What Does Your Debt

| DTI | What it means |

|---|---|

| Less than 36% | You have a good amount of debt relative to your income, which should make it easier to maintain financial stability. If you apply for new financing, you should have little trouble getting approved, as long as your credit score is high enough to qualify. |

| 37-41% | This is within a normal range of how much debt you should have relative to your income. However, you may need to eliminate some debt before you apply for your next loan or line of credit. This will make it easier to ensure you can get approved. |

| 41-45% | Having this much debt will make it difficult to find a lender that will extend you a new line of credit. You should take action to reduce debt and stop making new charges on your credit cards until youve paid off some of your balances. Consider options, like debt consolidation, that can make it easier to pay off your balances. |

| More than 50% | This much debt is bad for your financial health and you need to get help immediately. This much debt may make it difficult to pay off on your own, since you have too much debt to qualify for do-it-yourself options, like debt consolidation loans. Call to review your options for relief with a trained credit counsellor. |

How lenders use debt-to-income ratio during loan underwriting

Talk to a trained credit counsellor to find the best way to eliminate debt for your needs and budget.

What’s The Difference Between Your Debt

Debt-to-credit and DTI ratios are similar concepts however, it’s important not to confuse the two.

Your debt-to-credit ratio refers to the amount you owe across all revolving credit accounts compared to the amount of revolving credit available to you. Your debt-to-credit ratio may be one factor in calculating your credit scores, depending on the scoring model used. Other factors may include your payment history, the length of your credit history, how many credit accounts you’ve opened recently and the types of credit accounts you have.

Your DTI ratio refers to the total amount of debt you carry each month compared to your total monthly income. Your DTI ratio doesn’t directly impact your credit score, but it’s one factor lenders may consider when deciding whether to approve you for an additional credit account.

Familiarizing yourself with both ratios may give you a better understanding of your credit situation and help you anticipate how lenders may view you as you apply for credit.

How To Calculate Your Credit Utilization Rate

Your credit utilization rate measures how much credit you are using compared to how much you have available. The calculation looks at both your and your .

For example, if your current balance is $2,000 and you have a $5,000 limit, that makes your credit utilization rate 40%.

“It’s not the dollar amount owed that’s important, it’s the percentage,” Droske says. “So, a $500 balance on a $10,000 credit limit is a 5% ratio, but the same $500 balance on a $1,000 limit is 50%.”

Read Also: What Happens To Credit When You File Bankruptcy

What Industries Have High D/e Ratios

In the banking and financial services sector, a relatively high D/E ratio is commonplace. Banks carry higher amounts of debt because they own substantial fixed assets in the form of branch networks. Higher D/E ratios can also tend to predominate in other capital-intensive sectors heavily reliant on debt financing, such as airlines and industrials.

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Read Also: What Happens If You File Bankruptcy On Your Home

Does Dti Ratio Affect Your Credit Scores

Your DTI ratio may not directly impact your credit scores. But there are some indirect ways that your DTI or income can impact your credit scores.

For example, your credit utilization ratio may account for nearly 30% of your credit scores. And it looks at outstanding balances on your credit cards relative to your total available credit. Reducing your credit utilization ratio will also reduce your DTI ratio and could improve your credit scores.

But a loss of income could make it difficult to pay your bills on time. And late or missed payments could affect your credit scores. Thatâs because a loss of income can change your DTI ratio.

How Much Of The Installment Loan Amounts Is Still Owed Compared With The Original Loan Amount

For example, if you borrowed $10,000 to buy a car and you have paid back $2,000, you still owe more than 80% of the original loan. Paying down installment loans is a good sign that you’re able and willing to manage and repay debt.

The amounts of debt that you owe is an important part of your credit and makes up 30% of your FICO Score. Keep track of your debt and credit utilization.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Recommended Reading: Where Do You Go To File Bankruptcy

Modifying The D/e Ratio

Not all debt is equally risky. The long-term D/E ratio focuses on riskier long-term debt by using its value instead of that for total liabilities in the numerator of the standard formula:

Long-term D/E ratio = Long-term debt ÷ Shareholder equity

Short-term debt also increases a companys leverage, of course, but because these liabilities must be paid in a year or less, they arent as risky. For example, imagine a company with $1 million in short-term payables and $500,000 in long-term debt, compared with a company with $500,000 in short-term payables and $1 million in long-term debt. If both companies have $1.5 million in shareholder equity, then they both have a D/E ratio of 1. On the surface, the risk from leverage is identical, but in reality, the second company is riskier.

As a rule, short-term debt tends to be cheaper than long-term debt and is less sensitive to shifts in interest rates, meaning that the second companys interest expense and cost of capital are likely higher. If interest rates are higher when the long-term debt comes due and needs to be refinanced, then interest expense will rise.

Finally, if we assume that the company will not default over the next year, then debt due sooner shouldnt be a concern. In contrast, a companys ability to service long-term debt will depend on its long-term business prospects, which are less certain.

What Is A Good Debt

What counts as a good debt-to-equity ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky. Companies in some industries, such as utilities, consumer staples, and banking, typically have relatively high D/E ratios. Note that a particularly low D/E ratio may be a negative, suggesting that the company is not taking advantage of debt financing and its tax advantages.

Recommended Reading: How Does Filing Bankruptcy Affect Child Support

If Youre Applying For A Mortgage There Are Two Types Of Debt

If youre in the market for a mortgage, you should also consider front and back end debt-to-income ratios. When youre applying for a mortgage, lenders will likely look at debt-to-income ratio in two ways.

- The front-end ratio is used to determine if you can repay your mortgage. A front-end DTI ratio includes your projected monthly mortgage payment, insurance, property taxes, homeowners association fees, but does not include other monthly expenses like student loans or credit card debt. You should only have to worry about your front-end ratio when youre applying for a mortgage.

- The back-end ratio is an overall measure of debt compared to your income. It includes all of your monthly debts, like credit cards and student loan debt, in addition to any household payments. As such, this number tends to be higher than front-end ratios, but it is the more common measure of your DTI.

Tips For Borrowing Money

- If youre thinking about borrowing money but arent sure how to make your credit work for you, consider working with a financial advisor. Finding a financial advisor doesnt have to be difficult. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Credit cards come in all forms with different benefits and different costs. Consider using our tool to help you find the right credit card for your situation.

Read Also: How Often Can You File For Bankruptcy In California

Things You Should Know About A Good Debt

Brittney is a credit strategist and debt expert with years of experience applying her in-depth knowledge of the credit and personal finance industries to write comprehensive, user-friendly guides on the products and strategies readers can use to make smart financial decisions throughout the credit-building process.

Edited by: Lillian Guevara-Castro

Lillian brings more than 30 years of editing and journalism experience, having written and edited for major news organizations, including The Atlanta Journal-Constitution and the New York Times. A former business writer and business desk editor, Lillian ensures all BadCredit.org content equips readers with financial literacy.

As with many complex fields, a lot of jargon exists in the world of finance . Making matters worse, some of those difficult terms are actually redundant, i.e., they mean the same thing as other terms. This not only makes it harder to figure out what you should know, it can even make it challenging to determine what you already know.

| | | | |

How To Maintain A Low Credit Utilization Rate

Already have a low utilization percentage? Make sure you continue to never charge more than you can pay off. “Don’t treat credit cards as a long-term loan,” Droske says. “Consider it a short-term loan and a convenient way to pay for things.”

And lastly, avoid closing any of your credit cards especially your oldest one. Closing credit cards often has an immediate negative impact on your utilization percentage as your credit limit will go down.

“Low balances and high credit limits are the recipe for low utilization,” Droske says.

Editorial Note:

Recommended Reading: How To File Bankruptcy Yourself In Arkansas

Options If You Can’t Pay Your Credit Card Bill This Month

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

We are an independent publisher. Our advertisers do not direct our editorial content. Any opinions, analyses, reviews, or recommendations expressed in editorial content are those of the authors alone, and have not been reviewed, approved, or otherwise endorsed by the advertiser.

To support our work, we are paid in different ways for providing advertising services. For example, some advertisers pay us to display ads, others pay us when you click on certain links, and others pay us when you submit your information to request a quote or other offer details. CNETs compensation is never tied to whether you purchase an insurance product. We dont charge you for our services. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear.

What’s happening

Why it matters

What Is His Debt To Income Ratio

- Gross Monthly Income of Mr. A is 18,00,000 divided by 12 months = Rs.1,50,000/-

- Gross Monthly Debt obligation of Mr. A is = 50,000 + 20,000 = Rs.70,000/-

- His Debt to Income Ratio is *100 which is 46.67%. This may be considered to be a bit high by most lenders.

Once his car loan is paid off Mr. As Debt-income ratio will become *100 = 33.33% which is a very acceptable value.

Recommended Reading: Does Filing Bankruptcy Erase Student Loans

Understanding Debt To Income Ratio Vs Debt To Credit Ratio

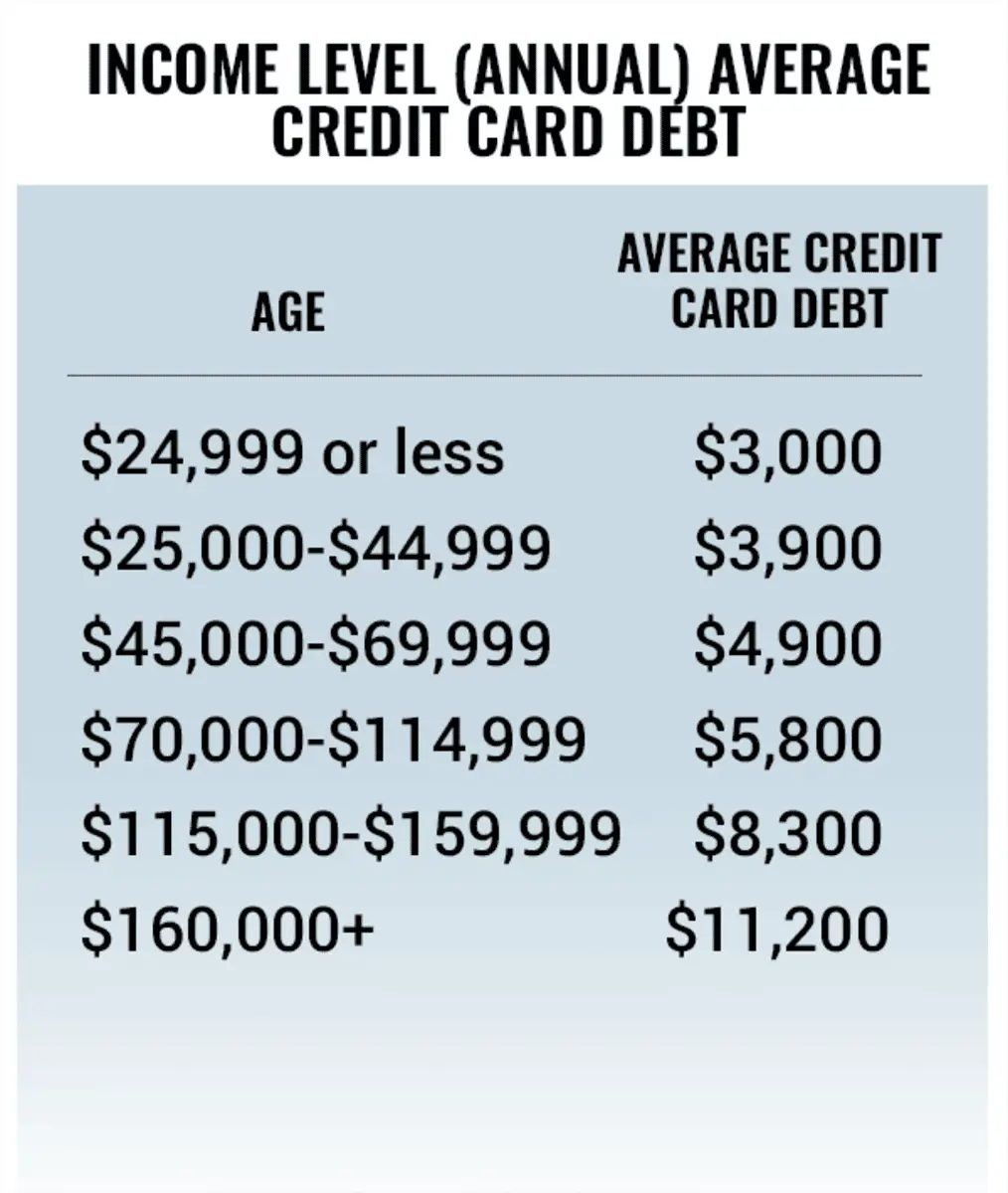

Debtmost Americans have it. On average, each American household with a credit card carries $8,398 in credit card debt alone. Factor in mortgages and auto loans on top of that, and its easy to see why so many people need to pay attention to debt to income ratio and debt to credit ratio.

While they sound similar, theyre two separate things, and they both directly or indirectly affect your credit score or ability to take out more lines of credit. Depending on which credit scoring model you use, your debt to credit ratio can affect your credit score. In contrast, your debt to income ratio can affect a lenders decision on whether or not to approve a credit application.

Sound confusing? Dont worry. Well help you sort it all out.

How To Lower Your Credit Utilization Rate And Get A Higher Credit Score

It’s important to make your CUR as low as it can be, without hitting 0%. This will help you get a good credit score, which will in turn help you qualify for the best rewards credit cards.

To improve your CUR, work on paying down your existing balances before doing anything else. If you already have a good credit score but are still struggling to pay off credit card debt, consider getting a balance transfer credit card. Balance transfer cards offer temporary interest-free periods so you can just make payments toward your principal balance without worrying about accruing interest.

If you want to maximize no-interest periods, consider the Citi Simplicity® Card with a 0% intro APR for 21 months on balance transfers from date of first transfer . There is a $5 or 5% fee charged to make the balance transfer.

Once you paid down at least some of your balance, it may make sense to then ask for a credit limit increase, as long as you’re confident you won’t overspend with a higher credit limit.

Don’t Miss: How To Report Bankruptcy Fraud Anonymously

How To Reduce Your Debt

Here are few things to consider if you want to reduce your debt-to-income ratio or learn how to use credit wisely:

Avoid Taking On New Debt

Avoiding debt can help build your financial well-being, according to the CFPB. And because your DTI ratio depends on your amount of debt versus your income, taking on more debt without growing your income will increase your DTI ratio. So itâs a good idea to apply only for the credit you need and avoid taking on new debt.

Pay Down Existing Debt

There are a few different strategies for paying off debt. The CFPB talks about the snowball and highest-interest-rate methods. But there are many more strategies for handling loan paymentsâsuch as consolidating debtâthat you might explore, too.

Before you make any decisions, consider talking to a qualified financial professional to figure out a debt management plan for your specific situation. You might even have access to some financial planning services through your employer or retirement plan administrator.

Pay More Than the Minimum

The CFPB recommends paying more than the minimum payment on your credit cards whenever possible. This may help you reduce your credit card debt faster and minimize charges. It can also help your , which can be an important factor in calculating your credit scores.

Use a Budget

Recommended Reading: Can You Declare Bankruptcy And Keep Your Car

How To Calculate D/e Ratio In Excel

Business owners use a variety of software to track D/E ratios and other financial metrics. Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as D/E ratio and debt ratio. Or you could enter the values for total liabilities and shareholders equity in adjacent spreadsheet cells, say B2 and B3, then add the formula =B2/B3 in cell B4 to obtain the D/E ratio.

Read Also: What Does The Bankruptcy Trustee Investigate

What Does D/e Ratio Tell You

D/E ratio measures how much debt a company has taken on relative to the value of its assets net of liabilities. Debt must be repaid or refinanced, imposes interest expense that typically cant be deferred, and could impair or destroy the value of equity in the event of a default. As a result, a high D/E ratio is often associated with high investment risk it means that a company relies primarily on debt financing.

Debt-financed growth may serve to increase earnings, and if the incremental profit increase exceeds the related rise in debt service costs, then shareholders should expect to benefit. However, if the additional cost of debt financing outweighs the additional income that it generates, then the share price may drop. The cost of debt and a companys ability to service it can vary with market conditions. As a result, borrowing that seemed prudent at first can prove unprofitable later under different circumstances.

Changes in long-term debt and assets tend to affect D/E ratio the most because the numbers involved tend to be larger than for short-term debt and short-term assets. If investors want to evaluate a companys short-term leverage and its ability to meet debt obligations that must be paid over a year or less, they can use other ratios.

For example, cash ratio evaluates a companys near-term liquidity:

Cash Ratio

\begin \text = \frac = 1.80 \\ \end Debt-to-equity=$134,000,000$241,000,000=1.80