What Does Bankruptcy Help With

Bankruptcy will stop phone calls and letters from bill collectors. When you file your bankruptcy petition, you immediately get an automatic stay. Youâll be protected from phone calls and collection letters, wage garnishments, repossessions, and lawsuits. At the end of the bankruptcy process, a discharge ends your legal obligation to pay your unsecured debt, such as credit card debts, medical bills, and unsecured personal loans.

If you have steady income, you may be able to pay secured creditors, like your mortgage company, through a payment plan in a Chapter 13 bankruptcy.

How A Bankruptcy Discharge Works

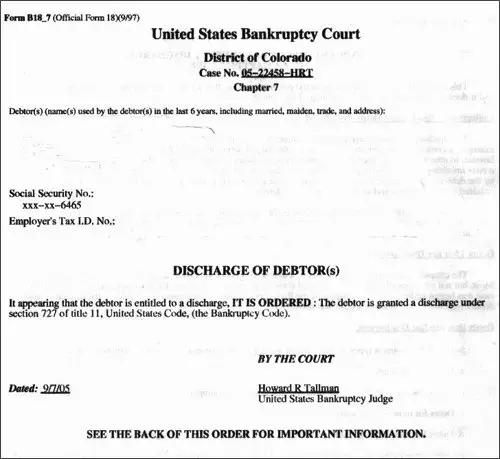

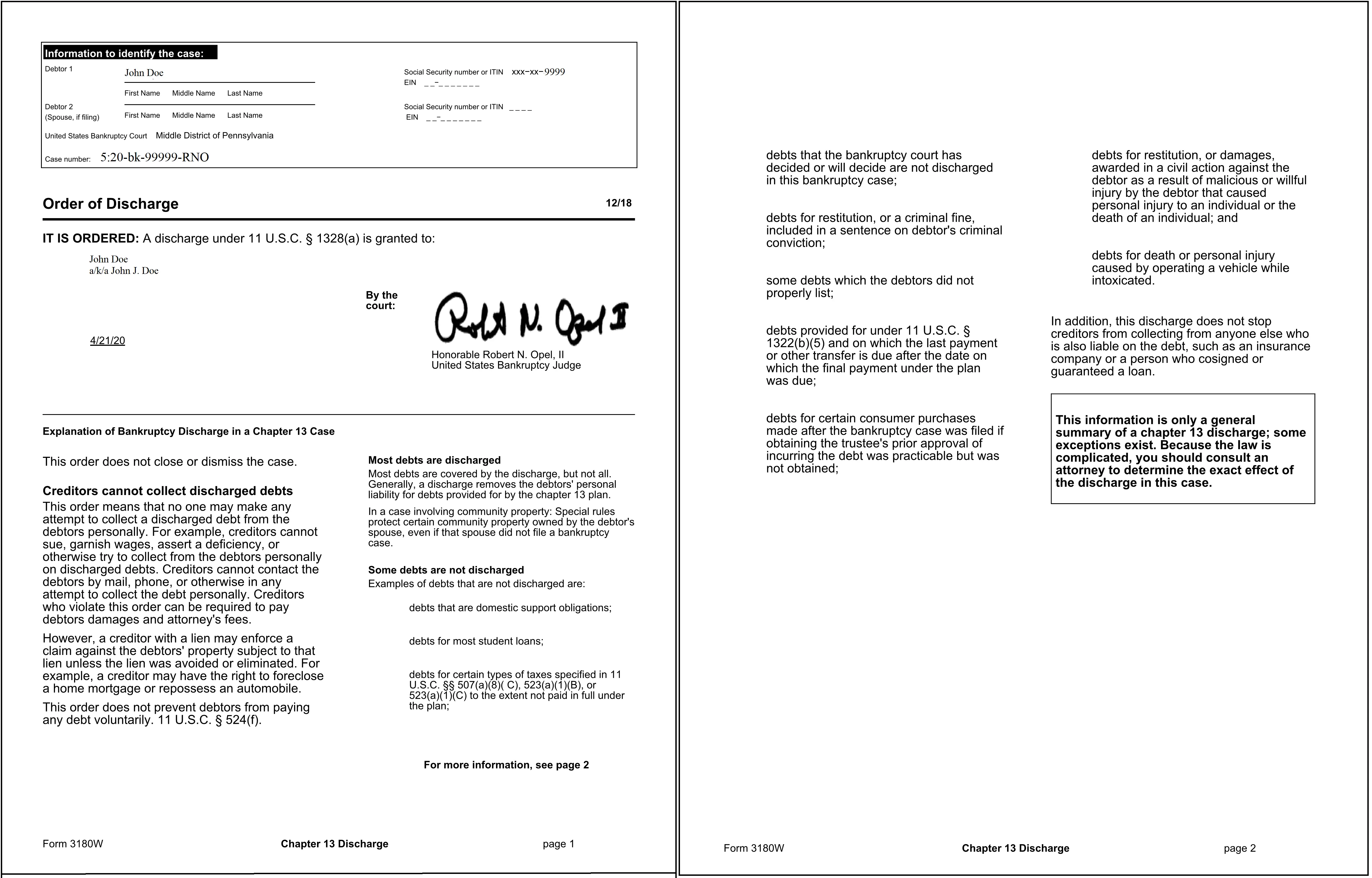

A copy of the discharge order will be mailed to all your creditors, as well as to the U.S. Bankruptcy Trustee, the trustee who is personally handling your bankruptcy case, and the trustees attorney. This order includes notice that creditors should take no further actions to collect on the debts or they’ll face punishment for contempt.

Keep a copy of your order of discharge along with all your other bankruptcy paperwork. You can use a copy of these papers to correct credit report issues or to deal with creditors who try to collect from you after the bankruptcy discharge.

You can file a motion with the bankruptcy court to have your case reopened if any creditor tries to collect a discharged debt from you. The creditor can be fined if the court determines that it violated the discharge injunction. You can try simply sending a copy of your order of discharge to stop any collection activity, then talk to a bankruptcy attorney about taking legal action if that doesn’t work.

Discharging Debts In Bankruptcy

A bankruptcy discharge releases a debtor from being personally responsible for certain types of debts. So, after a bankruptcy discharge, the debtor is no longer legally required to pay any debts that are discharged.

The discharge prohibits the creditors of the debtor from collecting on the debts that have been discharged. This means that creditors have to stop all legal action, telephone calls, letters, and other type of contact with the debtor. This prohibition is permanent for the debts that have been discharged by the bankruptcy court.

You cannot discharge all debts in bankruptcy. Some of the most common debts that you cannot get rid of in bankruptcy are debts from child or spousal support, most student loans, most tax debts, wages you owe people who worked for you, damages for personal injury you caused when driving while intoxicated, debts to government agencies for fines or penalties, and more.

You May Like: Does Declaring Bankruptcy Affect Your Spouse

What Does Bankruptcy Discharge Mean

Categories

If youve had serious financial hardship in the past that prevented you from being able to repay your debts, you may have filed for personal bankruptcy. As a last resort to eliminate your debts, bankruptcy can get your creditors off your back and end the collection calls. It can also give you a clean slate and help you work toward building a better and healthier financial foundation.

