Fiscal Year 2021 In Review

The federal government ran a deficit of $2.8 trillion in fiscal year 2021, the difference between $4.0 trillion in revenues and $6.8 trillion in spending. This deficit was 12% lower than in fiscal year 2020, due to revenue increases outpacing expenditure growth. The FY2021 deficit, however, was almost three times that of FY2019 , as federal COVID-19 relief spending has continued to drive outlays to record highs. This years deficit amounted to approximately 13% of GDP, the second largest deficit as a share of the economy since 1945. Revenues tallied 18% of GDP, while spending rose to 30% of GDP.

Receipts totaled $4.0 trillion in FY2021an 18% year-over-year increasereflecting the general strength of the economy during the initial stages of the pandemic recovery. Individual income and payroll tax revenues together rose 15%, due to a combination of higher wages, increased employment, and payroll taxes that had been deferred by most employers from 2020 to 2021 per the CARES Act of March 2020. Corporate tax revenues increased by 75% in part due to higher corporate profits, and unemployment insurance receipts increased by 31% as states replenished their unemployment insurance trust funds.

A Brief History Of Us Debt

Sabrina Jiang / Investopedia

Nearly all national governments borrow money. The U.S. has carried national debt throughout its history, dating back to the borrowing that financed the Revolutionary War. Since then, the debt has grown alongside the economy as a result of increased government responsibilities and in response to economic developments.

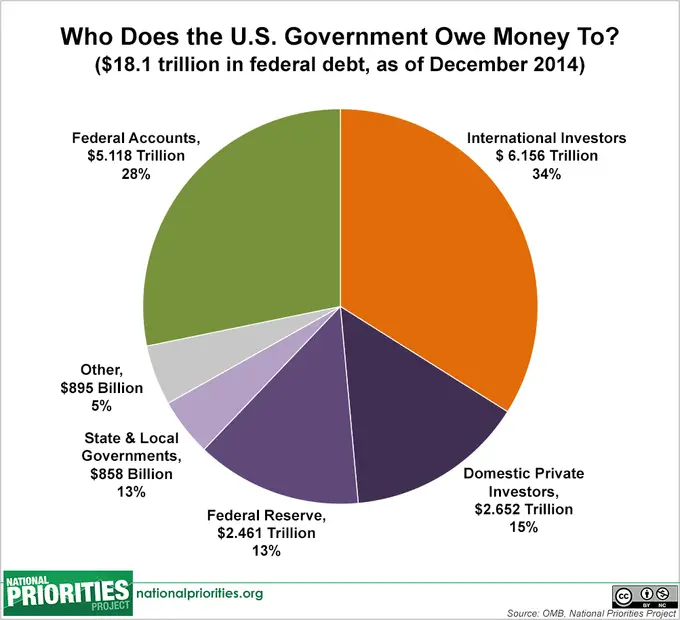

The federal debt is held primarily by the American public, followed by foreign governments and U.S. banks and investors. Note that the portion of the federal debt held by the public is considered more meaningful than the overall national debt because it excludes intragovernmental debtthat is, it only accounts for U.S. debt held by entities other than the federal government. So, while national debt totaled $31.1 trillion as of October 2022, federal debt held by the public was $24.3 trillion and intragovernmental debt amounted to $6.9 trillion. Thus, while national debt-to-GDP was at 121% as of the second quarter of 2022, the ratio of federal debt to GDP counting only debt held by the public was 95%.

Us National Debt Tops $30 Trillion For First Time In History

The Treasury Department this week reported that the total national debt of the United States surpassed $30 trillion for the first time in history, an amount equal to nearly 130% of America’s yearly economic output, known as gross domestic product. The eye-popping figure makes the U.S. one of the most heavily indebted nations in the world. The federal debt has been high and rising for decades, but the federal government’s response to the coronavirus pandemic, which involved massive infusions of cash into the U.S. economy, greatly accelerated its growth. At the end of 2019, prior to the pandemic, the national debt stood at $22.7 trillion. One year later, it had risen by an additional $5 trillion, to $27.7 trillion. Since then, the nation has added more than $2 trillion in further debt. A grim reminder

While the $30 trillion figure, by itself, has no significant meaning, it may serve to focus attention on what some see as a major concern for the future health of the country. “Hitting the $30 trillion mark is a reminder of just how high our debt is and just how much we’ve been borrowing,” said Marc Goldwein, senior vice president and senior policy director for the Committee for a Responsible Federal Budget.

Don’t Miss: How To File For Bankruptcy In Ri

Tracking The Federal Deficit: January 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $165 billion in January, the fourth month of fiscal year 2021. This months deficitthe difference between $552 billion of spending and $387 billion of revenuewas $132 billion greater than last Januarys. But federal finances deteriorated more than the raw numbers suggest. Adjusting for shifts in the timing of some payments, the deficit this January would have been $211 billion greater than last Januarys. The federal deficit has now reached $738 billion so far this fiscal year, an increase of 120% over the same point last year . Compared to the same point last fiscal year, cumulative revenues have ticked up 1%, but cumulative spending has surged 27%mostly due to the COVID-19 pandemic and the federal response to it.

Increased spending so far this fiscal year has likewise mostly resulted from pandemic relief. About 60% of the increase in cumulative year-to-date spending has come from refundable tax credits and unemployment insurance benefits . Outlays from the Public Health and Social Services Emergency Fund are also up $26 billion compared to the first four months of fiscal year 2020, and Medicaid spending is $29 billion greater.

Revenues rose 4% from last January, thanks to greater revenue from individual income, payroll, and corporate income tax revenue.

Why The Federal Reserve Owns Treasurys

As the nation’s central bank, the Federal Reserve is in charge of the country’s credit. It doesn’t have a financial reason to own Treasury notes. So why does it?

The Federal Reserve actually tripled its holdings between 2007 and 2014. The Fed had to fight the 2008 financial crisis, so it ramped up open market operations by purchasing bank-owned mortgage-backed securities. The Fed began adding U.S. Treasurys in 2009. It owned $1.6 trillion, by 2011, maxing out at $2.5 trillion in 2014.

This quantitative easing stimulated the economy by keeping interest rates low and infusing liquidity into the capital markets. It gave businesses continued access to low-cost borrowing for operations and expansion.

The Fed purchased Treasurys from its member banks, using credit that it created out of thin air. It had the same effect as printing money. By keeping interest rates low, the Fed helped the government avoid the high-interest-rate penalty it would incur for excessive debt.

Also Check: Auction For Foreclosed Homes

Tracking The Federal Deficit: March 2020

The Congressional Budget Office reported that the federal government generated a $117 billion deficit in March, the sixth month of fiscal year 2020. Marchs deficit is a $30 billion decrease from the $147 billion deficit recorded a year earlier in March 2019. Marchs deficit brings the total deficit so far this fiscal year to $741 billion, which is 7% higher than the same period last year. Total revenues so far in FY2020 increased by 6% , while spending increased by 7% , compared to the same period last year.

Analysis of Notable Trends in This Fiscal Year to Date: Through the first six months of FY2020, federal reserve remittances increased by 22% because of lower short-term interest rates, which decreased the Federal Reserves interest expenses and increased its payments to the Treasury. As in previous months, the rise in spending was driven by increasing expenditures on the military , Social Security, Medicare, and Medicaid , and net interest on the public debt . Notably, the March 2020 report was not significantly impacted by the new coronavirus pandemic nor the federal governments emergency measures responding to it. CBO anticipates that those budgetary effects will be more noticeable in April.

What Extraordinary Measures Are Still Available To The Treasury

Since August 1, 2021, the Treasurys extraordinary measures have consisted of suspending the issuance of new state and local government securities and savings bonds, suspending investments of the Thrift Savings Plans G Fund, limiting investments of the Civil Service Retirement and Disability Fund and the Postal Service Retiree Health Benefits Fund , and suspending interest payments to those two funds.

During the coming weeks, the Treasury could take any of the following measures:

- Continue to suspend investments of the Thrift Savings Plans G Fund. Otherwise rolled over or reinvested daily, those investments totaled $20 billion in Treasury securities as of August 31, 2021.

