What Will Happen To Our National Debt

U.S. spending is currently at an all-time high to combat the effects of COVID-19. The current level of debt-to-GDP is comparable to the period immediately after World War II. Despite the effort to reduce the national debt, it is apparent and crucial for the government to take on the debt during times of crisis. Being able to adequately and successfully respond to emergencies is one of the many reasons why the national debt should be reduced governments should respond to events in an appropriate and timely manner with its citizens in thought.

Us National Debt To Gdp

Thegross domestic product of a country is a measurement of economic activity. This can be further defined as the value that goods and services of the United States holds. The debt of the country is how much the country has borrowed to fund its sectors and activities. Debt-to-GDP is a measure of what a country owes compared to what it produces, and is an indicator of how a country might be able to pay back its debt. If a country is able to continuously pay interest on its debt without refinancing or hampering with economic growth, it is considered stable. The higher the debt-to-GDP ratio, the more trouble a country will have paying off public debt to external lenders.

The U.S. debt-to-GDP ratio was110% in the first quarter of 2020. This number is the U.S. national debt divided by the nominal GDP. The nominal GDP is the economic production with the current prices of goods and services considered. According to theWorld Bank, a debt-to-GDP ratio that exceeds 77% can slow down economic growth. Some consequences of this include lower wages, increased inflation, and higher taxes.

Choose A Repayment Method And Set A Goal

Whichever method you choose, the first step is going to be to take stock of everything you owe, how much you owe in total, and the interest rate. Then, you can start to prioritize what you owe.

Two popular strategies are the debt avalanche and the debt snowball. The debt snowball tackles the smallest debt first to build momentum, working through bigger debts next, while the debt avalanche focuses on paying down higher-interest debt first to decrease the amount you pay overall.

You May Like: What Types Of Bankruptcies Are There

A Brief History Of Us Debt

Investopedia / Sabrina Jiang

Nearly all national governments borrow money. The U.S. has carried national debt throughout its history, dating back to the borrowing that financed the Revolutionary War. Since then the debt has grown alongside the economy, as a result of increased government responsibilities, and in response to economic developments.

Millions Of Americans Have Had $25b In Student Loan Debt Forgiven: Who Why And How

Peter Butler

How To and Money writer

I’m a writer/editor for CNET How-To and Money, living in South Berkeley, CA with two kids and two cats. I enjoy a variety of games and sports — particularly poker, ping-pong, disc golf, basketball, baseball, puzzles and independent video games.

What’s happening

President Biden still hasn’t announced his decision on widespread student loan forgiveness, but millions of borrowers have already had $25 billion in debt canceled during his term.

Why it matters

With one in five Americans owing student debt, loan forgiveness can help ease the pain of soaring inflation and economic uncertainty.

Time is running out on President Joe Biden to make a decision on federal student loan forgiveness. The pause on student loan payments expires on Aug. 31, and borrowers will be asked to resume payments after more than two years of forbearance.

Biden campaigned in 2020 on a platform of canceling a “minimum of $10,000” in student loan debt for everyone and on April 28 promised a decision “in the next couple of weeks,” but months have passed with no action on widespread student loan relief. About one in five Americans owe money on student loans for a total of $1.6 trillion, or an average of $37,013 per borrower.

Read Also: What Is Non Exempt Property In Bankruptcy

Can The Us Pay Off Its Debt

As budget deficits are one of the factors that contribute to the national debt, the U.S. can take measures to pay off its debt through budget surpluses. The last time that the U.S. held a budget surplus was in 2001. Much of the world depends on U.S. bonds to fund their own countries, and it has become a way of life for governments around the world. While it is unlikely that the U.S. will stop doing this, measures can be taken in other areas to decrease the national debt.

Is The National Debt A Problem

Economists and lawmakers frequently debate how much national debt is appropriate. Most agree that some level of debt is necessary to stimulate economic growth and that there is a point at which the debt can become a problem, but they disagree about where that point is. If the debt does get too big, it can result in cuts to government programs, tax hikes, and economic turmoil.

Read Also: How Long Does Chapter 7 Bankruptcy Affect Your Credit Score

Whos Responsible For The Current National Debt

In short? Pretty much every administration.

Regardless of political affiliation, parties in power have run up the deficit through higher spending and lower revenue collection, says Brian Rehling, head of Global Fixed Income Strategy at Wells Fargo Investment Institute.

While its easy to say a particular president or presidents administration caused the federal deficit and national debt to move a certain direction, its important to note that only Congress can authorize the type of legislation with the most impact on both figures.

Heres a look at how Congress acted during four notable presidential administrations and how their actions impacted both the deficit and national debt.

