How Much Debt Does The Government Have

Each years budget deficit is added to the debt, while each budget surplus is subtracted from it. The national debt is over $29 trillion as of December 2021. 1 Its grown that large due to government spending programs that help boost the economy. Congress puts a limit on the debt, which is known as the debt ceiling.

The National Debt Is Now More Than $31 Trillion What Does That Mean

The gross federal debt of the United States has surpassed $31,000,000,000,000. Although the debt affects each of us, it may be difficult to put such a large number into perspective and fully understand its implications. The infographic below offers different ways of looking at the debt and its relationship to the economy, the budget, and American families.

The $31 trillion gross federal debt includes debt held by the public as well as debt held by federal trust funds and other government accounts. In very basic terms, this can be thought of as debt that the government owes to others plus debt that it owes to itself.

Americas high and rising debt matters because it threatens our economic future. The coronavirus pandemic rapidly accelerated our fiscal challenges, but we were already on an unsustainable path, with structural drivers that existed long before the pandemic. Putting our nation on a better fiscal path will help ensure a stronger and more resilient economy for the future.

The Country Has An Impending Repayment That Could End With The Us Defaulting On Debt For The First Time In Its History If The Debt Ceiling Remains

The US debt ceiling has been reached and Congress is at an impasse. The House has passed a bill to suspend the limit, but the Republican senators say they will not support the bill. This leaves the real risk of a government shutdown as well as the US being unable to repay debt payments in October.

Negotiations are ongoing and failure would also lead to the termination of the Democrat political agenda.

The country is teetering on a debt precipice which would cause an economic slowdown around the globe. The debt news comes as Chinese real estate giant Evergrande is close to bankruptcy, causing a slide on world stocks in the last few days.

Don’t Miss: Debt Clock Real Time

The Politics Of National Debt

Disagreements about national debt have repeatedly preoccupied U.S. Congress. Whenever the national debt approaches the limit periodically reset by Congress, lawmakers are faced with a choice of raising the ceiling once again or letting the U.S. government default on its obligations, risking dire economic consequences. The U.S. government briefly shut down before Congress raised the limit in 2013. A similar standoff two years earlier led Standard & Poor’s to downgrade its U.S. credit rating.

In 2021, Congress narrowly averted a scheduled Oct. 1 government shutdown by passing a short-term funding bill, then raised the U.S. debt ceiling by $2.5 trillion to $31.4 trillion in December. That limit was expected to be reached in early 2023.

Americans profess to be concerned about the national debt in poll after poll, while also overwhelmingly supporting defense spending and outlays for Social Security and Medicare, and opposing tax increases.

As a result, elected officials too have been eager to be seen to be addressing the national debt, usually without linking it to the spending the debt enables or to the tax increases that a balanced budget would require.

Us National Debt Exceeds $31t For 1st Time

Outstanding public debt totals just over $31.1T, Treasury Department data shows

ANKARA

The US national debt exceeded $31 trillion for the first time amid rising interest rates to tame the record-high inflation, and growing economic uncertainty, according to Treasury Department data.

The total public debt outstanding amounted to just over $31.1 trillion, the data showed on Tuesday.

In July, the Congressional Budget Office projected the US federal debt held by the public to equal 98% of GDP by the end of this year.

Debt that is high and rising as a percentage of GDP could slow economic growth, push up interest payments to foreign holders of US debt, and heighten the risk of a fiscal crisis, CBO warned in the 2022 Long-Term Budget Outlook report.

This could also make the US fiscal position more vulnerable to an increase in interest rates, and cause lawmakers to feel more constrained in their policy choices, the office added.

Don’t Miss: How Much Debt Does The Us Have

How Is The Us Government In Debt To Itself

The government owes the most money to itself. U.S. government agencies, including giant trust funds of the Social Security and Medicare systems, and the independent Federal Reserve System account for 41 percent of the federal debtthe federal debtAs of , federal debt held by the public was $20.83 trillion and intragovernmental holdings were $5.88 trillion, for a total national debt of $26.70 trillion. At the end of 2020, debt held by the public was approximately 99.3% of GDP, and approximately 37% of this public debt was owned by foreigners.https://en.wikipedia.org National_debt_of_the_United_StatesNational debt of the United States Wikipedia, more than $2 of every $5.

