Get Your Bankruptcy Removed Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

How Long Does Bankruptcy Stay On Your Credit Report

The higher end of the spectrum would be more of what you would see if something came off immediately, while the lower end is what you might expect after the seven year. Does paying off credit cards help my credit scores? In addition, borrowing money becomes more costly , insurance rates may increase and employers may have an issue hiring or promoting you when they see a bankruptcy on your credit. How are you aware if bankruptcy is best for your needs? Ten years is a long time to wait for something to happen. Studies show people with six inquiries are eight times more likely to file bankruptcy. How does bankruptcy affect your credit score? How much and how soon credit scores can rise. Using data from equifax credit bureau, researchers at the federal reserve bank of philadelphia found that filers equifax credit scores plunged in the 18 months before filing bankruptcy and rose steadily afterward. Good credit scores are your passport to competitive interest rates for mortgages, cars, credit card offers, insurance premiums, and more. When you default on a credit account, the account generates negative payment history and an eventual charge. Bankruptcies fall off personal credit reports after 10 years, after which time a damaged credit score can begin to improve. When that something is a bankruptcy falling off your credit report it can feel like eternity.

How many points your credit score will go up after bankruptcy comes off, will depend on where it was beforehand.

Thank You To This Issues Contributors:

Bankruptcy impacts a credit score more than any other singular event in a credit report. While the bankruptcy itself is a key factor adversely affecting credit scores, other sub-components also play roles in determining a credit score. An estimated 35 percent of a FICO® credit score is Payment History, which is measured by several sub-factors, including a bankruptcy. Understanding how the many issues resulting from a bankruptcy filing impact a credit score can help consumers, and perhaps your clients, rebuild their scores.

Before pursuing a bankruptcy, a consumer should better understand the six primary payment history issues that lower a credit score:

All of these six factors determine the overall impact to credit scores from Payment History.

You May Like: How Many Times Trump Filed For Bankruptcy

Think Twice About Working With Credit Repair Agencies

Instead of paying a credit repair agency, consider using that money to increase your emergency fund and savings. Focus your efforts on the habits and circumstances that led to your bankruptcy and how you can change them.

There are many unscrupulous agencies out there that will claim they can remove a bankruptcy or fix a credit report, says Samah Haggag, a senior marketing manager for Experian. There is nothing a credit repair organization can do that you cannot do yourself.

Why this matters: Credit repair agencies take the heavy lifting out of credit-building, but they charge fees. If youre willing to put in the work of checking your credit reports and disputing errors, you can save that money and use it to continue paying down existing debt.

How to get started: Take a look at your budget and request copies of your credit report yourself before looking into credit repair agencies.

What If I Need A Loan Or Credit Card Immediately After Bankruptcy

Luckily, most mortgage companies provide FHA loans for scores of 560-600. Traditional financing options often require a score of 600 or higher.

There are options for buying high-cost necessities after filing bankruptcy claims. Secured credit cards and loans exist for those facing bankruptcy. You can look into credit builder loans or other financing options specially built for people after bankruptcy.

Read Also: How To File Bankruptcy In Illinois

What Should You Do To Improve Your Credit Score After A Bankruptcy

After you have filed for bankruptcy, it will be very difficult for you to be approved for any type of credit, including regular unsecured credit cards. So, you should ease back into borrowing money by applying for a secured credit card. A secured card is just as good for your credit as is an unsecured credit card, but there is a difference. With a secured credit card, your credit limit is determined by a security deposit that you give the issuer.

For example, if you want a $500 credit limit, the card issuer will ask you for a $500 deposit. The security deposit is kept by the bank as collateral in the event that you fail to repay your credit card. Usually, if you use the credit card and make all of your payments on time, the card issuer will return the security deposit to you within 12 to 18 months.

Dont be discouraged from applying for a secured credit card after your debt has been discharged. Its one of the greatest ways to build a good credit history after bankruptcy. That said, make sure to make all of your payments on time and dont fall back into the bad habits that cause you to file for bankruptcy the first time.

Here are some quick tips on improving your credit score:

How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.