Trumps Impact On The Trade Deficit

The federal deficit, the gap between the amount of money the federal government spends and how much revenue it brings in, will exceed $1 trillion this year under the Trump Administration. This was the Congressional Budget Office fiscal outlook back in January. Congressional Budget Office: The Budget and Economic Outlook 2020 to 2030

Of this $1 trillion, $893 billion of it is the trade deficit, which is the difference between how much the US imports versus how much it exports. Of the $893 billion, about half of it is with China, our largest trading partner.

Long before he was even a candidate for president, Trump advocated for tariffs to reduce the U.S. trade deficit and promote domestic manufacturing. His contention was the country was being “ripped off” by its trading partners, a sentiment he has echoed since the 1980s all the way up to his candidacy for president and throughout his administration.

In 2001, China achieved two major accomplishments in its push to modernize its trade relations with the west. The first was joining the World Trade Organization, and the second was achieving Most Favored Nation trading status thanks to the United StatesâChina Relations Act passed in late 2000. Wikipedia – China-United States Trade War

You May Like: Will Filing Bankruptcy Affect My Car Loan

Negative Real Interest Rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt, meaning the inflation rate is greater than the interest rate paid on the debt. Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk. Economist Lawrence Summers states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness.

In the late 1940s through the early 1970s, the U.S. and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay this low. Between 1946 and 1974, the U.S. debt-to-GDP ratio fell from 121% to 32% even though there were surpluses in only eight of those years which were much smaller than the deficits.

Recent Additions To The Public Debt Of The United States

| ~19,428 | ~106.1% |

On July 29, 2016, the BEA released a revision to 20132016 GDP figures. The figures for this table were corrected the next week with changes to figures in those fiscal years.

On July 30, 2015, the BEA released a revision to 20122015 GDP figures. The figures for this table were corrected on that day with changes to FY 2013 and 2014, but not 2015 as FY 2015 is updated within a week with the release of debt totals for July 31, 2015.

On June 25, 2014, the BEA announced a 15-year revision of GDP figures would take place on July 31, 2014. The figures for this table were corrected after that date with changes to FY 2000, 2003, 2008, 2012, 2013 and 2014. The more precise FY 19992014 debt figures are derived from Treasury audit results. The variations in the 1990s and FY 2015 figures are due to double-sourced or relatively preliminary GDP figures respectively. A comprehensive revision GDP revision dated July 31, 2013 was described on the Bureau of Economic Analysis website. In November 2013 the total debt and yearly debt as a percentage of GDP columns of this table were changed to reflect those revised GDP figures.

