End Of Fiscal Year 2018

This entry reflects the U.S. Treasury Departments official end-of-year spending, revenue, and deficit figures for Fiscal Year 2018, as released in its Final Monthly Treasury Statement for Fiscal Year 2018.

The total deficit for FY 2018 is $779 billion, with total spending clocking in at $4.1 trillion and total revenue at $3.3 trillion. The deficit grew by 17 percent compared to FY 2017 and is the highest federal deficit in six years . While spending grew by about 3 percent in FY 2018, revenue grew by less than 1 percent . Disturbingly, federal interest payments on the debt spiked to $372 billion up 20 percent from FY 2017 reflecting the largest year-over-year increase in over a decade .

Debt Issuance: Government Account Series

Debt held by government accountsin the form of Government Account Series securitiesis mostly determined by the transactions of a few large trust funds. When a trust fund receives cash that is not immediately needed to pay benefits or to cover the programs expenses, the Treasury credits the trust fund with that income by issuing GAS securities to the fund. The Treasury then uses the cash to finance the governments ongoing activities. When revenues for a trust fund program fall short of expenses, the reverse happens: The Treasury redeems some of the GAS securities. The crediting and redemption of securities are intragovernmental transactions between the Treasury and trust funds, but both directly affect the amount of debt subject to limit.

On many days, the amount of outstanding GAS securities does not change much. However, that amount can fall noticeably when redemptions occur because of the payment of benefits under programs such as Social Security and Medicare. The Treasury normally offsets the redemption of GAS securities, which reduces the amount of debt subject to limit, by borrowing additional amounts from the public to obtain the cash necessary to make benefit payments. In addition, most GAS securities pay interest to the funds holding them, and those payments are reinvested in the form of additional securities.7

Debt Grows Into The Trillions During 1980s And 1990s

At the start of the 1980s, an increase in defense spending and substantial tax cuts continued to balloon the federal debt. The national debt at the end of the Ronald Reagan era was $2.7 trillion.

The era under President Bill Clinton was marked with tax increases, reductions in defense spending and an economic boom that reduced the growth of debt, but it still reached a staggering $5.6 trillion by 2000.

Also Check: How Many Years After Bankruptcy Can You File Again

Tracking The Federal Deficit: January 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $165 billion in January, the fourth month of fiscal year 2021. This months deficitthe difference between $552 billion of spending and $387 billion of revenuewas $132 billion greater than last Januarys. But federal finances deteriorated more than the raw numbers suggest. Adjusting for shifts in the timing of some payments, the deficit this January would have been $211 billion greater than last Januarys. The federal deficit has now reached $738 billion so far this fiscal year, an increase of 120% over the same point last year . Compared to the same point last fiscal year, cumulative revenues have ticked up 1%, but cumulative spending has surged 27%mostly due to the COVID-19 pandemic and the federal response to it.

Increased spending so far this fiscal year has likewise mostly resulted from pandemic relief. About 60% of the increase in cumulative year-to-date spending has come from refundable tax credits and unemployment insurance benefits . Outlays from the Public Health and Social Services Emergency Fund are also up $26 billion compared to the first four months of fiscal year 2020, and Medicaid spending is $29 billion greater.

Revenues rose 4% from last January, thanks to greater revenue from individual income, payroll, and corporate income tax revenue.

Tracking The Federal Deficit: October 2018

Analysis of Notable Trends in October 2018:The Congressional Budget Office reported that the federal government generated a $98 billion deficit in October, the first month of Fiscal Year 2019. Octobers deficit is 56 percent higher than the deficit recorded a year earlier in October 2017. Total revenues increased by 7 percent , while spending increased by 18 percent , compared to a year earlier.

Recommended Reading: How Many Times Did Donald Trump Claim Bankruptcy

Tracking The Federal Deficit: June 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $173 billion in June, the ninth month of fiscal year 2021. Junes deficit was the difference between $450 billion in revenue and $623 billion in spending.

So far this fiscal year, the federal government has run a cumulative deficit of $2.2 trillion, the difference between $3.1 trillion in revenue and $5.3 trillion in spending. This deficit is nearly triple the shortfall over the same period in FY2019 , but is 19% lower than at the same point in FY2020. This is the first time in FY2021 that the cumulative deficit has decreased year-over-year.

