Two: Use Secured Credit Cards Or Small Loans To Help Build A Record Of On

Secured credit cards. To begin rebuilding your credit, you may wish to obtain a secured credit card. A secured credit card uses money deposited in a bank account as collateral for the credit card. The creditor can take the money in the account only if you default. Some banks offering secured cards do not require a credit check, and it may be easier to obtain a card from them. However, be sure to shop around. Some secured card providers charge excessive fees and interest. You should also make sure the provider reports to all three credit reporting agencies .

It is important to use no more than twenty percent of your available credit on your secured card .

Example: if you have a limit of $500, avoid carrying a balance of more than $100 on the card at any one time.

The purpose of this card is to rebuild your credit, so responsible use is essential. If you are a couple, it is good to have a separate card for each of you.

Quick Note: A secured credit card is not the same thing as a prepaid credit card. Although very convenient, prepaid credit cards do nothing to improve your credit.

Small Lines of Credit and Vehicle Loans. A small unsecured line of credit can be useful in rebuilding your credit. Likewise, if you need a vehicle, a car loan is another way to rebuild credit. However, I do not suggest getting a car loan just to rebuild your credit. See below for information on obtaining a vehicle loan after bankruptcy.

Declarations Of Insolvency And Inability To Pay

Consult B 6/74-8, B 6/176-177 and B 6/220-222 for declarations of insolvency and inability to pay. From 1825-1854 these records cover London and county cases. After 1854 they cover London only. They usually show:

- the date the declaration was filed

- name, address and occupation of the debtor

- debtors solicitors name

How Long Does It Take For A Bankruptcy Discharge After The Meeting Of Creditors

Also known as the 341 hearing or 341 meeting, the meeting of creditors is an important stage of the California bankruptcy process in both Chapter 7 and Chapter 13 cases. Our Roseville bankruptcy attorneys explain how the meeting of creditors fits into the bankruptcy timeline in both chapters, including how long into a bankruptcy case the meeting of creditors occurs, and how long it takes for a bankruptcy discharge after the 341 hearing has concluded.

Read Also: How Do You File Bankruptcy In Missouri

What Does A Chapter 13 Discharge Mean

A discharge is the fancy legal term for your debts being forgiven in your bankruptcy. When we talk about debts forgiven in bankruptcy, we would say that your debts are discharged. The Chapter 13 discharge order is the final order you receive in your Chapter 13 bankruptcy. It is signed by the bankruptcy judge assigned to your cases and states clearly that you have received a Chapter 13 discharge. In other words, it is the formal document that releases you of your debts.Some people refer to the order less formally such as discharge papers.

Bankruptcy Discharge Certificate Canada: What Are The Benefits Of Keeping My Bankruptcy Discharge Papers

As reviewed above, after you have actually successfully finished every one of your bankruptcy responsibilities and any kind of conditions of discharge, you will receive your discharge from bankruptcy. When you get your bankruptcy discharge your Trustee will give you a bankruptcy discharge certificate Canada.

That paper is proof that you have actually formally been launched from your financial debts that were included in your bankruptcy. As already stated, particular financial obligations cant be discharged in bankruptcy. Also, any type of debts that you sustain after the day of your bankruptcy are your responsibility as well as are not eliminated by your bankruptcy discharge.

Recommended Reading: Toygaroo Reviews

Bankruptcy Discharge Certificate Canada: What If I Fail To Include One Of My Creditors In My Bankruptcy

If I failed to remember to include one of my creditors in my bankruptcy do I need to pay them? If your Trustee hasnt been discharged yet, simply tell the creditor to call your Trustee to participate in your bankruptcy.

If your Trustee has actually been discharged then the creditor is qualified to be paid the same returns your other creditors obtained from your bankruptcy. You will need to pay this amount.

If you intentionally omitted the lender from your bankruptcy after that the lender can ask the court to enable their financial obligation to survive, and if successful, you will need to pay the full amount.

