Your Credit Score Is Too Low

A low credit score might indicate that you may have trouble making on-time payments or handling the financial responsibilities of the loan.

Before applying for a mortgage, review your credit score and credit report and dispute any errors. If your credit score is low, you may want to work on increasing it before applying. If you have a qualifying credit score, make sure you dont do anything during the mortgage process to cause it to drop, like miss a payment or max out a credit card.

Our Quick Tip: You can get your free VantageScore® 3.0 courtesy of Rocket Homes® along with tips on how to improve your credit based on your report.

How Long Does Underwriting Take

The underwriting process is variable. If you’ve got a relatively uncomplicated loan and a straightforward financial situation, underwriting could take as little as a few days. But if you have a more complex financial situation or a more complicated type of loan, such as a VA loan that requires a special appraisal, it could take a few weeks.

Making Big Purchases On Credit

Just as opening or closing lines of credit can ding your score, so can running up existing accounts. Again, keep your credit and finances stable until you close on your home. Use cash instead, or better yet, delay buying new furniture or a television until after closing.

Also, you want to get a sense of how your budget will handle your new homeownership costs. You might want to wait a few months before adding more monthly payments for big purchases to the mix.

Recommended Reading: When Can Bankruptcy Be Removed From Credit Report

When Your Loan Is Rejected

If your loan application is rejected, there are a few steps you can take to put yourself in a better position to get a mortgage in the near future. First, you should understand why your loan was denied, then work to fix those issues.

If your DTI was too high, work on paying down your debt. If your credit score was too low, continue to make your payments on time, pay down some of your debt and check your credit report for any errors. If your LTV was too high, take this time to save for a down payment.

How Often Does An Underwriter Deny A Loan

According to recent data collected about mortgage lending activities by the Home Mortgage Disclosure Act , loan denials are more common on home equity loans, home improvement loans and refinance applications. Home purchases have the lowest denial rates.

The table below shows the home purchase, home equity and home improvement loan and cash-out refinance denial rate by race, according to 2020 HMDA data compiled by the NCRC.

| Loan purpose |

|---|

| 9% |

Read Also: How Does Chapter 13 Bankruptcy Work

Buy Now Pay Later: Experts Say Ease Of Payment Is Convenient But Could Overwhelm Shoppers During Holiday Season

Payment plan is free to use, but late fees and missed payment fees apply

InvestigateTV – According to the Consumer Financial Protection Bureau , from 2019 to 2021 the amount of money spent using Buy Now, Pay Later financing grew over 1,000% from $2B to over $24B.

There is no cost to use Buy Now, Pay Later, but there could be fees for missed or late payments.

Kim Palmer with NerdWallet pointed out that the challenge for consumers is its still a form of debt.You still have to pay it back and it can be overwhelming, especially when youre signing up for multiple buy now, pay later purchases, Palmer said.

She pointed out the payment plan could be useful, especially if you suddenly need to make an essential purchase and you have no other way to fit it in your budget.

But when were talking about the holiday shopping season, it can be really dangerous because youre making all kinds of purchases that are not necessarily essential, and you want to try to avoid taking on so much debt that it makes it hard for you to pay it back, Palmer said.

She said instead of turning to credit cards and Buy Now, Pay Later services this holiday, have a conversation with your family and friends about scaling back this year. She said were all facing financial stress this year from inflation and economic uncertainty, so tempering expectations and restraining your budget may be your best move right now.

Copyright 2022 Gray Media Group, Inc. All rights reserved.

Most Read

How To Avoid A Mortgage Loan Denial

There are some measures you can take to reduce your chances of a mortgage denial in underwriting.

REPAIR YOUR CREDIT BEFORE YOU APPLY.

Whether its paying off maxed-out credit cards or refinancing out of a cosigned car loan, taking these steps before you fill out a loan application may help boost your score and save you the heartache of a mortgage rejection.

FILL OUT A COMPLETE AND ACCURATE LOAN APPLICATION.

Whether its a prior address or the exact start and end dates of prior employers, taking the extra time to give the lender the most accurate information may reduce the chances of getting denied after preapproval.

DONT SWITCH JOBS OR CHANGE HOW YOURE PAID.

A salaried, full-time job for two years gives you the highest odds of approval when it comes to income. Lenders verify your employment up to and including the day of your closing, and a job change before closing could delay your closing or flip an approval to a denial.

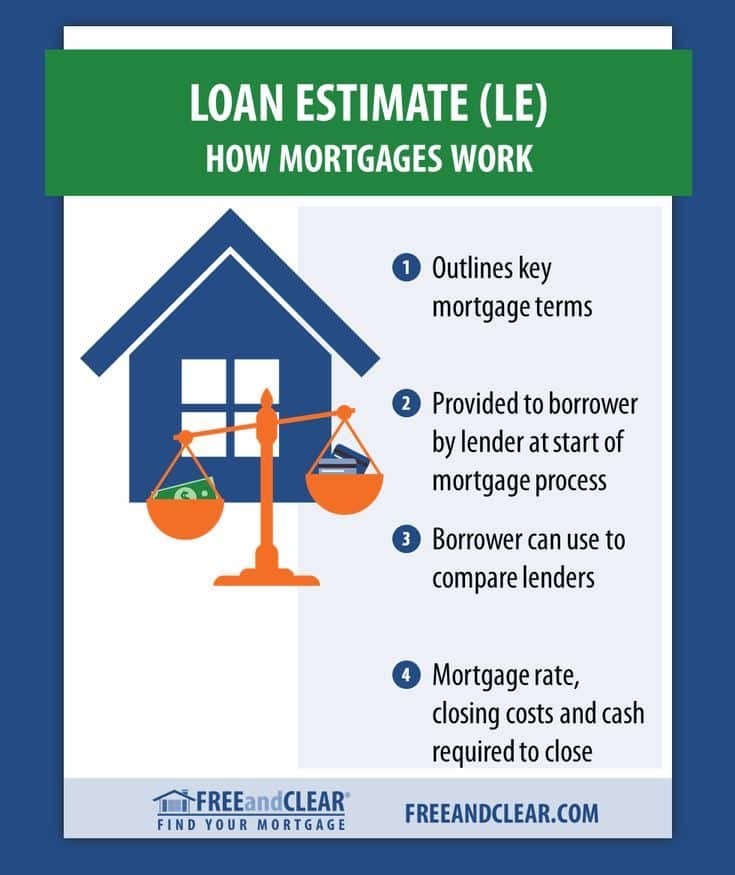

GET A FULL CREDIT APPROVAL BEFORE YOUR HOUSEHUNT.

Many lenders offer full credit approvals that allow you to have your income, credit and assets fully vetted by an underwriter before you find a home.

HAVE YOUR DOWN PAYMENT IN THE BANK FOR AT LEAST TWO MONTHS BEFORE APPLYING.

Most lenders require two months worth of bank statements to prove you have the funds for a down payment. If you have a cash stash, deposit it a few months ahead of your loan application.

GET RID OF AS MUCH DEBT AS POSSIBLE.

APPLY FOR THE RIGHT LOAN PROGRAM.

You May Like: Realtor Com For Sale

Don’t Close Major Credit Card Accounts

Problem: Logic would seem to be on the side of lowering credit card debt and eliminating unnecessary or unused lines of credit. However and this is where it can get confusing closing a credit card account might have the opposite effect by doing so, you may increase your ratio.

How does closing a credit card affect your credit score and mortgage application? The percentage of available credit is among the top factors that influence your credit score, and ultimately your future mortgage interest rate. Closing unused credit cards reduces access to credit from your perspective, but in closing an account you will have increased your credit utilization ratio from a lenders point of view – and thats a bad thing.

For example, if you have credit card limits totaling $10,000 and balances of $2,000, your ratio is 20%. If you then close a credit card with a limit of $6,000, you just raised your utilization percentage to 50%. That does not bode well for your credit scores, which could complicate mortgage approval, and/or raise your interest rate.

Closing your oldest major credit card accounts is almost always a BIG mistake before buying a home.

Reasons A Mortgage Underwriter May Decline A Loan

A loan can be denied for many reasons which can include:

- Your FICO is too low: Having a low credit score can be an issue for most steps in the homebuying process.

- Your income is unstable: An important part of your application is your employment history and income stream.

- You have a higher amount of debt: A high debt-to-income ratio indicates your expenses are higher than your monthly income which can have a negative impact on the credit decision. The lower your DTI, the more likely you will be able to continue to make your mortgage payments.

- Insufficient funds to close your loan: You’re responsible to pay the difference between the purchase price and the loan amount. If sufficient funds aren’t available to close, it could result in a decline.

If the lender is unable to approve your loan, they are required to provide the reasons for the decline. Understanding why your loan has been declined can help you take the necessary steps to improve your financial position.

Understanding how an underwriter reviews a loan can help as you prepare to apply for a mortgage. If you would like more information, please speak with a Home Lending Advisor to learn more.

You May Like: How Long Bankruptcy Remain On Credit

Don’t Be Afraid To Talk To Your Lender

Problem: Withholding information, or neglecting to disclose specific facts often leads to larger consequences. The process of applying for a loan is invasive, disruptive, confusing, and sometimes downright upsetting. But if you dont disclose everything to your lender, you might jeopardize your ability to own your own home.

Good mortgage professionals are like detectives they are very likely to discover any truths youve withheld. If the information youd rather not discuss is deemed severe enough, you could be accused of mortgage fraud. Even if the loan does close, you might not be out of the woods, and prosecution for a crime is undoubtedly a worse fate than delaying a home purchase.

Solution: If we only had one piece of advice to offer prospective home buyers, it would be to talk with the lender about everything! Make an effort to be upfront, honest, and forthcoming with information about your financial affairs, earnings, savings, and personal relationships. If there are questions regarding past or present financial claims, explain fully and prepare to supply as much documentation as possible. An accurate financial profile is your responsibility.

Keep in mind that lenders are as interested in making a deal as you are. There are often ways to work around less than a stellar financial record there are even loans available if you have had a bankruptcy or a previous mortgage default and foreclosure or short sale.

How Long Does It Take For The Underwriter To Make A Decision

The mortgage underwriting process can take anywhere from a few days to weeks. Your loan type, financial situation, missing paperwork, and issues with property surveys or title insurance are all things that can affect how long it takes an underwriter to approve, suspend or deny your mortgage.

A great tip for speeding up your underwriting process is to become a Certified Home Buyer with Churchill Mortgage. That means an underwriter reviews your file before you go under contract on a house. Its even better than being preapproved or prequalified for a mortgage.

And that extra certification helps you not only stand out from other buyers, but also save time on the whole underwriting process once you find the home of your dreams.

Keep in mind that the underwriting process is just one of the steps in closing on a house. Other factors in the home-buying and mortgage loan process can dramatically affect how long closing on your house takes.

Also Check: How Does An Individual File For Bankruptcy

Mortgage Loan Denied In Underwriting: Why It Happens And What To Do

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

No homebuyer wants to hear the words, Your mortgage loan was denied in underwriting. Fortunately, its unlikely youll get this news if your loan was properly preapproved before you found a home. If your home loan application is denied, there are steps you can take to salvage your homebuying chances and fix the issues to flip the underwriting denial to an approval.

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

Recommended Reading: Can I File Bankruptcy Online

What To Do If Your Loan Is Denied

The Equal Credit Opportunity Act protects you from being denied credit because of factors like your race, sex, marital status, and more. If you think you were improperly denied a loan, you can bring this issue up with your lender.

If that doesn’t resolve the situation, you can contact your state’s attorney general office, sue the lender in court, and/or file a complaint with the Consumer Financial Protection Bureau.

However, if youre loan was denied because it did not pass the lending standards after the underwriting process, then you take other steps depending on the reason. For example, you may have to work on your credit score by reducing debt if your credit report was an issue. Or, you may consider saving for a larger down payment if your loan-to-value ratio was a problem.

How Many Mortgage Preapprovals Get Denied In Underwriting

About 9% of all mortgages were denied during the underwriting phase in 2020, according to the Consumer Financial Protection Bureau. The denial rate varies by loan type. For example, in 2020, around 14.1% of FHA loans were denied during underwriting, while just 7.6% of conventional loans were denied.

Recommended Reading: How Will Filing Bankruptcy Affect My Credit Score

How Long Does Mortgage Underwriting Take

The mortgage underwriting process can take anywhere from a few days to a few weeks, depending on whether the underwriter needs additional information from you, how busy the lender is, and how streamlined the lenders practices are.

The quicker you compile your documents and respond to the lenders requests for information, the smoother and speedier the process can be.

Keep in mind, however, that underwriting is just one part of the overall lending process. You can expect to completely close on a loan in 40-50 days.

How To Pay Off Debt During The Covid

During a global pandemic, everything can feel exponentially more stressful and difficult. With millions of Americans filing for unemployment since the beginning of March, many of us are forced to deal with the anxiety of finances on top of everything else we have to worry about.

Here are 4 simple things you can do to help relieve some of the stress and burden of your finances during the coronavirus pandemic:

Don’t Miss: National Debt Real Time Clock

Ask For A Lower Payment Plan

Many companies have special programs to help people right now. Contact the companies you owe money to and try to work out a new payment plan with lower payments or delayed due dates, and find out if your state or local government offers programs that will allow you to hold off on paying some bills right now. Make sure to get any changes in writing.

Value Of The Collateral

In case of secured loans such as home loan, car loan, etc., you need to pledge an asset you own as collateral. Underwriters gauge the collateral’s value to ensure that it can be used to recover the loan amount in case of a default. If the collateral doesn’t have a value equal to or higher than the loan amount, it will serve little purpose.

Read Also: Will I Lose My House If I File Bankruptcy

Opening Lines Of Credit

You can still be denied a mortgage even after being pre-approved for one. Mortgage lenders check your credit during pre-approvaland again just before closingbefore giving you the final green light. In the interim, maintain the status quo in your credit and finances. That means not opening new lines of credit or closing existing lines of credit. Doing so can lower your credit score and increase your debt-to-income ratioboth key reasons for a lender to deny final approval.

Instead, wait until after youve closed on your home to take out new lines of credit . And while its great to pay off a credit card account or loan before you close on your home, closing the account removes that credit history from your report. Length of credit is one of the key factors credit reporting bureaus use to generate your credit score.

Instead, leave the account open and active, but dont use it until after closing.

Some credit card companies may close your account for long-term inactivity, which can negatively affect your credit, too. Keep accounts active by making small purchases that you pay off immediately and in full every month.

Get Your Credit In Shape

A lower credit score can make it more difficult for you to get approved for a mortgage, and can also make your loan more expensive with a higher interest rate.

If your credit score needs improvement, commit to paying down debt. Doing so will raise your credit score and reduce your DTI ratio many lenders look for 36 percent or less. That gives your applications chances a double boost.

In addition, check your credit report to ensure there are no errors that could negatively impact your score. You can get a copy from the three major credit bureaus at AnnualCreditReport.com. If you do find a mistake, contact the agency to dispute it as soon as possible.

Don’t Miss: What Happens When You Declare Bankruptcy In Uk