What Does The Rest Of The Budget Look Like

Emergency spending aside, most of the federal budget goes toward entitlement programs, such as Social Security, Medicare, and Medicaid. Unlike discretionary spending, which Congress must authorize each year through the appropriations process, entitlements are mandatory spending, which is automatic unless Congress alters the underlying legislation. In 2019, only 30 percent of federal spending went toward discretionary programs, with defense spending taking up roughly half of that.

Read Also: Filing Bankruptcy Chapter 7 In Ohio

What Makes The Debt Bigger

The leading federal spending categories currentlySocial Security, Medicare/Medicaid and defenseare the same as in the 1990’s, when national debt was much lower relative to GDP. The U.S. remains the world’s largest economy and one of the richest countries. How, then, did the debt situation deteriorate? Numerous factors are in play.

Concerns Over Chinese Holdings Of Us Debt

According to a 2013 Forbes article, many American and other economic analysts have expressed concerns on account of the People’s Republic of China’s “extensive” holdings of United States government debt as part of their reserves. The National Defense Authorization Act of FY2012 included a provision requiring the Secretary of Defense to conduct a “national security risk assessment of U.S. federal debt held by China.” The department issued its report in July 2012, stating that “attempting to use U.S. Treasury securities as a coercive tool would have limited effect and likely would do more harm to China than to the United States. An August 19, 2013 Congressional Research Service report said that the threat is not credible and the effect would be limited even if carried out. The report said that the threat would not offer “China deterrence options, whether in the diplomatic, military, or economic realms, and this would remain true both in peacetime and in scenarios of crisis or war.”

Recommended Reading: When Filing Bankruptcy Can They Take Your Tax Refund

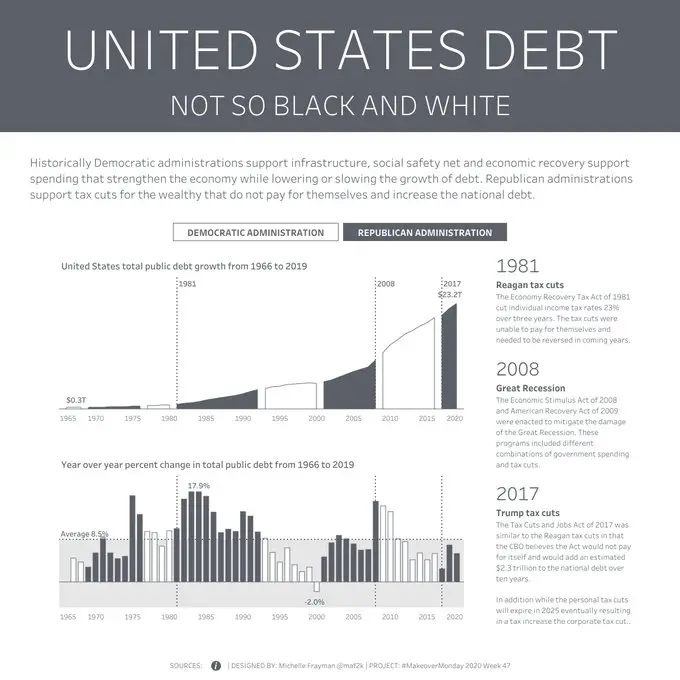

National Debt By President

The National Debt has always been an area of interest for the United States President George Washington appointed future President Alexander Hamilton to understand and solve the $80 million debtthat had accrued due to the Revolutionary War. Hamilton came up with the plan to pay off the debt through taxes and the creation of the national bank. Since then the United States has steadily increased its budget deficit, and the national debt has continued to rise.The first time that the national debt hit the $1 billion mark was in 1863 while the Civil War was occurring it hit the $2 billion was two years later when the civil war ended in 1865. As the country went to battle during World War I and World War II, the national debt hit the $10 billion mark and $100 billion marks respectively. By 1982 after the Vietnam War and the Cold War, the national debt hit the $1 trillion mark for the first time in history. By the 21st Century, the national debt got to $20 trillion after major events such as the War on Terror and the Great Recession. Today , the national debt stands at $30.2 trillion and public debt is roughly 100% of the country’s GDP.