You May Like: How Many Bankruptcies Has Donald Trump Filed

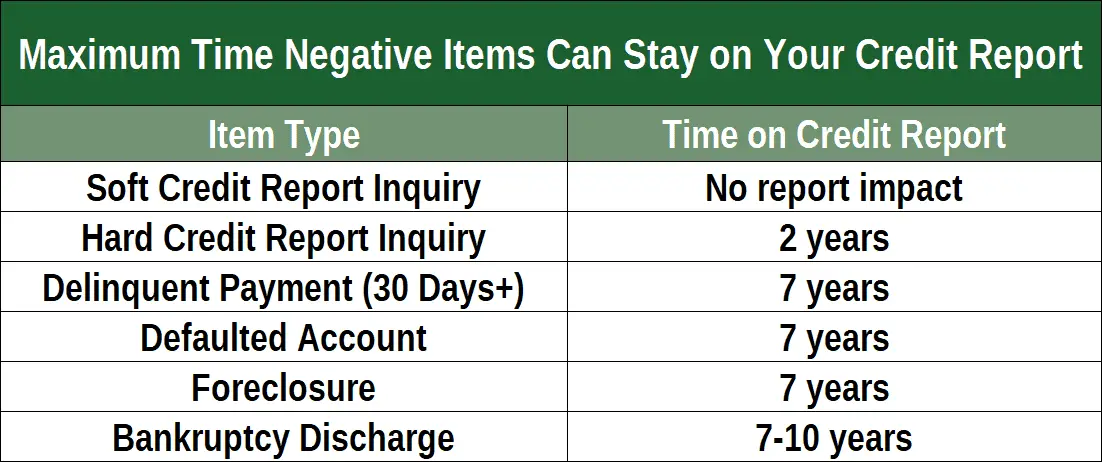

How Long Do Derogatory Marks Stay On Your Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Derogatory marks on your credit are negative items such as missed payments, collections, repossession and foreclosure. Most derogatory marks stay on your credit reports for about seven years, and one type may linger for up to 10 years. The damage to your credit score means you may not qualify for new credit or may pay more in interest on loans or credit cards.

If the derogatory mark is in error, you can file a dispute with the credit bureaus to get negative information removed from your credit reports. You can see all three of your credit reports for free on a weekly basis through April 2022.

If the derogatory marks are not errors, you’ll need to wait for them to age off your credit reports.

If you are not in a position to pay your bills, learn how to limit the damage to your finances.

Heres how long derogatory marks stay on your credit reports click to learn how to recover:

Why You Need To Work On Your Credit Asap

If you have a 550 credit score, borrowing is going to be challenging. A credit score of 550 or lower is usually too low to qualify for a mortgage. However, youre not that far off from the score you need to qualify for this good debt. With FHA financing options, you only need a 560-600 to qualify. Of course, if you want to use traditional financing options, you generally need at least a 600 credit score.

However, besides loan approvals there are other concerns that come with a low score:

So, is bankruptcy bad for your credit? Yes. But it might not be as bad as you think. And there are financing options specifically designed to help people in your situation. For instance, there are solutions for buying a car after bankruptcy.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

How Credit Scores Work

First, lets take a look at how your credit score is calculated in the first place. You have credit scores from each of the three major credit bureaus: TransUnion, Equifax, and Experian. These bureaus track all of your credit activity. That includes the use of your credit cards and whether you pay them in full, your student loans, mortgages, auto loans, and more. Each item the bureaus track is factored into your credit score, which ranges from 280 to 850.

The exact mechanism by which the bureaus arrive at an individuals credit score is proprietary they keep it secret so that, in theory, no one can game the system. However, FICO recently released some data about how much certain common events will affect your credit score, called damage points.

Your score affects your access to all sorts of things. It will show up when you want to get a credit card or a loan, for example. If you want to rent an apartment or get a cell phone plan, theyll check your credit. Some employers may even check your score when you apply for a job.

Evaluating Credit Card Offers

You will typically begin to receive new offers for credit after bankruptcy. However, be aware that many new credit card offers will have low limits, high-interest rates, and high annual fees. Reviewing the offer terms carefully before signing up for a new credit card after bankruptcy is essential. The goal is to accept a credit card with the highest possible limit because credit reporting agencies rate you based on your total available credit. Not only can lower limits can harm your score, but youll want to pay off the majority of your balance each month.

If you dont qualify for a typical, unsecured credit card, you might want to start rebuilding your credit by getting a secured credit card from your bank. Youll deposit a certain amount of money in the bank as collateral for the card. In exchange, you have a line of credit equal to the amount in the account. A secured credit card rebuilds credit because the creditor typically reports payments on your credit reportyoull want to be sure that will happen.

Recommended Reading: Bankruptcy Petition Preparer Services

You May Like: How Long Does It Take To Finalize Bankruptcy

Should You Worry About Changes In Your Credit Score

Changes in your credit score are completely normal, so theres no need to worry about small fluctuations! That being said, its good to check your credit report at least once a month so you can monitor these changes when they occur.

You may want to take note of large changes in your score as they could be an indication that something bigger is happening for example, if you have unauthorized accounts opened in your name, or youve been a victim of identity theft.

