What Is The Debt

The debt-to-income ratio is a metric used by creditors to determine the ability of a borrower to pay their debts and make interest payments. The DTI ratio compares an individuals monthly debt payments to his or her monthly gross income. It is a key indicator that lenders use to measure an individuals ability to repay monthly payments and accumulate additional debt.

What Is A Debt

Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow.

Different loan products and lenders will have different DTI limits. To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000. If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

What Factors Make Up A Dti Ratio

- Front-end ratio: also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

Recommended Reading: Can You File Bankruptcy On Income Taxes

The Fha Streamline Refinance

The FHA offers a refinance program called the FHA Streamline Refinance which specifically ignores DTI, even if its a high DTI that wouldnt qualify for an FHA purchase loan.

Official FHA mortgage guidelines also waive income verification and credit scoring as part of the streamline refi process. Instead, the FHA looks to see that the homeowner has been making the homes existing mortgage payments on time and without issue.

If the homeowner can show a perfect payment history dating back three months, the FHA assumes that the homeowner is earning enough to pay the bills.

In Summary: What Is A Good Debt

Its good to have a low DTI because it increases your ability to take on debt if you need to, and it also indicates that youre likely able to manage the debt load you currently have. If youre looking to get a new loan, its good to know how your DTI is calculated and whether yours may help, or hurt, your chances of qualifying. Normally in life, the higher the score, the better. In the case of DTI, low is the way to go.

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice, legal, financial, or tax advice. We cannot and do not guarantee their applicability or accuracy in regard to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues. Calculators do not include the fees and restrictions that certain products may have. This calculator does not indicate whether you would qualify for a Laurel Road loan. Please visit the applicable banking product pages on laurelroad.com for specific terms and conditions.

In providing this information, neither Laurel Road nor KeyBank nor its affiliates are acting as your agent or is offering any tax, financial, accounting, or legal advice.

Read Also: How Often Can You File For Bankruptcy In California

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

Rental Verification Is Required On Manual Underwriting

Many folks who rent do not realize the importance of paying their rental payments with a check. Many renters pay their monthly rental payments on time, month after month, year after year, but do not pay it with a check or online and pay it with cash. Any cash rental payment will not count for verification of rent. Verification Of Rent is one of the most important compensating factors a borrower can have and verification of rent is a requirement on all manual underwriting.

The only way verification of rent can be proven is by providing 12 months canceled checks and/or 12 months bank statements if the rental payments were wired to the landlord and paid online. If the renter has been renting from a registered property management company, then verification of rent form signed by the property management manager can be used in lieu of canceled checks and/or online bank statements. Verification of Rent is also required for mortgage loan applicants with credit scores of under 600. Reason verification of rent is so important is lenders want to determine payment shock. For example, if you are living rent-free with family and are used to paying no rent and new housing payment will be $1,200, that is a huge payment shock However, if renters are currently paying $1,000 per month in rent and new housing payment will be $1,100, then your payment shock of $100 per month or 10% should be no issue.

Read Also: How Does Filing Bankruptcy Affect Your Tax Return

What Is Your Debt

Your debt-to-income ratio is your monthly debt obligations compared to your total monthly income.

Your debt includes everything from credit card and car payments to student loans and the payment of items such as child support. If you owe money on it, its debt and it should be counted in your DTI.

Lets look at it as a box of donuts donuts make everything better.

Every month, you get one dozen donuts to take to a donut party. Delicious! But every month, before the party, you also have to give two donuts to your dog-walker and one donut to your mailman. You also have to give a donut to your landlord.

While your donut income may be 12, you cant take 12 donuts to the donut party because every month you have to give away four of your donuts. The donut party organizers care less about how many donuts you start with every month and more about how many donuts you actually bring to the party. After all, you cant eat donuts you dont have!

In this example, your monthly donut debt is 4 and your monthly donut salary is 12. Four divided by twelve is .33, or 33%. So, your debt-to-donut ratio is 33%. Not bad!

What Dti Should I Aim For

As a rule of thumb, your DTI should range between 36% and 43% when youre applying for a mortgage.

That said, a lower debt-to-income ratio is always better. The lower your debt-to-income ratio, the better mortgage rate youll get.

DTI is a key ingredient in home affordability for many borrowers: When a low DTI helps you avoid high-interest mortgage loans, you can afford a more expensive home.

