Impact Of A High Debt

A high debt-to-income ratio can have a negative impact on your finances in multiple areas. First, you may struggle to pay bills because so much of your monthly income is going toward debt payments.

A high debt-to-income ratio will make it tough to get approved for loans, especially a mortgage or auto loan. Lenders want to be sure you can afford to make your monthly loan payments. High debt payments are often a sign that a borrower would miss payments or default on the loan.

While your credit score isnât directly impacted by a high debt-to-income ratio, some of the factors that contribute to a high debt-to-income ratio could also hurt your credit score. More specifically, high credit card and loan balances, which may play a role in your high debt-to-income ratio, can hurt your credit score.

How To Get A Car Loan With A High Debt

There are two sets of ways to get a car loan with a high debt-to-income ratio because fractions have a numerator and denominator.

Lenders use the DTI ratio to determine if you can afford a specific vehicle and set a maximum ranging from 35% to 55%.

You can improve your DTI by lowering the numerator , increasing the denominator , or both.

You can reduce your monthly debt installments by extending the term, making a down payment, improving your credit score, or choosing a cheaper vehicle.

Or, you might boost your earnings by reporting on all income sources or picking up a side gig to increase your wages.

What Factors Make Up A Dti Ratio

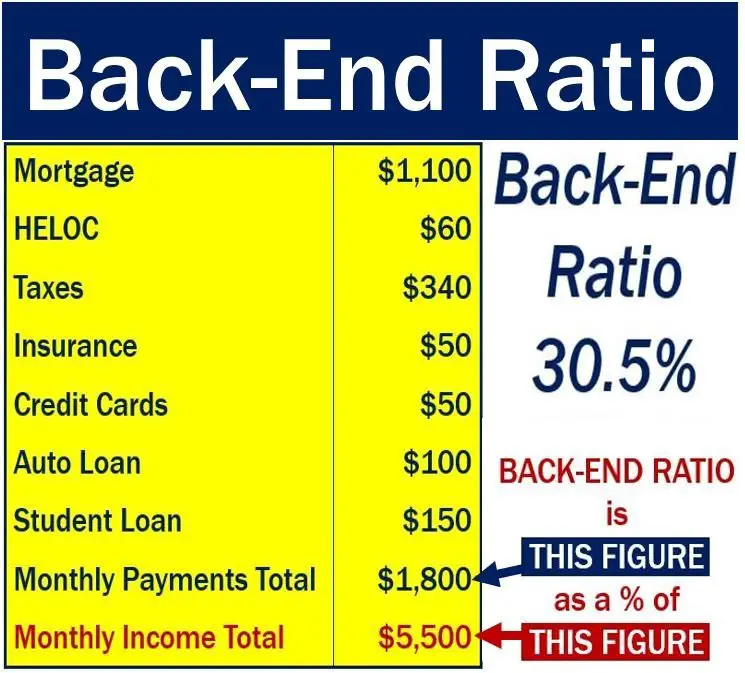

- Front-end ratio: also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

Recommended Reading: What Are The Requirements To File Chapter 7 Bankruptcy

How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johnâs income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

Divide Your Debt Payment By Your Gross Income

Now that youâve determined your monthly gross income and your monthly debt payments, use the following formula to finish your calculations:

monthly debt payment total / gross monthly income = debt-to-income ratio

In other words, divide your monthly debt payment total by your gross monthly income.

For example:Using the values above, divide your monthly debt payment total of $2,400 by your gross monthly income of $3,467. This would result in a debt-to-income ratio of 0.69.

You May Like: Usaa Auto Loan Eligibility Requirements

Read Also: What Does Bankruptcy Petition Mean On Credit Report

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

Does Your Dti Affect Your Credit Score

Your debt-to-income ratio does not affect your credit scores credit-reporting agencies may know your income but do not include it in their calculations.

But your credit-utilization ratio, or the amount of credit youre using compared with your credit limits, does affect your credit scores. Credit reporting agencies know your available credit limits, both on individual cards and in total, and most experts advise keeping the balances on your cards no higher than 30% of your credit limit. Lower is better.

To reduce your debt-to-income ratio, you need to either make more money or reduce the monthly payments you owe.

Recommended Reading: What To Bring To Bankruptcy Attorney

Paying Down Debt Or Increasing Your Income Can Help Improve Your Dti Ratio

. Your DTI is over the limit. DTI For Car Loan. Start Today-Talk To A Debt Specialist.

Learn whether you have a healthy level of debt that wont hinder you from applying for a new home loan or use this. This DTI calculator is an essential first step in the home-buying process. Speak With Trained Agents.

The debt-to-income formula is simple. In these examples the lender holds the deed or title which is a representation of ownership until the secured loan is fully. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you.

Ad Debt Help Without The Loans Or Bankruptcy. Then multiply that number by 100. Ad Auto Approve is the ideal way to get out of your high-interest auto loan.

Check our financing tips and find cars for sale that fit your budget. Learn whether you have a healthy level of debt that wont hinder you from applying for a new home loan or use this. We Make It Easy To Get Your Funds In As Little As 24 Hours.

Why are you paying more than you need to for your car loan. Lenders use it to determine the risk factor involved in providing loans. Total monthly debt payments divided by total monthly gross income before taxes and other deductions.

Start Today-Talk To A Debt Specialist. The most common secured loans are mortgages and auto loans. Get Helpful Advice and Take Control of Your Debts.

Net Worth Calculator Find Your Net Worth Nerdwallet Net Worth Consumer Debt Personal Loans

Whats The Maximum Dti For A Car Refinance Loan

There isnt a universal maximum DTI for auto refinancing it varies from lender to lender.

RateGenius reviewed financing application data between 2015 and 2019 and found that 90% of approved auto refinance loan applicants had a DTI of less than 48%. However, if youre DTI is higher, you could still get approved for a car loan or refinance loan.

48% DTIFrom 2015 to 2019, 90% of approved auto refinance loan applicants had a DTI of less than 48%.RateGenius

According to Joel Benavides, Consumer Credit Manager at RateGenius and consumer lending veteran, There really isnt a max DTI for auto loans because the variance by lender is all over the place. The average max DTI for our lenders is around 50%, which is close to baseline from my experience.

In other words, one auto refinance lender may have a max debt-to-income ratio of 40% while another might not have a cap at all, choosing to focus more on other factors.

So, if you want to keep it simple, a good DTI is below 36%, but you can still get a loan if your DTI ratio is below 50%. Anything above 50% and you should consider paying down your existing debt. Or else, you may be entering subprime loan territory.

Compare Auto Refinance Rates

You May Like: Foreclosed Homes For Sell

Building A Car Buying Budget

It’s important that you stay in control of your own auto loan deal. A good way to do this is to prepare a car buying budget ahead of time. Remember that sticker price is just one aspect of the loan process. You can expect more fees to increase your total.

Some of these additional fees are negotiable, such as dealer add-ons and doc fees. Others like tax, title, and license fees are non-negotiable. You can also expect to need a down payment as a bad credit borrower. Usually, subprime lenders require you to bring in around $1,000 or at least 10% of the vehicle’s selling price, sometimes whichever is less.

Why Do Lenders Care About My Debt

When a lender considers whether or not to let you borrow money, it wants information about how you handle your finances both past and present. So lenders will look at different factors like your , and debt-to-income ratio to get an idea of your financial picture.

When lenders see a healthy debt-to-income ratio, it can help them feel more confident that youll be able to make your loan payments. This might help you qualify for financing.

Also Check: Can You File Bankruptcy On A Court Ordered Judgement

Car Payment Percentage Of Income

The rule of thumb that most people tend to follow is spending ten percent or less of your monthly pay after taxes on a car. There is a bit of flexibility if you budget this way. Consider some of the following advice:

Before shopping, take a long look at your budget. Figure out what you are comfortable paying each month. This is just as important as the cost of the car. The payment should be less than 10 percent of your take-home paycheck. Another factor you should consider is that the total price of the car should be less than somewhere between 15 to 20 percent of your yearly income.

This may make you feel that you can’t afford a decent vehicle. If you consider your budget and balance your spending, however, things will look different. You should put 50 percent of your income for needs such as housing, food, and transportation. Another 30 percent should be for your wants, such as travel and entertainment. The final 20 percent should be for savings and paying off credit cards.

