Average Credit Card Debt By Location And Generation

After growing for eight years in a row, the average credit card balance dropped by 14% and $8793 from 2019 to 2020, according to data from Experian.

- Credit card balances fell across the U.S. and states where consumers had the heaviest debt loads saw the biggest decreases. The average balance in the District of Columbia fell by 20% to $5,6713 in 2020.

- In California, it dropped by 18% to $5,1203 and in New York, it declined by 17% to $5,4143. At the other end of the spectrum, the average credit card balance in North Dakota fell by only 8% to $4,8653.

- Americans of all ages reduced the amount of card debt owed during 2020, with older Americans decreasing theirs the most. Members of the Silent Generation paid down outstanding credit card balances by 16% to an average of $3,1773. Baby boomers lowered card debt by 12% to an average of $6,0433 while Gen Xers reduced theirs by the same percentage to an average of $7,1553. Millennials decreased outstanding credit card debt by 11% to an average of $4,3223 while the members of Gen Z old enough to have card debt lowered theirs by 6% to an average of $1,9633.

What Are The Most Common Reasons For Getting A Credit Card

The majority of credit card users own more than one card, and 58% use two or more cards on a regular basis. Our survey also examined why people open their cards.

More than half of Americans say they’ve applied for a credit card to help build their credit score â making it the most common reason for signing up.

The most common reasons Americans have applied for a card include:

- Building their credit score

- Having credit in case of an emergency

- To cover school / university expenses

- Maxing out their other credit card

Baby boomers are more likely to apply to earn rewards and bonuses, while millennials are more interested in spending flexibility. Millennials are about twice as likely as boomers to apply for a credit card to cover purchases they otherwise couldn’t afford.

In addition, millennials are more than twice as likely as baby boomers to say they applied for a credit card because they maxed out other cards.