When Does The Discharge Occur

The timing of the discharge varies, depending on the chapter under which the case is filed. In a chapter 7 case, for example, the court usually grants the discharge promptly on expiration of the time fixed for filing a complaint objecting to discharge and the time fixed for filing a motion to dismiss the case for substantial abuse . Typically, this occurs about four months after the date the debtor files the petition with the clerk of the bankruptcy court. In individual chapter 11 cases, and in cases under chapter 12 and 13 , the court generally grants the discharge as soon as practicable after the debtor completes all payments under the plan. Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing. The court may deny an individual debtor’s discharge in a chapter 7 or 13 case if the debtor fails to complete “an instructional course concerning financial management.” The Bankruptcy Code provides limited exceptions to the “financial management” requirement if the U.S. trustee or bankruptcy administrator determines there are inadequate educational programs available, or if the debtor is disabled or incapacitated or on active military duty in a combat zone.

Read Also: Can You Get An Sba Loan With A Bankruptcy

Bankruptcy Discharge Certificate Canada: How Long Will I Be Bankrupt

For a 1st time bankrupt person, many will certainly qualify for an automatic discharge after 9 months.

If you have been bankrupt before a second bankruptcy discharge will not be able to get a discharge in 9 months. Your bankruptcy will be prolonged. A 2nd bankruptcy lasts for a minimum of 24 months. If you have surplus income, a second-time bankrupt will not have the ability to get a bankruptcy discharge certificate Canada for 36 months.

For a 3rd time bankrupt, the timeline is the same as the 2nd time bankrupt. Nonetheless, it is more probable that there will be resistance to that bankrupts discharge by the Trustee or one or more creditors. The court can prolong the time in whichever means it believes is most suitable.

Discharge And Your Business

After discharge you can carry on a business without the restrictions that applied during your bankruptcy.

You can act as a director of a limited company or be involved in its management .

You will be able to obtain credit without having to mention your bankruptcy but you will want to ensure that you can repay it.

