Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

How To Calculate Your Debt

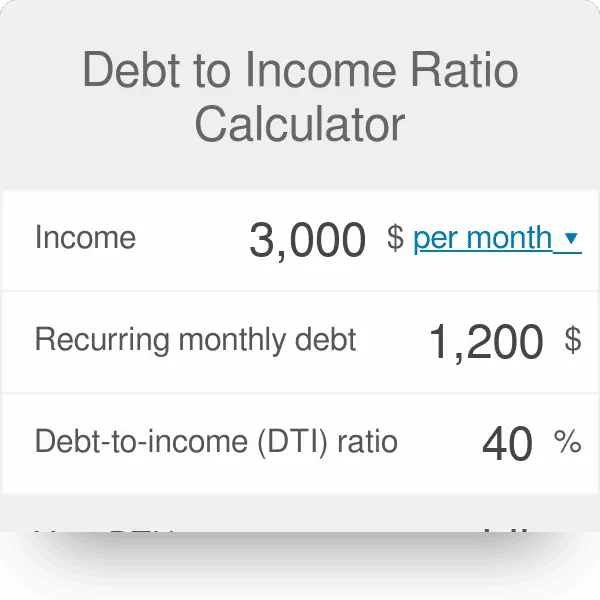

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, you’d then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, you’d take 0.3 and multiply it by 100, giving you a DTI of 30%.

How To Understand Your Dti Ratio

Your DTI can help you determine how to handle your debt and whether you have too much debt.

Heres a general rule-of-thumb breakdown:

-

DTI is less than 36%: Your debt is likely manageable, relative to your income. You shouldnt have trouble accessing new lines of credit.

-

DTI is 36% to 42%: This level of debt could cause lenders concern, and you may have trouble borrowing money. Consider paying down what you owe. You can probably take a do-it-yourself approach two common methods are debt avalanche and debt snowball.

-

DTI is 43% to 50%: Paying off this level of debt may be difficult, and some creditors may decline any applications for more credit. If you have primarily credit card debt, consider a . You may also want to look into a debt management plan from a nonprofit credit counseling agency. Such agencies typically offer free consultations and will help you understand all of your debt relief options.

-

DTI is over 50%: Paying down this level of debt will be difficult, and your borrowing options will be limited. Weigh different debt relief options, including bankruptcy, which may be the fastest and least damaging option.

Debt-to-income ratio, or DTI, divides your total monthly debt payments by your gross monthly income. The resulting percentage is used by lenders to assess your ability to repay a loan.

To calculate debt-to-income ratio, divide your total monthly debt obligations by your gross monthly income.

Recommended Reading: How To Remove Bankruptcy Accounts From Credit Report

What Is Included In Your Debt

Your DTI ratio should include all revolving and installment debts car loans, personal loans, student loans, mortgage loans, , and any other debt that shows up on a credit report. Certain financial obligations like child support and alimony should also be included.

Monthly expenses like rent, health insurance premiums, transportation costs, 401k or IRA contributions, and bills for utilities and services are generally not included. However, if you have long-overdue bills for these types of accounts, they might eventually be passed on to a collection agency. The debt may be included in the calculation if that is the case.

There are two types of DTI ratios that lenders look at when considering a mortgage application: front-end and back-end.

What is your front-end ratio?

The front-end-DTI ratio, also called the housing ratio, only looks at how much of an applicants gross income is spent on housing costs, including principal, interest, taxes and insurance.

What is your back-end ratio?

The back-end-DTI ratio considers what portion of your income is needed to cover your monthly debt obligations, including future mortgage payments and housing expenses. This is the number most lenders focus on, as it gives a broad picture of an applicants monthly spending and the relationship between income and overall debt.

A general rule would be to work towards a back-end ratio of 36% or lower, with a front-end ratio that does not exceed 28%.

How To Lower Debt

Increase IncomeThis can be done through working overtime, taking on a second job, asking for a salary increase, or generating money from a hobby. If debt level stays the same, a higher income will result in a lower DTI. The other way to bring down the ratio is to lower the debt amount.

