What Is A Debt

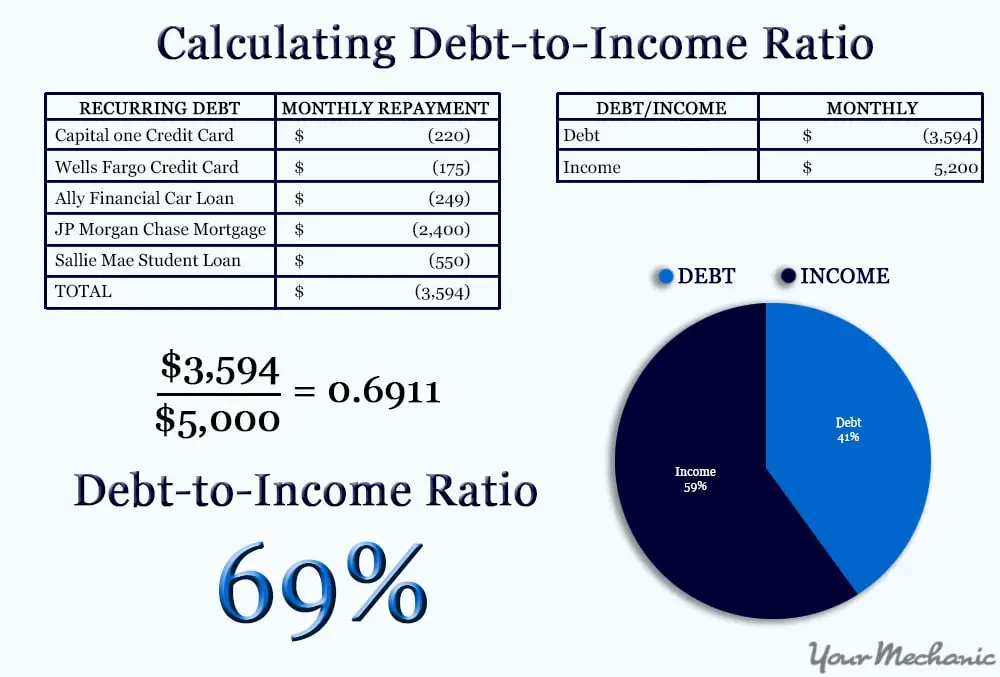

A debt-to-income, or DTI, ratio is derived by dividing your monthly debt payments by your monthly gross income. The ratio is expressed as a percentage, and lenders use it to determine how well you manage monthly debts — and if you can afford to repay a loan.

Generally, lenders view consumers with higher DTI ratios as riskier borrowers because they might run into trouble repaying their loan in case of financial hardship.

To calculate your debt-to-income ratio, add up all of your monthly debts rent or mortgage payments, student loans, personal loans, auto loans, credit card payments, child support, alimony, etc. and divide the sum by your monthly income. For example, if your monthly debt equals $2,500 and your gross monthly income is $7,000, your DTI ratio is about 36 percent. .

How Does Your Debt

An important metric that your bank uses to calculate the amount of money you can borrow is the DTI ratio comparing your total monthly debts to your monthly pre-tax income.

Depending on your , you may be qualified at a higher ratio, but generally, housing expenses shouldnt exceed 28% of your monthly income.

For example, if your monthly mortgage payment, with taxes and insurance, is $1,260 a month and you have a monthly income of $4,500 before taxes, your DTI is 28%.

You can also reverse the process to find what your housing budget should be by multiplying your income by 0.28. In the above example, that would allow a mortgage payment of $1,260 to achieve a 28% DTI.

Talk To Freedom Mortgage About Buying A Home

Freedom Mortgage is committed to fostering homeownership across America. We can help you buy a home with a conventional, VA, FHA, or USDA loan. Visit our Get Started page or call one of Freedom Mortgage’s friendly loan advisors at .

Recommended Reading: How To Appeal A Bankruptcy Court Decision

How Much Does Your Debt

Your DTI never directly affects your or . may know your income but they dont include it in their calculations. Your is still factored into your home loan application. However, borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score. Lowering your credit utilization ratio will help boost your credit score and lower your DTI ratio because you are paying down more debt.

Why Is Dti Important

Your DTI is important to both you and lenders because it demonstrates that you have a good balance of debt and incoming funds. It proves to lenders that you are responsible with your money and that you can handle additional debt.

The Consumer Financial Protection Bureau requires that mortgage lenders examine your financial health before you take out a loan to assure that you can afford to repay the money. Calculating your DTI is one of a few ways they go about doing this. If your DTI percentage is low enough, you may qualify for a better loan than you would if you were responsible for more debt. On the other hand, if your DTI is too high, lenders may be unwilling to grant you a mortgage loan, so its important to make sure your DTI is within an acceptable range.

Recommended Reading: What Does Chapter 11 Bankruptcy Mean

How To Calculate Your Debt

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, you’d then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, you’d take 0.3 and multiply it by 100, giving you a DTI of 30%.