Recommended Reading: What’s The Difference Between Chapter 7 And Chapter 13 Bankruptcy

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

What Does Debt To Income Really Mean

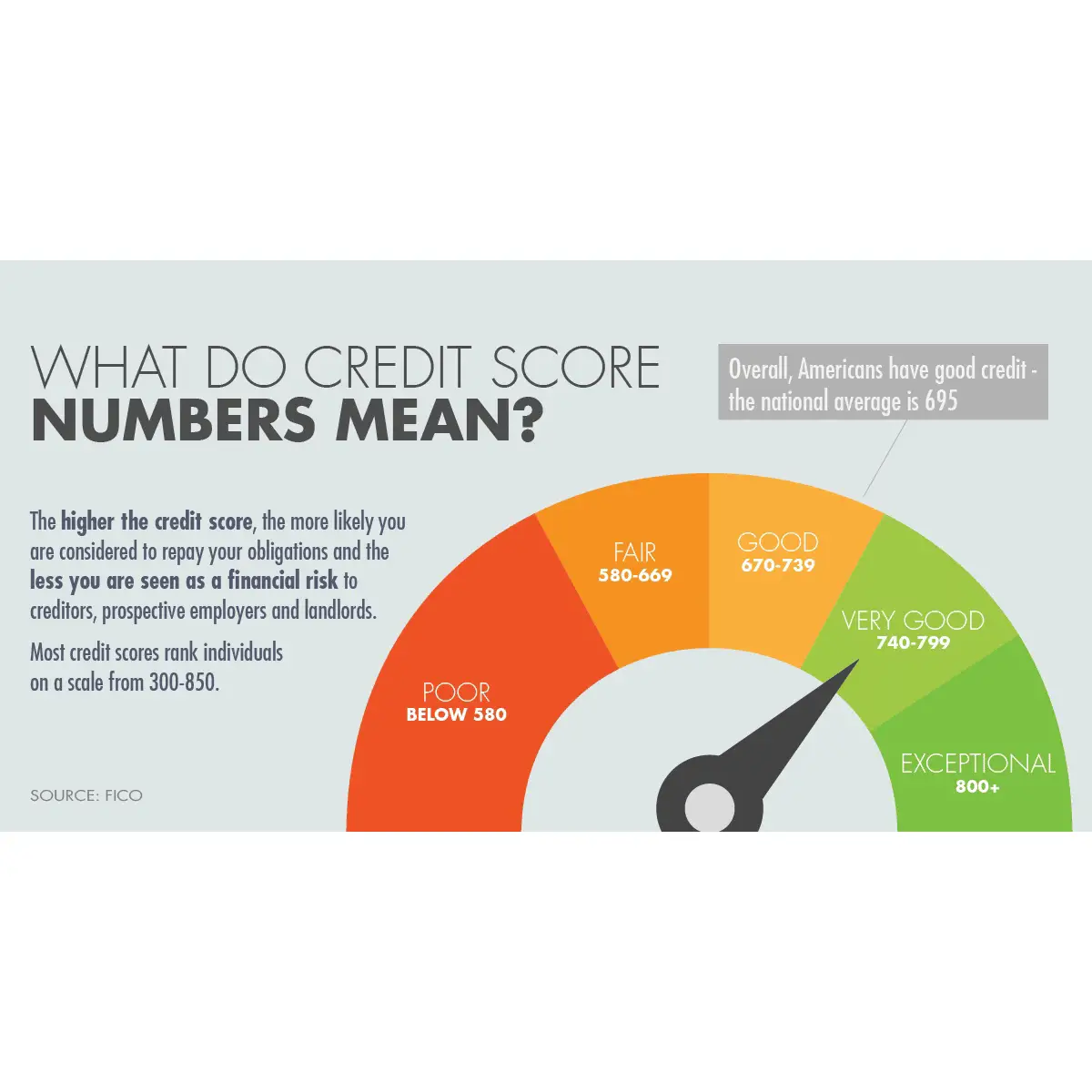

In addition to your , your debt-to-income ratio is an important part of your overall financial health. Calculating your DTI may help you determine how comfortable you are with your current debt, and also decide whether applying for credit is the right choice for you.

When you apply for credit, lenders evaluate your DTI to help determine the risk associated with you taking on another payment. Your DTI is a percentage calculated by dividing your monthly gross income with your monthly debt payments. Follow the steps below to discover your own DTI.

You May Like: Can You Buy A House Right After Bankruptcy

The Va Interest Rate Reduction Refinance Loan

The VA Interest Rate Reduction Refinance Loan is another refinance program that waives traditional DTI rules.

Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W-2s and pay stubs.

The VA Streamline Refinance is available only to military borrowers who already have a VA loan. Homeowners must also show theres a benefit to refinancing their existing home loan either in the form of a lower monthly payment or a change from an ARM to a fixed-rate loan.

Dti And Getting A Mortgage

When you apply for a mortgage, the lender will consider your finances, including your credit history, monthly gross income and how much money you have for a down payment. To figure out how much you can afford for a house, the lender will look at your debt-to-income ratio.

Expressed as a percentage, a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

Your lender will also look at your total debts, which should not exceed 36%, or in this case, $1,440 . In most cases, 43% is the highest ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application because your monthly expenses for housing and various debts are too high as compared to your income.