Need some tips on how to manage your money successfully? Look here.

But its important to understand that you wont be considered bankrupt forever. At some point, youll be discharged from bankruptcy, at which point youll be eliminated of your responsibility to repay your debt. Failure to get discharged can present a real problem for you, which is why its important to go through the process in its entirety.

To learn more about personal bankruptcy, check out our new video!

What Is A Chapter 7 Discharge Injunction

Once you get your discharge, your creditors are enjoined from pursuing the debt. That means that the court has ordered them to stop collection activity. If your creditors ignore this order, you may be able to get damages caused by their actions. We typically see this in cases where debt collection companies continue to send payment demands even though the person received the discharge. In these cases, we have sued the debt collectors and won. The discharge is serious and debt collectors should respect it.

You May Like: How Many Times Has Donald Trump Filed For Bankruptsy

Does A Chapter 13 Remove Negative Items From My Credit Report

Yes! One of the best parts about Chapter 13 bankruptcy is that negative items are removed from your credit report. This allows you to build credit quickly after your Chapter 13 plan confirmation.;Weve discussed this in our article what does bankruptcy do to my credit? Many times, your credit report begins to show these items as removed within a month or two of filing bankruptcy. This causes many of our clients to see their credit score go up as much as 50 points after filing a bankruptcy!

Who Will Know I Filed For Bankruptcy

Bankruptcy is a legal process and your documents are filed with the federal government, specifically the Office of the Superintendent of Bankruptcy. People can search the government records, but they must first know the name of a person to search and must pay a fee before any information is provided.

Your creditors will also be notified that you filed for bankruptcy.

A creditor is an individual or business that is owed money by the debtor. There are two major types of creditors: secured and unsecured. A secured creditor is one that holds a right or claim against the debtors property. An unsecured creditor does not have a direct claim on the debtors property.

A creditor must file a proof of claim to participate in any dividend distribution from your bankruptcy. They can also request a creditors meeting to review the affairs of the bankrupt, although this rarely happens in most personal bankruptcies in Canada. The creditors role also includes informing the trustee of any irregularities before or during the bankruptcy filing.

Your employer is not notified that you filed bankruptcy unless you have a wage garnishment. In that case, your trustee will notify the payroll department to ask them to stop taking money from your pay.