While 10 percent of your take-home money for a car will seem extreme, when you look at the entire budget and work it in a balanced fashion, it will make sense.

Also read: Professional Debt Mediation What It Is and How It Works

Debt To Income Ratio For Car Loan: Get Approved With High Dti

If youre looking to get approved for an auto loan, your debt-to-income ratio will be one of the first things taken into consideration by your lender. In fact, many lenders wont even consider applicants with DTIs over 40%.

Unfortunately, if you have high debts and a small income, this may disqualify you from most car loans. However, there are some options available to help you get around these hurdles. Heres how to get a car loan with a high debt-to-income ratio.

Don’t Miss: How Long Does Bankruptcy Stay On Record

Should I Include My Spouses Debt

In states where you have the option to do so, this depends on how beneficial it is for you. Having two incomes available means that you could qualify for larger loans. Combined debt and income could give a lower, stronger DTI ratio.

Applying as a couple would be ideal in such a case. However, if a couples combined credit score and debt-to-income ratio severely affect the prospects of qualifying for a good mortgage, it might be better to apply as an individual.

Read Also: Fha Limits In Texas

Dti Ratio For Auto Loans

Naturally, the lower your DTI percentage, the better. If youre applying for an auto loan, lenders typically want to see a DTI of no more than 36 percent of your monthly gross income. For example, if you make around $2,500 a month, you may be denied a car loan if your monthly debt payments total more than $900 a consistently high debt-to-income ratio stands out to lenders as a habitual bad credit factor.

You May Like: Unclaimed Pallets For Sale

Could Refinancing An Auto Loan Affect Mortgage Approval

Refinancing your existing car loan can be worth considering if it can help reduce your DTI. Even if your credit score dips slightly with the inquiry and new account, it may not be an issue if your score is high enough to absorb it.

Another way to reduce your DTI is to pay down your auto loan or a different installment loan enough that you only have 10 or fewer payments left on the account. Once a loan gets to that point, mortgage lenders can exclude the payment from your DTI calculation.

You can also postpone other large purchases to keep your credit card balances down and make other efforts to pay down small balances to eliminate the monthly payment.

How To Calculate Your Debt

Here’s an example:

You pay $1,900 a month for your rent or mortgage, $400 for your car loan, $100 in student loans and $200 in credit card paymentsbringing your total monthly debt to $2600.

Your gross monthly income is $5,500.

Your debt-to-income ratio is 2,600/5,500, or 47%.

Recommended Reading: Does A Married Couple Have To File Bankruptcy Together

What Is A Debt To Income Ratio For A Car Loan

What does a debt to income ratio mean? I want to take out a loan to purchase a car, but my friend said I will get approved if I have a low debt to income ratio.

a lower debt to income ratio will increase your chances of getting approved for a loanhow much you earn with how much debt you oweyour monthly debt payments and dividing that by your monthly income$6000$1,80030%30% of what you earn in a month goes towards making these monthly financial payments43%less than 36%before

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

Also Check: Secu Houses For Sale

Finding A Loan That Works For You

Now that you know you need to have a little space in your budget for auto loan approval, you need to find a lender that knows how to work with credit-challenged consumers. Subprime lenders are found through special finance dealerships, but they can be hard to pick out of a crowd.

Instead of searching all over town for a dealer that has the right lending resources, start here at Auto Credit Express. We’ve been connecting borrowers with less than perfect credit to dealerships in their local areas for over 20 years now, and we want to help you, too. There’s never any obligation, and the process is fast and free. Get started right now by filling out our car loan request form and we’ll get right to work for you.

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

You May Like: How To Find Companies In Bankruptcy

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

You Need To Know This Number If Youre Going For A Mortgage

Your debt-to-income ratio is a personal finance measure that compares the amount of debt you have to your gross income. You can calculate your debt-to-income ratio by dividing your total recurring monthly debt by your gross monthly income

Why do you need to know this number? Because lenders use it as a measure of your ability to repay the money you have borrowed or to take on additional debtsuch as a mortgage or a car loan. Itâs also a helpful number for you to know as you consider whether you want to make a big purchase in the first place. This article will walk you through the steps to take to determine your debt-to-income ratio.

Also Check: How To File Bankruptcy In Iowa For Free