Which Type Of Bankruptcy Is Right For My Situation

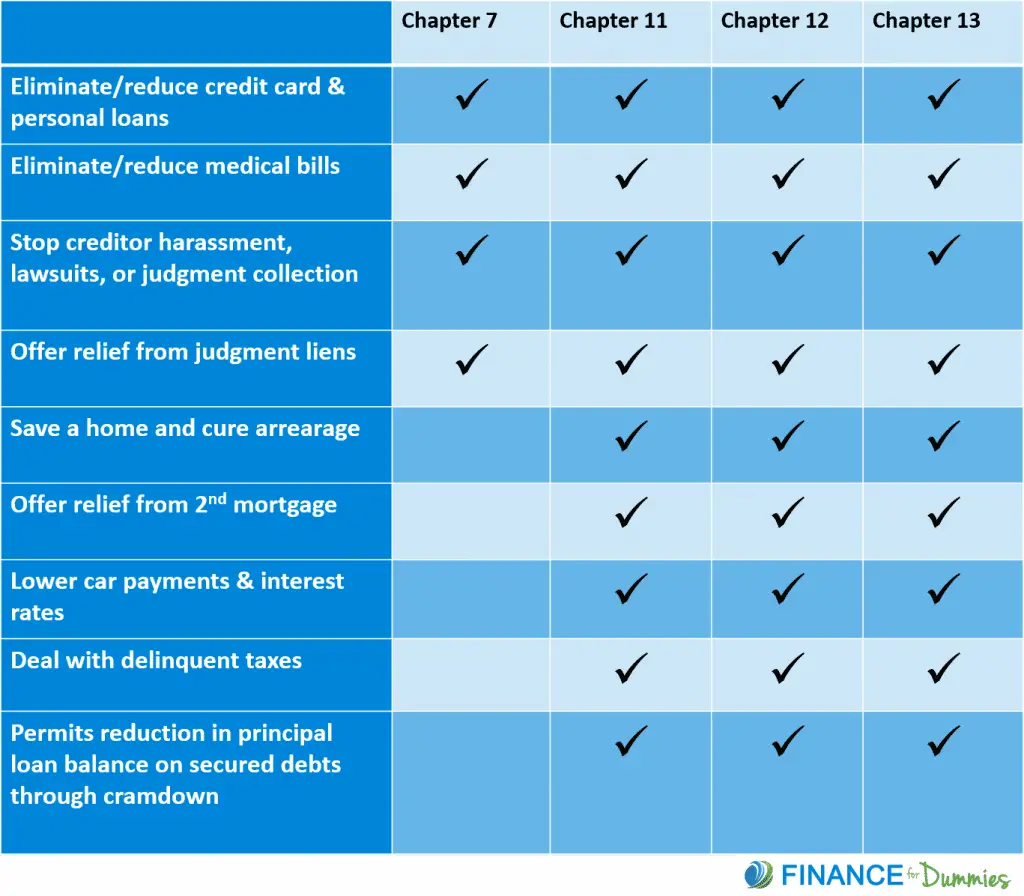

Since the other types of bankruptcies are specifically geared toward certain individuals or businesses, most people only qualify for Chapter 7 or Chapter 13. Heres a side-by-side comparison to show how theyre different:

The biggest difference between Chapter 7 and Chapter 13 bankruptcy comes down to the persons assets and income level. For instance, if someone had a recent job loss or an unsteady income, they might fall into a Chapter 7 bankruptcy. But if the means test says they make enough money to pay back their debts, they would fall into a Chapter 13 instead. Someone might also apply for Chapter 13 if avoiding home foreclosure is a top priority, or they could go for Chapter 7 if timing is an issuesince its significantly faster than Chapter 13.

But bankruptcy is a nerve-wracking experience, and choosing between Chapter 7 and Chapter 13 is like trying to pick the lesser of two evils. In both cases, privacy goes out the window. All your information literally gets laid out on a table for the court to look through. Then theres the fact that about half of Chapter 13 bankruptcy cases nationwide are dismissed because the debtor cant make the monthly payments.4

So, lets look at some ways you can avoid filing for bankruptcy altogether.