Also Check: Which Milk Company Filed For Bankruptcy

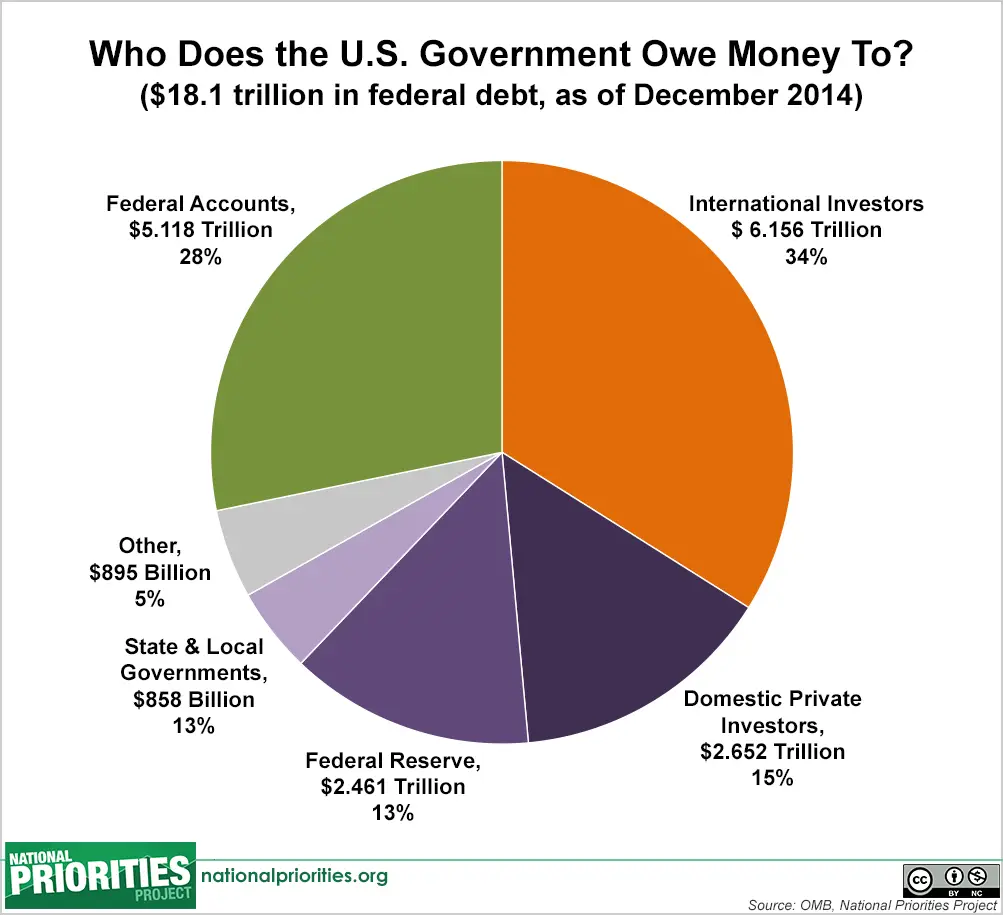

Why The Federal Reserve Owns Treasurys

As the nation’s central bank, the Federal Reserve is in charge of the country’s credit. It doesn’t have a financial reason to own Treasury notes. So why does it?

The Federal Reserve actually tripled its holdings between 2007 and 2014. The Fed had to fight the 2008 financial crisis, so it ramped up open market operations by purchasing bank-owned mortgage-backed securities. The Fed began adding U.S. Treasurys in 2009. It owned $1.6 trillion, by 2011, maxing out at $2.5 trillion in 2014.

This quantitative easing stimulated the economy by keeping interest rates low and infusing liquidity into the capital markets. It gave businesses continued access to low-cost borrowing for operations and expansion.

The Fed purchased Treasurys from its member banks, using credit that it created out of thin air. It had the same effect as printing money. By keeping interest rates low, the Fed helped the government avoid the high-interest-rate penalty it would incur for excessive debt.

The Fed ended quantitative easing in October 2014. Interest rates on the benchmark 10-year Treasury note rose from a 200-year low of 1.43% in July 2012 to around 2.17% by the end of 2014 as a result.

The Federal Open Market Committee said the Fed would begin reducing its Treasury holdings in 2017. But it purchased Treasurys again just a few years later.

What Are The Primary Drivers Of Future Debt

The main drivers are still mandatory spending programs, namely Social Securitythe largest U.S. government programMedicare, and Medicaid. Their costs, which currently account for nearly half of all federal spending, are expected to surge as a percentage of GDP because of the aging U.S. population and resultant rising health expenses. Yet, corresponding tax revenues are projected to remain stagnant.

Meanwhile, interest payments on the debt, which now account for nearly 10 percent of the budget, are expected to rise, while discretionary spending, including programs such as defense and transportation, is expected to shrink as a proportion of the budget.

President Trump signed off on several pieces of legislation with implications for the debt. The most significant of these is the Tax Cuts and Jobs Act. Signed into law in December 2017, it is the most comprehensive tax reform legislation in three decades. Trump and some Republican lawmakers said the bills tax cuts would boost economic growth enough to increase government revenues and balance the budget, but many economists were skeptical of this claim.

The CBO says the law will boost annual GDP by close to 1 percent over the next ten years, but also increase annual budget shortfalls and add another roughly $1.8 trillion to the debt over the same period. In addition, many of the provisions are set to expire by 2025, but if they are renewed, the debt would increase further.

Don’t Miss: When Will Bankruptcy Come Off My Credit Report

Great Depression And Stock Market Crash

People started investing heavily in the stock market in 1920 unaware that Black Tuesday would dawn with an $8 billion loss in market value when the stock market crashed on October 29, 1929. The United States relied on the gold standard and raised inflation, rather than lowering rates to ease the burden of inflation.

During the following era, income inequality between classes grew. More than 25 percent of the workforce was unemployed, people made purchases on credit and were forced into foreclosures and repossessions.

President Franklin D. Roosevelt developed programs for unemployment pay and social security pensions, along with providing assistance to labor unions. Although Roosevelt addressed many problems in the U.S. economy, the funding for his programs grew the national debt to $33 billion.

