How Is The Administration Forgiving Student Loans In 2022

The recent changes don’t face the legal scrutiny of wide-ranging debt relief, yet. Starting July 1st, 2023, borrowers who are disabled won’t have to have their earnings reviewed for three years after they claim relief. Those who attended a school that closed suddenly will have their debt forgiven automatically after a year. The Education Department also streamlined a debt forgiveness program geared toward public service workers and simplified the process for qualifying for relief through income-driven repayment plans.

In addition, the administration has said it will discharge the debts of tens of thousands of students who attended predatory institutions like Corinthian Colleges and ITT Technical Institute. And the new rules will make it easier for borrowers to sue universities that defrauded them.

Previously, borrowers generally had to apply for relief individually through the so-called borrower defense rule. The time-intensive and bureaucratic process has left many behind. As of September more than 392,000 applications were awaiting review by the Education Department. The new rule bars institutions from requiring students to sign non-arbitration clauses and allows legal services groups to take on their cases in class-action suits.

Advocates for students ripped off by predatory institutions, including the National Student Legal Defense Network, have long been pushing for the administration to adopt this practice.

How Does The National Debt Affect Me

Interest payments also have an important role as they grow in step with the national debt. As the government allocates more funds towards paying off interests, other investment areas could get crowded out. Areas such as education, research and development, and infrastructure may not progress at sufficient or adequate levels due to interest payments. Interest payments currently take many of the dollars that are raised through federal income, estate, and federal excise taxes. Net worth is also an important and interesting factor that can be affected by the national debt.The cost of borrowing money to purchase large assets such as homes will increase due to the Federal Reserves interest rates. Interest rates will push down the prices of homes as individuals will struggle to qualify for mortgage loans this will then lower prices on home values.

Raising Reserve Requirements And Full Reserve Banking

Two economists, Jaromir Benes and Michael Kumhof, working for the International Monetary Fund, published a working paper called The Chicago Plan Revisited suggesting that the debt could be eliminated by raising bank reserve requirements and converting from fractional-reserve banking to full-reserve banking. Economists at the Paris School of Economics have commented on the plan, stating that it is already the status quo for coinage currency, and a Norges Bank economist has examined the proposal in the context of considering the finance industry as part of the real economy. A Centre for Economic Policy Research paper agrees with the conclusion that “no real liability is created by new fiat money creation and therefore public debt does not rise as a result.”

The debt ceiling is a legislative mechanism to limit the amount of national debt that can be issued by the Treasury. In effect, it restrains the Treasury from paying for expenditures after the limit has been reached, even if the expenditures have already been approved and have been appropriated. If this situation were to occur, it is unclear whether Treasury would be able to prioritize payments on debt to avoid a default on its debt obligations, but it would have to default on some of its non-debt obligations.

Recommended Reading: How Often Can You File Bankruptcy In Kentucky

Tracking The Federal Deficit: April 2019

The Congressional Budget Office reported that the federal government generated a $161 billion surplus in April, the seventh month of Fiscal Year 2019, for a total deficit of $531 billion so far this fiscal year. Aprils surplus is 33 percent less than the surplus recorded a year earlier in April 2018. If not for timing shifts of certain payments, the surplus would have been 5 percent smaller than the surplus in April 2018. Total revenues so far in Fiscal Year 2019 increased by 2 percent , while spending increased by 6 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Income tax refunds were down by 5 percent compared to last tax season, contrary to many analysts expectations. Further, outlays from the refundable earned income and child tax credits increased by 12 percent versus last year, reflecting expansions enacted in the Tax Cuts and Jobs Act of 2017. Net interest payments on the public debt continued to rise, up 13 percent compared to last year, largely as a result of higher interest rates and the nations steadily growing debt burden.

Fannie Mae And Freddie Mac Obligations Excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of Fannie Mae and Freddie Mac has made the U.S. government reluctant to incorporate them into its own books. When the two mortgage companies required bail-outs, White House Budget Director Jim Nussle, on September 12, 2008, initially indicated their budget plans would not incorporate the government-sponsored enterprise debt into the budget because of the temporary nature of the conservator intervention. As the intervention has dragged out, pundits began to question this accounting treatment, noting that changes in August 2012 “makes them even more permanent wards of the state and turns the government’s preferred stock into a permanent, perpetual kind of security”.

You May Like: Does Personal Bankruptcy Affect My Spouse

How The National Debt Affects You

When the national debt is below the tipping point, government spending continues and contributes to a growing economy, which means more funding for programs that you can take advantage of.

But when the debt exceeds the tipping point, your standard of living could be impacted. Interest rates may increase and that could slow the economy. The stock market could react to a lack of investor confidence, which could mean lower returns on your investments. And a recession may even be possible.

This also puts downward pressure on a countrys currency because its value is tied to the value of the countrys bonds. As the currencys value declines, foreign bond holders’ repayments are worth less. That further decreases demand and drives up interest rates. As the currencys value declines, goods and services may become more expensive and that contributes to inflation.

How Bad Is National Debt

Americans living with high levels of government and private debt tend to see saving in a positive light, while treating borrowing as a problem. In fact, they go hand in hand since borrowings come from savings and provide savers with the interest they earn from deferring consumption.

U.S. national debt provides corresponding low-risk assets for pension funds and families, and enables consumption in excess of production for the country as a whole.

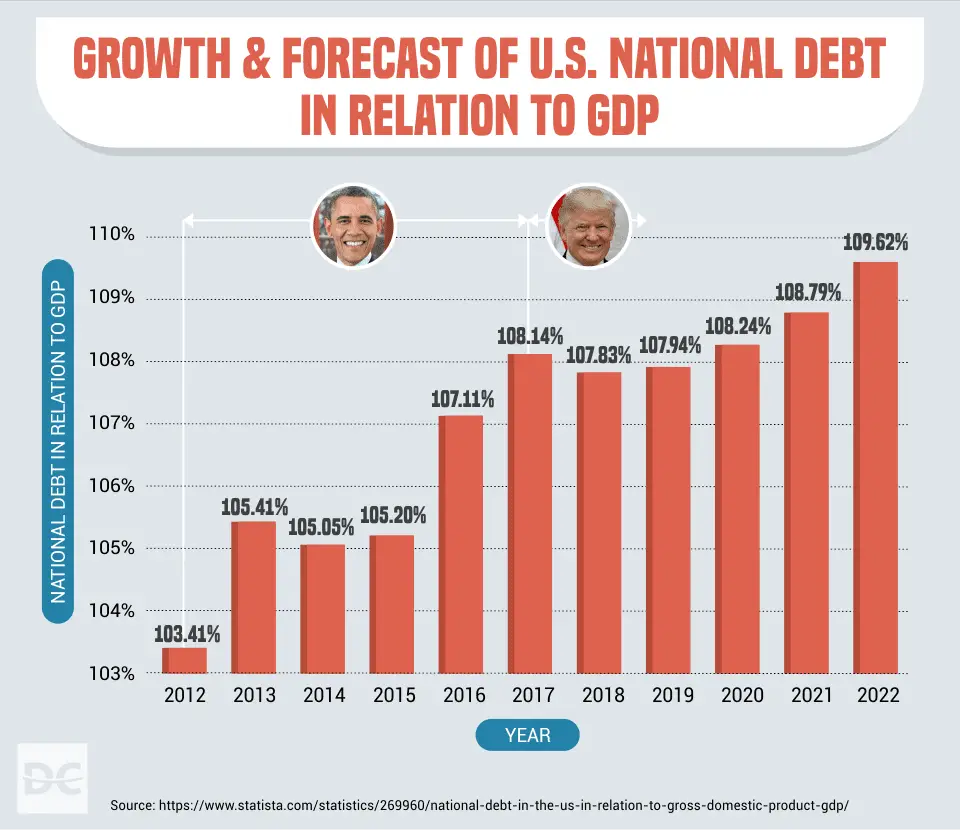

At the same time, nothing more than simple arithmetic is required to see the pace of the recent growth of government debt as unsustainable. That’s the term the U.S. Treasury used in the Financial Report of the U.S. Government for Fiscal Year 2021, after calculating that under prevailing trends the federal debt-to-GDP ratio would increase from 100% in 2021 to 701% by 2096.Economists and policy analysts on the left often differ from those on the right in evaluating the tradeoffs between the everyday utility of government debt and its growing risks amid rapid accumulation.

Critics of public debt often contend it can crowd out private investment, a theory not supported by U.S. credit markets developments in recent decades. In contrast, economists using Modern Monetary Theory argue government borrowing can improve economic outcomes if it fosters public investment that expands the economy’s productive potential.

Don’t Miss: Family Trust Foreclosed Homes

Why Is The Us In Debt To China

The U.S. doesn’t restrict who may buy its securities. China invests in U.S. debt because of the positive effect these low-risk, stable investments can have on its economy. By investing in dollar-denominated securities, the value of the dollar increases relative to the value of China’s currency, the yuan. This, in turn, makes Chinese goods cheaper and more attractive than U.S. goods to buyers. That increases sales and strengthens the economy.

How Is The Debt Ceiling Raised

Inflation and legislation that expands government activities require the debt ceiling to be raised.

If the debt ceiling is not raised, the Treasury must resort to alternative measures to raise funds. Once those measures are exhausted, the government would go bankrupt. Politics can result in Congress refusing to raise the debt ceiling to gain concessions on other areas of policy.

Also Check: How Many Times Has Mike Bloomberg Filed For Bankruptcy

What Is National Debt

National debt denotes the outstanding obligations of a country. Such obligations may also be called government debt, federal debt, or public debt.

The national debt of the United States is what the federal government owes creditorsincluding debt held by the public and federal government trust funds. U.S. national debt totaled $30.5 trillion as of July 15, 2022.

Public And Government Accounts

As of July 20, 2020, debt held by the public was $20.57 trillion, and intragovernmental holdings were $5.94 trillion, for a total of $26.51 trillion. Debt held by the public was approximately 77% of GDP in 2017, ranked 43rd highest out of 207 countries. The CBO forecast in April 2018 that the ratio will rise to nearly 100% by 2028, perhaps higher if current policies are extended beyond their scheduled expiration date.

The national debt can also be classified into marketable or non-marketable securities. Most of the marketable securities are Treasury notes, bills, and bonds held by investors and governments globally. The non-marketable securities are mainly the “government account series” owed to certain government trust funds such as the Social Security Trust Fund, which represented $2.82 trillion in 2017.

The non-marketable securities represent amounts owed to program beneficiaries. For example, in the cash upon receipt but spent for other purposes. If the government continues to run deficits in other parts of the budget, the government will have to issue debt held by the public to fund the Social Security Trust Fund, in effect exchanging one type of debt for the other. Other large intragovernmental holders include the Federal Housing Administration, the Federal Savings and Loan Corporation’s Resolution Fund and the Federal Hospital Insurance Trust Fund .

Don’t Miss: Can You File Bankruptcy On Utility Bills

What Is Mohela The Missouri Agency At The Center Of The Student Debt Relief Court Battle

This week, President Joe Biden’s plan to wipe away billions of dollars in student debt was halted by a panel of federal judges. The case in question stemmed from a challenge by six Republican-led states seeking to block the program, accusing the White House of overreaching its authority. One of the states involved is Missouri, and central to the state’s argument to block the program is a Missouri agency called MOHELA.

Here’s what you need to know about MOHELA, Missouri’s lawsuit to block student debt relief, and what could come next.

Tracking The Federal Deficit: December 2018

The Congressional Budget Office reported that the federal government generated an $11 billion deficit in December, the third month of Fiscal Year 2019, for a total deficit of $317 billion so far this fiscal year. If not for timing shifts of certain payments, the deficit in December would have been roughly $32 billion, according to CBO. Decembers deficit is 52 percent lower than the deficit recorded a year earlier in December 2017. Total revenues so far in Fiscal Year 2019 increased by 0.1 percent , while spending increased by 9.4 percent , compared to the same period last year.

Analysis of Notable Trends in December 2018: Revenue from customs duties spiked by 83 percent from October-December 2018, relative to the same period in 2017, due to the administrations imposition of new tariffs. Conversely, corporate income tax revenue declined by 15 percent from October-December 2018 relative to the same period in 2017. This dip mainly reflects the reduction of corporate tax rates enacted in the Tax Cuts and Jobs Act of 2017. On the spending side, interest payments on the federal debt in December 2018 rose by 47 percent relative to December 2017.

Also Check: Trustee Sale Vs Foreclosure

Who Decides How Much Interest The Us Pays On Its Debt

Supply and demand. In other words, the marketplace. When the government needs to raise debt financing, it sells debt securities in an auction. Bidders offer to buy the debt for a specific rate, yield, or discount margin, and all successful bidders receive the highest yield or discount the Treasury accepts. Government debt buyers may include central banks, though their goal is typically to foster sustainable economic growth rather than to finance deficit spending.

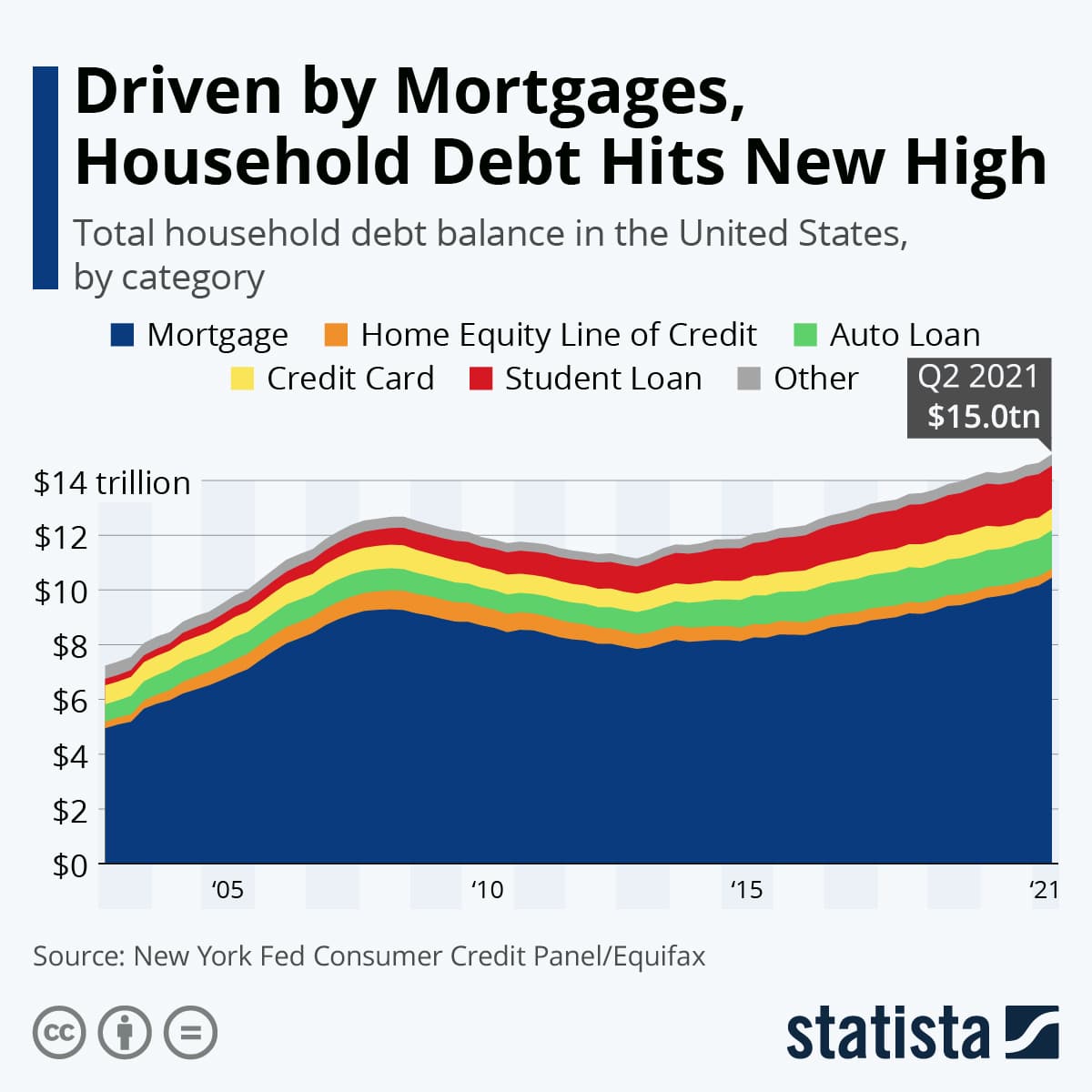

Total Household Debt Reaches $1651 Trillion In Q3 2022 Mortgage And Auto Loan Originations Decline

NEW YORKThe Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit . The Report shows an increase in total household debt in the third quarter of 2022, increasing by $351 billion to $16.51 trillion. Balances now stand $2.36 trillion higher than at the end of 2019, before the pandemic recession. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

Mortgage balances rose by $282 billion in the third quarter of 2022 and stood at $11.67 trillion at the end of September, representing a $1 trillion increase from the previous year. Credit card balances also increased by $38 billion. The 15% year-over-year increase in credit card balances represents the largest in more than 20 years. Auto loan balances increased by $22 billion in the third quarter, consistent with the upward trajectory seen since 2011. Student loan balances slightly declined and now stand at $1.57 trillion. In total, non-housing balances grew by $66 billion.

“Credit card, mortgage, and auto loan balances continued to increase in the third quarter of 2022 reflecting a combination of robust consumer demand and higher prices,” said Donghoon Lee, Economic Research Advisor at the New York Fed. “However, new mortgage originations have slowed to pre-pandemic levels amid rising interest rates.”

Housing Debt

Student Loans

Household Debt and Credit Developments as of Q3 2022

| Category |

Don’t Miss: Current Us Debt 2022

Tracking The Federal Deficit: April 2020

The Congressional Budget Office reported that the federal government generated a $737 billion deficit in April, the seventh month of fiscal year 2020. Aprils deficit is a $897 billion swing from the $160 billion surplus recorded a year earlier in April 2019. Aprils shortfall brings the total deficit so far this fiscal year to $1.48 trillion, which is 179% higher than the same period last year. Total revenues so far in FY2020 decreased by 10% , while spending increased by 29% , compared to the same period last year.

Where Can I Trade Commodities

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Don’t Miss: What Is Your Credit Score After A Bankruptcy

The Federal Debt Ceiling

The federal debt ceiling is the legal amount of federal debt that the government can accumulate or borrow to fund its programs and pay for fees such as the national debt interest. Since its creation through the Second Liberty Bond Act in 1917, the debt ceiling has grown about 100 times. These instances have included permanent raises, temporary extensions, and revisions to what the debt limit can be defined as. When the debt ceiling isnt raised, the federal government is unable to issue Treasury bills and must rely solely on tax revenues to pay for its programs this has occurred 7 times since 2013.

Tracking The Federal Deficit: December 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $20 billion in December 2021, the third month of fiscal year 2022. This deficit was the difference between $486 billion in revenues and $507 billion of spending. Decembers deficit was 85% smaller than that of December 2020. Additionally, both this year and last year, the timing of the New Years Day federal holiday shifted payments that would normally have occurred at the beginning of January into December. In the absence of these timing shifts, the federal government would have run a monthly surplus in December 2021 for the first time since January 2020, prior to the onset of the COVID-19 pandemic.

Analysis of notable trends: Through the first quarter of FY2022, the federal government has run a deficit of $377 billion, $196 billion less than at this point in FY2021. After factoring in the aforementioned timing shifts, the FY2022 deficit to date is $353 billion, or 33% smaller than FY2021the rest of this discussion accounts for these payment shifts. However, this deficit is $17 billion larger than the deficit accrued during the first quarter of FY2020, before the start of the pandemic.

Recommended Reading: Unclaimed Pallets For Sale

Is Mohela Actually Involved In The Lawsuit Where Does It Stand On The Issue

According to a letter from the agency to one of Missouri’s members of Congress, MOHELA did not actively seek to involve itself in the lawsuit.

In a letter to U.S. Rep. Cori Bush’s office in late October, responding to questions Bush posed in the wake of the lawsuit, the agency said its executives “were not involved with the decision.” It describes itself as “a public instrumentality of the State of Missouri” and “a governmental entity.”

The only official contact and communications between MOHELA and the AG’s office on the matter, according to the agency, is when they received Sunshine requests asking for copies of MOHELA’s contract with the federal government in August, September and October.

MOHELA declines in that letter to take a specific stance on both the debt relief program and the challenge to it.