What Is Bankruptcy And How Does It Work

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

When youre drowning in debt with no end in sight, you may start wondering if you should file for bankruptcy. There are both benefits and drawbacks to taking this drastic step, so its important to know what youre signing up for. Here, well discuss how bankruptcies work and help you decide if its the right route for you to take.

Also Check: Epiq Corporate Restructuring Llc

When Should A Business File For Bankruptcy

Instead of thinking about how successfulor notyour business is, when considering bankruptcies, think most about your debts and your ability to repay them.

The truth is, if your business is consistently unable to keep up with your debts and expenses, its already bankruptor on a very short trajectory towards it, explains Meredith Wood inAllBusiness. Filing for bankruptcy protection is meant to help you get out of this untenable situation and keep many of your personal assets. You may be able to keep your business open while you pay off debt by reorganizing, consolidating, and/or negotiating terms.

Filing for bankruptcy canlead to the closure of your business, but it can also be used to save your company by allowing you to renegotiate your debt situation. Either way, it doesnt foreclose your ability tostart another business in the future.

While filing for bankruptcy does take recovery time, it isnt the all-time credit-wrecker you may think, Wood continues. Typically, after 10 years, it is removed from your credit history, and youll likely be able to get financing several years before that.

If you feel like your debt and business expenses are overwhelming your small businesss ability to continue, you should think about bankruptcy. The next step is to determine what type of bankruptcy represents the best way to move forward.

Dont Miss: What Is Epiq Bankruptcy Solutions Llc

You May Like: Damaged Freight For Sale

Chapter 13 Bankruptcy: Reorganization

A Chapter 13 bankruptcy also involves repaying creditors. But, instead of selling valuable assets, you use income earned on your job to repay creditors through a repayment plan. Similar to the Chapter 7, there is also a trustee involved. A trustee in a Chapter 13 collects your monthly payment and disburses that money to your creditors.

A Chapter 13 bankruptcy separates your unsecured debt and arrears from your secured debt, and gives you 3 to 5 years to repay the debt. This can be a great resource for someone with mortgage arrears. Typically, a mortgage company might only give a borrower a few months to catch up on past due payments. A bankruptcy would spread those payments over 36-60 months, making the mortgage payments a lot more affordable.

In addition to allowing a longer repayment period for arrears, Chapter 13 repayment plans also allow the debtor to pay less to unsecured creditors. Many people end up paying somewhere between 5 to 80 percent of the total unsecured debt owed. For example, if you owe $10,000 and the courts decide that you only need to pay 40 percent of your debt, you could pay $4,000 and the remaining debt would be wiped away.

In most states, Chapter 13 bankruptcy will stay on your credit report for 10 years from the date filed. Some bureaus will remove this after 7 years from the date filed if a discharge was obtained.

What Are The 6 Types Of Bankruptcy

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Bankruptcy, often considered a last financial resort, is a legal process that can help alleviate outstanding debts for individuals and businesses. Reasons to file for bankruptcy can include divorce, job loss, exorbitant medical bills or credit card debt. There are also alternatives you may want to consider see more about those below.