You May Like: How To Claim Bankruptcy In Nj Without A Lawyer

Debt To Income Ratio Requirements With Manual Underwriting: Qualifying For Mortgage With Lender With No Overlays

Homebuyers who told they do not qualify for a home loan by another lender because they do not meet debt to income ratio requirements with manual underwriting or lender do not do manual underwriting or have many mortgage lender overlays please contact us at Gustan Cho Associates at 1-800-900-8569 or text us for faster response. Borrowers can also email us at [email protected]. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays to answer all of your questions and issue pre-approval letters. We are a full-service mortgage company licensed in multiple states with no lender overlays. We have zero overlays on FHA Loans and just follow HUD 4000.1 FHA Handbook Guidelines.

How To Reduce Your Dti Ratio

If you find that your debt-to-income ratio is higher than youd like it to be, there are obviously only two things you can do about it.

You can bring your DTI down to a more desirable level if you can pay off a debt or to lower your total monthly debt obligations by even a hundred dollars.

Recommended Reading: What Does It Mean When Your Debt Goes To Collections

How To Calculate Your Debt

Here’s an example:

You pay $1,900 a month for your rent or mortgage, $400 for your car loan, $100 in student loans and $200 in credit card paymentsbringing your total monthly debt to $2600.

Your gross monthly income is $5,500.

Your debt-to-income ratio is 2,600/5,500, or 47%.

How Can I Improve My Debt

Improving your DTI is just one way to help make yourself more competitive for the specific loan that you want. Although your DTI is only one of several factors considered by lenders when you apply for a loan, the lower your ratio, the better off you are.

There are really on two simple steps that help improve your ratio:

- Increase your monthly income

To increase your monthly income, think about picking up a second job or asking your employer for a raise. In order to decrease your overall debt, think about your budget and see if there are any funds that can be redirected to pay your debt down.

Read Also: Can Student Loans Be Discharged In Bankruptcy

D/e Ratio Formula And Calculation

Debt/Equity

\begin & \text = \text + \text \\ \end Assets=Liabilities+Shareholder Equity

These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset. Because the ratio can be distorted by retained earnings or losses, intangible assets, and pension plan adjustments, further research is usually needed to understand to what extent a company relies on debt.

To get a clearer picture and facilitate comparisons, analysts and investors will often modify the D/E ratio. They also assess the D/E ratio in the context of short-term leverage ratios, profitability, and growth expectations.

What Are Compensating Factors

Compensating factors are positive factors that show strength on the mortgage borrowers such as low payment shock through the following positive factors:

- verification of rent

- longevity on the job

- part-time or other income that the borrower has but is not used to qualify for the mortgage loan

- the working spouse who is not added to the loan

- other positive factors

Read Also: What Are The Two Most Common Types Of Consumer Bankruptcies

How To Calculate D/e Ratio In Excel

Business owners use a variety of software to track D/E ratios and other financial metrics. Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as D/E ratio and debt ratio. Or you could enter the values for total liabilities and shareholders equity in adjacent spreadsheet cells, say B2 and B3, then add the formula =B2/B3 in cell B4 to obtain the D/E ratio.

What Is Considered A Good Debt

Lenders consider different ratios, depending on the size, purpose, and type of loan. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and guidelines vary, most lenders like to see a DTI below 3536% but some mortgage lenders allow up to 4345% DTI, with some FHA-insured loans allowing a 50% DTI. For more on Wells Fargos debt-to-income standards, learn what your debt-to-income ratio means.

Don’t Miss: Can You File Bankruptcy If You Owe Back Taxes

How Is Your Dti Ratio Calculated

To calculate your DTI ratio, divide your total recurring monthly debt by your gross monthly income the total amount you earn each month before taxes, withholdings and expenses.

For example, if you owe $2,000 in debt each month and your monthly gross income is $6,000, your DTI ratio would be 33 percent. In other words, you spend 33 percent of your monthly income on your debt payments.

How To Lower Debt

Increase IncomeThis can be done through working overtime, taking on a second job, asking for a salary increase, or generating money from a hobby. If debt level stays the same, a higher income will result in a lower DTI. The other way to bring down the ratio is to lower the debt amount.

BudgetBy tracking spending through a budget, it is possible to find areas where expenses can be cut to reduce debt, whether it’s vacations, dining, or shopping. Most budgets also make it possible to track the amount of debt compared to income on a monthly basis, which can help budgeteers work towards the DTI goals they set for themselves. For more information about or to do calculations regarding a budget, please visit the Budget Calculator.

Make Debt More AffordableHigh-interest debts such as credit cards can possibly be lowered through refinancing. A good first step would be to call the credit card company and ask if they can lower the interest rate a borrower that always pays their bills on time with an account in good standing can sometimes be granted a lower rate. Another strategy would be to consolidating all high-interest debt into a loan with a lower interest rate. For more information about or to do calculations involving a credit card, please visit the . For more information about or to do calculations involving debt consolidation, please visit the Debt Consolidation Calculator.

Also Check: When You File Bankruptcy Who Pays The Debt

How Is The Debt