BudgetBy tracking spending through a budget, it is possible to find areas where expenses can be cut to reduce debt, whether it’s vacations, dining, or shopping. Most budgets also make it possible to track the amount of debt compared to income on a monthly basis, which can help budgeteers work towards the DTI goals they set for themselves. For more information about or to do calculations regarding a budget, please visit the Budget Calculator.

Make Debt More AffordableHigh-interest debts such as credit cards can possibly be lowered through refinancing. A good first step would be to call the credit card company and ask if they can lower the interest rate a borrower that always pays their bills on time with an account in good standing can sometimes be granted a lower rate. Another strategy would be to consolidating all high-interest debt into a loan with a lower interest rate. For more information about or to do calculations involving a credit card, please visit the . For more information about or to do calculations involving debt consolidation, please visit the Debt Consolidation Calculator.

Also Check: Does Declaring Bankruptcy Clear Debt

How To Calculate Dti Ratio

In the world of real estate investment strategy, debt to income ratio, or DTI, is a way to compare the amount of debt you have to your overall income.

It is a lenders way to estimate a potential borrowers ability to make the monthly payments due on its loan, taking into account the borrowers income and existing fixed monthly expenses, including debt service. It is generally expressed as a percentage.

When Do You Include Your Spouses Debt

Including your spouses debt depends on whether youll be applying for the mortgage jointly or as an individual. Certain states operate under community property rules, which establish that both spouses are under equal obligation to repay debts incurred during the marriage. In those states, excluding a spouses debt from the DTI ratio is not allowed.

States where community property rules apply are:

In the rest of the country common-law rules apply. Couples are not legally obligated to equally share all debt acquired while married. This means they can apply for a loan as individuals and the spouses income and debt will bear no influence in the lenders evaluation.

In common-law states, applying as a couple is favorable if the combined debt results in a lower, stronger DTI ratio. Having two incomes also means that you could qualify for larger loans.

However, if a couples combined credit score and debt-to-income ratio severely impacts their eligibility for a good mortgage loan, its best to apply as an individual.

Also Check: What Should You Not Do Before Filing Bankruptcy

Focus On Increasing Your Income

Boosting your income can also help you work toward an ideal debt-to-income ratio. If youre overdue for a raise, it might be time to ask your boss for a salary increase. You could also pick up a side job, such as tutoring, freelancing in a creative field or working as a virtual admin, to increase your earnings. Those looking to make a more extreme change might seek out a new company or career path.

Finding ways to make more money will not only help you get the right debt-to-income ratio for a personal loan, mortgage or another type of financing, it can also give you more financial stability. You may have more wiggle room in your budget to build an emergency fund and avoid taking on new debts.

Dti Ratio And The Real Estate Investment Industry

As a word of caution, however, what is included in the gross income calculation is not necessarily consistent with all lenders. Remember that lenders tend to look at extending loans to borrowers in the most conservative way possible. Many will count only W-2 income .

Schedule E income, which is income found on Schedule E of IRS Form 1040, is income earned from rental real estate, partnerships, S corporations and other specific sources. Some lenders will use this income in calculating the DTI ratio, some will disregard it completely, and some will only use it if there is a least a two year history of Schedule E income .

If you are worried about your DTI ratio when applying for a loan, and you have meaningful Schedule E income, you should check with your lender about whether they will use it in determining your DTI and ultimate approvability.

Remember, at RFG we use Schedule E to supplement a borrowers income in determining approvability.

Use our House Flipping Calculator to see how much flipping a house will cost!

BACK TO REAL ESTATE FORMULAS

You May Like: Debt Consolidators Of America

Focus On Paying Down Debt

Debt-to-income ratios dont look at how much money you have in the bank. Theyre laser-focused on how much money you have coming in compared with the amount of debt you owe. As such, taking money you would have spent elsewhere and devoting to paying down your debt will help lower your DTI, even if the funds in your bank account stay the same or even go down.

Keep in mind, however, that when youre applying for pre-approval of a home loan, lenders will look at your bank statements to see how much money you have on hand. So, if youre going overboard paying down debt, that could hurt your loan application in other ways.