Learn How Long Chapter 7 Bankruptcy Will Stay On Your Credit Report

By Carron Nicks

Most people file a bankruptcy case when they need to put financial problems behind them and get a fresh start. Part of that fresh start often involves improving a credit score, and filers can take positive steps by paying bills on time and keeping credit balances low. Even so, it can take up to ten years for the bankruptcy to fall off your credit report, depending on the bankruptcy chapter that you file.

You May Like: Online Bankruptcy Preparation Services

What Is The Credit Score Cost Of Waiting To File

While a 240-point drop is certainly worth noting, its also worth noting how much waiting to file or not filing at all can negatively impact your score.

Bankruptcy can give you a clean break from debt, which means you can focus on rebuilding. On the other hand, digging yourself out of debt can take years and lead to more damage.

- Missed payments remain on your credit report for seven years.

- Collection accounts remain for seven years from the date the original account became delinquent.

- Debts that get settled remain on your credit for seven years from the date of filing.

So, while bankruptcy will negatively affect your credit, not filing can also have a significant negative impact. And the damage can last just as long.

Talk to a debt relief specialist to see if bankruptcy is the best option for you.

What Can Do To Repair Your Credit History While You Wait

The golden rule to a good credit score is to make sure all your credit accounts are paid on time and any past due accounts have been brought up-to-date. Try to reduce your credit balance where possible and keep the balances on revolving accounts low.

Avoid applying for credit if you think there is any chance you may be declined, by checking your credit score and running pre-approved applications you can get a good idea if it will be successful and this reduces the number of checks on your file. Fewer checks mean an improved score.

If any negative information has been put on your file by mistake you can contact the credit agency and ask them to remove it, this is called a notice of correction. When they receive your query they will contact the company who provided the data you are querying and let you know the outcome within 28 days. The credit agency is not legally allowed to change the information on your credit report without permission from the company who originally provided it to them.

Having a low credit score doesnt mean you cant get credit. There are some lenders that specialise in approving loans for borrowers with poor credit. However, those loans typically come with higher interest rates and less favourable terms.

Also Check: Will Filing For Bankruptcy Stop A Judgement

Is Your Credit Rating Really Worth Stressing About

Are you current on all your debt payments? Yes? No? Maybe?

If youâre behind on any debt payments, your credit score could probably be better. So, rather than worrying about possibly making your already bad credit worse, think about how a bankruptcy discharge could help you build credit.

So, what happens to my credit score if I file bankruptcy?

Like all negative information reported to the credit credit bureaus, filing any type of bankruptcy will have a negative impact on your credit score. Since a bankruptcy filing is public record, they will find out, even if theyâre not directly notified by the bankruptcy court.

But, unlike other things that have a negative effect on your FICO score, a bankruptcy filing is often the first step to building a good credit score.

Work With Your New Creditors

If you ever have to miss a debt payment due to unforeseen financial hardship, contact your creditor long before your next due date. Work with the creditor to establish a future payment arrangement, and ask a service representative or manager to note your account with a “promise to pay.” Specifically request that the creditor not report the missed payment to credit bureaus, and check your credit reports after a few weeks to ensure that it did not.

References

Also Check: How To File Bankruptcy In Illinois

How Does A Collection Account Affect My Credit

Once an account enters collections, it will harm your credit score AND credit history. If at all possible, avoid letting an account ever enter this status because of the harsh consequences.

First, the instance stays on your credit report for 7 years from your first delinquency. That means creditors will see you as risky, and it will be difficult to increase your credit score during this time. Its also going to significantly drop your score. If you have a score of 700, for example, expect a drop of around 100 points.

How To Avoid Defaulting On Loans In The Future

Even if you can’t keep up on a bill payment, there may be ways to prevent default. If you’re proactive in exploring your options, you could potentially avoid the fees, damage to your credit, or loss of property that can happen as a result of default.

Here are some preventive measures to consider:

- Reach out to your lender. Communicate with your creditor before you fall behind. Your lender may be more flexible if you reach out while your account is still in good standing, and you could potentially work out a modified repayment plan that fits your budget and prevents you from falling behind.

- Ask about deferment. If you can’t afford to pay much, or anything toward your debt, ask your lender about getting payments temporarily deferred or even suspended through a forbearance plan.

- Consolidate debt. If your credit is in good standing, or if it improved since you took on your debt, you may be able to consolidate your debt and avoid falling behind by taking out a new loan with more affordable payments. You can use Experian CreditMatch to find a debt consolidation loan that works for you.

Don’t Miss: Ezbankruptcyforms.com Reviews