Student Loan Debt By State

Student loan debt is a topic were read and hear about often these days. Its a political hot topic too. As of 2018, a total of 44.2 million borrowers owe a total of over $1.5 trillion in student debt. Here a debt by State breaking down provided by the Institute for College Access & Success, listing the ten highest and lowest stated with debt.

Highest Student Loan Debt by State:

Lowest Student Loan Debt by State:

My home state of New York ranks 13th overall. Student loan debt can be crippling for young adults beginning their financial lives. Its a topic we have covered with our three children often. Weve advised making smart choices about the cost of obtaining an advanced degree and understanding the return on investment. Its not wise to borrow $200K for a career that earns you $50K per year.

How Much Credit Card Debt Does The Average American Have

Lets continue:

11. American people aged 45-54 have an average credit card debt of $7,670, with 51.7% of those indebted, which is the highest proportion of the age groups.

Median credit card debt is the highest for Americans aged 45-54 at $3,200. Americans younger than 35, on the other hand, have the lowest median credit card debt at $1,900.

In the table below, you can find the median and average debt by age in the US:

| Age | |

| $8,080 | 28% |

12. Americans aged 75 or older have the highest average credit card debt of $8,080, but only 28% of them are charged with credit card debt.

The credit card debt of Americans aged 75 or older rose to 28% in 2019 from 10% in 1989. Over the same period, the median amount owed escalated from $400 to $2,700.

13. Around 34% of people aged 1829 have student loans. Borrowers under 24 owe an average of $16,500.

People aged 35 have the highest average American student loan debt at $42,600 per borrower. The end balance is 287%, which is higher than the value of their original loan.

Student borrowers aged 30-44 owe 49% of the national student loan debt balance, which means $823.2 billion.

14. Even though women have a lower income, they have higher student loan payments than men .

This also shows that men have a lower percentage of the average American student loan debt per person than women. Out of the total national student loan debt, $929 billion belongs to women. The most common reason for this debt is the persistent gender wage gap.

Individuals Debt By State

A recent gives a clear picture of debt by State. Here are some of the key finding of that report:

- Residents of Washington, D.C. have the highest debt-to-income ratio at 1.09, meaning that overall people in D.C. have 9% more debt than their income can cover. This area also has the highest total debt per capita at $84,380, according to the Federal Reserve Bank of New York.

- West Virginia has the lowest debt-to-income ratio, at 0.65, meaning that overall West Virginians make about 35% more money than they owe. This State also has the least total debt per capita at $28,790, according to the Federal Reserve Bank of New York.

- In states with the highest debt-to-income ratios, mortgage debt makes up a much higher percentage of residents total debt compared to other forms of debt.

- In states with the lowest debt-to-income ratios, residents have a higher percentage of credit card debt compared to residents in states with the highest DTI.

- Overall, Washington, D.C. has more than 3x more total debt per capita than West Virginia.

Here are the ten states with the highest debt-to-income ratios:

Here are the ten states with the lowest debt-to-income ratios:

Recommended Reading: How To Access Bankruptcy Court Filings

Choose A Repayment Method And Set A Goal

Whichever method you choose, the first step is going to be to take stock of everything you owe, how much you owe in total, and the interest rate. Then, you can start to prioritize what you owe.

Two popular strategies are the debt avalanche and the debt snowball. The debt snowball tackles the smallest debt first to build momentum, working through bigger debts next, while the debt avalanche focuses on paying down higher-interest debt first to decrease the amount you pay overall.

Average Credit Card Debt By Income

The greater the household income, the higher the credit card debt. Individuals in the highest annual income percentile, 90th to 100th, had an average of $12,600 in credit card debt more than three times as much as households making the least.

| Income percentile | Percentage who have credit card debt | Average credit card debt |

|---|

You May Like: What Does Bankruptcy Mean For Boy Scouts

American Medical Debt In 2020

Medical debt can be difficult to track. However, it’s clear that it’s a growing problem.

According to Urban Institute, 16% of Americans — over 52 million people — had medical debt in collections in 2017. That number is higher, 19%, in communities of color.

Some states have significantly higher numbers, too. For example, 31% of West Virginians have medical debt in collections.

The median debt also varies quite a bit. In the United States overall, the median medical debt in collections is $694. In Alaska, Wyoming, and West Virginia, though, that number is over $1,000 .