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Also Check: J And J Bankruptcy

What’s The Difference Between Your Debt

Debt-to-credit and DTI ratios are similar concepts however, it’s important not to confuse the two.

Your debt-to-credit ratio refers to the amount you owe across all revolving credit accounts compared to the amount of revolving credit available to you. Your debt-to-credit ratio may be one factor in calculating your credit scores, depending on the scoring model used. Other factors may include your payment history, the length of your credit history, how many credit accounts you’ve opened recently and the types of credit accounts you have.

Your DTI ratio refers to the total amount of debt you carry each month compared to your total monthly income. Your DTI ratio doesn’t directly impact your credit score, but it’s one factor lenders may consider when deciding whether to approve you for an additional credit account.

Familiarizing yourself with both ratios may give you a better understanding of your credit situation and help you anticipate how lenders may view you as you apply for credit.

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Don’t Miss: What Does It Mean When You File For Bankruptcy

What Factors Make Up A Dti Ratio

- Front-end ratio: also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

Should You Worry About Your Dti

No. Instead of worrying about your debt-to-income ratio, you should work towards lowering the number to a more favorable percentage. The DTI is an important tool for lending institutions, but it is only one of the many barometers they use to gauge how safe it would be to lend you money.

However, when it comes to buying a home, your DTI sits front and center on the negotiation table. You will certainly incur higher interest rates with a high DTI, and you may be required to slap down a heftier down payment.

Seasoned lenders know that a ratio above 40 percent means you’re treading on the slippery slope to fiscal collapse. It says you’re making ends meet, but just barely. Lenders will assume that any additional loan you take on might be the last straw.

Can you lower your DTI? Of course! Lowering your ratio is almost as easy as calculating it. Then again, it will take you a lot longer. Fortunately, it’s easier and quicker than improving your credit score, but it does require a major shift in your way of thinking.

Can you reduce your DTI to zero? Maybe or maybe not, but that’s still a goal worth setting. Use the following tips to put your best foot forward for lenders.

Read Also: How Long After Bankruptcy For Fha Loan

Debt To Income Calculation

The DTI ratio calculation is simple, just divide the fixed monthly expenses by the borrowers monthly gross income.

A good DTI ratio in the traditional lending world is considered to be 43%, meaning that your monthly expenses do not exceed 43% of your gross income. In the real estate investing world, that number varies.

Private lenders, like Rehab Financial Group, LP will look at the borrowers overall income and expenses and review how much free cash the borrower has on a monthly basis. The acceptable DTI can vary greatly generally the higher the income, the higher the DTI can be. It is perhaps easiest to explain it by examples as follows:

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

You May Like: Foreclosed Houses In My Area

Is All Debt Treated The Same In My Debt

Ultimately, your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. The ratio doesnt weigh the type of debt differently. The more debt you have, the higher your DTI and the harder it may be to qualify for a great loan.

How Lenders View Your Debt

Now that you know how a debt-to-income ratio is calculated, you might be wondering what lenders think of your score.

The criteria can vary from lender to lender, but heres a general breakdown of the industry standards:

DTI less than 36%Lenders view a DTI under 36% as good, meaning they think you can manage your current debt payments and handle taking on an additional loan.

DTI between 3643%In this range, lenders get nervous that adding another loan payment to your plate might be challenging, especially if an emergency pops up. You wont necessarily get turned down for another loan, but lenders will proceed with caution.

DTI between 4350%When your DTI gets to this level, youre almost too risky for lenders, and you may not be able to get a loan.

DTI over 50%At this point, youre in the danger zone, and lenders probably wont lend you money. With a DTI ratio over 50%, that means over half of your monthly income is going to pay debt. Add in normal living expenses, like groceries and insurance, and theres not much left over for saving or covering an emergencyand another loan could tip you over the edge.

You May Like: Can You File Bankruptcy On Business Taxes

How To Improve Your Dti

We’d like to tell you to just spend less and save more, but you’ve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.