How To Calculate Debt

You can calculate your DTI ratio before you apply for a mortgage, regardless of which kind of loan youre looking to get.

First, there are two types of ratios lenders evaluate:

- Front-end ratio: Also called the housing ratio, this shows what percentage of your income would go toward housing expenses. This includes your monthly mortgage payment, property taxes, homeowners insurance and homeowners association fees, if applicable.

- Back-end ratio: This shows how much of your income would be needed to cover all monthly debt obligations. This includes the mortgage and other housing expenses, plus credit cards, auto loan, child support, student loans and other debts. Living expenses, such as utilities and groceries, are not included in this ratio.

The back-end ratio may be referred to as the debt-to-income ratio, but both ratios are usually factored in when a lender says theyre considering a borrowers DTI.

Two Main Kinds Of Dti

The two main kinds of DTI are expressed as a pair using the notation x .

Can I Get A Mortgage With A 50% Dti

It could be hard to find a mortgage lender that will grant you a home loan with a 50% DTI, but not impossible. Fannie Mae, a government-sponsored mortgage finance entity, will allow a DTI of “over 45%” on a case-by-case basis if the borrower has six months in payments reserves plus other qualifying factors.

You May Like: How To View Foreclosed Homes

What Is The Debt

DTI Calculator | What is DTI? | How to calculate DTI | DTI requirements for a mortgage | How to improve your DTI | FAQs

Your debt-to-income ratio is the percentage of your gross monthly income that goes toward recurring debts such as rents, mortgages, car payments, student loans, and credit card bills. Lenders factor in DTI when determining your borrowing power.

Before a lender will approve you for a specific mortgage amount, they’ll want to be sure you can afford the monthly payment. If too much of your income is already allocated toward existing financial obligations, lenders may question your ability to manage more debt.