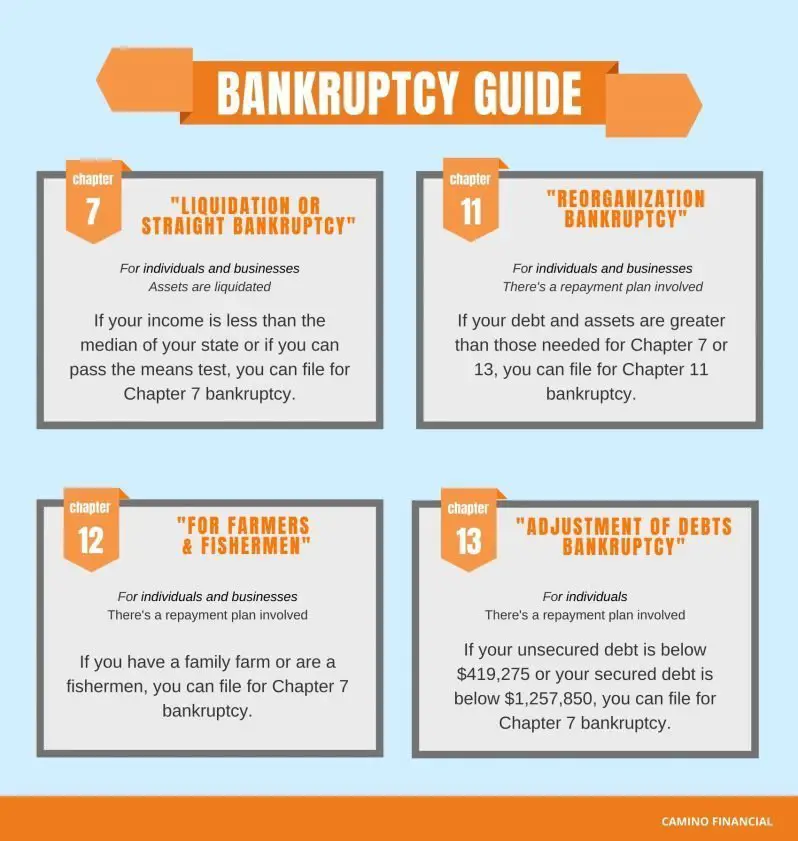

There are several types of bankruptcy six, as a matter of fact. The two most common types of bankruptcy for individuals are Chapter 7 and Chapter 13. But there are four other types of bankruptcy as well, according to the U.S. Bankruptcy Code: Chapter 9, Chapter 11, Chapter 12 and Chapter 15.

The type of bankruptcy you file depends on your situation.

Regardless of which type you file, the process you follow is typically the same: Youll usually find a bankruptcy attorney and make your case before a judge, who will then erase some of your debts or set you up with a repayment plan. Also note that an eligibility requirement for all bankruptcy chapters is that you must undergo credit counseling within the 180 days before filing.

Read Also: Foreclosed Properties For Sale

How Many Types Of Bankruptcy Are There

There are 6 different types of bankruptcy according to the United States Bankruptcy Code. Each one of them is named after the chapter in the code where it is described. Hence, we have the following bankruptcy types: Chapter 7 , Chapter 9 , Chapter 11 , Chapter 12 , Chapter 13 and Chapter 15 . These chapters apply to different circumstances and entities. The most common bankruptcy types people usually resort to are Chapter 7 and Chapter 13 for individuals and Chapter 7or Chapter 11 for companies. In this post, we are going to summarize the most common aspects related to each bankruptcy option.

What Are The Different Chapters Of Bankruptcy

People often wonder what are the different chapters of bankruptcy this is the first step best decision when faced with seemingly impossible debts. Find out more about Chapter 7, Chapter 13, and Chapter 11 bankruptcy and what it can do for your credit and financial situation.

The Key Takeaways

- Chapter 11 Bankruptcy is a plan to reorganize a company. It is often used by large companies to keep them active and pay their creditors.

- Chapter 7 BankruptcyAlthough bankruptcy does not require a repayment plan, you will need to liquidate non-exempt assets in order to repay creditors.

- Chapter 13 Bankruptcy can eliminate qualified debt by a repayment plan that is spread over three or five years.

- Chapter 7, Chapter 11, or Chapter 13 bankruptcy filings can have an impact on your credit score. However, not all of your debts will be erased.

- Bankruptcy can be a complicated legal process. Its best to have a lawyer who is familiar with bankruptcy.

- Consult an experienced bankruptcy attorneyTo determine if bankruptcy is an option, and determine which of the different chapters of bankruptcy might be best for you.

Learn The Different Types of Bankruptcy

Bankruptcy can be used to either reorganize or get rid of your debts. Insolvency is simply when you are unable to pay your bills. This happens most often because your debts exceed your income.

What Is Chapter 11 Bankruptcy?

What Is Chapter 7 Bankruptcy?

What Is Chapter 13 Bankruptcy?

How do you know which type of bankruptcy is right for you?

You May Like: Will Filing Bankruptcy Help My Credit

What Happens When I File A Chapter 7 Case

A bankruptcy proceeding is initiated by filing a petition with the bankruptcy court. When you file for Chapter 7 liquidation, the petition operates as an automatic stay, which generally prevents creditors from pursuing debt collection actions against you unless the bankruptcy judge approves it first. The automatic stay goes into effect immediately upon filing the petition no court hearing or approval by a judge is necessary. When the case is filed, the United States trustee for your judicial district appoints a trustee to review your financial affairs and administer your case. The appointed trustee has the power to liquidate any asset you own that is not by law exempt from collection or subject to a lien in order to pay your creditors.

Chapter 1: Adjustment Of Debts For Individuals With Regular Income

Chapter 13 bankruptcy is a reorganization bankruptcy typically reserved for individuals. It can be used for sole proprietorships since sole proprietorships are indistinguishable from their owners. Chapter 13 is used for small businesses when a reorganization is the goal instead of liquidation. You file a repayment plan with the bankruptcy court detailing how you are going to repay your debts. Chapter 13 and Chapter 7 bankruptcies are very different for businesses.

Chapter 13 allows the proprietorship to stay in business and repay its debts and Chapter 7 does not.

The amount you must repay depends on how much you earn, how much you owe, and how much property you own. If your personal assets are involved with your business assets, as they are if you own a sole proprietorship, you can avoid problems such as losing your house if you file Chapter 13 instead of Chapter 7.

Also Check: Pallet Lots For Sale

The Different Types Of Business Bankruptcies And Their Factors

On Behalf of Debra Booher & Associates Co., LPA | Nov 17, 2022 | Business Bankruptcy |

There are a lot of different types of business bankruptcies. Unique factors affect each and can make certain ones better for your business than others.

Here is what you need to know about business bankruptcies and how they can affect your company.

Chapter 1: Business Reorganization

For a business, bankruptcy does not necessarily mean ruin. If it did, there would be three fewer major air carriers , two fewer car manufacturers , and no Marvel Universe.

Chapter 11 filings which surged during the coronavirus shutdown in 2020 allow troubled businesses to protect themselves from creditors while they reorganize their business operations, debts, and assets.

If all goes well, the business re-emerges a few years later oftentimes smaller, sleeker, more efficient, profitable and creditors have enjoyed a more satisfactory return than they would have if the business ended operations and was liquidated.

Sometimes, however, Chapter 11 buys only time. The reorganization plan fails, and liquidation results. The 2011 demise of Borders Books, once the nations No. 2 bookseller, is a prominent example.

Don’t Miss: Can You Refile Bankruptcy If Dismissed

What Is The Difference Between Chapter 7 11 And 13

If you do some research on bankruptcy, youll likely come across Chapter 11. So, how does Chapter 11 differ from Chapter 7 and Chapter 13? While Chapter 7 and Chapter 13 are personal bankruptcies, Chapter 11 is typically for businesses that have an overwhelming amount of debt.

These businesses arent producing enough revenue to pay their bills and must either shut down operations or file for bankruptcy. When a business files for Chapter 11 bankruptcy, it creates a reorganization plan describing how it will repay its debt.

Is There More Than One Kind Of Bankruptcy

Yes. For individuals, there are two main types of bankruptcies that can be filed: Chapter 7 bankruptcy and Chapter 13 bankruptcy. Chapter 7 cases are also referred to as “liquidation” cases, while Chapter 13 cases are commonly referred to as “debt adjustment” or “wage earner” cases. Individuals may also be eligible for a Chapter 11 bankruptcy, which allows the debtor to propose a plan for reorganization to pay creditors overtime, but Chapter 11 is normally used to reorganize a business. Farmers and fisherman can also file a separate type of bankruptcy available only to farmers under Chapter 12. The word “Chapter” is simply a reference to a chapter number in the Bankruptcy Code.

Don’t Miss: Can You Get Student Loans After Bankruptcy

How To Prevent Bankruptcy

Bankruptcy is generally a last resort, for businesses and individuals alike. Chapter 7 will, in effect, put a business out of business, while Chapter 11 may make lenders wary of dealing with the company after it emerges from bankruptcy. A Chapter 7 bankruptcy will remain on an individuals credit report for 10 years, a Chapter 13 for seven.

While bankruptcy may be unavoidable in many instances , one key to preventing it is borrowing judiciously. For a business, that could mean not using debt to expand too rapidly. For an individual, it might mean paying off their credit card balances every month and not buying a larger home or costlier car than they can safely afford.

Before filing for bankruptcy, and depending on their own internal legal resources, businesses may want to consult with an outside attorney who specializes in bankruptcy law and discuss any alternatives that are available to them.

Individuals are required by law to take an approved credit-counseling course before they file. Individuals also have other resources available to them, such as a reputable debt relief company, which can help them negotiate with their creditors. Investopedia publishes an annual list of the best debt relief companies.

Small Business Bankruptcy In Canada

If a small business is set up as a partnership or sole proprietorship and it ends up insolvent it will be treated like a personal bankruptcy.

The reason for this is that a sole proprietorship or partnership is legally the same as the individual that runs the business.

The assets of the business are not separate from the owners personal assets.

However, when a business is incorporated the business bankruptcy process will be quite different, and can become quite challenging.

An incorporated business and its assets and liabilities are their own legal entity and are separate from the business owner.

If your business is incorporated or a sole proprietorship / partnership we can help you find the trustee for filing bankruptcy who has extensive experience handling business bankruptcies in Canada.

Also Check: Cost To File Chapter 7 Bankruptcy

What Are The Different Types Of Bankruptcy In The United States

While bankruptcy codes vary by country, and some countries may not allow for bankruptcy as many Western countries understand it, there are several types of bankruptcy options available in the United States. These types of bankruptcy are best known for the chapters in the US Code which describes them and their rules. They are Chapter 7, Chapter 11, Chapter 12 and Chapter 13.

Of all the types of bankruptcy, perhaps Chapter 7 is best known. It is also the most severe. All unsecured debts are terminated with money being paid after any assets are liquidated that are not exempt. In most cases, the liquidation of assets will not affect many people, unless they have substantial assets such as land or a second home. Chapter 7 is available both to individuals and corporations.

While Chapter 7 is seen as a termination of all debts, this is not necessarily the case. Some debts, such as secured debts, may be allowed to continue standing. Car loans and home mortgage loans, for example, will still be in effect unless they are defaulted on. If a default does occur, it is nearly like a liquidation in that cars can be repossessed and homes can be foreclosed upon.

Also Check: How To File Bankruptcy In Iowa For Free

Chapter 1: Small Business Payment Plan

While this chapter is normally considered for individuals, Chapter 13 can be used for small business bankruptcy by sole proprietors because the sole proprietor and the individual are indistinguishable in the eyes of the law, they exist as one.

Characteristics:

- A small business that wishes to reorganize rather than liquidate may file for Chapter 13 bankruptcy.

- To do so, it must include a payment plan detailing how debts will be paid.

- And this plan will depend on how much you earn, how much is owed, and the value of the property you own.

Why not file for Chapter 7 liquidation bankruptcy and be done with the debt?

Chapter 13 protects personal property, such as a home, that would be subject to seizure in the event a sole proprietor filed Chapter 7.

Read Also: Pallets Of Merchandise For Sale In Los Angeles

How Do I Find Out Whether I’d Qualify For Chapter 7 Bankruptcy

You’ll take the two-part Chapter 7 means test. If your household income is lower than the median household income in your state, you’ll pass. However, if you don’t qualify after the first part, you’ll have another chance. The second portion of the means test lets you subtract some monthly expenses from your income. If you don’t have enough remaining to pay a meaningful amount to creditors through a Chapter 13 repayment plan, you’ll qualify for Chapter 7.