Analysis of Notable Trends: Thus far in FY2021, year-over-year comparisons of deficit levels have largely reflected the trajectory of the COVID-19 pandemic and subsequent federal response. BPC expects this trend to continue through the rest of the fiscal year.

Cumulative year-to-date outlays are up 6% compared to the first nine months of FY2020 and are 58% greater than at this point in FY2019. These changes are indicative of continued spending towards COVID-19 relief programsin particular, refundable tax credits and supplemental unemployment compensationas every month to date in the current fiscal year has contained pandemic-related expenditures, whereas only March-June did for the relevant period last year.

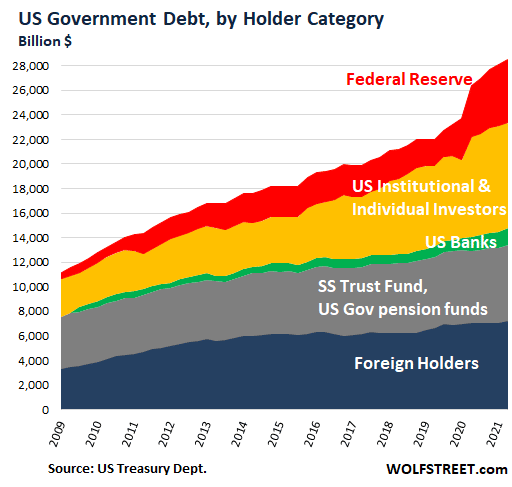

Why The Federal Reserve Owns Treasurys

As the nation’s central bank, the Federal Reserve is in charge of the country’s credit. It doesn’t have a financial reason to own Treasury notes. So why does it?

The Federal Reserve actually tripled its holdings between 2007 and 2014. The Fed had to fight the 2008 financial crisis, so it ramped up open market operations by purchasing bank-owned mortgage-backed securities. The Fed began adding U.S. Treasurys in 2009. It owned $1.6 trillion, by 2011, maxing out at $2.5 trillion in 2014.

This quantitative easing stimulated the economy by keeping interest rates low and infusing liquidity into the capital markets. It gave businesses continued access to low-cost borrowing for operations and expansion.

The Fed purchased Treasurys from its member banks, using credit that it created out of thin air. It had the same effect as printing money. By keeping interest rates low, the Fed helped the government avoid the high interest rate penalty it would incur for excessive debt.

The Fed ended quantitative easing in October 2014. Interest rates on the benchmark 10-year Treasury note rose from a 200-year low of 1.43% in July 2012 to around 2.17% by the end of 2014 as a result.

The Federal Open Market Committee said the Fed would begin reducing its Treasury holdings in 2017. But it purchased Treasurys again just a few years later.

Don’t Miss: How Much Does Bankruptcy Cost To File

Calculating The Annual Change In Debt

Conceptually, an annual deficit should represent the change in the national debt, with a deficit adding to the national debt and a surplus reducing it. However, there is complexity in the budgetary computations that can make the deficit figure commonly reported in the media considerably different from the annual increase in the debt. The major categories of differences are the treatment of the Social Security program, Treasury borrowing, and supplemental appropriations outside the budget process.

Social Security payroll taxes and benefit payments, along with the net balance of the U.S. Postal Service, are considered “off-budget”, while most other expenditure and receipt categories are considered “on-budget”. The total federal deficit is the sum of the on-budget deficit and the off-budget deficit . Since FY1960, the federal government has run on-budget deficits except for FY1999 and FY2000, and total federal deficits except in FY1969 and FY1998FY2001.

What Makes The Debt Bigger

The leading federal spending categories currentlySocial Security, Medicare/Medicaid and defenseare the same as in the 1990’s, when national debt was much lower relative to GDP. The U.S. remains the world’s largest economy and one of the richest countries. How, then, did the debt situation deteriorate? Numerous factors are in play.

Recommended Reading: How Long Does It Take To File Bankruptcy Chapter 13

Us Debt Surged By $7 Trillion Under Trump It Will Go Much Higher Under Biden

President Donald Trump certainly lived up to his self-proclaimed status as the King of Debt during his term in office. The national debt spiked by $7 trillion during Trumps tenure and its about to soar much higher under his successor.

Armed with a slim majority in the US Senate, President-elect Joe Biden is expected to make the case Thursday for a $2 trillion fiscal package to repair and rebuild the economy. That would be on top of the $900 billion relief package launched last month.

The proposal, made up of $2,000 stimulus checks, state and local aid, and unemployment insurance, aims to shore up a recovery that looks increasingly fragile. The Biden teams package is a shoot for the moon approach, one lawmaker told CNN.

Adding to Americas $27 trillion mountain of debt may be painful, but its the wise move given the scale of the problems and dirt-cheap borrowing costs.

This is not the time to tighten the belt. The economy is in no condition for austerity, said Joe Brusuelas, chief economist at RSM.

Another 965,000 Americans filed for first-time unemployment benefits last week, up sharply from 784,000 the previous week. Jobless claims remain well above the worst levels of the Great Recession. The United States lost 140,000 jobs in December, the first decline since the spring.

Risks To Economic Growth

Debt levels may affect economic growth rates. In 2010, economists Kenneth Rogoff and Carmen Reinhart reported that among the 20 developed countries studied, average annual GDP growth was 34% when debt was relatively moderate or low , but it dips to just 1.6% when debt was high . In April 2013, the conclusions of Rogoff and Reinhart’s study came into question when a coding error in their original paper was discovered by Herndon, Ash and Pollin of the University of Massachusetts Amherst. Herndon, Ash and Pollin found that after correcting for errors and unorthodox methods used, there was no evidence that debt above a specific threshold reduces growth. Reinhart and Rogoff maintain that after correcting for errors, a negative relationship between high debt and growth remains. However, other economists, including Paul Krugman, have argued that it is low growth which causes national debt to increase, rather than the other way around.

Commenting on fiscal sustainability, former Federal Reserve Chairman Ben Bernanke stated in April 2010 that “Neither experience nor economic theory clearly indicates the threshold at which government debt begins to endanger prosperity and economic stability. But given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time.”

Recommended Reading: What Is The Origin Of The Word Bankruptcy

National Debt For Selected Years

| Fiscal year | |

|---|---|

| 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.

On June 25, 2014, the BEA announced: “n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 19402009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 19502010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures were revised back to 1947.

Fiscal years 19401970 begin July 1 of the previous year fiscal years 19802010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

19091930 calendar year GDP estimates are from MeasuringWorth.com Fiscal Year estimates are derived from simple linear interpolation.

Audited figure was “about $5,659 billion.”

Audited figure was “about $5,792 billion.”

Audited figure was “about $6,213 billion.”

Audited figure was said to be “about” the stated figure.

Audited figure was “about $7,918 billion.”

Audited figure was “about $8,493 billion.”

Why Does Interest Rise

Higher interest rates and growing debt are two of the main causes of the interest on the debt. But what causes them to rise?

Interest rates increase when the economy is doing well. Investors have the confidence to buy riskier assets, such as stocks. There’s less demand for bonds, so the interest rates must rise to attract buyers.

Recommended Reading: How Long Out Of Bankruptcy For Fha Loan

Taking National Debt Personally

While voters are not fans of national debt on principle, the debt-to-GDP ratio makes for a lackluster rallying point in practice, since even economists can’t agree on what percentage is too high.

Hence efforts to frame the national debt burden in easily understood terms. One popular tactic is to divide national debt by the population to determine debt per capita. Dividing the U.S. national debt of $30.5 trillion as of July 2022 by an estimated U.S. population of 332.4 million as of Jan. 1, 2022 yields national debt per capita of nearly $92,000, which sounds like a lot.

Fortunately, the per capita apportionment of government debt ignores the fact that no individual, not even a child, can hope to repay debt in a currency they create, the way the U.S. government and many other sovereign borrowers do. The improbability of default by a sovereign borrowing in its own currency is what marks out such debt as a “safe asset” relative to credit issued to private borrowers. In this sense, national debt can be thought of as an interest-bearing currency supplementing the interest-free banknotes. Like currency, national debt is a government obligation serving as an asset and store of value for its owners.

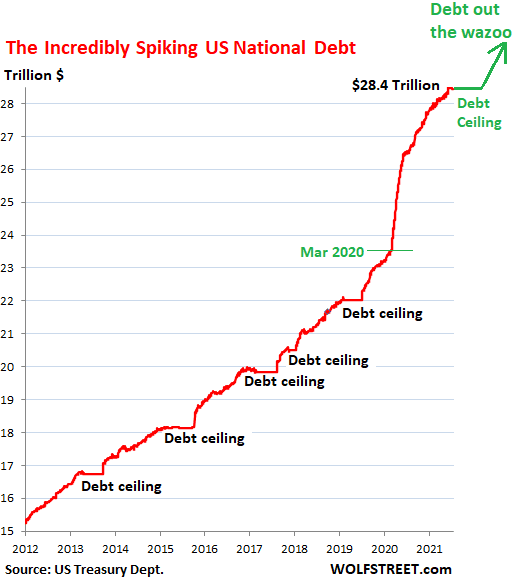

What Is The Current Situation

P.L. 116-37 specifies that the amount of borrowing that occurs during the suspension of the debt limit will be added to the previous ceiling of $22.0 trillion. As of June 30, 2021, an additional $6.5 trillion had been borrowed, bringing the amount of outstanding debt subject to the statutory limit to $28.5 trillion. The new debt limit, which will be established on August 1, 2021, will reflect additional borrowing through July 31.

If the current suspension is not extended or if a higher debt limit is not legislated before August 1, from that date forward, under normal procedures, the Treasury will have no room to borrow other than to replace maturing debt. To avoid breaching the limit, the Treasury would then begin to take the extraordinary measures that, along with cash inflows, should allow it to finance the governments activities for a limited time without an increase in the debt ceiling.

Recommended Reading: How To Get My Bankruptcy Discharge Papers

Can America Keep Piling Up Debt

Economists debate whether the spending is sustainable. The U.S. finances the debt by selling bonds at auction. Demand has traditionally been high due to the size of our economy and a historically stable government, but the Treasurys auction of bonds in March 2021 was met with a tepid response.

Historically low interest rates meant the U.S. borrowed money cheaply, and it would theoretically invest it in an economy that would produce higher rates of return.

But interest rates are not expected to stay low forever. The 10-year rate on Treasury notes was expected to rise from 1.7% in March 2021 to at least 2.0% by the end of 2021, according to Kiplingers forecast.

The cost to just finance our debt is expected to be $378 billion in 2021 and increase to $665 billion by the end of the decade, according to CBO estimates. That money will be spent only on interest, not on the principal.

The U.S. is by far the most indebted organization in world history. While debt has been an issue since the inception of the U.S., its rapid growth will continue to challenge lawmakers into creating better programs to reign in expenditures, as well as American consumers who must develop improved way of managing their personal debt.

6 Minute Read

Tracking The Federal Deficit: June 2020

The Congressional Budget Office reported that the federal government ran a deficit of $864 billion in June, the ninth month of fiscal year 2020. This monthly deficit is more than 100 times larger than last Junes deficit of $8 billion. This difference came from a sizable drop in revenues, which were down 28% from last June , and especially from a massive increase in outlays, up 223% from last June . The budget deficit so far this fiscal year has surged to $2.7 trillion, $2 trillion more than at the same point last year. As exemplified by June, the cumulative difference stems from a drop in revenues13% lower than at the same point last yearand a much bigger leap in outlays49% higher than at this time last year.

The drop in revenue between last June and this one was due almost entirely to the administration delaying the deadline for quarterly tax payments from June 15 to July 15. Monthly revenue was down $93 billion compared to a year ago, of which $43 billion came from delaying corporate tax payments while $42 billion came from delaying individual and payroll tax payments. CBO expects most of this delayed revenue to eventually be collected, although some will be lost as businesses fail before the new payment deadlines.

Recommended Reading: How Long Do Bankruptcy Restrictions Last