Why Do Governments Lower Interest Rates On Growing Economies

This knowledge in the financial community enables governments to lower the interest rates that it offers on its debt and reduce the cost of financing deficits.

Thanks to economic indicators, you can work out whether a countrys national debt will trigger a virtuous cycle of investment and expansion, or a destructive debt spiral.

Why Does Larger National Debt Attract Bond Buyer

Having a large national debt doesnt always discourage buyers of bonds. For example, the United States has a debt to GDP ratio of 108% and a lot of people want to buy US Treasury bonds.

You can see this data summary of US Local & State Government Debt for more information.

Some countries, such as the USA are always considered a good place to invest, and the government bonds of those countries are always in high demand.

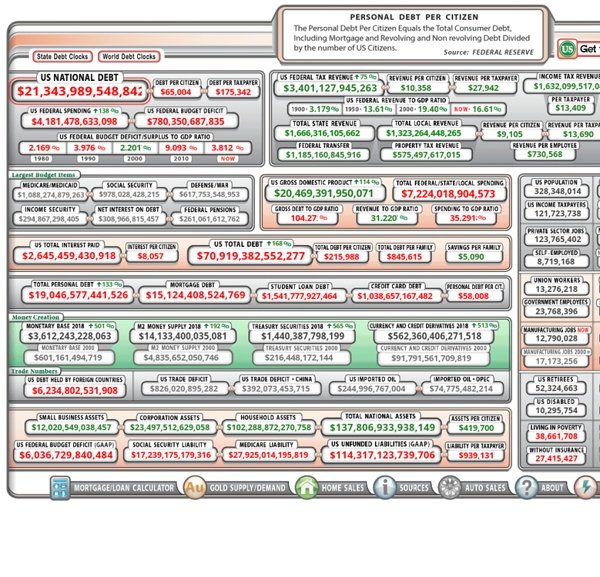

Us National Debt Clock

The US National Debt Clock covers the outstanding debt owed by the federal government. Two-thirds of the clock shows the public debt by way of treasury bills, notes, and bonds – this covers individuals, businesses, and foreign governments. The other third of the debt is what the government owes to itself – this covers federal programs like Social Security.

The largest budget items include: Medicare and Medicaid, Social Security, defense, and interest paid on the national debt. The former two items are a part of the mandatory programs that the government is required to fund with federal expenses. To give you an idea of how much more the U.S. spends compared to other countries, for the defense budget alone the U.S. spends more than China, India, Russia, Saudi Arabia, France, Germany, the United Kingdom, Japan, South Korea, and Brazil combined.

The Debt Clock also gives statistics on the demographics of the country, which is helpful in understanding where program funding may go. With a population of over 329 million, 60 million people are enrolled in Medicare and 79 million people receive Medicaid. In addition to this, there are currently 54 million retirees who seek Social Security benefits.

Recommended Reading: Do It Yourself Bankruptcy Chapter 7 Forms

Other Reasons For National Debt

Other obvious reasons for national debt are more mundane costs which occur as a result of culture and lifestyle.

For example, the healthcare costs in the United States have been rising for years and is one of the highest in the world.

Another reason for rising debt is the economic infrastructure we live in, which relies on productivity in individuals. As people live longer, more money is paid out in pensions.

The sustainability of such expenses largely depends on the countrys economic infrastructure, which in many cases, is lagging behind and adding to rising national debt-to-GDP ratios.

Summary Of Chinese Public Debt Types

The majority of Chinese public debt is not officially owed by the central government.

However, all of that debt is ultimately guaranteed by the national government of China and should rightfully be recorded in its entirety as the Chinese national debt. The location of those debts are ranked below:

So, an investigation of Chinas national debt requires more research at the local government level that in the national government accounts.

These figures for total public debt also do not touch upon the undisclosed debts of state-owned banks and state-owned enterprises, which represent a large sector of the Chinese economy.

What facts should you know about Chinas national debt?