While statistics are scarce, it seems likely that rising healthcare costs — especially during a global pandemic — will have pushed these numbers higher.

| State |

|---|

| 2.08 |

As you can see, residential and commercial real estate loans have had more charge-offs and delinquencies in Q2 2020 than they did in Q1, though the rates are notably lower than they were in previous years.

The delinquency and charge-off rate for consumer loans was 1.98% in Q2, while the overall rate, which includes real estate and commercial loans, was 1.54%. The consumer delinquency and charge-off rate is notably lower than the 2.47% from Q1, which may be a reflection of relief measures put in place by companies in response to coronavirus-related income loss.

Again, these figures can take time to adjust to new economic conditions, so we may see changes in the coming months.

Average New Car Payment In : $568

| Average finance rate on 24-month personal loans from commercial banks, Aug. 2020 | 9.34% |

Personal loans are versatile financial products. They can be used for a variety of financial needs, including weddings, renovations, vacations, or debt consolidation.

The SCF doesn’t break out total personal loan debt as a separate category, so we can only say that it’s part of the $417 billion “Other” category.

However, we can talk about the average personal loan debt.

According to TransUnion’s September Monthly Industry Snapshot, the average unsecured personal loan amount was $5,538, down from $6,096 in September 2019.

The average balance per customer, however, is $9,074, indicating that many people who have one unsecured personal loan have at least one more. That’s higher than the $8,989 per customer in September of last year.