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross household income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Also Check: Amazon Pallets For Sale Denver

What Factors Make Up A Dti Ratio

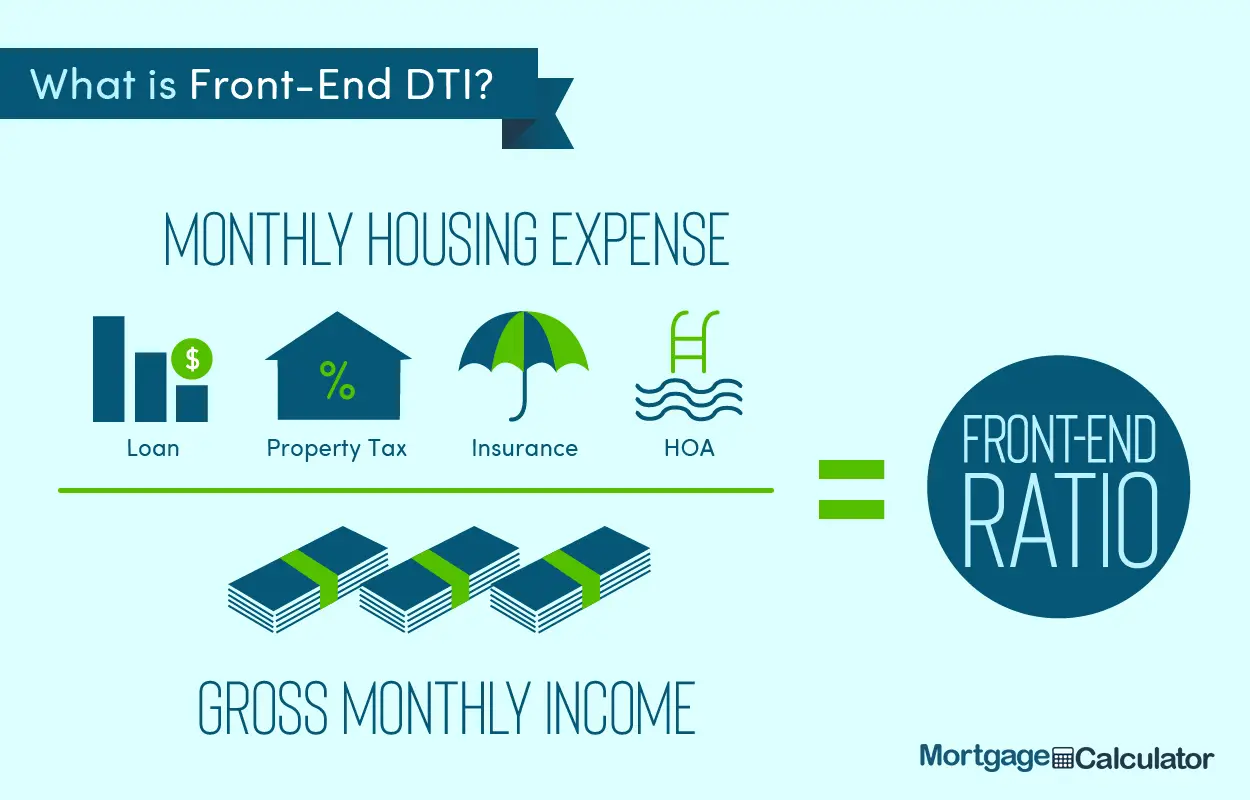

There are two components mortgage lenders use for a DTI ratio: a front-end ratio and back-end ratio. Here’s a closer look at each and how they are calculated:

- Front-end ratio, also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

Next Step: Understand The Total Cost Of Borrowing

When considering a new loan or restructuring your current debts, remember to consider your borrowing costs. Extending the term of your loan may lower your monthly payment, but you may pay more in interest over the life of the loan, increasing your total payments.

Only one qualifying relationship discount may be applied per application. All loans are subject to qualification. To learn which checking accounts qualify, please consult a Wells Fargo banker.

Personal Loans: To qualify for a customer relationship discount, you must maintain a qualifying Wells Fargo consumer checking account and make automatic payments from a Wells Fargo deposit account. If automatic payments are not selected at account opening, or are canceled for any reason at any time after account opening, the interest rate and the corresponding monthly payment may increase.

Home Equity: To qualify for a customer relationship interest rate discount, you must maintain a qualifying Wells Fargo consumer checking account or mortgage relationship and make automatic payments from a qualified consumer deposit account.

Wells Fargo Bank, N.A. Member FDIC.

Don’t Miss: Do Married Couples Have To File Bankruptcy Together

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

How Much Debt Does The Average Canadian Have Before They Seek Help

Debt-to-income ratio is a good metric to use to decide if youll need help to get out of debt. When your DTI is too high to get approved for new loans, you wont be able to consolidate on your own. This means youll need help to get out of debt. is usually the right place to start, so you can get an unbiased expert opinion on the best way to get out of debt in your unique financial situation.