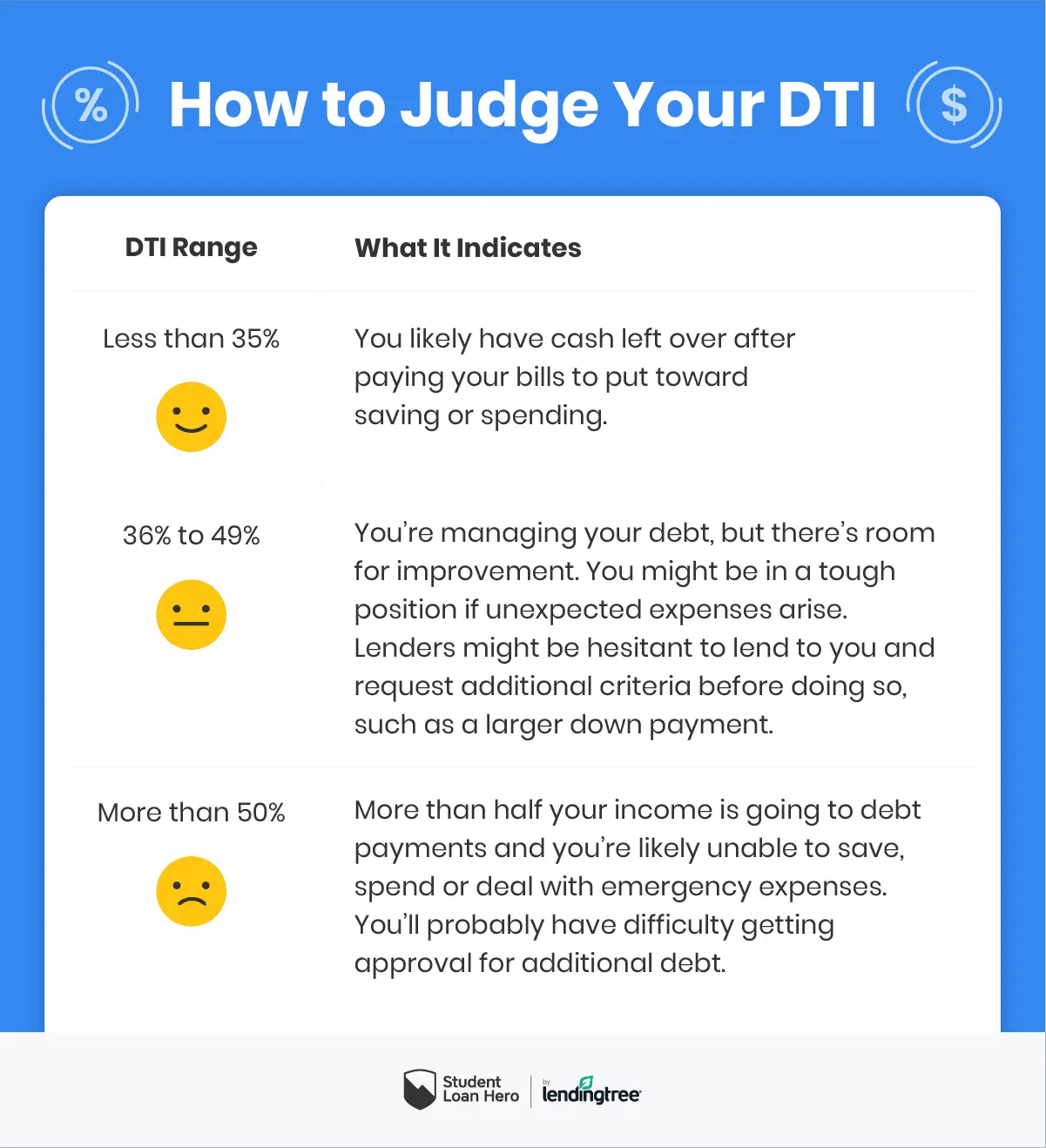

DTI requirements vary somewhat by lender and loan type, but as a general rule, you’ll want to keep your total recurring debt payments to less than 36% of your income â with no more than about 28% going toward mortgage costs.

The lower your debts in relation to your income, the easier time you’ll have getting a home loan.

You can use our debt-to-income ratio calculator to see how your DTI matches up to the 28/36% rule.

| ð¡ Getting ready to buy a house? Find top local realtors through Clever Real Estateâs free agent matching service. Qualify for thousands in cash back savings. Learn More |

What Goes Into A Debt

Debt-to-income ratios come in two forms: the front-end DTI and the back-end DTI. Lenders look at both of these when considering your loan application.

Heres how those break down:

- Front-end DTI: Also called a PITI ratio , this number reflects your total housing debt in relation to your monthly income. If you take home $6,000 per month and are trying to buy a home that would require a $1,500 monthly payment, your front-end DTI would be:

- Back-end DTI: Your back-end DTI encompasses all your monthly debts in relation to your income. For example, if you make $6,000 a month, have a $600 car payment, a $400 student loan payment, and an expected $1,500 mortgage payment, your back-end DTI would look like this:

For most lenders, the back-end DTI is most important, as it more accurately reflects what you can afford each month.

You May Like: How Long Does A Bankruptcy Stay On My Credit Report

Learn More About Home Loans

We think its important for you to understand how we make money. Its pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. Thats why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform dont represent all financial products out there, but our goal is to show you as many great options as we can.

Reduce Your Monthly Debts

The fastest way to lower your DTI is to pay down your existing loan and credit card balances.

One strategy is to pay off your smallest loans first, which will free up cash to put toward larger debts like car payments and student loans.

Another option for reducing your credit balances is to refinance your high interest and high balance loans. Rather than let a high interest rate inflate what you owe, try shopping around for a lower rate.

Recommended Reading: Does Bankruptcy Mean Going Out Of Business

How Does Our Income

To calculate your DTI ratio using our income-debt ratio calculator, enter the following information:

Annual gross income: Enter your annual gross income the total amount you earn per year before taxes and deductions are taken out. If you dont know what your annual income is, estimate it based on your average monthly income.

Minimum monthly credit card payment: This is the amount on your credit card bills you must pay, at a minimum, each month.

Auto loan payment: Include your auto payment for a leased or purchased vehicle, along with any monthly payments toward a spouse or another family members vehicle.