Also Check: How Many Times Did Donald Trump File For Bankruptcy

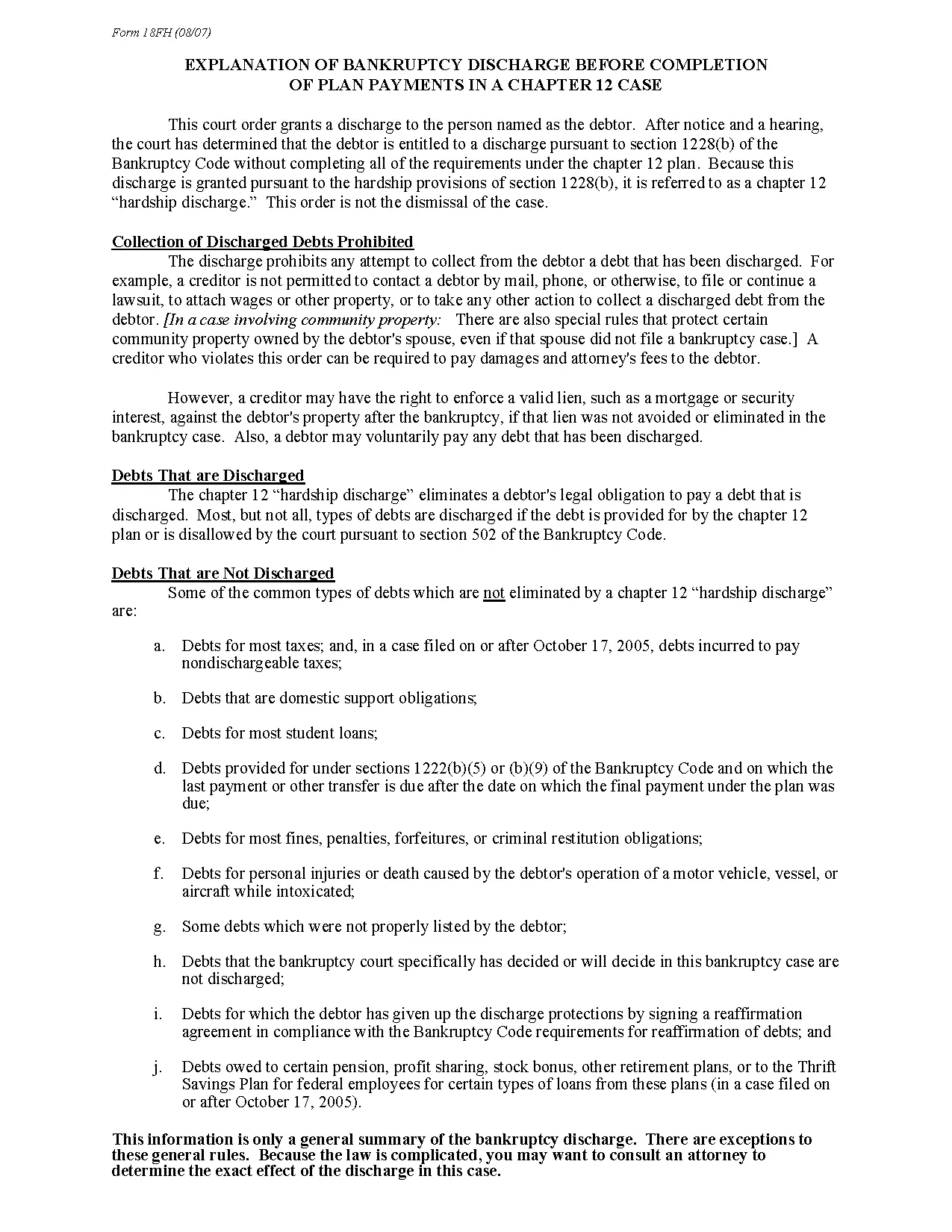

What Debts Can’t Be Discharged

Depending on which type of bankruptcy is filed, there are certain types of debts that cannot be discharged. The following types of debt are not dischargeable under the specific chapters listed below.

- Debt secured by a lien

- Court costs

- Debts that result from you maliciously or willfully injuring another person or entity

- Debt that results from death or personal injury while driving under the influence

- Mortgages

- Debt that results from death or personal injury while driving under the influence

- Criminal fines

The following debts can be discharged, but the discharge may be stopped if a creditor files a motion in court requesting that the debt be declared non-dischargeable.

- Debt that was a result of fraud

- Civil court judgements

How To Get Proof You’ve Been Discharged

Your discharge from bankruptcy will happen automatically, so you won’t necessarily get proof sent to you.

Email the Insolvency Service to get a free confirmation letter. You should only ask for this after the discharge date.

If you ask for a confirmation letter, you must include your:

- full name

- National Insurance number

- court reference number

If youre applying for a mortgage, youll need a Certificate of Discharge. If you originally applied for bankruptcy through a court then youll need to ask them for a certificate. This costs £70 and £10 for extra copies.

If you originally applied for bankruptcy online, email the Insolvency Service for a certificate. Theres no fee for a Certificate of Discharge if you applied online.

Also Check: How Many Bankruptcies Has Donald Trump Filed

Fans Of Nbcs The Office May Remember An Episode In Which Michael Scott Yells To His Office I Declare Bankruptcy Unfortunately Theres A Lot More To Fixing A Heap Of Debt Than Making A Loud Proclamation Filing For Bankruptcy Is A Complex Legal Process That Might Save You Money But It Also Comes With Serious Consequences Youll Want To Consider

The first step in determining whether a bankruptcy is right for you is defining what it is. Here are a couple important terms to know:

- Bankruptcy is a legal means by which someone with a large burden of debt can get out from under it. In a 1934 case , the U.S. Supreme Court defined the purpose of bankruptcy as giving a new opportunity in life and a clear field for future effort, unhampered by the pressure and discouragement of preexisting debt. In other words, its an opportunity for a financial do-over.

- If bankruptcy is the end goal, a bankruptcy discharge is a tool used to accomplish it. A bankruptcy discharge is a court order that releases a debtor from personal liability for specific debts. It legally prohibits a lender or creditor from taking any action to collect the debt in question.

Sound too good to be true? In several important ways, it is. For one, the bankruptcy shows up on your credit reports for seven to 10 years, depending on the type of bankruptcy you file, and will almost surely harm your credit scores. It also only applies to certain specific types of debts, so its not a catch-all remedy.

Follow along to learn more about discharged debt and whether a Chapter 7 or Chapter 13 bankruptcy might make sense for you. If in doubt, work with a qualified or bankruptcy lawyer to ensure you make the best decision for your needs.

Do you really need to talk to a credit counselor if youre considering bankruptcy?

What Happens In Every Bankruptcy Case

When you file a bankruptcy case, you’ll have to complete certain requirements before you can qualify to have your debts discharged . At a minimum, you’re required to:

- fill out bankruptcy paperwork with details about your financial situation, including your assets, debts, income, and expenses

- pay a filing fee

- provide 521 financial documentation to the bankruptcy trustee

- complete .

You’ll have to wait 60 days after your meeting of creditors before the court will issue your discharge order. If all of your property is exemptmeaning that you’re allowed to keep itthe court won’t have to take any further action in your case and will most likely close it.

Also Check: Shark Tank Bankruptcies

Bankruptcy Discharge Certificate Canada: Who Tells My Creditors That I Am Discharged From Bankruptcy

The Trustee will notify the Office of the Superintendent of Bankruptcy that the individual has been released from bankruptcy. The Trustee advises the OSB by filing a copy of the bankruptcy discharge certificate Canada. The Trustee advised the creditors that the insolvent is qualified to a discharge unless an opposition is filed in the bankruptcy notification sent out to all creditors.

The Canadian credit bureaus, Equifax Canada and TransUnion Canada are notified because they pay the OSB to get Canadian bankruptcy information. The credit bureaus then update all credit files with the corresponding bankruptcy info, including discharges.

Will A Chapter 13 Discharge Remove A Foreclosure From My Credit Report

Yes! A Chapter 13 will remove any negative items regarding your foreclosure. It will remove the indication of the foreclosure itself, but also the missed payments leading up to the foreclosure. The Chapter 13 will also prevent you from being sued for a deficiency judgment and will prevent you from being taxed on any deficiency that is forgiven.

Don’t Miss: How Many Times Has Trump Filed For Bankrupsy

What Is Bankruptcy Fraud

In the United States, bankruptcyfraud is a federal crime. Bankruptcy is a legal process which allows a business or individual to be discharged of all their debts due to an inability to pay. There are multiple types of bankruptcy, but all have the same definition of what types of actions constitute bankruptcy.

There are three methods of committing bankruptcy fraud: concealment of assets, multiple filings and petition mills. The number of cases rises in proportion to the number of bankruptcy filings each year. Convictions for this crime can result in a fine up to $250,000 US Dollars and/or up to five years in prison.

Concealment of assets is the most common type of bankruptcy fraud. This type of fraud occurs when the debtor hides his assets during the declaration phase of the bankruptcy process, in an attempt to keep them from being liquidated. Debtors may fail to include them on the list of assets, transfer ownership to family or friends and move assets into off-shore accounts.

Bankruptcy Discharge Certificate Canada: The Complete Happy Story Of Your Bankruptcy Discharge

- Post author

If you would like to listen to the audio version of this Brandons Blog, please scroll to the bottom and click on the podcast

TheIra Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.We hope that you and your family are safe and healthy.