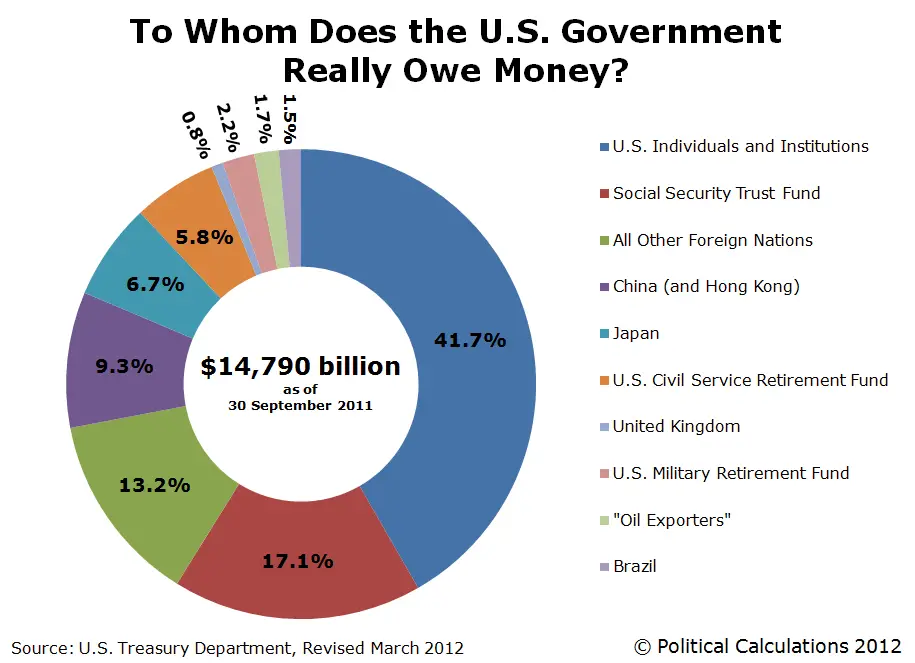

Us Debt: How Big Is It And Who Owns It

US federal debt is still a record high. This week it passed a milestone: the fourth straight year the deficit has passed the $1tn mark. As of today, the national debt stands at $16,066,241,407,385.80 .

It’s an issue that’s sure to come up in the first presidential debate this Wednesday.

So, how does the US borrow money? Treasury bonds are how the US – and all governments for that matter – borrow hard cash: they issue government securities, which other countries and institutions buy. So, the US national debt is owned mostly in the US – but the $5.4tn foreign-owned debt is owned predominantly by Asian economies.

Under President Obama’s first term, that figure has gone up from $3tn, a rise of 74.1%. Under George W Bush, it went up too – by 85% over the whole two terms – and 64% in his second term alone.

Holders of US Treasury bonds, $bn

The US Treasury releases the figures on this every quarter – we have made them more useable. So, who has the most?

It reflects a US national debt which has grown starkly, from $7.8tn in 2005 to busting through the US debt ceiling of $14.294tn last year – according to these day by day figures.

The full data is below. What can you do with it?

Also Check: Are Student Loans Included In Bankruptcy

Debt Grows Into The Trillions During 1980s And 1990s

At the start of the 1980s, an increase in defense spending and substantial tax cuts continued to balloon the federal debt. The national debt at the end of the Ronald Reagan era was $2.7 trillion.

The era under President Bill Clinton was marked with tax increases, reductions in defense spending and an economic boom that reduced the growth of debt, but it still reached a staggering $5.6 trillion by 2000.

The National Debt Is Big And Getting Bigger Does It Matter

WASHINGTON The United States national debt is nestled in a brick-laden underpass just a block away from Times Square. It ticks away, month after month, year after year, never getting smaller, never slowing down.

That national debt clock the brainchild of the real estate tycoon Seymour Durst, who installed it on West 43rdStreet in Manhattan in 1989 isnt actually the national debt. Its a representation of the national debt, a simple tally of how much money the federal government has borrowed from the public and has yet to pay back.

Durst said of the clock when it was installed that it was meant to strike anxiety if not fear into passersby. If it bothers people, he said, then its working.

When Durst died in 1995, the national debt totaled more than $4 trillion. In 2008, less than 20 years later, the debt clock ran out of digits, forcing the Durst Organization to add two more. The clock can now track our collective debt into the quadrillions.

The clock currently reads $28 trillion, give or take, and will grow rapidly in the coming years. The coronavirus pandemic has cost the U.S. economy $16 trillion, give or take, and Congress appropriated more than $3 trillion in aid in 2020.

Lawmakers have echoed Dursts distaste for the national debt for decades, with varying degrees of sincerity. And we are hearing them again, as Congress debates a nearly $2 trillion relief package to respond to the pandemic and its economic fallout.

You May Like: What Happens When You Declare Bankruptcy

What Is The Current National Debt

As of June 23, 2022, the total U.S. national debt was $30.4 trillion, after crossing the $30 trillion mark for the first time in February. At the end of 2019, prior to the COVID-19 pandemic, the national debt was $23 trillion. One year later, it had risen to $27.7 trillion. Since then, it has increased by more than $2 trillion.

Consider Consolidating Or Refinancing While Interest Rates Are Low

For borrowers with credit card debt and other relatively small debts with high interest rates, consolidating your debts could make them more manageable. Debt consolidation loans roll all of your existing debts into one debt, with one monthly payment and one balance. You could pay less in interest on a debt consolidation loan than you would on a credit card, especially while interest rates are low.

Refinancing could be a smart move for people with larger debts, like mortgages, private student loans, and car loans. Refinancing replaces your current loan with a new loan, and can often help to bring down the interest rate. With interest rates currently much lower than they have been in the past, refinancing could be a smart move to lower your interest costs and make headway on your debt.

Read Also: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy