The Cost Of A Bankruptcy Attorney

In most cases, the first question a client asks is how much does bankruptcy cost. The answer is that it depends on the type of firm or bankruptcy attorney you want and the services they offer. There are many different types of bankruptcy attorneys and law firms, just like there are many different types of people. Additionally, there are different types of bankruptcies available. First we need to look at the client and the types of law firms, before we look at the cost of the bankruptcy and the styles of attorneys.

Some law firms rely on their speed. Other bankruptcy provide personalized service. Then there are others that have more experience. You also have low budget bankruptcy practices, paralegal services and so on. The cost to file bankruptcy is determined by what the client values in the law firm. For example, does the client value speed, talking directly to an attorney? Or, is a client willing to pay less to interact with only paralegals and never see the attorney until the court hearing?

As stated above, this does not mean that you cannot find a deal. For example, Tran Bankruptcy Law are bankruptcy attorneys with years of experience and the know how to be efficient and provide personal attention without the high fees. This is due to the fact that Tran Bankruptcy Law have found ways to run their firms efficiently, while saving costs. For example, Tran Bankruptcy Law have gone paperless, and learned how to use technology effectively to speed up the process.

Required Credit Counseling Costs

Before you can file for bankruptcy, you must take a court-approved credit counseling session. You’ll also have to take a financial management course. These courses usually come with a small fee from the provider.

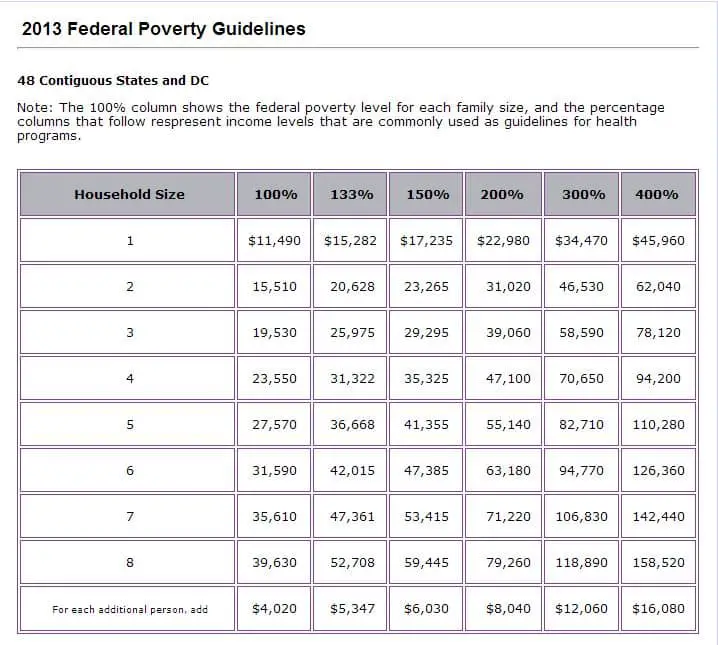

Court costs are are typically less than $50. Fee waivers and reduced rates are available based on household income.

The U.S. Department of Justice website has a list of agencies approved in each state. Visit their websites to find the costs of their bankruptcy-required courses.

How To Save Money On Bankruptcy Costs

Although everyone who files for bankruptcy protection has unmanageable debts, some applicants are worse off than others. Be sure to fully document your financial situation before consulting a bankruptcy attorney. If you are unemployed, a low-wage earner, disabled or elderly, you might be able to use these low cost bankruptcy options.

Bankruptcy is a hard step to take and recovering from it isnt easy. Though a successful Chapter 7 petition will discharge your debts, it will remain on your for 10 years, affecting your ability to get a loan or any type of credit. A Chapter 13 resolution might not be as damaging, but it will require that you stick to a repayment plan for three to five years, even if the court reduces your debts.

Given the consequences of bankruptcy, an open discussion with an attorney about his or her fees can help. Obviously, if there are impediments to rebuilding your finances after bankruptcy such as a disability or your advanced years, that is relevant, and an attorney might be willing to reduce fees to mitigate the damage bankruptcy is certain to cause.

As we noted earlier, in most Chapter 7 and Chapter 13 instances, bankruptcy attorneys charge a flat fee, meaning they will tell you before starting work on your case what it will cost. In Chapter 7 cases, theyll want the money up front in Chapter 13, they often demand just a portion of the fee to start the case and will take the remainder through the court-approved Chapter 13 plan.

Also Check: What Happens To My Car In Chapter 7 Bankruptcy

Average Cost Of Chapter 7 Bankruptcy In Major Cities

So, lets take a look at some PACER info on the actual bill for an attorney. We took a look at a random sample of Chapter 7 cases in a few major metro areas to get a sense of the bankruptcy attorney fees in each area. In Los Angeles, the tab ranged from $1,500 to $2,000. In Dallas, it was $774 to $1,820. In Miami, attorneys charged anywhere from $1,000 to $2,000, and in New York City, the bill was in the range of $1,000 to $2,200.

Theres a lot of variation depending on the complexity of the case. In addition, many debtors qualify for free or discounted legal help, leading to even more variation.

One bankruptcy attorney in Los Angeles warns consumers to be on the lookout for competent, board-certified attorneys to handle their case. A bankruptcy is delicate, and you want someone with plenty of experience to represent you. A difference on the front end of a few hundred dollars could actually cost thousands in the long run, including refiling fees.

People looking to file for bankruptcy should be careful about focusing solely on the cost, said M. Erik Clark, managing partner of Borowitz & Clark, LLP. There are so many ways that a bankruptcy case can turn out wrong and having an experienced attorney can help them avoid a bad outcome.

How Much Does It Cost To File For Bankruptcy On Your Own

As weve mentioned, bankruptcy costs are relative and dependent on many different factors. Heres what the costs will look like if you decide to file for bankruptcy on your own.

How much does it cost to file Chapter 7 bankruptcy on your own?

The Chapter 7 filing fee is $338 for all states.

Even without a lawyer, you will have to receive, which costs you around $50. This is a process that people with financial problems use even when not filing for bankruptcy. It is about a better understanding of their budgeting process, , financial tools, etc.

Additional fees, like paying for a debt education course , will cost you anywhere between $50 and $100.

Keep in mind that even in scenarios in which you cant afford the fees, you can negotiate with the provider to lower them a bit or even waive them off.

How much does it cost to file Chapter 13 bankruptcy on your own?

The Chapter 13 filing fee is $313 regardless of the state.

Keep in mind that with the Chapter 13 filing fee, you also need to prove that you have a disposable income. Your eligibility for the approval of the Chapter 13 filing fee will depend on your ability to make the payments in question to the trustee.

Other than this, its worth mentioning that other filing expenses will also be mandatory. Furthermore, when discussing the average bankruptcy costs, we are usually talking about the figure with all the additional expenses in the process added, not just the filing cost.

Filing for bankruptcy online

Recommended Reading: How To File Bankruptcy For Small Business

Can The Cost Ever Rise

The cost of $1,800 to file for bankruptcy can go up if certain conditions exist. These conditions include the following:

You might be surprised to learn that the cost is not determined by the amount you owe.

How Much Does It Cost To File Bankruptcy With A Lawyer

When calculating the average cost to file bankruptcy, you must sometimes take into consideration the lawyer fee, as well. There are numerous advantages to this approach, and looking for bankruptcy legal aid is always a smart choice.

Keep in mind that the lawyer fee goes on top of the bankruptcy filing fee . In other words, its $338/$313 plus the lawyer fee and any other additional expenses.

How much does a lawyer charge for chapter 7 bankruptcy?

Bankruptcy chapter 7 costs for those who choose to go the lawyer-assisted route are between $500 and $3,500. The complexity of the case is usually the determining factor. Hiring a larger firm will cost more than picking a solo practitioner, but there is also a scenario where major law firms offer lower costs to get a larger volume of cases. So it may be wise to shop around.

One of the issues you need to be aware of is that the attorney will ask for the payment before the filing. The reason behind this is simple: a successful Chapter 7 case will delete all your debt, including the money you owe to the attorney in question.

How much does a lawyer charge for chapter 13 bankruptcy?

The Chapter 13 filing cost with the help of a lawyer is anywhere between $1,500 to $6,000. But what most people pay on average is around the $3,000 mark.

You May Like: Can Filing Bankruptcy Stop Car Repossession

Attorney Fees Are Public Record

Thats right your attorney has to disclose her fees and theyre available to the public. You can research any bankruptcy law firms fees on the federal PACER website. PACER costs $0.10 per page viewed and you can search either by bankruptcy district to get a general sense of the fees in your area of by specific law firm to get an idea of what a particular attorney will charge. Local rules may require additional disclosure, but at a minimum attorneys must list their fees on the Statement of Financial Affairs, which requires a list of:

all payments made or property transferred by or on behalf of the debtor to any persons, including attorneys, for consultation concerning debt consolidation, relief under the bankruptcy law, or preparation of a petition in bankruptcy within one year immediately preceding the commencement of this case.

The Three Main Costs Of Bankruptcy And How Much Bankruptcy Costs

No matter which trustee you go with there are certain fees set by the government that youll need to pay. However, the overall costs of bankruptcy will depend on how much you make, how big your family is, your assets and more.

In total, there are three main costs associated with bankruptcy and they are:

Base Contribution

In Canada, the minimum cost for filing for bankruptcy is $1,800. This can be paid at once or in $200 installments over 9 months. This fee is used to cover certain costs like administration fees, your LIT, government fees, and more.

Surplus Income

Surplus income payments are calculated using the income limits created by the Office of the Superintendent of Bankruptcy. To calculate your surplus income payment simply take the difference between your income and the income limit and then divide it by two. If your surplus income payment is less than $200, you can be discharged from bankruptcy after 9 months. All youll need to pay is the base contribution mentioned above.

However, surplus income payments are required if your surplus income payment is more than $200. Moreover, if it is, your bankruptcy will be extended for another year . This basically means that those who make a lot of money will generally have to pay more for their bankruptcy than those who are barely scraping by.

Learn to calculate your bankruptcy payments.