What Happens When The Us Hits The Ceiling

The U.S. government generally spends more than it takes in $3.1 trillion more in fiscal 2020. Once it hits the debt limit, borrowing to make up the difference is not possible. The government can spend only its cash on hand and its tax revenues.

Yellen will then have to use extraordinary measures to conserve cash. One such measure is temporarily not funding retirement programs for government employees. The expectation is that once the ceiling is raised, the government would make up the difference.

Working in Yellens favor is that the Treasury Department had about $450 billion in cash on hand at the end of July, which likely lasted a month or so. In September, estimated tax payments from companies and individuals will be paid to the Treasury. Things then get difficult in October.

If the debt ceiling isnt raised before the Treasury Department exhausts its options, decisions will have to be made about who gets paid with daily tax receipts. Government employees or contractors may not be paid in full. Loans to small businesses or college students may stop.

When the government cant pay all its bills, it is technically in default. Some pundits have claimed that a government default would have dire economic consequences soaring interest rates, markets in panic and maybe an economic depression.

But Americans no longer live in normal political times. The major political parties are more polarized than ever.

You May Like: What Is The Chapter 11 Bankruptcy

How Much Does Rising Us Debt Matter

The massive borrowing due to the pandemic, along with Bidens big spending plans, has renewed debate over the peril posed by the national debt. Some economists fear that the United States will become stuck in a debt trap, with high debt tamping down growth, which itself leads to more debt. Others, including those who subscribe to the so-called modern monetary theory, say the country can afford to print more money.

Some say that servicing the debt could divert investment from vital areas, such as infrastructure, education, and the fight against climate change. There are also fears it could undermine U.S. global leadership by leaving fewer dollars for U.S. military, diplomatic, and humanitarian operations around the world. Other experts worry that large debts could become a drag on the economy or precipitate a fiscal crisis, arguing that there is a tipping point beyond which large accumulations of government debt begin to slow growth. Under this scenario, investors could lose confidence in Washingtons ability to right its fiscal ship and become unwilling to finance U.S. borrowing without much higher interest rates. This could result in even larger deficits and increased borrowing, or what is sometimes called a debt spiral. A fiscal crisis of this nature could necessitate sudden and economically painful spending cuts or tax increases.

What Would A Breach Of The Debt Limit Mean

While even approaching the debt limit has costs for the government, a full breach of the debt limit would be catastrophic. A breach would occur in a situation where Treasury runs out of extraordinary measures before Congress increases, suspends, or abolishes the debt limit. While it is impossible to know with certainty the consequences of a breach, some broad strokes are clear. First, it would mean that Treasury would be unable to make full payments on promised obligations. This would include payments to Social Security, Medicare, Medicaid, nutrition benefits, military salaries and retirement, defense contractors, law enforcement, unemployment insurance and others in total approximately 80 million payments a month. Forcing Treasury to spend only what is covered by revenues would lead to an immediate 40 percent cut in government spending. Depending on how long it would take Congress to raise the debt ceiling under this scenario, Americans and those who are entitled to these benefits could go days or weeks without getting them. This could have ripple effects throughout the economy, as it jeopardizes the ability for families, veterans, retirees, and others to pay rent, buy groceries and medication, or run their businesses.

Recommended Reading: Can You File Bankruptcy On Business Taxes

The National Debt Dilemma

- The pandemic has taken the U.S. national debt to levels not seen since the 1940s.

- The United States is in a unique position because it holds the worlds reserve currency, allowing it to carry debt more cheaply than other countries.

- Some experts argue that the United States can safely continue to sustain high levels of debt, while others warn that it will eventually have to face the consequences.

The U.S. national debt is once again raising alarm bells. The massive spending in response to the COVID-19 pandemic has taken the budget deficit to levels not seen since World War II. This expansion follows years of ballooning debttotaling nearly $17 trillion in 2019that will now be even more difficult to reduce. Raising the debt ceiling, the legal limit on government borrowing, has become a perennial fight in Congress.

How High Can Our National Debt Get Before It Will Be A Threat To Our Financial Stability

How high can our national debt get before it will be a threat to our financial stability? ie: dollar loses its status as the reserve currency.

The national debt of the US is the amount owed by the US federal government and is the value of the Treasury securities that have been issued primarily by the Treasury and which are outstanding at that point of time. By far, the largest component of US public debt is debt held by the public, investors outside the federal government, including that held by individuals, corporations, the Fed, and foreign, state and local governments. Current total public debt is bit over 100% GDP. 47% of the debt held by the public is currently owned by foreign investors, primarily China and Japan.

Central banks all over the world hold financial reserves, in bonds or money market instruments denominated in a currency other than their own, called foreign reserves. Currently, the US$ is considered the worlds reserve currency with roughly 60% of international currency reserves being held in US$, a good chunk of it in dollar-denominated US Treasury securities. This generates a strong demand for US Treasury bonds and keeps interest rates low reducing private sector borrowing expenses. In this sense, having the status of reserve currency is a huge privilege the US enjoys.

Don’t Miss: How Long After Creditors Meeting Is Bankruptcy Discharged

How Does Us Debt Compare To That Of Other Countries

The United States debt-to-GDP ratio is among the highest in the developed world. Among other major industrialized countries, the United States is behind only Japan.

The pandemic has sharply increased borrowing around the world, according to the International Monetary Fund. Among advanced economies, debt as a percentage of GDP has increased from around 75 percent to nearly 95 percent, driven by double-digit increases in the debt of the United States, Canada, France, Italy, Japan, Spain, and the United Kingdom .

The United States has long been the worlds largest economy, with no record of defaulting on its debt. Moreover, since the 1940s it has been the worlds reserve-currency country. As a result, the U.S. dollar is considered the most desirable currency in the world.

High demand for the dollar has helped the United States finance its debt, as many investors put a premium on holding low-risk, dollar-denominated assets such as U.S. Treasury bills, notes, and bonds. Steady demand from foreign creditorslargely central banks adding to their dollar reserves, rather than market investorsis one factor that has helped the United States to borrow money at relatively low interest rates. This puts the United States in a more secure position for a fiscal fight against COVID-19 compared to other countries.

How Does The National Debt Affect Me

Interest payments also have an important role as they grow in step with the national debt. As the government allocates more funds towards paying off interests, other investment areas could get crowded out. Areas such as education, research and development, and infrastructure may not progress at sufficient or adequate levels due to interest payments. Interest payments currently take many of the dollars that are raised through federal income, estate, and federal excise taxes. Net worth is also an important and interesting factor that can be affected by the national debt.The cost of borrowing money to purchase large assets such as homes will increase due to the Federal Reserves interest rates. Interest rates will push down the prices of homes as individuals will struggle to qualify for mortgage loans this will then lower prices on home values.

Recommended Reading: How Long Is A Bankruptcy On Your Credit

We’re All In Debt Together

The American debt per citizen is over $85,332

We’re constantly under assault by debt. We’re crushed under the weight of . We’re up to our eyeballs in medical debt. We’re choosing between paying rent and student loans because it’s possible to be making minimum wage with an expensive college degree.

So what’s another 85K, right? A lot, actually.

If our country doesn’t correct its debt spiral, it risks defaulting on its obligations. That would diminish its power around the world.

It could also raise interest rates, reduce spending on government programs, and weaken entitlements like Social Security.

Since the US national debt now exceeds the gross domestic product , our economy seems to be headed off a cliff. Yet Congress keeps raising the debt ceiling, allowing the federal government to borrow more and more without paying it back. As citizens, we need to be better informed.

Does your personal debt feel as dire as our national debt? We can help.

See If You Qualify for a Personal Loan up to $250k