States Where The Average Credit Card Balance Fell The Most

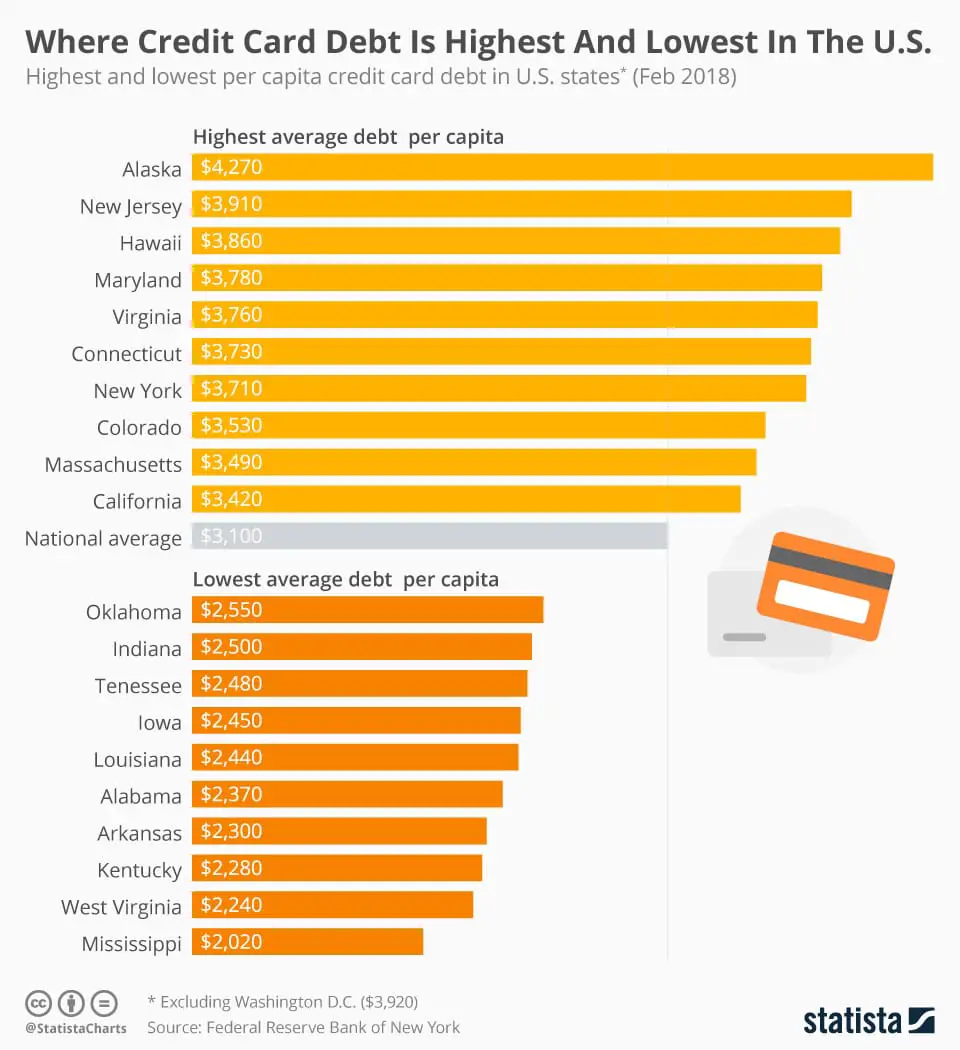

Collectively, U.S. consumers have made significant headway paying off their credit card debts over the past five years. Balances have fallen the steepest in Alaska, New Jersey and Virginia. The states that paid down credit card balances the most since 2017 are also some of the states with the highest average balances.

| Change in Average Credit Card Balance by State |

|---|

| State |

You May Like: Secu Houses For Sale

Negotiate With Your Credit Card Company

If youve already missed a payment or are about to, reach out to your credit card issuer. The company may be willing to work out a more manageable repayment plan for you. Some offer forbearance or hardship programs that could reduce your monthly payment or postpone a certain number of payments. You may even be able to settle your debt for a lower amount if the company determines that you arent able to pay back the full amount.

If you are able to work out an alternate repayment plan with your creditor, be sure to ask for the plan in writing.

Average Credit Card Debt Soars By 13 Percent Largest Increase Since 1999

The average debt held by households in the United States surged by 13 percent in the second quarter, the largest increase in such debt since 1999, according to an Aug. 30 report from the Federal Reserve Bank of New York.

More consumers are increasingly relying on credit amid sky-high inflation in order to pay their bills.

Meanwhile, the current credit card interest rate is now at a record high of 17.96 percent, according to Bankrate, a financial advice website.

American Households Are Falling into Debt

Total American household debt rose by $312 billion from the second quarter of 2021 for a total of $16.15 trillion at the end of June 2022.

This is a 2 percent rise from the year-ago quarter, largely due to a jump in mortgage rates, and car loan and credit card balances, caused by40-year high inflation, said Joelle Scally, a New York Fed analyst, in a statement.

The Federal Reserve is attempting to fight inflation by raising interest rates, causing fears that its aggressive moves may encourage a bad recession, as the economy recovers from the pandemic.

The second quarter of 2022 showed robust increases in mortgage, auto loan, and credit card balances, driven in part by rising prices, said Scally, who reviews microeconomic data at the central bank branch.

Bidenflation is wreaking havoc on American families finances. Credit card debt is rapidly rising, wrote Rep. Lloyd Smucker in a .

Also Check: How To Get A Mortgage After Bankruptcy And Foreclosure

How Personal Loans Can Help

As an alternative option to a balance transfer card, a personal loan is a good way to score a lower interest rate on your credit card debt and you can even find loan amounts that may cover your entire credit card balance.

Personal loans stand out from balance transfer cards in that they give you more time to pay off your debt and allow for larger amounts of debt. With balance transfer credit cards, issuers often limit the total balance you can transfer to a percentage of your credit limit or a specific dollar amount. You likely need good or excellent credit to qualify for a balance transfer card, but with personal loans there are some available if you have bad credit.

Should You Close Unused Credit Cards

While Americans, on average, have nearly four credit cards each, that’s only a national average. When it comes to how many credit card accounts you should have, you need to base that decision on your specific financial situation.

If you are considering closing credit cards you don’t use, think again. Though it may seem counterintuitive, closing credit accounts can actually hurt your credit score. Here’s why:

- Increased credit utilization: When you close a credit card account, you’ll lose the credit limit that goes along with it. That will lower your overall credit limit which could impact your , one of the most important factors in your credit score.

- The length of your credit history, measuring how long you’ve been actively using credit, makes up a smaller portion of your credit scores. Closing credit card accounts reduces your average credit history length. While a credit card closed in good standing can stay on your credit report for up to 10 years, credit models may treat these closed accounts differently, which could impact your credit scores.