Don’t Miss: Why Did Pg& e Filed Bankruptcy

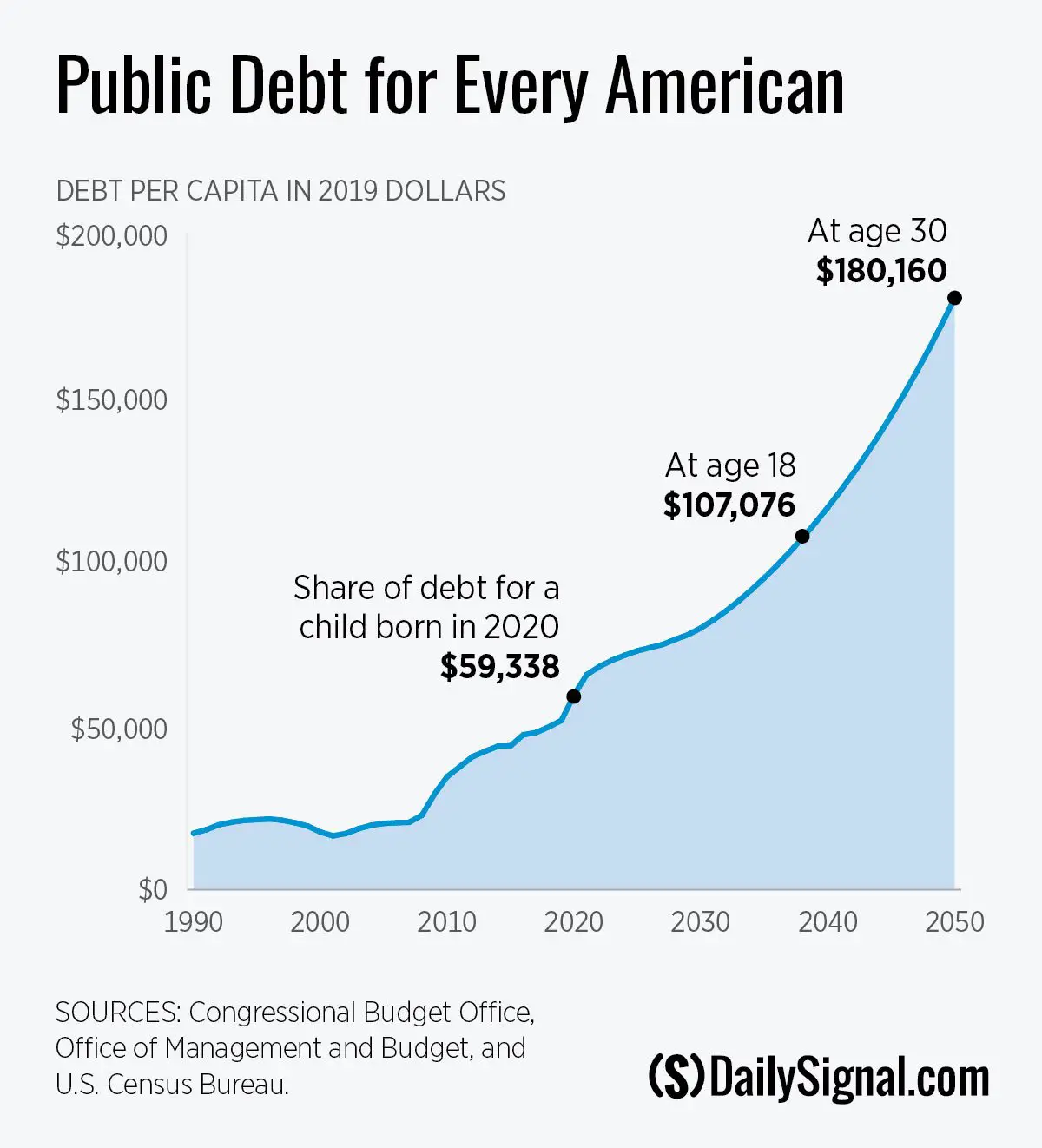

What Is The National Debt Costing Us

As the debt grows, so does the interest we pay.

Similar to a home or car loan, interest payments represent the price we pay to borrow money. As we borrow more and more, federal interest costs rise and compound. Rapidly growing interest payments are a burden that hinders our future economy.

Interest will become the fastest growing part of the federal budget.

In ten years, our interest will nearly triple from where it is today.

Cryptocurrencies Go Mainstream & Tax Reform

This was the year that Bitcoin and other cryptocurrencies reached a level where awareness really spread among ordinary people not just those seeking a means of keeping transactions out of the central banking system.

This was also the year for the first major tax reform in nearly three decades. The Tax Cuts & Jobs Act of 2017 cut taxes for corporations and individuals, giving the country a short-term economic boost.

National Debt: $20.245 trillion

Also Check: How Long Does Bankruptcy Stay On Your Credit Score

Use These Pay Off Debt Tools

Now that you have our debt numbers, youve prepared for the change, increased your knowledge on the topic, and have a motivating reason to move forward, lets dig into the tools to pay off debt.

Negotiate

When you are trying to pay off debt, let your creditors know. Some will be willing to work with you. You can call credit card companies and ask for a reduced interest rate. If you have a lump sum bill like a medical bill, you can call and try to work out a realistic payment plan.

The worst you can receive is a no, and you can call back at another time and speak with someone else or escalate to a supervisor or manager.

Debt Pay Off Techniques

Debt Snowball

The debt snowball is an accelerated debt payoff strategy. Its called the snowball because like a small snowball or anything for that rolling downhill it begins to pick up momentum. You attack the smallest debt first and once paid off move on to the next.

Debt Avalanche

The debt avalanche is another accelerated debt payoff strategy. Its called the avalanche because its likelier to pay off debts in a shorter time and save you the most money on interest.

To best understand which if the snowball or avalanche payoff method might be right for you, test out some what if scenarios to conclude what works best for you.

Calculating The Annual Change In Debt

Conceptually, an annual deficit should represent the change in the national debt, with a deficit adding to the national debt and a surplus reducing it. However, there is complexity in the budgetary computations that can make the deficit figure commonly reported in the media considerably different from the annual increase in the debt. The major categories of differences are the treatment of the Social Security program, Treasury borrowing, and supplemental appropriations outside the budget process.

Social Security payroll taxes and benefit payments, along with the net balance of the U.S. Postal Service, are considered “off-budget”, while most other expenditure and receipt categories are considered “on-budget”. The total federal deficit is the sum of the on-budget deficit and the off-budget deficit . Since FY1960, the federal government has run on-budget deficits except for FY1999 and FY2000, and total federal deficits except in FY1969 and FY1998FY2001.

Read Also: When You File Bankruptcy What Happens To Your Debt

Which States Have The Most Debt

Heres a look at the 10 states where residents have the most debt, ranked by DTI as of Q4 2021.

| Rank |

| 1.14 |

Sources: Federal Reserve Bank of New York, Bureau of Economic Analysis data

In other states, personal per capita income outweighs total debt per capita meaning that, in theory, residents there have a lighter overall debt burden. West Virginia is the state with the lowest debt, according to New York Federal Reserve data, with a total debt per capita of $32,080. It also has the lowest debt burden.

Heres how the states rank when you look at those with the lowest debt-to-income ratios.

Average American Debt By Type Of Debt

Here’s a breakdown of the total amount, according to the Federal Reserve Bank of New York’s Household Debt and Credit report from the first quarter of 2021.

| Debt type | |

| Home equity lines of credit | $1,210 |

| Other debt | $1,490 |

Mortgage debt is most Americans’ largest debt, exceeding other types by far. Student loans are the next biggest type of debt among those listed in the data.

Also Check: Does Filing For Bankruptcy Mean You Are Broke

What Is The Gdp Of A Country

The Gross Domestic Product is an indicator of how many goods or services the entire country produced over the year. Its an indication of how prosperous the country is as a whole. Naturally, though, its also important to consider other factors when considering prosperity, like imports, exports, debt, and so on.

Those issues would be outside the scope of this article, so we stuck to simple GDP statistics.

Debt Statistics At A Glance

These figures take a birds-eye approach to the United States debt picture, offering a wider perspective on how Americans are managing their finances.

- American consumer debt totaled $14.27 trillion in Q2 of 2020.1

- Overall consumer debt dropped from a record $14.3 trillion in Q1 to $14.27 trillion in Q2 of 2020, the first drop since 2014.1

- At $9.78 trillion, mortgages make up nearly 70% of American household debt. The next highest debt category is student loans at $1.54 trillion, followed by auto loans at $1.34 trillion.1

- Approximately 3.5% of all American household debt is in delinquent status.1

- Overall debt is highest in the 40-49 age group at $3.57 trillion and lowest in the 18-29 age group at $.94 trillion.1

- In July 2020, nearly half of respondents to a Federal Reserve Survey said they would be able to pay a $400 emergency expense with the money currently in their bank account, while another 38% said they would be able to put it on a credit card and pay it in full at the next statement.2

- Additionally, 37% reported they were living comfortably, 40% said they were doing okay, 17% said they were just getting by, and 6% said they were finding it difficult to get by.2

Read Also: How Much To File Bankruptcy In Wisconsin

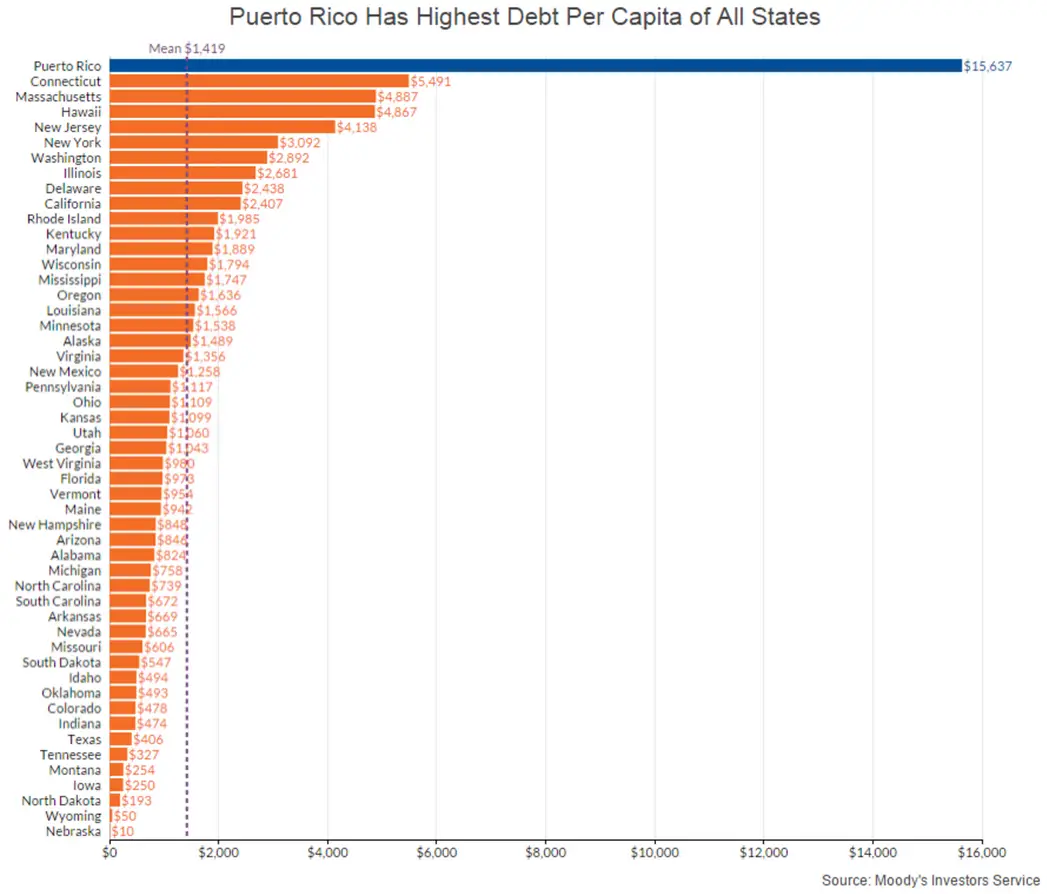

Government Debt By State

Now individuals are not the only ones who carry debt. Our State and Federal Government has an issue with balancing a budget too. A report from Truth in Accounting , profiles debt by state ranking by taxpayer burden. Taxpayer burden reflects the amount each taxpayer would have to send to their states treasury for the state to be debt-free.

Here are the highest taxpayer burden states:

Here are the lowest taxpayer burden states:

How does your state rank? I hope you dont live in New Jersey!

Are There Countries With No Debt

Statistically, its hard to establish if there are countries that have no external debt. In 2014, Brunei was listed as one of these. The country is one of the wealthiest nations in the world, so that could be why it doesnt need to borrow money. The politics at play in the region could also form a significant portion of the reason.

Generally speaking, youll be hard-pressed to find countries that have not borrowed money. Even with superpowers like the United States and China, having national debt is par for the course. The World Bank often offers countries stimulus loans as a way of boosting the global economy and staving off a global recession.

In truth, its a very complicated issue. Much of the actual world debt figures are obscured by countries borrowing from divisions within their government. The exact statistics are further obscured by countries which borrow more money to service the debt they already have. To complicate things even more, lenders like the World Bank may write off the debt.

Whats more:

Other lenders may write off debt in exchange for concessions from the country theyve lent money to. This all makes the question of which country has the most debt a lot more complicated to answer.

Thats easier said than done, but it does lend another element to questions like How much debt is America in?

Final Notes

Read Also: How Many Points Does Bankruptcy Lower Your Credit Score

How Many Americans Are In Debt

Even though household net worth is on the rise in America so is debt.1 The total personal debt in the U.S. is at an all-time high of $14.96 trillion.2The average American debt is $58,604 and 77% of American households have at least some type of debt.3,4,5

Lets pause a second to define debt. Plain and simple, debt is owing any money to anybody for any reason. If you have debt, youve most likely agreed on terms of repayment, and those terms mean specific payments at specific time periods until the debt is paid offtypically with interest .

Some of the most common types of debt in America include credit cards, student loans, auto loans, home equity lines of credit , and mortgages. Though each impacts Americans of all ages, some age groups are more impacted than othersso well look at not only American totals and averages, but also at debt across various age groups.

Tips To Pay Down Debt

As you can see, debt takes various forms. Here are some practical things you can do to begin dumping your debt.

Get Help / Educate Yourself

Any time you are trying to master a new subject or skill, increasing your knowledge on the topic is a must, including when you are working to pay off debt.

There are many resources you can tap to increase your financial IQ. Consider these:

- Blogs You can read a personal blog like Debt Discipline or use a mainstream site like Investopedia

- Books There are many books on personal finance. Two great ones to start with are The Total Money Makeover and The Millionaire Next Door.

- Podcast There are plenty of podcasts too if audio is your preferred medium. Its great to listen while commuting or doing work around the home. Planet Money and Freakonomics Radio are two good choices to start with.

If any of the above resources dont get you excited and you need a more personal approved, find someone you can help you. You might enlist a friend who is successful with their money to help you understand how they have done so. You could hire a coach or planner to help dig into your numbers and act as an accountability partner as you pay off debt.

Figure Out How Much Debt You Owe

A core step in paying off debt is to know your debt numbers. Grab all of your statements and begin to write down each debt type. Be sure to include the total amount due for each debt, including interest rate, minimum payment, and due date.

Stop Accumulating New Debt

Recommended Reading: Is It Better To Do Debt Consolidation Or Bankruptcy