- You could wrap $1 bills around the Earth 35,794 times with the debt amount.

- If you lay $1 bills on top of each other they would make a pile 1,004,216 km, or 623,990 miles high.

- Thatâs equivalent to 2.61 trips to the Moon.

Read Also: When To Apply For Credit After Bankruptcy

Why Is National Debt A Problem

If a government increases its national debt to a level that the market thinks is too high, it will have to increase the interest it pay in order to find lenders.

With the backstop of a high return from a safe source, banks do not need to lend to businesses to make a profit. When banks are less interested in offering loans, they raise interest rates for all borrowers.

High interest on loans increases business costs and the return on investment that is funded on debt reduces. In this instance, businesses cease to expand and unemployment rises.

Examples Of Capital Expenditure

Examples of infrastructure spending that improve an economy are:

- The development of transport infrastructure, such as motorways and railways

- Investment in universities to create more educational institutions or crate centers of excellence from existing establishments.

- Improvements in communication infrastructure, such as a fibre optic backbone to expand the nations internet bandwidth availability and speed.

If you are thinking of investing in a countrys economy, or if you are considering moving there, researching the national debt of that place and how the government spends money may be insightful.

A countrys national debt is one of many economic indicators that interplay to create a judgment on a countrys prospects for success.

Recommended Reading: How To Buy Pre Foreclosure

Do Foreign Countries Own National Debt

For example, Japan owns $1.276 trillions worth of US government debt.

You can research the economies of the largest US national debt holders. See our economic overviews of Brazil, China, the UK, Belgium, and India.

The ten largest holding nations of US government debt as of September 2020 are shown in the table below:

| Rank |

|---|

How Is National Debt Rated

Rating agencies score governments on a range of metrics. Countries with higher ratings can offer lower interest rates on their bonds because they are considered to be safe investments.

When investigating a countrys economy, the national debt is one metric that rating agencies note.

They also look at the debt-to-GDP ratio, the national debt per head of population, the interest rates on government debt, and the average bank lending rate.

You May Like: Can A Nonprofit File For Bankruptcy

Is Italys Debt Growing Or Gdp Suffering

For the same period of 1995 to 2019, Italys GDP steadily grew from a GDP-per-capita of $22,300 to over $35,000 until the 2008 crisis.

The recovery of the countrys GDP figures began a year after and has continued since.

Despite an uptrend in GDP-per-capita, Italys debt-to-GDP figures have been rising, meaning the countrys debt figures have increased more than their generated income.

To learn more about the Italian economy and what commodities the countrys primary import and export trade consists of, see our Overview Of Italys Economy.

Which Country Has The Most National Debt

According to the IMF, Japan is the most indebted country in the world in terms of a debt-to-GDP ratio.

To learn more about Japans economy and trade, see our Economic Overview Of Japan. We discuss top imports and exports along with GDP figures.

Debt-to-GDP is expressed as a percentage. GDP is a countys annual income and it is usually expected that the debt of a nation should be less than 100 percent of that GDP figure.

However, in many countries, the national debt is higher than the GDP.

Here are the ten most indebted nations in 2020:

| Rank |

|---|

Also Check: Bankruptcy Lawyers Springfield Mo

Interested In Trading Commodities

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Who Holds Italys National Debt

The Wall Street Journal reported that Italy is the country with the lowest amount of public debt shares held by non-residents out of all European countries.

As reported by Consob, the net wealth of Italian households was at an estimated 10 trillion in 2018, with more than half of it held as financial assets.

Unfunded state pensions owed to the Italian public are NOT included in the Italian national debt figure.

Estimations based on Banca DItalias figures show that only around $100bn of public debt is held by households.

Read Also: How Long After Filing Bankruptcy Can You Purchase A Home

Who Holds The Rest Of Italys Public Debt

Other primary debt holders of Italys public debt include financial institutions, private companies, and foreign investors:

| Debt Holder | |

|---|---|

| Other | 690bn |

As seen above, the total amount of 100 billion held by Italian households shows a small number of domestically held government securities. The majority of Italian national is held by Italian banks.

