Interest Rates May Vary

Since repayment schedules are more flexible with LOCs, interest rates vary depending on the balance of the principal amount borrowed.

Therefore, it might be difficult to predict how much total interest you will pay when you obtain a line of credit, as opposed to traditional loans which have fixed repayment schedules and interest rates.

Limitations Of Lines Of Credit

The main advantage of an LOC is the ability to borrow only the amount needed and avoid paying interest on a large loan. That said, borrowers need to be aware of potential problems when taking out an LOC.

- Unsecured LOCs have higher interest rates and credit requirements than those secured by collateral.

- Interest rates for LOCs are almost always variable and vary widely from one lender to another.

- LOCs do not provide the same regulatory protection as credit cards. Penalties for late payments and going over the LOC limit can be severe.

- An open LOC can invite overspending, leading to an inability to make payments.

- Misuse of an LOC can hurt a borrowers credit score. Depending on the severity, the services of a top credit repair company might be worth considering.

Line Of Credit Vs Term Loan

The main difference between a term loan and a line of credit is how you receive the money and the repayment terms. Term loans provide a specific sum of money that is repaid over a fixed period of time, otherwise known as the loan term. Lines of credit, on the other hand, provide a revolving account that allows borrowers to draw up to a certain loan amount, repay the amount borrowed, and redraw up to the amount of the credit limit to receive additional funds. Unlike keeping up with the fixed payments of a term loan, you will be required to pay interest on borrowed balance while the credit line remains open. In many cases line of credit, borrowers are required to meet a minimum monthly payment to avoid additional fees or penalties. Some lines of credit are open-ended the line does not close after a certain period of time as it does with a term loan. Others may close or become inactive after a certain amount of time or period of inactivity.

You May Like: Can Someone File Bankruptcy Without An Attorney

How Do You Get A Line Of Credit

To get a line of credit, you need to apply for one with a lender like a bank or credit union. You’ll provide personal information such as your annual income, employer, and home address. The lender will perform a credit check to verify your information and assess your riskiness as a borrower. The application process can happen almost instantaneously, but lenders may take a few business days to consider the application.

Understanding Secured Vs Unsecured Loans

Since income-based loans are personal loans, they can be either unsecured or secured loans.

When you get a secured loan, you offer a piece of property, like your car or home, to the lender as collateral for the loan. If you fail to repay the loan as agreed, the lender may be able to take the collateral to try to recover any unpaid amount.

On the other hand, an unsecured loan does not require you to put up any collateral, so its generally considered less risky to the borrower. But youll generally pay a higher interest rate because the lender faces a higher risk.

You May Like: Is There A Cheap Way To File Bankruptcy

Real Estate Line Of Credit

If youre in real estate or want to be, theres another product for you to think about. A real estate line of credit is similar to a personal HELOC or home equity line of credit, which is a loan thats based on how much equity you have in a piece of real estate.

For business purposes, you can use the equity in your own home or the equity in other properties that you own to secure the loan. But theres another option.

Real estate lines of credit come in two forms secured and unsecured. For an unsecured real estate line of credit, the SBA explains that your FICO score is the determining factor. This allows you to buy and flip houses, staying active in the market instead of having to wait until one property sells to buy the next.

The Problems With Lines Of Credit

Like any loan product, lines of credit are potentially both useful and dangerous. If investors do tap a line of credit, that money has to be paid back . Accordingly, there is a credit evaluation process, and would-be borrowers with poor credit will have a much harder time being approved.

Likewise, its not free money. Unsecured lines of creditthat is, lines of credit not tied to the equity in your home or some other valuable propertyare certainly cheaper than loans from pawnshops or payday lenders and usually cheaper than credit cards, but theyre more expensive than traditional secured loans, such as mortgages or auto loans. In most cases the interest on a line of credit is not tax deductible.

Some banks will charge a maintenance fee if you do not use the line of credit, and interest starts accumulating as soon as money is borrowed. Because lines of credit can be drawn on and repaid on an unscheduled basis, some borrowers may find the interest calculations for lines of credit more complicated and be surprised at what they end up paying in interest.

You May Like: Overstock Boxes For Sale

What Should Your Credit Limit Be Based On Income

Asked by: Mr. Laron Gibson

You can’t exactly predict a credit limit, but you can look at averages. Most creditworthy applicants with stable incomes can expect credit card credit limits between $3,500 and $7,500. High-income applicants with excellent credit might expect a credit limit of up to or more than $10,000.

How To Find The Best Personal Line Of Credit

You will need two primary things if you want to get a personal line of credit: a good credit score and solid credit history.

You want to have the best credit you can have, Dave Sullivan, credit expert with People Driven Credit Union, said. If you have any revolving lines of credit, its best to pay those down as low as you can prior to applying, and make sure that info has been reported to the credit bureaus.

And although a personal line of credit may have higher rates than something like a home equity line of credit , the interest rates on PLOCs are usually much lower than those of a credit card cash advance or payday loan.

Check with multiple lenders to see who will give you the best terms. You will want to consider interest rates, repayment terms and the length of the draw period.

The application process for a PLOC is much the same as applying for any loan, and it can often be completed online. Once youve decided on a lender and the credit limit youre seeking, youll need to provide information such as your name, Social Security number and employment and income details.

Recommended Reading: Will Filing Bankruptcy Affect My Credit

How Much Loan Can I Get On A 50000 Salary

A borrower that has to repay $1250 a month for existing borrowing, with a loan rate of 15%, a credit card limit of $5000, and two dependents can potentially qualify for a loan of $13,000. If the borrower qualifies for a rate of 9%, takes a five-year term, and has no other borrowings or dependents, they can possibly get a loan amount up to $100,000.

Origination Fees For A Loan Based On Income

Before you get into any personal loan agreement, the most important thing to understand is how much it will cost you. Amid financial trouble, we can quickly lose sight of the consequences of a loanthe interest and potentially high fees.

Regardless of the loan amount, many personal loans incur an origination fee. Also known as an underwriting fee, an origination fee compensates the lender for the loan processing. This includes handling the application, preparing legal documents, and other office-related expenses. Origination fees can come attached to a loan agreement at a fixed or variable rate that depends on the loan amount. Typically, origination fees range anywhere from 1%-8%.

While these profitable origination fees were mandatory parts of loans like mortgages in the past, todays creditors will apply origination fees to auto loans, private student loans, and personal loans as they see fit. When creditors choose to waive them, they will make money on loans in other ways. For example, if your loan doesnt have an origination fee, you will most likely have a higher interest rate than a personal loan that does have one.

One loan guaranteed to have an origination fee is a federal student loan. The amount of the fee depends on the type of loan it is. Direct subsidized and unsubsidized loans and Direct PLUS loans can range from 1% to 4.3%.

The lender deducts this fee from the loan amount before it reaches you, so consider that deduction in your overall budgeting plans.

Don’t Miss: National Debt Real Time Clock

Regions Bank Savings Secured Line Of Credit

This Regions Bank product is the only secured line of credit on this list and uses borrowers savings or money market accounts as collateral. Credit lines are available from $250 to $100,000 and can be used as overdraft protection. Monthly payments are the greater of 5% of your outstanding balance or $10. This account has a $50 annual fee.

Pros:

- Your line of credit serves as overdraft protection in addition to covering other expenses.

- Higher line of secured credit up to $100,000

- You might qualify for a discount if you have a relationship with the bank or set up automatic payments.

Cons:

- You must have a savings or money market account to use as collateral.

- Access to funds by card is not available.

Whats A Line Of Credit

Most of us have a lot going on. Like RBC clients Sarah and Jack. And they find juggling the expenses of everyday life can be a lot to manage. Thatâs why theyâre glad that their RBC advisor Kris recommended getting a line of credit a few years back. Itâs made a big difference. Kris explained to them that a line of credit is a lot like a loan â in that they were approved for a pre-determined amount . But, unlike a loan where you borrow the full amount up front, once youâre approved for a line of credit â you decide how much you use. You can use it all, or just part of it, any time you want without having to reapply. It is also a bit like a credit cardâ but with a much lower interest rate and no annual fees, or cash advance fees. By repaying what you borrowed on your line of credit, that amount becomes available to reuse again. To learn more about a line of credit and whether itâs right for you â talk to your RBC advisor today.

Recommended Reading: How To Get A Credit Card With Bankruptcy

How Can I Get A Loan With No Credit Check

Getting a loan with no credit check or a soft credit inquiry depends on your income, the amount you need, and if you have assets to secure the loan. Some lenders will approve loans for borrowers with bad credit if they have enough income to support the debt, can secure the loan, or add a cosigner. Like payday loan companies, other lenders charge such high rates for a very short amount of time that they often dont do credit checks. Pawnshops and title loan companies often dont do credit checks since they have an asset to secure the loan. Peer-to-peer lending sites may lend without credit checks or base their lending decisions on things other than the borrowers credit report.

Personal Loans Based On Income

Bad credit high income loans are easier to qualify for compared to bad credit low income loans. While its still a greater risk to loan money to a bad credit borrower, high income can encourage a lender to approve the loan. At the very least, they can justify the decision by showing that you have enough income to cover living expenses and monthly payments.

Quick. Simple. Secure.

Read Also: How To Have Bankruptcy Removed From Credit Report

Can You Get A Personal Loan With A Credit Score Of 550

The amount you qualify for with a credit score of 550 will depend on the lender. Avant considers borrowers with a credit score of 550 for loans up to $35,000. OneMain doesnt have a minimum credit score and will lend up to $20,000. The rates for these loans can be as high as 35.99%, which can make your interest costs really expensive.

If you are a high-income low credit score borrower, you can always apply for an income based loan. But, first, you need to see how much you can borrow based on your income to determine whether the loan amount meets your needs.

What Credit Score Is Needed For A Personal Line Of Credit

We dont usually associate personal lines of credit with bad credit scores, which is why the three lines we have reviewed are standouts. All three are willing to consider applications from consumers with fair to poor credit and rely at least partially on prior relationships with applicants, as well as your income and expenses.

You are probably eligible for a personal line of credit if your credit score is 670 or higher. The going gets rough as scores descend to the 600 mark, which is probably the lower limit.

The Elastic Personal Line of Credit from Republic Bank is an interesting case. It is similar in structure to a payday loan, charging high fees with little emphasis on credit scores. Moreover, its fees align with your pay period biweekly or semimonthly versus a monthly payment.

Personal lines of credit are harder to obtain than are most personal loans and credit cards. If you need an emergency loan, applying for a personal credit line may not be your best choice.

You May Like: Liquidation Pallets New Hampshire

Unsecured Vs Secured Lines Of Credit

Lines of credit for bad credit can either be secured or unsecured. With a secured line of credit, you have to provide an asset as collateral, like your home or car. Then, if you default on the loan, the lender can repossess the asset to recoup the loss. Unsecured lines of credit, on the other hand, are not guaranteed by collateral. This means you wont risk losing an item of value you own if you cant repay the loan.

Similarities And Differences With Other Loans

A personal line of credit has many similarities to credit cards, personal loans, a home equity line of credit, and payday loans, but enough differences to make it a distinctive form of borrowing worth investigating when you need money quickly.

For example, a personal LOC functions just like a credit card in that you can use it for almost anything, get a monthly statement showing your expenses, interest charges, amount owed, and minimum payment due, but is different in that the interest rate for an LOC is typically lower and the credit limit is much higher.

There are many differences between a line of credit and personal loans, the primary one being that money is disbursed on a draw as needed in an LOC, while money in a personal loan is disbursed all at once. The interest rate on a LOC is variable you pay it only on the portion of funds you use. A personal loan usually carries a fixed interest rate and monthly payments are made on the balance owed.

A LOC is first cousin to a HELOC in that both extend lines of credit for use as needed. However, you dont have to put your home up as collateral with a LOC. A LOC is unsecured and thus far more favorable for the borrower. The added risk to the bank could mean higher interest rates charged for the LOC, but still, they cant take your home.

Be sure to compare LOCs with other revolving/open-end credit options before deciding which works best for you.

As ever, be careful out there.

15 Minute Read

You May Like: Why Is Usa In Debt

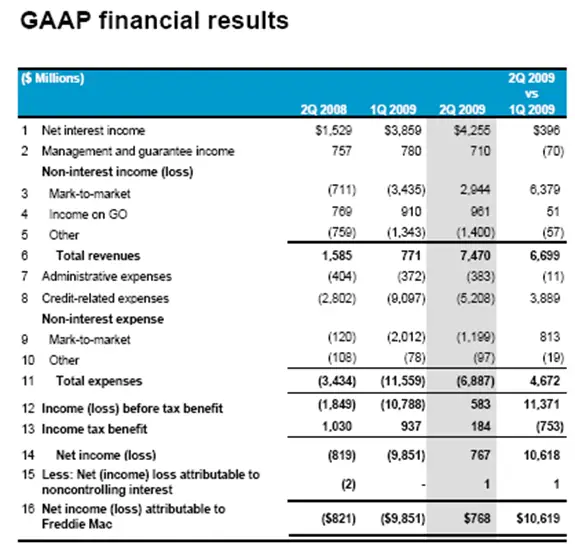

Where Is The Line Of Credit Entered In The Financial Statements

Lines of credit appear under liabilities on the balance sheet. They are considered current liabilities because they must be paid within the current 12-month operating cycle.

The excerpt below shows where lines of credit appear on a companys balance sheet, along with various other current liabilities. Each type of loan or credit has its own payment terms.

Can I Get A Loan With Bad Credit But Good Income

Good income can be a lifesaver when it comes to qualifying for a loan, especially with bad credit. Depending on how bad your credit is, you may or may not qualify for traditional loans. Before jumping to income-based loans, you should see if you can qualify for traditional loans and then compare which is a better deal.

Recommended Reading: Auctioned Houses For Sale

How Interest Is Charged On A Personal Line Of Credit

As mentioned, interest rates on a personal line of credit can be variable or fixed. If your rate is variable, it can fluctuate over time, potentially leading to higher costs than you initially anticipated.

If youd rather see all your costs upfront, look for a line of credit with a fixed rate. Fixed rates stay constant over the life of the loan, so you wont have to worry about increasing interest charges.

Whats more, you can plan for consistent payments that stay the same month after month.

| Open-end vs. closed-end credit: Where personal lines of credit fit in |

|---|

|

A personal line of credit is considered an open-end credit transaction, meaning that you can make multiple withdrawals from your account while you have the loan. Youll pay the money back before your account closes, but once you do, its available again during the same draw period. A closed-end credit transaction, on the other hand, involves getting a lump sum of money upfront. After you receive the loan, you start paying it back on a monthly repayment schedule. A personal loan is one example of a closed-end loan. |