How Does Us Debt Compare To That Of Other Countries

The United States debt-to-GDP ratio is among the highest in the developed world. Among other major industrialized countries, the United States is behind only Japan.

The pandemic has sharply increased borrowing around the world, according to the International Monetary Fund. Among advanced economies, debt as a percentage of GDP has increased from around 75 percent to nearly 95 percent, driven by double-digit increases in the debt of the United States, Canada, France, Italy, Japan, Spain, and the United Kingdom .

The United States has long been the worlds largest economy, with no record of defaulting on its debt. Moreover, since the 1940s it has been the worlds reserve-currency country. As a result, the U.S. dollar is considered the most desirable currency in the world.

High demand for the dollar has helped the United States finance its debt, as many investors put a premium on holding low-risk, dollar-denominated assets such as U.S. Treasury bills, notes, and bonds. Steady demand from foreign creditorslargely central banks adding to their dollar reserves, rather than market investorsis one factor that has helped the United States to borrow money at relatively low interest rates. This puts the United States in a more secure position for a fiscal fight against COVID-19 compared to other countries.

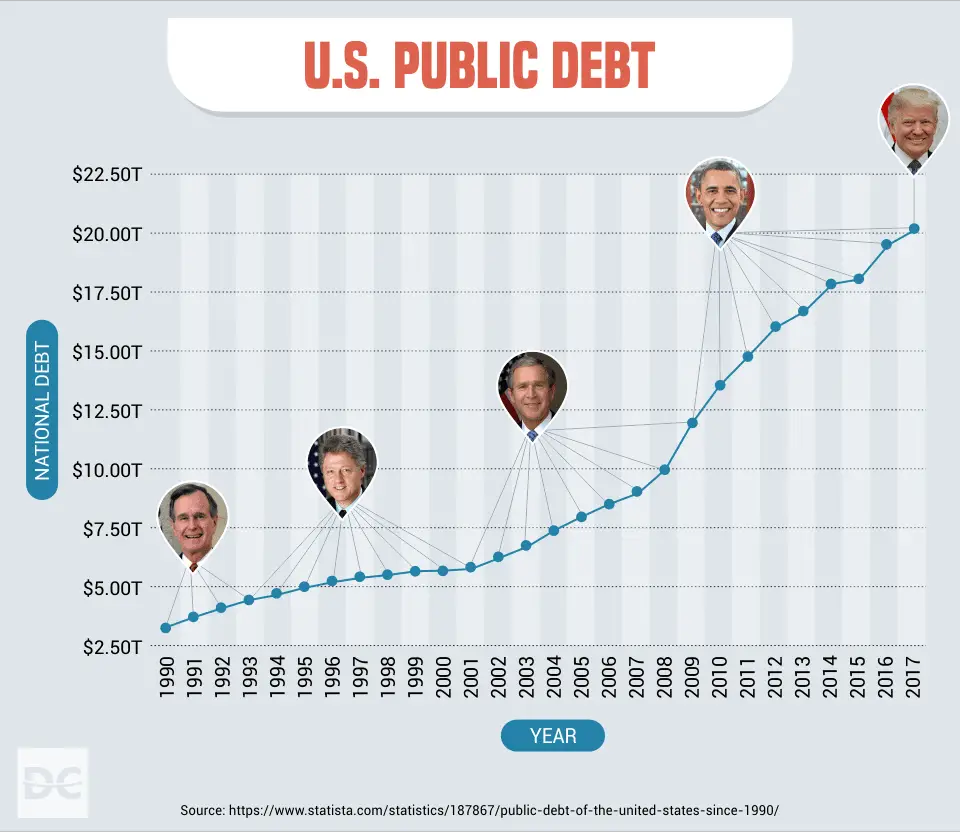

Our $23 Trillion National Debt: An Inter

While Americans may not personally feel the effects of our mounting debt today, we eventually will. The good news is that policy solutions can help address the issue before the bill comes due.

A founding pillar of American strength is our enduring commitment to building a bright future for the next generation. The very concept of the American Dream is rooted in this ideal.

When it comes to our nations finances, were falling short. Our federal budget will run a deficit of more than $1 trillion this year, and the national debt exceeds $23 trillion. Worse yet, our deficits and debt are projected to increase year after year, as far as the eye can see. Americas fiscal outlook is the definition of unsustainable.

While many Americans may not personally feel the effects of our mounting debt right now, the bill will ultimately come due, with interest. Running huge budget deficits damages our economy over time and eventually will diminish our leadership role in the world.

In fundamental terms, fiscal irresponsibility represents an inter-generational injustice, and a moral failure. Piling on trillions in red ink is making a choice to benefit ourselves today, at the expense of our own children and grandchildren.

In fundamental terms, fiscal irresponsibility represents an inter-generational injustice, and a moral failure. Piling on trillions in red ink is making a choice to benefit ourselves today, at the expense of our own children and grandchildren.

The Debt Ceiling: An Explainer

The United States hit its debt limit on August 1st, and the Treasury Department will soon run out of cash and other resources to stay below it, risking a default on obligations. Many do not fully understand what the debt limit is and the full impact of a breach. This piece explains the basics of the debt limit, the current situation, and the differences between a debt limit default and a government shutdown.

What is the national debt?

The national debt is the total amount of outstanding borrowings by the U.S. Federal government, accumulated over our history. The Federal government needs to borrow money to pay its bills when its ongoing operations cannot be funded by Federal revenues alone. When this happens, the U.S. Treasury Department creates and sells securities. These securities are the debt owed by the Federal government. There are many different types of Treasury debt bills, notes, and bonds are the most common ones. The various types of debt differ primarily in when they matureranging from a few days to 30 yearsand in how much interest they pay. The United States has not run an annual surplus since 2001, and has thus borrowed to fund government operations every year since then.

What is the debt limit?

The debt limit is a ceiling imposed by Congress on the amount of debt that the U.S. Federal government can have outstanding. This limit has been set at $28.4 trillion since August 1st, 2021.

What happens when the U.S. government hits the debt limit?

Don’t Miss: What Does Bankruptcy Mean For Forever 21

Are We Helpless When It Comes To The National Debt

In some ways, yes. But there are actions you can take to mitigate the effect of the national debt on your life.

- Pay your taxes: According to the IRS, the federal government loses $1 trillion each year due to unpaid taxes.

- Put pressure on your Congressional reps: Call or write to your Representatives and Senators in support of tax code reform, increased funding for the IRS to track down tax cheats and closing loopholes that give the countrys most profitable companies tax bills that are lower than most Americans.

- Follow your reps voting history: If youre curious how your Representatives and Senators have voted on fiscal policy issues, thats easy to check. You can use voting history to back up your concerns when writing or calling your reps.

- Learn about healthcare reform: While national healthcare remains a contentious topic, it could pay to learn how other countries control healthcare costs and how those policies could benefit you, your neighbors and the impact rising healthcare costs has on the national debt.

Rehling from Wells Fargo Investment Institute says that while the national debt has increased substantially over the past decade, the U.S. isnt unique in this regard. The rest of the developed world has seen similar trends.

While these budget trends are unsustainable over the long run, there is no indication that current debt levels are overly worrisome, he says.

Lower Returns On Your Investments

Bonds issued by the Treasury are typically seen as low-risk investments. When interest rates rise, the yield on these low-risk investments also rises, making them more attractive investments for income-minded investors over other riskier income-generating investments like corporate bonds.

This could leave companies that typically rely on bonds short on the loans they need to finance expansions and operations and translate into lower returns for equity investors when companies fail to meet revenue targets.

You May Like: What Does Debt To Income Ratio Mean

Are We Expecting Sovereign Debt To Do Too Much

The writer is an FT contributing editor

In July of 1694 an act of parliament gave William and Mary the right to levy a tax on shipping and beer. In return, they had to dedicate that revenue toward paying back a group of people who would lend them £1.2mn. This is the act that chartered what would become the Bank of England. The preamble gives the bank one purpose: the money is to go towards carrying on the War against France.

That is no longer the statutory goal of the Bank. But that first £1.2mn loan to William and Mary is still treated by economists and policymakers as definitional. Whether to carry on against France or inflation, central banks buy and sell sovereign debt. Any other assets are seen as either political or, worse, not normal: embarrassing panic buys to be shed from the balance sheet as quickly as possible.

In the past two weeks gilts had a swoon, and then a Fed governor said that treasury markets were functioning well two of the most terrifying words in markets. Its possible that were asking sovereign debt to do too much, and right there in that original act theres an option we keep pretending doesnt exist: central banks can buy whatever we tell them to.

Rising Debt Can Distort The Economy Indirectly By Setting Off Financial Distress Costs

A related, and far more important, potential problem is the extent to which these implicit or explicit transfers undermine growth indirectly. Economic agents arent stupid or incapable of learning. As uncertainty rises about how real debt-servicing costs are to be allocated, there is also increasing uncertainty about which sector will be forced to absorb the cost and how, so economic agents are likely to alter their behavior in ways that protect themselves.

Historical precedents show the many ways in which various sectors of the economy do this. As rising debt causes a growing gap between ex ante demand and supply, economic agents understand that this gap will be resolved by some combination of means including inflation, higher taxes, rising unemployment, wage suppression, financial repression, capital controls, and currency depreciation. As this happens, householdsespecially wealthy onesshift their wealth into movable assets or into foreign currency , consumers cut back on spending, home buyers and equipment buyers delay purchases, manufacturers move operations abroad, farmers hoard production or cut back on land development, and workers, if they are allowed to do so, will unionize and become more militant or, if not, they will work less efficiently. In countries where foreigners might be seen as acceptable political targets, foreign businesses in particular are likely to react to uncertainty over debt repayment by liquidating assets and moving abroad.

Also Check: Bankrupt Houses For Sale

How Demand Adjusts To Supply

This is a simple idea, even if it isnt always well understood. Government spending, whether financed by money creation or debt creation, automatically increases the purchasing power of some sector of the economy, in effect increasing demand. If government spending simultaneously increases supply by an equivalent amounteither directly or indirectly there is indeed no meaningful constraint on government spending.

But any government spending that increases demand without directly or indirectly increasing supply by the same amount creates an imbalance in ex ante supply and ex ante demand, an imbalance that must be resolved by implicit or explicit transfers. These transfers must reduce the purchasing power of one or more sectors of the economy by enough so that the ex ante gap between demand and supply is reduced to zero. Demand and supply must always balance at all times, and the ability to create credible money at will doesnt change this.

What is more, and contrary to what many MMT proponents seem to think, taxes and inflation are not the only mechanisms that can resolve the gap between demand and supply. There many such mechanisms, including the following ones.

What Would Happen If China Were To Call In Its Debt

China’s position as the largest foreign holder of U.S. debt gives it some political leverage. It is responsible for lower interest rates and cheap consumer goods. If it were to call in its debt, U.S. interest rates and prices could rise, slowing U.S. economic growth.

On the other hand, if China were to call in its debt, the demand for the dollar could plummet. This dollar collapse could disrupt international markets even more than the 2008 financial crisis. China’s economy would suffer along with everyone else’s.

If China ever did call in its debt, it slowly would begin selling off its Treasury holdings. Even at a slow pace, dollar demand would drop. That would hurt China’s competitiveness by raising the yuans value relative to the dollar. At some price point, U.S. consumers would buy American products instead. China could start this process only after it further expanded its exports to other Asian countries and increased domestic demand.

Also Check: How To File Bankruptcy On Car Loan

Is China’s Strategy Working

China’s low-cost competitive strategy seems to be working. Its economy grew more than 10% for the three decades before the 2008 recession. In 2019, it grew at 6.1%, an even more sustainable rate.

China has become one of the largest economies in the world. And if you measure it by gross domestic product and consider purchasing power parity , China is seen as the worlds largest economy.

China also became the world’s biggest exporter in 2009. China needs this growth to raise its low standard of living. For these reasons, we’ll likely see China remain one of the world’s largest holders of U.S. national debt.

Intergovernmental Vs Public Debt

The intragovernmental debt is what the government owes the Social Security Trust Fund and other federal agencies. It’s not part of the public debt and it doesn’t impact the interest on that debt. It’s money the government owes itself.

The debt held by the public$22.3 trillion as of January 2022is held in the form of Treasury bills, notes, and bonds, as well as Treasury Inflation-Protected Securities , savings bonds, and other securities. The majority of the public debt is owned by the American people, either through individual investors, the Federal Reserve, or state and local governments.

The total national debt was over $28 trillion for most of 2021. Congress raised the debt limit to $28.4 trillion on Aug. 1, 2021 to accommodate this, then it raised it again by another $2.5 trillion on Dec. 16, 2021. The interest on the public debt for fiscal year 2021 is estimated to be $413 billion, according to the Congressional Budget Office .

Don’t Miss: What Does A Bankruptcy Discharge Paper Look Like

How Much Debt Does The Average American Have

Lets see what stats have to say:

1. In 2020, the average Americans debt payments made up 8.69% of their income.

To put this into perspective, the average American allocates almost 9% of their monthly income to debt payments, which is a drop from 9.69% in Q2 2019.

The drop from 9.69% to 8.69% could be due to allowances made for coronavirus-related income loss and debt relief programs.

2. In 2020, the average revolving credit card balance of an average American cardholder was $6,271.

A revolving credit card balance is one that people pay interest on. Its one of the most important figures to note when looking at US consumer debt statistics.

The up-to-date figures on revolving credit card balances come from the 2019 survey of consumer finances which took place before the COVID-19 pandemic. However, at the end of last year, the average revolving balance for cardholders was $6,271.

3. In Q3 2020, the US credit card delinquencies stood at 1.53%, reaching record-low levels.

Despite coronavirus-related financial difficulties, Americans remained surprisingly steady in paying their credit card bills on time. In Q3 2020 the average American debt statistics show that the delinquency rate of credit card loans from commercial banks was 1.53%.

4. The US average mortgage rate in 2020 hit the lowest of 2.78%.

These low rates have also led to a rush on refinances, especially before December 2020, when the new 0.5% refinance fee kicked in.

| 2018 | 10.32% |

How Is The Covid

In response to the pandemic, the federal government has spent trillions of dollars to boost the economy, including on stimulus checks for citizens and aid for businesses and state and local governments. According to the Congressional Budget Office , these measures swelled the federal deficit to $3.1 trillion in 2020, about 15 percent of GDP and the highest level since World War II. Even before the pandemic, the CBO projected that annual deficits would breach the $1 trillion mark in 2020 and remain above that level indefinitely.

More on:

Debt held by the publicthe measure of how much the government owes to outside investorswas $16.9 trillion in 2019. That was more than double the amount in 2007, an increase to almost 80 percent of GDP from 35 percent. Before accounting for spending to combat COVID-19, publicly held U.S. debt was set to nearly double to more than $29 trillion over the next decade. Now, it is about $22 trillion, and its projected to be double the size of the economy by 2051.

Also Check: What Is The Best Way To Rebuild Credit After Bankruptcy

Interest On The National Debt And How It Affects You

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The interest on the national debt is how much the federal government must pay on outstanding public debt each year. The national debt includes debt owed to individuals, to businesses, and to foreign central banks, as well as intragovernmental holdings.

Get The Help You Need Along The Way

Say it again: Youre not in this alone. And guess what? You dont have to figure everything out on your own either. Learn the ins and outs of debt in Financial Peace University.

This nine-lesson course will teach you the plan to get outand stay outof debt, and get you pumped up to pay it off forever.

And listen: It actually works. The average debt paid off in the first 90 days of working this plan is $5,300.

When you’ve built a solid foundation of knowledge, it makes the debt-free journey quicker and easier. Thats a true win-win.

You May Like: Foreclosures In Jacksonville Fl

Why Gao Did This Study

GAO audits the consolidated financial statements of the U.S. government. Because of the significance of the federal debt to the government-wide financial statements, GAO audits Fiscal Service’s Schedules of Federal Debt annually to determine whether, in all material respects, the schedules are fairly presented and Fiscal Service management maintained effective internal control over financial reporting relevant to the Schedule of Federal Debt. Further, GAO tests compliance with selected provisions of applicable laws, regulations, contracts, and grant agreements related to the Schedule of Federal Debt.

Federal debt managed by Fiscal Service consists of Treasury securities held by the public and by certain federal government accounts, referred to as intragovernmental debt holdings.

Debt held by the public primarily represents the amount the federal government has borrowed to finance cumulative cash deficits and is held by investors outside of the federal governmentincluding individuals, corporations, state or local governments, the Federal Reserve, and foreign governments. The majority of debt held by the public consists of marketable Treasury securities, such as bills, notes, and bonds that are sold through auctions and can be resold by whoever owns them.

In commenting on a draft of this report, Fiscal Service concurred with GAO’s conclusions.

For more information, contact Dawn B. Simpson at 512-3406 or .