Other loan obligations: Also include any other loan obligations you may have, such as student loans, personal loans, home equity loans, and other debts that appear on your credit report.

After inputting these numbers, our calculator will show you how much money you have left over each month after paying your total monthly debts and your estimated maximum mortgage payment.

The more money you have remaining after paying your existing monthly debts, the more you can afford in a monthly mortgage payment. However, its important not to overextend your housing budget. Consider the other costs of homeownership homeowners association dues, maintenance, repairs, and future improvements when figuring out a comfortable monthly housing payment.

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Don’t Miss: Who Does The Us Owe Debt To

How To Increase Your Mortgage Affordability

If you want to increase how much you can borrow, thus increasing how much you can afford to spend on a home, there are few steps you can take.

1. Save a larger down payment: The larger your down payment, the less interest youll be charged over the life of your loan. A larger down payment also saves you money on the cost of CMHC insurance.

2. Get a better mortgage rate: Shop around for the best mortgage rate you can find, and consider using a mortgage broker to negotiate on your behalf. A lower mortgage rate will result in lower monthly payments, increasing how much you can afford. It will also save you thousands of dollars over the life of your mortgage.

3. Increase your amortization period: The longer you take to pay off your loan, the lower your monthly payments will be, making your mortgage more affordable. However, this will result in you paying more interest over time.

These are just a few ways you can increase the amount you can afford to spend on a home, by increasing your mortgage affordability. However, the best advice will be personal to you. Find a licensed mortgage broker near you to have a free, no-obligation conversation thats tailored to your needs.

How Your Dti Is Used By Lenders

When you apply for a mortgage, lenders will look at DTI, your credit history and your current credit scores. Why? Because all this information taken together can help them better understand how likely you will be to repay any money they loan to you. While there’s no immediate way to improve a credit score, certain actions can help , and can start you on a better path today. Think about:

- Pay down existing debt, especially revolving debt like credit cards. This will help improve both your DTI and your credit utilization ratio.

- Pay all bills on time every month. Late or missed payments appear as negative information on credit reports.

- Avoid applying for any new credit, as too many hard inquiries in a short time frame could affect your credit scores.

- Use your existing credit wisely. For example, make a small purchase with a credit card and pay off the full balance right away to help establish a positive payment history.

http://www.investopedia.com/terms/f/front-end-debt-to-income-ratio.asp

Read Also: Why Do Companies File For Bankruptcy

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

What Debt And Credit Facilities Are Considered In Your Debt

The debt and credit that financial institutions may look at when calculating your debt-to-income ratio include:

- Investment loans, lines of credit and/or margin loans

As a general guideline, if information doesnt show on your credit report, its not factored into your debt-to-income ratio by lenders. Your credit report contains details about your credit history, with the information used to calculate your credit score. Also known as a credit rating, your credit score is a number thats calculated by a credit bureau to suggest how trustworthy you are as a borrower.

Check your credit score for free with Canstar

Read Also: How To Find Out When My Bankruptcy Was Discharged

Reducing Total Recurring Monthly Debts

Reducing debt is much easier said than done. You must make a conscious effort to reduce spending or pay off some debts.

The most manageable first step in achieving this goal is to create a budget and stick to it long-term. After listing out your recurring debt payments and bills, what remains is your discretionary income.

While you could spend this on things you want, you could divert a portion of your discretionary income to reduce your overall debt burden.

How Does Dti Ratio Differ From Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if youre maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit youve been approved for by credit card companies.

Don’t Miss: What Does It Mean When You File For Bankruptcy

Divide That Total By Your Gross Monthly Income

Once you have an idea of what your monthly debt total is, divide it by your gross monthly income to determine your DTI ratio. Your gross monthly income is the amount of money you make each month before taxes. You can usually find your gross income on your paystubs or you can calculate it.

If you are a salaried employee, you can divide your yearly salary by 12 to find your gross monthly income. If you are paid hourly, multiply your hourly rate by the number of hours you work in a week and then multiply that number by 52 to get your yearly income, which you can divide by 12 to get your monthly gross income.

