcy discharge for several reasons, such as:

- Failing to maintain financial records adequately

- Committing a crime related to the bankruptcy case

- Failing to follow an order from the bankruptcy court

- Fraudulently transferring, hiding or destroying property that is supposed to be part of the bankruptcy case

- Failing to complete a court-ordered financial management course

How Discharge Affects Your Home

The official receiver has 3 years to take action in relation to your home, this means it wont be affected by your discharge. Your share in your home will become yours again if they haven’t done any of the following within 3 years from the date your bankruptcy order was made:

- sold your share to someone – like your partner, friend or family member

- applied to the court for an order that you and anyone else living in your home have to leave

- applied to the court for a charging order

- come to an agreement youll pay them the value of your share

Find out more information about how bankruptcy will affect your home.

Also Check: Are Bankruptcy Courts Affected By Government Shutdown

Debt Discharge Comes After Selling Off Assets

Chapter 7 bankruptcy often involves the liquidation of assets in order to pay past debts. Only after this process is completed can you have qualifying debts discharged. Some property is protected from liquidation by federal or state bankruptcy exemptions. In fact, many people who file for Chapter 7 can keep a majority of their property. It will be up to your attorney and bankruptcy trustee to decide what you can keep, what deals you can make with the creditor, and what you need to give up in your bankruptcy case.

Once assets are liquidated, the courts tend to discharge debts right away. In the whole Chapter 7 bankruptcy process, this happens about four months after you first file in bankruptcy court. Keep in mind you need to complete educational classes on debt management in between filing and receiving the discharge, or the judge may dent your debt discharge.

Will A Chapter 13 Discharge Remove A Judgment From My Credit Report

Yes! A Chapter 13 removes judgments from your credit report. If you are subject to a judgment lien, you may need to avoid the lien through the Chapter 13 Plan in order to remove it completely. Your Chapter 13 bankruptcy attorney can discuss this with you and determine if you qualify for lien avoidance.

Also Check: Can You File Bankruptcy For Free

Will The Order List Discharged Debts

Noand many find this fact surprising. Instead of listing the wiped out debt, the order will provide general information about debt categories that dont go away in bankruptcy . For instance, it will explain that youll likely remain responsible for paying:

- domestic support obligations

- liabilities covered by a reaffirmation agreement .

For certain other debts, the creditor must file a lawsuit within the bankruptcy case asking the judge to declare that the bankruptcy will not discharge the debt. Debts that arise out of fraud committed by the debtor, or for personal injury caused by the debtor while intoxicated, are debts that the court might declare are nondischargeable.

Dont Miss: What Does Dave Ramsey Say About Bankruptcy

What Does A Bankruptcy Discharge Do

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

A bankruptcy discharge is a court order that wipes out certain debts like credit card debts and medical bills. Once you receive a discharge, you’re no longer legally obligated to repay the debts that were discharged. Some debts, like those that are secured by collateral, can only be discharged if you give up the collateral. In Chapter 7 cases, dischargeable debts will be eliminated in a matter of months. In Chapter 13 cases, the filers must complete their 3-5 year payment plan before their dischargeable debts are eliminated.

Written bythe Upsolve Team. Legally reviewed byAttorney Paige Hooper

A bankruptcy discharge is an order from the bankruptcy court that says youâre no longer responsible for paying certain debts. The court enters discharges in both Chapter 7 and Chapter 13 cases. To get a discharge, you must successfully complete all the requirements for your bankruptcy case. In a Chapter 13 case, this usually means completing all your plan payments. Once the court has entered your discharge order, creditors and debt collectors arenât allowed to try to make you pay the discharged debts.

Read Also: How Long Will Bankruptcy Be On My Credit Report

Can A Bankruptcy Discharge Be Revoked

Being granted with a bankruptcy discharge does not mean that you are no longer liable to pay off your debts. The court can still revoke the discharge under some rare circumstances.

For instance, the creditor or the US trustee can still request the bankruptcy court to revoke the discharge, especially if anomalies were proven to be present during the proceeding.

Examples of these are fraudulent activities, misstatements discovered during the audit or failure to provide necessary documents. As a general rule, the request to revoke the bankruptcy discharge should be filed within the year that the discharge was granted. Failure to do so will prevent the creditors from filing for revocation in the future.

What Does Bankruptcy Discharged Mean Summary

I hope you found this what does bankruptcy discharged mean Brandon Blog post informative. Are you worried because you or your business are dealing with substantial debt challenges and you assume bankruptcy is your only option? If it is too much debt for any reason, call me. It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties whileavoiding bankruptcy. We can get you the relief you need and so deserve.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

We understand that people and businesses facing financial issues need a realistic lifeline. There is no one solution fits all method with the Ira Smith Team. Not everyone has to file bankruptcy in Canada. The majority of our clients never do. We help many people and companies stay clear of bankruptcy.

We will get you or your business back up driving to healthy and balanced trouble-free operations and get rid of the discomfort factors in your life, Starting Over, Starting Now.

Don’t Miss: What Does Bankruptcy Chapter 13 Mean

What Does Bankruptcy Discharged Mean: Restrictions Placed On Undischarged Bankrupts

By enabling debtors to file an assignment in bankruptcy or consumer proposal, the Bankruptcy and Insolvency Act provides relief to an honest but unfortunate debtor. Garnishment of wages ceases, legal actions and collection calls cease, and the debtor receives some breathing space. If a bankrupt fails to fulfill his or her obligations, what happens? Can they receive a discharge from bankruptcy?

This Brandon Blog examines a recent case from Nova Scotia dealing with what does bankruptcy discharged mean for both a bankrupt person and for the licensed insolvency trustee. I also describe what does it mean for an undischarged bankrupt if the bankruptcy trustee gets its discharge when the bankrupt person does not have their bankruptcy discharge.

I will eventually get to the Court case, but there is first some background information that I will provide which sets the stage for a better understanding of the Court decision.