To help you understand when it may be time to get help, this map shows the average debt-to-income ratio of Canadians whove called us for help. You can see the average DTI for other Canadians in different provinces and territories that realized that they needed help to get out of debt.

Dont wait for your debt to get any higher before you ask for help. Get a free evaluation from a trained credit counsellor now.

Read Also: How Long To Get Discharged From Bankruptcy

Should You Worry About Your Dti

No. Instead of worrying about your debt-to-income ratio, you should work towards lowering the number to a more favorable percentage. The DTI is an important tool for lending institutions, but it is only one of the many barometers they use to gauge how safe it would be to lend you money.

However, when it comes to buying a home, your DTI sits front and center on the negotiation table. You will certainly incur higher interest rates with a high DTI, and you may be required to slap down a heftier down payment.

Seasoned lenders know that a ratio above 40 percent means you’re treading on the slippery slope to fiscal collapse. It says you’re making ends meet, but just barely. Lenders will assume that any additional loan you take on might be the last straw.

Can you lower your DTI? Of course! Lowering your ratio is almost as easy as calculating it. Then again, it will take you a lot longer. Fortunately, it’s easier and quicker than improving your credit score, but it does require a major shift in your way of thinking.

Can you reduce your DTI to zero? Maybe or maybe not, but that’s still a goal worth setting. Use the following tips to put your best foot forward for lenders.

How Much Mortgage Payment Can I Afford

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a down payment. As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

While your household income and regular monthly debts may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.

You May Like: How To File For Bankruptcy In Ri

Know Which Mortgage Option Is Right For You

Okay, now lets talk about types of mortgages. Most of them are garbage designed to help you pay for a home even if you cant afford it.

But when you do the math, you find that these mortgages charge you tens of thousands of dollars more in interest and fees and keep you in debt for decades longer than the option we recommend.

Thats why getting the right mortgage is so important! Setting boundaries on the front end makes it easier to find a home you love thats in your budget.

Here are the guidelines we recommend:

- A fixed-rate conventional loan. With this option, your interest rate is secure for the life of the loan, keeping you protected from the rising rates of an adjustable-rate loan.

- A 15-year term. Your monthly payment will be higher with a 15-year term, but youll pay off your mortgage in half the time of a 30-year termand save tens of thousands in interest.

Your mortgage lender will most likely approve you for a bigger mortgage than you can actually afford. Do not let your lender set your home-buying budget. Ignore the banks numbers and stick with your own.

Knowing your house budget and sticking to it is the only way to make sure you get a mortgage you can pay off as fast as possible.

Read Also: How To Find A Good Mortgage

The Annual Salary Rule

The ideal mortgage size should be no more than three times your annual salary, says Reyes.

So if you make $60,000 per year, you should think twice before taking out a mortgage thats more than $180,000. However, if you have a partner, and your combined income is $120,000, you can comfortably increase your loan amount to $360,000.

Thats not to say you should always opt for the most expensive mortgage you can qualify for. If you settle on something below your max, youll have more wiggle room to put money into a savings account or pay for other costs like home renovations.

You May Like: How To Become A Mortgage Specialist

Also Check: What Happens When You Declare Bankruptcy In Monopoly

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

Don’t Miss: What Happens After Bankruptcy Petition Is Filed

The Standard Mortgage To Income Ratio Rules

All loan programs have their own maximum debt ratio allowances as follows:

- FHA 31%

- Conventional 28%

- USDA 29%

The VA doesnt have a maximum housing ratio they focus on the total debt ratio, which compares your total monthly debts . Any subprime loans or loans from lenders that arent one of the above will have their own guidelines per the lenders discretion.

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Read Also: Can You Buy A Car While In Chapter 13 Bankruptcy

Our Standards For Debt

Once youve calculated your DTI ratio, youll want to understand how lenders review it when they’re considering your application. Take a look at the guidelines we use:

35% or less: Looking Good – Relative to your income, your debt is at a manageable level

You most likely have money left over for saving or spending after youve paid your bills. Lenders generally view a lower DTI as favorable.

36% to 49%: Opportunity to improve

Youre managing your debt adequately, but you may want to consider lowering your DTI. This may put you in a better position to handle unforeseen expenses. If youre looking to borrow, keep in mind that lenders may ask for additional eligibility criteria.

50% or more: Take Action – You may have limited funds to save or spend

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may limit your borrowing options.

How Does The Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Also Check: How To File Chapter 7 Bankruptcy In Virginia

Should I Apply For A Home Loan With A High Dti

In limited instances, high debt-to-income ratios mean lenders may be less willing to give you a mortgage loan or may ask you to pay a higher interest rate for the loan, costing you more money. While you can still apply for and receive a mortgage loan with a high DTI, its best to look for ways to lower the ratio if possible so you can get a better interest rate.