Once you know your monthly gross income, you should be able to use it to find your DTI. If you make $4,000 a month as your gross income and your total debts amount to $1,200, the formula to calculate your DTI would look like this:

= 0.3, or 30%

The Va Interest Rate Reduction Refinance Loan

The VA Interest Rate Reduction Refinance Loan is another refinance program that waives traditional DTI rules.

Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W-2s and pay stubs.

The VA Streamline Refinance is available only to military borrowers who already have a VA loan. Homeowners must also show theres a benefit to refinancing their existing home loan either in the form of a lower monthly payment or a change from an ARM to a fixed-rate loan.

Also Check: Bank Owned House For Sale

What Is Debt To Income Ratio: Formula & How Its Used

Debt to income ratio is a financial term used to describe the percentage of an individuals monthly income that goes towards paying debts. This figure provides creditors with an indication of an individuals ability to make debt repayments, and is therefore an important factor in credit decisions. A high debt to income ratio may result in an individual being refused credit, or being offered less favorable terms such as a higher interest rate.

There are two types of debt to income ratio: front-end and back-end. Front-end debt to income ratio includes only housing-related expenses such as mortgage payments or rent. Back-end debt to income ratio includes all monthly debts including credit card payments, car loans, personal loans and any other form of borrowing.

Understanding Gross Income Net Income And Mortgages

Before you can calculate the income percentage for your mortgage, youll need to understand what defines gross income, net income, and mortgages.

As such, lets break these definitionsone-by-one.

Gross Income

Gross income for individuals is the total payment you receive from your employer before any taxes or other deductions. Gross income is not limited to cash payments it includes services received and property. Your gross annual income is the amount of money you earn in a year before tax and includes all your income sources.

For businesses, gross income is identical to gross margin or gross profit. As printed on their income statement, a companys gross income is the revenue earned from all sources minus the cost or services or cost of goods sold .

Net Income

Net income is the total amount earned by a person in any given period from their taxable wages, investment incomes, tips, and any other income. The amount is calculated after Social Security taxes, income taxes, Federal Insurance Contributions Act tax, 401k payments, health insurance, and any outstanding legal obligations such as child support, loan payments, and wage garnishments.

For individuals, net income is calculated using this equation:

Total amount Earned Paycheck Deductions = Net Income.

Mortgages

Mortgages are paid back over time, typically over 15 or 30-year terms. The property purchased acts as collateral for the money lent by an individual to buy the home.

Front-End Ratio and Back-End Ratio

Read Also: How To File Bankruptcy Chapter 7

Should You Worry About Your Dti

No. Instead of worrying about your debt-to-income ratio, you should work towards lowering the number to a more favorable percentage. The DTI is an important tool for lending institutions, but it is only one of the many barometers they use to gauge how safe it would be to lend you money.

However, when it comes to buying a home, your DTI sits front and center on the negotiation table. You will certainly incur higher interest rates with a high DTI, and you may be required to slap down a heftier down payment.

Seasoned lenders know that a ratio above 40 percent means you’re treading on the slippery slope to fiscal collapse. It says you’re making ends meet, but just barely. Lenders will assume that any additional loan you take on might be the last straw.

Can you lower your DTI? Of course! Lowering your ratio is almost as easy as calculating it. Then again, it will take you a lot longer. Fortunately, it’s easier and quicker than improving your credit score, but it does require a major shift in your way of thinking.

Can you reduce your DTI to zero? Maybe or maybe not, but that’s still a goal worth setting. Use the following tips to put your best foot forward for lenders.

What Is The Mortgage To Income Ratio

You can calculate your mortgage to income ratio with the following calculation:

Total mortgage payment/Gross monthly income

You figure your total mortgage payment by adding up your principal, interest, monthly real estate tax payment, monthly homeowners insurance payment, and mortgage insurance amounts. Your gross monthly income is the amount of income you bring home each month before taxes.

Read Also: How To File Bankruptcy In Oregon

How Is The Debt