You May Like: How Many Bankruptcies Has Donald Trump Filed

Make An Emergency Fund

If you lose your job or face any sort of unexpected financial needs, having an emergency fund can help you avoid a disastrous outcome that lands you back in debt. You’ll want to get started on creating this type of savings account as soon as possible, even if you only have a limited amount of money to contribute on a regular basis. The deposits will add up over time and making regular deposits, no matter how small, will help you establish the habit of saving.

Are You Getting A Refund

Refunds that are issued as a result of returns for years prior to the year of bankruptcy are considered to be the property of the estate in bankruptcy. As a result, these refunds will be sent to the trustee. Any refunds issued in relation to returns for years subsequent to the year of bankruptcy will be sent to you, unless the trustee has obtained a court order.

For the year of bankruptcy, any issued refund related to the pre-bankruptcy return will be sent to the trustee. Issued refunds related to the post-bankruptcy return will also be sent to the trustee if your bankruptcy assignment date is July 7, 2008, or later. Post-bankruptcy refunds that are issued for bankruptcies with an assignment date prior to that will be sent to you, unless the trustee has obtained a court order or has provided us with an Authorization and Direction letter.

Don’t Miss: Can A Bankruptcy Be Removed Early

Contact Arm Lawyers Today

Never hesitate to reach out to our office during any part of the process. We can skillfully guide you through everything, step by step. If youre already a client, great! Call if you need us. But, If you arent a client, thats ok too! Call for a free bankruptcy consultation today.

We are a debt relief agency. We help people for relief under the U.S. Bankruptcy Code.

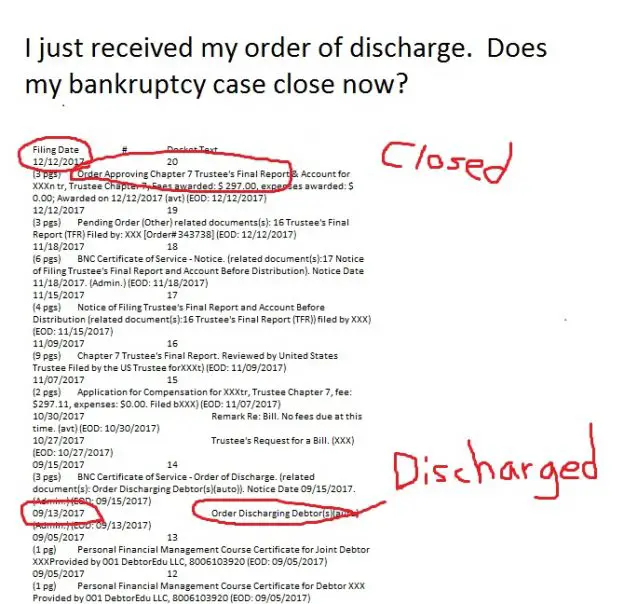

Why A Case Isn’t Over After A Bankruptcy Discharge

Most people file for bankruptcy for the debt discharge. It’s the last court action that directly affects many filers, so, understandably, they think the case is over once it’s received. It’s also confusing that, in many instances, the court will close the case soon after the entry of discharge. But the discharge order and case closure are different.

The bankruptcy discharge releases the debtor from liability for certain debts, so the debtor is no longer legally required to pay the balance. The discharge also prohibits creditors from collecting discharged debts in any manner, including through lawsuits, demand letters, and telephone calls.

In some cases, the bankruptcy will continue for some time after the discharge order is issued. In fact, for creditors, the trustee, and the court, the case could be just getting underway.

You May Like: Can Restitution Be Discharged In Bankruptcy

Tips For Recovering From Bankruptcy

Filing for bankruptcy can feel like you’ve hit the financial equivalent of rock bottom. While it does wipe out your old debt, bankruptcy stays on your credit report for seven to 10 years, hurting your long-term chances of qualifying for a mortgage or other credit.

What does life after bankruptcy look like? There will be hardships you’ll have to endure – from cashflow management to establishing good credit and rebuilding your financial profile – but it’s possible to financially recover from bankruptcy and give yourself a fresh start.