The OSB will also notify the credit bureau when you file including the date of filing and type of proceeding . They update the credit reporting agencies at the end of your bankruptcy with the date of discharge.

Also Check: Who Is Epiq Corporate Restructuring Llc

Bankruptcy Discharge Certificate Canada: The Complete Happy Story Of Your Bankruptcy Discharge

- Post author

If you would like to listen to the audio version of this Brandons Blog, please scroll to the bottom and click on the podcast

TheIra Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.We hope that you and your family are safe and healthy.

How Does A Bankruptcy Filer Get A Fresh Start

A bankruptcy discharge ends your legal obligation to pay certain debt. The bankruptcy discharge means that you no longer owe the debt â whether it is paid or not. Qualified judgments, garnishments, and collection actions related to the bankruptcy case permanently stop as soon as the case is filed and can never resume once a discharge has been entered. The discharge also protects the filer from employment discrimination.

Recommended Reading: How Many Donald Trump Bankruptcies

Permanent Debt Relief In The Form Of A Bankruptcy Discharge

At the end of a successful bankruptcy case the bankruptcy court issues a bankruptcy discharge order, which erases the filer’s personal liability to pay back the debt. That discharge is generally permanent. Although a bankruptcy discharge can be revoked, it’s rare. It typically happens if it’s later discovered that the filer lied in their bankruptcy petition, didn’t list all of their income or assets, or committed some other type of bankruptcy fraud.

The filer never has to pay back discharged debt. It’s illegal for creditors to try to collect on discharged debt. If they do, the filer can bring legal action against the creditor, which can force them to pay a penalty for violating the discharge order.

The bankruptcy discharge and the automatic stay both stop creditors from taking collection action against you. The difference is that the automatic stay happens automatically after bankruptcy filing and is temporary, while discharge is granted in successful bankruptcy cases and is generally permanent. The filer has to meet certain conditions to receive a bankruptcy discharge. That includes attending the meeting of creditors, filing all necessary bankruptcy paperwork, providing documents the bankruptcy trustee requests, completing credit counseling and financial management courses, and anything else that is required in the filer’s specific circumstances.

What Does Receivership Mean For 1 Better Guarantor Bankruptcy Discharge

- Post author

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

what does receivership mean

Recommended Reading: What Is A Bankruptcy Petition Preparer

Contact Arm Lawyers Today

Never hesitate to reach out to our office during any part of the process. We can skillfully guide you through everything, step by step. If youre already a client, great! Call if you need us. But, If you arent a client, thats ok too! Call for a free bankruptcy consultation today.

We are a debt relief agency. We help people for relief under the U.S. Bankruptcy Code.

Get Your Credit Report Fixed

So, what to do next?

Youve gotten your reports and check them for these errors and youve found one or more of them . No worries, get free help drafting written disputes to your creditors and the bureaus and set your problem up to get fixed as soon as possible!

If it takes a lawsuit to fix it, remember, the law requires that the Credit Bureaus pay the costs and attorneys fees for that .

Youve done the work of going through bankruptcy make sure you get the Fresh Start that you deserve!

More on life after bankruptcy

You May Like: How To File Bankruptcy In Wisconsin

Is Debt Discharged In A Chapter 7 Taxable

No! One of the greatest things about bankruptcy is that your debt is discharged tax free. If you were to settle your debt with your debt collectors, you would receive a 1099 at the end of the year. You would have to pay tax on any money forgiven by the debt collector. In bankruptcy, the discharge makes it so that the debt forgiveness is not taxable.

I got a 1099 from my creditor even though my debt was discharged in bankruptcy. What do I do?

This happens. Its an accounting issue for the creditor. No worries though. You can simply complete an IRS Form 982 when you complete your tax returns to explain you have a bankruptcy discharge. If you file this form, you wont have to pay tax. If we file your taxes for you, we will do this for you so you dont have to worry about it.

What Are The Consequences For A Bankrupt Of Not Being Discharged

Not being discharged has important consequences for a bankrupt.

A person who is bankrupt may not borrow more than $1,000 without informing the lender that he/she is bankrupt. Failure to do so is an offence under the BIA that is liable to a fine, imprisonment or both.

Information pertaining to bankruptcy remains on an individual’s credit file for 6-7;years following discharge of a first-time bankrupt. Times may vary across provinces/territories.

- Date modified:

Recommended Reading: How To File Bankruptcy In Wisconsin

What Does A Chapter 13 Discharge Mean

A discharge is the fancy legal term for your debts being forgiven in your bankruptcy. When we talk about debts forgiven in bankruptcy, we would say that your debts are discharged. The Chapter 13 discharge order is the final order you receive in your Chapter 13 bankruptcy. It is signed by the bankruptcy judge assigned to your cases and states clearly that you have received a Chapter 13 discharge. In other words, it is the formal document that releases you of your debts.Some people refer to the order less formally such as discharge papers.