Much of Italys foreign debt is held through Italian investment funds, which Banca DItalia includes in the total foreign debt figure of 290 billion.

As of 2020 September, Italys total public debt is estimated to be over 2,580 billion.

Quebecs Public Sector Debt

Our Quebec Debt Clock shows the growth of the public sector debt in real time. Public sector debt includes the governments gross debt as well as the debt of Hydro-Québec, of the municipalities, and of the universities other than the Université du Québec and its constituent universities.

Based on data provided by the Quebec Department of Finance in its March 2022 budget , we estimate that the debt will increase by $14.9 billion by March 31, 2023, the equivalent of $40.8 million per day, $28,344 per minute, or $472 per second.

When analyzing a governments indebtedness, it is necessary to go beyond what it manages directly and include the health and education networks, municipalities and other entities under the governments ultimate responsibility, since the government guarantees their debt. Public sector debt is therefore the most exhaustive measure of Quebecs debt, the one that provides a picture of what the government of Quebec borrows either directly or indirectly.

The only liquid assets of the government, those that could be sold quickly to pay off debt, are net financial assets. These assets came to $16 billion as of March 31, 2022. It is hard to assess the market value of government-owned fixed assets and infrastructure since there are no relevant markets. Moreover, it is highly unlikely that the government would sell schools or bridges at some point to pay off the debt.

Components of the public sector debt

Don’t Miss: What Credit Cards Can You Get After Bankruptcy

Peter G Peterson Foundation

The Peter G. Peterson Foundation hired Wire Media to create a deceptively simple looking microsite in coordination with a billboard campaign to inform people about the national debt and the problems it causes. We wrote, designed, and built The National Debt Clock microsite and provided code to place the same debt information on billboards in cities around the United States.

The microsite features interactive, editable, mobile-friendly charts and graphs. The debt tickers are updated in real time, pulling data from an online source.

Wire Media provided the overall strategy, content creation, UX and visual design, and web development. And we brought in, managed, and coordinated among two partner teams to make all of this magic happen: Capellic and Software for Good .

We also designed a simple infographic and provided interim ongoing support for their two websites for over half a year.

Concerns Over Chinese Holdings Of Us Debt

According to a 2013 Forbes article, many American and other economic analysts have expressed concerns on account of the Peoples Republic of Chinas extensive holdings of United States government debt as part of their reserves. The National Defense Authorization Act of FY2012 included a provision requiring the Secretary of Defense to conduct a national security risk assessment of U.S. federal debt held by China. The department issued its report in July 2012, stating that attempting to use U.S. Treasury securities as a coercive tool would have limited effect and likely would do more harm to China than to the United States. An August 19, 2013 Congressional Research Service report said that the threat is not credible and the effect would be limited even if carried out. The report said that the threat would not offer China deterrence options, whether in the diplomatic, military, or economic realms, and this would remain true both in peacetime and in scenarios of crisis or war.

Read Also: How Long Is Bankruptcy On Public Record

Recommended Reading: Who Does The Us Owe Debt To

A Us Debt Default Would Echo Through The Global Economy By Reducing International Trade Make Dollarized Economies Suffer And Affect Business Contracts

More than 33 years ago, a billboard-sized running total display was installed a block away from Times Square in New York City to remind passersby how much money the U.S. federal government has borrowed from the public and has yet to pay back.

RELATED:

However, this tally, well-known as the National Debt Clock, did not seem to bother successive U.S. governments, including the current administration. It read US$31.1 trillion for the first time on Oct. 3, and is still ticking away madly.

The swelling national debt number, edging closer to the US$31.4-trillion statutory ceiling the U.S. Congress placed on the government’s borrowing ability, has raised concerns about U.S. fiscal sustainability and its negative spillover effects on global financial markets.