If you choose to keep the accounts open, it’s important to know that having multiple accounts won’t negatively impact your credit scores. If anything, the larger combined credit limits will inflate your total credit limithelping your utilization stay low.

How to Get the Best Credit Card for You

Resources

Get the Free Experian app:

Experian’s Diversity, Equity and Inclusion:

You May Like: What Happens If Your Bankruptcy Case Gets Dismissed

Average Monthly Credit Card Payment

The average next credit card payment for Credit Karma members is $173. But the average payment is naturally higher for those with higher total credit card debt. For example, Gen X members average $7,923 in credit card debt and have an average next payment of $222. On the flip side, Gen Z members have an average of $2,589 in total card debt and an average next payment of only $78.

But Nearly Half Of Americans Depend On Credit Cards For Essentials

As much as Americans would like to limit their credit card usage, many simply can’t afford to do so.

About 43% of Americans say they depend on their credit cards for essential living expenses, such as housing, food, and utilities.

Those costs add up quickly. The average credit card user spends $1,579 on their cards each month, with a whopping 1 in 8 saying they put more than $5,000 on their cards each month.

Overall, the average respondent in our study reports spending about 30% of the limit on their primary card each month. That’s in line with advice from credit experts, who suggest limiting your credit card utilization to 30% or lower. Any higher, andyou risk lowering your credit score.

Recommended Reading: Bankruptcy Attorney Des Moines

Sign Up For Credit Counseling

Feel overwhelmed by your debt and not sure if any of the above solutions will work for you? A reputable nonprofit agency may be able to help. Most credit counseling agencies offer debt management plans . The agency may negotiate with the credit card companies on your behalf to lower both your interest rates and your monthly payments. You make one monthly payment to the agency, which distributes the funds to your creditors.

One caveat: if you sign up for a DMP, youll have to close the credit card accounts that are part of the plan. The downside: this reduces the amount of credit available to you, changing your and likely lowering your credit score. But getting out of debt will make your credit stronger in the future.

Many Relied On Credit Cards During The Pandemic

Despite data from the Federal Reserve Bank of St. Louis showing an overall increase in credit card interest rates, the average annual amount of credit card interest paid by households carrying balances dropped slightly this year from $1,155 in 2020 to $1,029 in 2021 because of an overall reduction in household revolving credit card debt. But not every cardholder saw their debt decrease. According to NerdWallets survey, some Americans leaned on their credit cards to get through the pandemic.

One in 5 Americans report increasing their overall credit card debt during the pandemic. Additionally, 18% of Americans say they relied on credit cards to pay for necessities during the pandemic and 17% say the same thing about paying for emergencies.

Under normal circumstances, it goes against most financial advice to carry a credit card balance or rely on credit cards to cover emergencies. But the last two years have been anything but normal. One of the benefits of establishing good credit is being able to lean on it in tough times, and for many, credit cards may have been the thing that kept food on the table and the lights on. And thats completely OK.

If your financial situation has stabilized, a great 2022 goal would be to pay down debt and build up savings. If thats not a possibility for you yet, its OK to spend the year recovering and setting more modest goals.

Sara Rathner, NerdWallet’s Credit Cards Expert

You May Like: Us In Debt To China

Americans Want To Use Their Credit Cards Less Often

Americans seem to understand that credit card use can expose them to risks, whether through theft or overspending. That may be why nearly 3 in 5 Americans say they want to decrease their credit card usage.

When possible, Americans say they prefer to make day-to-day purchases with a debit card. The most-preferred methods of payment for day-to-day purchases are:

Those Who Started Using Credit Cards Earlier Have Less Debt

Our survey data suggests using credit cards at a younger age may actually help card holders avoid debt later in life.

Americans who started using their cards at age 25 or younger are 13% more likely to not carry credit card debt compared to those who took out their first credit cards at a later age.

About 68% of Americans say they started using their own credit card at age 25 or younger. Americans started using their cards at age:

You May Like: How To File Bankruptcy While Married

Heres How Us Credit Card Debt Has Changed In 5 Years

A colorful mix of credit cards in a wallet

When convenience is the priority, credit cards are king. The 2-by-3-inch plastic rectangle transformed how American consumers shopped: With one swipe, people could buy dinner, cover unexpected or urgent expenses at the last minute, or finance a large household purchase. Credit cards can also be an effective way to build your credit by establishing a track record of on-time debt payments.