- Suspend investments of the Exchange Stabilization Fund.3 Otherwise rolled over daily, such investments totaled $23 billion as of August 31, 2021.

- Suspend the issuance of new securities for the CSRDF and the PSRHBF, which total about $3 billion each month.

- Redeem, in advance, securities held by the CSRDF and the PSRHBF in amounts equal in value to benefit payments that are due in the near future. CBO estimates that such payments amount to about $7 billion per month, and an annual payment of about $48 billion is scheduled for September 30, 2021.

- Exchange Federal Financing Bank securities, which do not count against the debt limit, for Treasury securities held by the CSRDF.4 Approximately $9 billion in securities was available to be exchanged as of August 31, 2021.

Read Also: Can You Keep Your Home If You File Bankruptcy

Tracking The Federal Deficit: September 2019

The Congressional Budget Office reported that the federal government generated a surplus of $83 billion in September, the final month of Fiscal Year 2019. This brings the total FY2019 deficit to $984 billion,26 percent higher than last years deficit. If not for timing shifts of certain payments, this years deficit would have been21 percent larger than the deficit inFY2018. On an apples-to-apples basis, total revenues inFY2019increased by4 percent , while spending increased by7 percent , compared to the prior fiscal year.

Analysis of Notable Trends for Fiscal Year 2019: Corporate income tax revenue increased by 14 percent relative to 2018, although that year notably was tied for the lowest corporate revenue level as a share of the economy since 1965, a result of the Tax Cuts and Jobs Act of 2017 . Customs duties increased by 71 percent versus last year due to the imposition of tariffs, specifically on certain imports from China. On the spending side, outlays from the refundable earned income and child tax credits increased by 14 percent versus last year, reflecting expansions enacted in TCJA. Finally, payments for net interest on the public debt rose by an alarming 14 percent , largely due to higher short-term interest rates and a growing federal debt burden on which those interest payments are owed.

Debt By Year Compared To Nominal Gdp And Events

In the table below, the national debt is compared to GDP and influential events since 1929. The debt and GDP are given as of the end of the fourth quarter in each year to coincide with the end of the fiscal year. That’s the best way to accurately determine how spending in each fiscal year contributes to the debt and compare it to economic growth.

From 1947-1976, debt and GDP are given at the end of the second quarter since, during that time, the fiscal year ended on June 30. For years 1929 through 1946, debt is reported at the end of the second quarter, while GDP is reported annually, since quarterly figures are not available.

Also Check: How To Claim Bankruptcy In Manitoba

Wars And Armed Conflict

Overseas wars and military operations and military aid to foreign allies, in combination with increased domestic security spending, interest costs, and long-term veterans funding obligations, have added more than $8 trillion to the national debt since 2001, by one estimate.

Meanwhile, annual U.S. military spending exceeds that of the next nine highest spenders combined.

When Would The Extraordinary Measures And Cash Be Exhausted And What Would Happen Then

CBO estimates that unless the debt limit is increased, the Treasuryafter using all available extraordinary measureswill probably be unable to make its usual payments starting in late October or early November, although an earlier or later date is possible. After that point, the debt limit would cause delays of payments for some government activities, a default on the governments debt obligations, or both.6

If the debt limit is not raised above the amount established on August 1, 2021, the Treasury will not be authorized to issue additional debt that increases the amount outstanding. That restriction would ultimately lead to delays of payments for some government activities, a default on the governments debt obligations, or both.

1. See Congressional Budget Office, Federal Debt and the Statutory Limit, July 2021 , www.cbo.gov/publication/57152.

2. For more information about different measures of federal debt, see Congressional Budget Office, Federal Debt: A Primer ,www.cbo.gov/publication/56165.

3. The Exchange Stabilization Fund is operated by the Treasury to stabilize exchange rates.

5. In addition to taking those measures, the Treasury has stopped issuing State and Local Government Series securities. That suspension does not provide additional borrowing capacity but allows the Treasury to substitute one form of public debt for another.

CBO seeks feedback to make its work as useful as possible. Please send any comments to .

Phillip L. Swagel

Don’t Miss: How To File Bankruptcy Chapter 7 In Texas

Us Federal Debt Since The Founding

Chart D.15f: Federal Debt since the Founding

The United States federal government began with a substantial debt, the cost of the Revolutionary War. Under Alexander Hamiltons funding system the debt was paid off by 1840. Government debt has typically peaked after wars. It breached 30 percent of GDP after the Revolutionary War, the Civil War, and World War I. It breached 100 percent of GDP in World War II. Government debt also breached 100 percent of GDP in the aftermath of the financial crisis of 2008.

Tracking The Federal Deficit: July 2019

The Congressional Budget Office reported that the federal government generated a $120 billion deficit in July, the tenth month of Fiscal Year 2019. This makes for a total deficit of $867 billion so far this fiscal year, 27 percent higher than over the same period last year . Total revenues so far in Fiscal Year 2019 increased by 3 percent , while spending increased by 8 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Increased revenues were driven mostly by a 7 percent increase in payroll taxes due to the strong labor market that has resulted in continued job growth and rising wages. On the spending side, outlays for Social Security, Medicare, and Medicaid increased by a combined 6 percent . Department of Education outlays rose by 79 percent , mostly due to an upward revision to the net subsidy costs of previously issued student loans. Finally, net interest payments on the federal debt continued to rise, increasing by 14 percent versus last year due to higher interest rates and a larger federal debt burden.

Don’t Miss: How Long Bankruptcy Last On Credit Report

Interest And Debt Service Costs

Despite rising debt levels, interest costs have remained at approximately 2008 levels because of lower than long-term interest rates paid on government debt in recent years. The federal debt at the end of the 2018/19 fiscal year was $22.7 trillion. The portion that is held by the public was $16.8 trillion. Neither figure includes approximately $2.5 trillion owed to the government. Interest on the debt was $404 billion.

The cost of servicing the U.S. national debt can be measured in various ways. The CBO analyzes net interest as a percentage of GDP, with a higher percentage indicating a higher interest payment burden. During 2015, this was 1.3% GDP, close to the record low 1.2% of the 19661968 era. The average from 1966 to 2015 was 2.0% of GDP. However, the CBO estimated in 2016 that the interest amounts and % GDP will increase significantly over the following decade as both interest rates and debt levels rise: “Interest payments on that debt represent a large and rapidly growing expense of the federal government. CBO’s baseline shows net interest payments more than tripling under current law, climbing from $231 billion in 2014, or 1.3% of GDP, to $799 billion in 2024, or 3.0% of GDPthe highest ratio since 1996.”

According to a study by the Committee for a Responsible Federal Budget , the U.S. government will spend more on servicing their debts than they do for their national defense budget by 2024.

Negative Real Interest Rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt, meaning the inflation rate is greater than the interest rate paid on the debt. Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk. Economist Lawrence Summers states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness.

In the late 1940s through the early 1970s, the U.S. and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay this low. Between 1946 and 1974, the U.S. debt-to-GDP ratio fell from 121% to 32% even though there were surpluses in only eight of those years which were much smaller than the deficits.

Also Check: Over Stock Phone Number

How The Debt Compares To Gdp Plus Major Events That Impacted It

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The U.S. national debt grew to a record $31.12 trillion in October 2022. It has grown over time due to recessions, defense spending, and other programs that added to the debt. The U.S. national debt is so high that it’s greater than the annual economic output of the entire country, which is measured as the gross domestic product .

Throughout the years, recessions have increased the debt because they have lowered tax revenue and Congress has had to spend more to stimulate the economy. Military spending has also been a big contributor, as has spending on benefits such as Medicare. In 2020 and 2021, spending to offset the effects of the COVID-19 pandemic also added to the debt. In 2022, tax increases on the wealthy and corporations decreased the future debt outlook, but student loan forgiveness increased it.

One way to look at the national debt is by comparing it to GDP each year, as well as other major events that have impacted it. Below, we’ll dive into the U.S. national debt per year and what caused it to grow over time.