DISGRACEFUL RECORD

The total public debt outstanding reached US$31.1 trillion on Oct. 3, including US$24.3 trillion in debt held by the public and US$6.8 trillion in intergovernmental holdings, said the U.S. Treasury Department’s daily treasury statement released on Oct. 4.

In fact, real-time data released by the official website of the National Debt Clock showed that the debt number, having so far well surpassed US$31.1 trillion, amounts to more than 93,400 dollars of debt per American citizen, and nearly US$250,000 of debt per taxpayer.

DEBT ADDICT

“By the 21st century, the national debt got to 20 trillion dollars after major events such as the War on Terror,” it said.

TIME BOMB

Student Loan Debt Clock

The Student Loan Debt Clock gives insight into the current amount of federal and private loans that students have taken out to pay for college. Student debt in the U.S. is increasing by $2,853.88 every second. As of July 2020, the student debt loan clock is at $1.7 trillion. Loan amounts continue to rise as need-based grants are not growing as quickly as the average cost of attending college.

This Student Loan Debt Clock shows different items that are related to student debt in real time. As of July 21 2020, $91 million has been paid towards reducing student debt, but $153 million new student loans were borrowed. Full-time college students spent over $369 million on various college expenses, and federal student aid totaled oner $161 million.

You May Like: What Happens If You Declare Bankruptcy In Ontario

When Was The Debt Clock Installed

Real estate investor Seymour Durst created the debt clock in 1989. At that time, the national debt was almost $3 trillion and 50% of the gross domestic product . It was initially installed on 42nd Street and Sixth Avenue in New York City. Durst is famously quoted as saying, If it bothers people, then it’s working.

Durst also bought front-page newspaper ads to further express his concern about the growing national debt. He conveyed a prophetic message in his 1991 message: “Federal debt soaring, national economy shrinking, soon the twain shall meet.”

The debt clock faithfully recorded the increasing U.S. debt until 2000. That’s when the prosperity of the 1990s created enough revenue to reduce the federal budget deficit and debt. It seemed as if the debt clock had accomplished its goal.

Unfortunately, that prosperity didnt last. The 2001 recession and the 9/11 terrorist attacks meant lower revenues and higher government spending, which added to the debt. The national debt exceeded $6 trillion by July 2002more than double what the national debt was when the clock was initially installed. The Durst Corporation reactivated the clock at that time. When the debt exceeded $10 trillion in September 2008, one more digit had to be added.

The national debt has grown by more than $18 trillion since the financial crisis in 2008. In 2020 alone, the national debt hit four new milestones. The table below highlights several national debt milestones from 2017 through 2021.

| Debt Milestone |

|---|

National Debt For Selected Years

| Fiscal year | |

|---|---|

| 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.

On June 25, 2014, the BEA announced: n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 19402009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 19502010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures were revised back to 1947.

Fiscal years 19401970 begin July 1 of the previous year fiscal years 19802010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

19091930 calendar year GDP estimates are from MeasuringWorth.com Fiscal Year estimates are derived from simple linear interpolation.

Audited figure was about $5,659 billion.

Audited figure was about $5,792 billion.

Audited figure was about $6,213 billion.

Audited figure was said to be about the stated figure.

Audited figure was about $7,918 billion.

Audited figure was about $8,493 billion.

Don’t Miss: Did Mattress Firm File For Bankruptcy

Other Impacts Of Rising Interest Rates

When interest rates rise, the cost of mortgages on properties rise and so the cost of rents also rise. The increase in the cost of premises forces businesses to increase their prices in order to remain in profit.

This in turn increases the cost of living and causes inflation without economic growth. A workforce faced with an increased cost of living will demand higher wages.

This increases business costs and the price of goods, stoking inflation further. It doesnt help that companies tend to cut costs through employee salaries.

Eventually, businesses will be squeezed to the point of bankruptcy or move their production abroad to save their profitability.