Convenience comes with responsibility, however. That same little card can also cause financial woes if not managed wisely. Credit cards have higher interest rates than many other forms of borrowing money, which can add up if balances arent immediately paid down. In the world of lending, convenience aint cheap.

The average American carries thousands of dollars in credit card debtan average of $5,589 as of the fourth quarter of 2021, according to Experian data. To see how consumer credit habits have changed over time, Experian looked at the average credit card balance at a national and state level going back to 2017.

Canva

Save A Starter Emergency Fund

Before you attack your debt, make sure youve got $1,000 saved as a starter emergency fund. Why? As youre paying off debt, life will happenwere talking about the flat tire, leaking refrigerator and unexpected medical bill. If you dont have money saved up to pay cash for emergencies, youll be tempted to pull out a credit cardand go deeper in debt.

Recommended Reading: List Of Insurance Company Bankruptcies 2021

Get The Help You Need Along The Way

Say it again: Youre not in this alone. And guess what? You dont have to figure everything out on your own either. Learn the ins and outs of debt in Financial Peace University.

This nine-lesson course will teach you the plan to get outand stay outof debt, and get you pumped up to pay it off forever.

And listen: It actually works. The average debt paid off in the first 90 days of working this plan is $5,300.

When you’ve built a solid foundation of knowledge, it makes the debt-free journey quicker and easier. Thats a true win-win.

Why Some Credit Card Users Have Never Missed A Payment

About 54% of Americans say they have never missed a credit card payment. The most common reason for never missing a payment is having enough money on hand . Conversely, only 18% cite living frugally.

The reasons Americans cite for never missing credit card payments are:

- Always having enough money to make a payment

- Always paying at least the minimum payment

- Spending less than they earn .

- Prioritizing credit card payments over other debt

- Making payments whenever they spend money rather than waiting until they’re due

- Subscribing to auto-payments or monthly reminders

- Living frugally

- Rarely using their credit card

Always having enough money to make payments was the most popular answer for Gen Z, millennials, and baby boomers.

The findings also suggest younger Americans may be more cautious about nonessential spending. About 31% of Gen Z respondents say they’ve never had debt because they spend less than they earn, while just 18% of baby boomers say the same.

Read Also: How To File For Bankruptcy In Nj Without A Lawyer

What Is The Average Credit Card Debt

Based on data from the Federal Reserve Bank of New York and the U.S. Census Bureau, each American household carries an average of $6,865 in credit card debt.

At the end of 2019, right before the coronavirus pandemic began, that average reached $7,568. Then it plunged to $6,293 in the first quarter of 2021. Here’s a look at how the countrys average credit card debt has changed over the last 10 years based on first-quarter data.

| Year |

|---|

| $6,865 |

Total Credit Card Debt Held By Americans

In its 2021 report, the Bureau of Consumer Financial Protection revealed that total credit card debt in American households reached $926 billion in 2019, and went down to $811 billion during the second quarter of 2020, due to reduced spending during the pandemic and federal economic relief programs. By the end of 2020, total credit card debt in the U.S. went up to $825 billion.

Recommended Reading: How Long To Keep Bankruptcy Papers

Carrying Debt Is Expensive

No consumer in their right mind wants to more than double the amount they pay for something because of interest. When you are ready to focus your energies on accelerating your debt repayment in order to minimize the amount of interest you pay, there are four possible approaches you should consider, explained below.

First, however, to truly accelerate your debt repayment, you will need to send more than the minimum payment required by your creditors. Use our PowerCash calculator to find anywhere from $50 to $200 of your household income you can redirect to your debt repayment activities without much pain.

What Is The Average Credit Card Debt Of Adults In The United States

A detailed analysis of credit card debt in America with suggestions on how to handle an overwhelming debt load.

Ask the average American how much credit card debt his or her fellow citizens have, and youre likely to get an ear full. Given the value to the media of reporting dire figures and dangerous consequences, it is easy to find a range of data, from the tame and mild to the outrageous and wild.

How much credit card debt does the average American have?

The average American adult has just $1,385 in credit card debt. This figure results from dividing the total US credit card debt from December 2021 of over $357 Billion according to NerdWallet.com by the roughly 332 Million Americans the US Census Bureau estimates there were in the US as of July 2021.

Why is this figure so much lower than most figures?

This is where the adage comes into play: You can make statistics say whatever you want. It all depends on how you interpret both the question and the data.

Also Check: How Many Bankruptcies Has Trump Filed