Assets You Lose

Additional Reading

Recommended Reading: Does Bankruptcy Affect Your Credit Rating

Average Chapter 7 Bankruptcy Attorney Fees

Under Chapter 7, youll surrender all of your non-exempt property to the Bankruptcy Trustee. Bankruptcy exemptions vary by district and some give more protection than others. The Trustee will sell that property and use the proceeds to pay your creditors. At the end of the process, your remaining unsecured debt is discharged, which means its forgiven.

When you file under Chapter 7, youll generally have to pay up-front. Nationwide, the average attorney fee for a Chapter 7 case is $1,250. That cost may vary significantly by market. You can generally expect to pay more in a large metro area than in a small town. In addition to your location, the complexity of your case and the quality of your attorney, if were being honest may affect your fees. If youre filing a relatively simple no asset case , youll pay less than you would for a complex case which is more likely to result in litigation. The cost will also vary based on the experience level and professional reputation of the attorney. An experienced attorney in a well-established firm will charge more than a fresh law school graduate.

Chapter 7 Vs Chapter 13

The most common type of bankruptcy for individuals is Chapter 7, which effectively wipes the slate clean after certain assets are liquidated, and cash from the liquidation is distributed to creditors.

The second most common type of bankruptcy for consumers is Chapter 13 bankruptcy, which allows the debtor to keep some valuable assets by agreeing to a three- to five-year payment plan. For example, if the debtor wants to keep their house, Chapter 13 would allow them to make payments through a trustee, and they would be protected from any legal action that creditors could take.

Also Check: What Happens To Your Assets When You File Bankruptcy

Your Creditors May Hold A Meeting

Sometimes, a meeting of creditors is required or requested. The purpose of this meeting is to

- allow creditors to obtain information about the bankruptcy

- confirm the appointment of the LIT

- appoint up to five inspectors to supervise the administration of your estate and

- allow creditors to give direction to the LIT.

If a meeting is called, you will be required to attend.

What Happens To Your Information

Any previous name included in the bankruptcy petition will appear on the bankruptcy order, and in the:

- notice of your bankruptcy, which is permanently recorded in the Gazette but excluded from search engine results one year and three months after publication

- Individual Insolvency Register which will be removed within three months of your discharge

You May Like: Legit Debt Relief Programs

What Happens To Your Assets After Discharge

Assets that are part of the bankruptcy stay under the trustees control when your bankruptcy ends. It can take time for all assets to be dealt with.

You must keep making any payments agreed under an IPA or IPO.

Your family home

If your family home has not been dealt with 3 years after the bankruptcy order, the interest may be given back to you.

If the interest in your family home is returned to you, the Land Registry will be told that the property is no longer part of your bankruptcy estate. The trustee will send notice to the Land Registry and the restrictions will be removed.

Your business

The restrictions on your business end when bankruptcy ends, unless the official receiver feels youve been dishonest. They can then apply to extend the restrictions

Bankruptcy Court Filing Fees

The bankruptcy court filing fee for Chapter 7 bankruptcy is $338. Itâs due when the bankruptcy petition is filed, unless the court grants an exception to this rule.

Since Chapter 7 bankruptcy is only available to consumers who pass the means test, the bankruptcy laws provide two exceptions to this requirement.

-

Paying the fee in installments

Don’t Miss: Average Credit Card Debt Usa

What Can You Do If You Can’t Find A Licensed Insolvency Trustee

If you are unable to get an LIT to accept your file, or if you cannot afford to hire an LIT, the OSB’s Bankruptcy Assistance Program may be able to help, provided that you:

- have contacted at least two LITs and tried to obtain their services

- are not, and have not recently been, involved in commercial activities

- are not required to make surplus income payments and

- are not in jail

A creditor is harassing me daily. What should I do?

Although the regulations differ slightly across Canada, there are limits on what creditors and collection agencies are allowed to do. For example, they cannot make telephone calls of such a nature or frequency that they amount to harassment of you or your family. In addition, there are certain times when they are not allowed to call.

Tips for dealing with collection agencies If you feel you are being harassed, contact either an LIT or a qualified and experienced credit counsellor. They can help you by serving as an intermediary between you and your creditor.

and we will send you some information and a list of LITs who participate in the program.

Working With A Licensed Insolvency Trustee

Declaring personal bankruptcy in Canada is done with the help of a Licensed Insolvency Trustee you do not need to hire a lawyer or consultant. The entire process and cost of filing a personal bankruptcy including the Trustees fees and Government filing fees are set by the Bankruptcy and Insolvency Act these tariff-based fees are strictly regulated and monitored by the Federal Government.

You May Like: How Many Times Has Trump Declared Bankruptcy

Exceptions To Payment Rules

There are some exceptions to the payment rules. You can make direct payments for:

- secured creditors, like a mortgage lender

- debts which are not included in the bankruptcy , these are called non-provable debts

- money owed after 19 March 2012 to the Department for Work and Pensions for budgeting or crisis loans

You must keep paying rent and any new debts after the bankruptcy. You might not need to pay bills that are unpaid at the date of your bankruptcy order. You may have to pay a deposit for future supplies of gas, electricity or other utilities. Or your utility accounts may be transferred to a spouse or partner.