Your Responsibilities Don’t End When You Receive A Discharge

Just because you received a discharge doesn’t mean that you have no more responsibilities in your bankruptcy. If you have a complex bankruptcy with ongoing lawsuits or appeals, your case might remain open for a long time after the court grants your discharge.

In addition, if you have nonexempt property that the trustee has not abandoned, it will remain property of the bankruptcy estate. The court will not close your case until the trustee files a report stating that he or she has administered all property of the estate.

Until the court closes your case, you have a duty to cooperate with the trustee. This means that you may still be required to:

- turn over nonexempt assets to the trustee

- provide additional information or documentation

- testify in a pending lawsuit, or

- appear at a deposition or 2004 examination.

Also Check: How To File Bankruptcy In Wisconsin

What To Do After Bankruptcy Discharge

Once you receive your discharge, your debts are wiped clean. However, a record of your bankruptcy, will stay on your for seven years for the first time bankrupt, longer for a subsequent bankruptcy.;

The good news is that once discharged, you have no more debt. You will have a fresh start to earn the trust of creditors from the ground up.

What Does Receivership Mean Summary

I hope that you found this what does receivership mean Brandon Blog helpful in describing the role of a privately appointed receiver especially in opposing the discharge of the bankrupt guarantor of the companys secured debt. Problems will arise when you are cash-starved and in debt. There are several insolvency processes available to a person or company with too much debt. You may not need to file for bankruptcy.

If you are concerned because you or your business are dealing with substantial debt challenges, you need debt help and you assume bankruptcy is your only option, call me.

It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties with debt relief options as analternative to bankruptcy. We can get you the relief you need and so deserve. Our professional advice will create for you a personalized debt-free plan for you or your company during our no-cost initial consultation.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems; financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

Read Also: How Long After Filing Bankruptcy Can You Buy A Home

Why A Case Isn’t Over After A Bankruptcy Discharge

Most people file for bankruptcy for the debt discharge. It’s the last court action that directly affects many filers, so, understandably, they think the case is over once it’s received. It’s also confusing that, in many instances, the court will close the case soon after the entry of discharge. But the discharge order and case closure are different.

The bankruptcy discharge releases the debtor from liability for certain debts, so the debtor is no longer legally required to pay the balance. The discharge also prohibits creditors from collecting discharged debts in any manner, including through lawsuits, demand letters, and telephone calls.

In some cases, the bankruptcy will continue for some time after the discharge order is issued. In fact, for creditors, the trustee, and the court, the case could be just getting underway.

When Is A Discharge Challenged

A bankrupt’s discharge may be opposed by creditors, the LIT or the BIA if the bankrupt has failed to meet his/her obligations or has committed an act of misconduct under the Bankruptcy and Insolvency Act of the BIA). The Court will then review the opposition and render a decision.

There are four types of discharge:

- Absolute dischargeThe bankrupt is released from the legal obligation to repay debts that existed on the day the bankruptcy was filed, with the exception of certain types of debt.

- Conditional dischargeThe bankrupt must meet certain conditions to obtain an absolute discharge. Generally, the bankrupt will be required to pay a certain amount of money over a specific period. However, the Court may also impose other conditions. Once all conditions have been met, an absolute discharge will be granted.

- Suspended dischargeAn absolute discharge that will take effect at a later date.

- Refused dischargeThe Court has the right to refuse a discharge.

Read Also: What Is Epiq Bankruptcy Solutions Llc

Bankruptcy Discharge Certificate Canada: Who Tells My Creditors That I Am Discharged From Bankruptcy

The Trustee will notify the Office of the Superintendent of Bankruptcy that the individual has been released from bankruptcy. The Trustee advises the OSB by filing a copy of the bankruptcy discharge certificate Canada. The Trustee advised the creditors that the insolvent is qualified to a discharge unless an opposition is filed in the bankruptcy notification sent out to all creditors.

The Canadian credit bureaus, Equifax Canada and TransUnion Canada are notified because they pay the OSB to get Canadian bankruptcy information. The credit bureaus then update all credit files with the corresponding bankruptcy info, including discharges.

Will A Chapter 13 Discharge Remove A Judgment From My Credit Report

Yes! A Chapter 13 removes judgments from your credit report. If you are subject to a judgment lien, you may need to avoid the lien through the Chapter 13 Plan in order to remove it completely. Your Chapter 13 bankruptcy attorney can discuss this with you and determine if you qualify for lien avoidance.

You May Like: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy?