What Is A Debt

A debt-to-income ratio is the percentage ofgross monthly incomethat goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed. There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 36/43.

Front-end ratio is the percentage of income that goes toward your total monthly mortgage costs, such as:

- Mortgage principal and interest

- Alimony payments

- Vacation/rental property costs

Lenders often look at both ratios during themortgage underwriting process the step when your lender decides whether you qualify for a loan. Our debt-to-income calculator looks at the back-end ratio when estimating your DTI, because it takes into account your entire monthly debt. In addition to your DTI ratio, lenders may look at your credit history, current credit score, total assets andloan-to-value ratiobefore deciding to approve, deny or suspend the loan approval with contingencies.

Whats Considered A Good Debt

The lower the DTI, the better. More specifically, a DTI of 36% or below is generally considered good, while a DTI of 37-42% is considered manageable. A DTI of 43% or higher will likely mean you wont qualify for a loan, as anything 43% or higher is considered cause for concern. A DTI of 50% or higher is considered dangerous.

Why 43%? Lenders came up with this number as a result of mortgage-risk studies that analyzed the type of borrowers who are most likely to have trouble making repayments and ultimately default on their loans.

Your DTI is a factor lenders consider when determining the rates and terms of your loan. In general, youre more likely to get a better rate with a lower DTI.

Convert Your Answer To A Percentage

The final result is your debt-to-income ratio.

Lets work through an example. Assume you pay rent at a monthly rate of $1,000, a car payment of $400 and a minimum credit card payment of $150. Lets also assume that you have a gross monthly income of $5,000. Your debt-to-income ratio is $1,550 divided by $5,000, which equals .31 . Lenders consider those with a lower DTI to present a lower credit risk. Not only will you more likely be preapproved, youll also likely qualify for a lower interest rate. The lower your DTI, the less credit risk you are to lenders.

Donât Miss: Fha Loan Limits Texas

Read Also: How Many Different Chapters Of Bankruptcy Are There

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

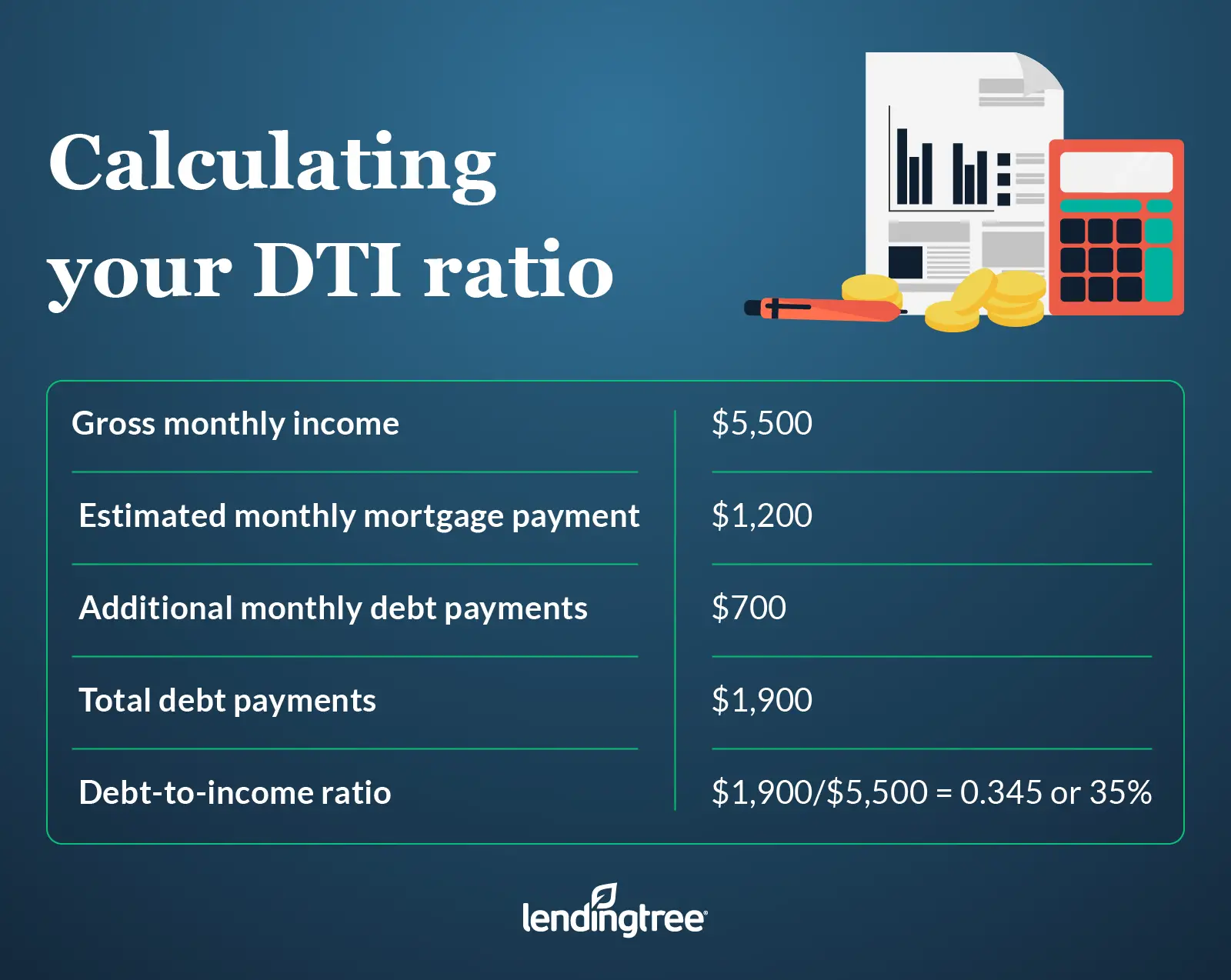

Formula For Debttoincome Ratio

Divide your monthly payments by your gross monthly income, and then determine your DTI percentage by multiplying the resulting figure by 100.

- Monthly debt payments / monthly gross income = X * 100 = DTI ratio

For example, your income is $10,000 per month. Your mortgage, property taxes, and homeowners insurance is $2,000. Your car and credit card payments come to another $1,000. Your DTI is 30 percent.

| Housing Costs | |

| $6,000 | 28% |

Lenders dont favor applicants who make more money. Instead, they approve those with a reasonable ratio of monthly debt compared to their income.

In the above examples, the applicant who makes the least is the most qualified for a loan.

Also Check: Fha Build On Own Land

You May Like: Does Chapter 7 Bankruptcy Include Student Loans

Cut Back On Credit Card Purchases

Scaling back on unnecessary expenses is always a fiscally responsible move, but reducing your dependence on credit card purchases, in particular, will help you meet your DTI goals. Its way too easy to spend beyond your means by relying on credit cards and racking up more debt in the process. Credit card interest payments are another cost you simply dont want to deal with if youre trying to lower your debt-to-income ratio.

Excessive unpaid credit card balances also impact your , which is another important factor that lenders will weigh when considering your mortgage application. So, for the sake of your homebuying aspirations, put the credit card back in your wallet whenever possible.

Should I Apply For A Home Loan With A High Dti

In limited instances, high debt-to-income ratios mean lenders may be less willing to give you a mortgage loan or may ask you to pay a higher interest rate for the loan, costing you more money. While you can still apply for and receive a mortgage loan with a high DTI, its best to look for ways to lower the ratio if possible so you can get a better interest rate.

Recommended Reading: Does Claiming Bankruptcy Clear Student Loans

Why Is Dti Important

Your DTI is important to both you and lenders because it demonstrates that you have a good balance of debt and incoming funds. It proves to lenders that you are responsible with your money and that you can handle additional debt.

The Consumer Financial Protection Bureau requires that mortgage lenders examine your financial health before you take out a loan to assure that you can afford to repay the money. Calculating your DTI is one of a few ways they go about doing this. If your DTI percentage is low enough, you may qualify for a better loan than you would if you were responsible for more debt. On the other hand, if your DTI is too high, lenders may be unwilling to grant you a mortgage loan, so its important to make sure your DTI is within an acceptable range.

Calculating A 25% Dti

- Monthly Social Security Income : $6,000

- Monthly recurring debts: $500

- Monthly recurring debts: $2,000

- Monthly housing payment: $2,500

Most mortgage programs require homeowners to have a DebttoIncome of 40% or less, but loan approvals are possible with DTIs of 45 percent or higher. In general, mortgage applicants with elevated DTI must show strength on some other aspect of their application.

This can include making a large down payment showing an exceptionallyhigh credit score or having large amounts of reserves in the bank accounts and investments.

Also, note that once a loan is approved and funded, lenders not longer track DebttoIncome ratio. Its a metric used strictly for loan approval purposes. However, as a homeowner, you should be mindful of your income versus your debts. When debts increase relative to income, longterm saving can be affected.

Also Check: 10 Year Treasury Vs 30 Year Mortgage

Read Also: How To Build Credit Score After Bankruptcy

Mortgage Approval: Whats Behind The Numbers In Our Dti Calculator

Your debt-to-income ratio matters when buying a house. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan. DTI is calculated by dividing your monthly debt obligations by your pretax, or gross, income.

In most cases, lenders want total debts to account for 36% of your monthly income or less. Nonconventional mortgages, like FHA loans, may accept higher a DTI ratio, but conventional mortgages may not be as flexible.

Lenders consider low DTI as important as having a stable job and a good credit score. When evaluating your mortgage application, DTI tells lenders how much of your income is already spoken for by other debts. If the percentage is too large, its a clue you may have trouble paying your monthly mortgage payments, and lenders will be reluctant to approve your loan.

Hate surprises? Estimating your DTI with the NerdWallet calculator before submitting your mortgage application can help you understand how much house you can afford.

Dti And Your Mortgage

Lenders must evaluate your financial health before deciding to give you a loan to make sure you will be able to repay it. When your DTI is evaluated, lenders typically dont want to see anything too much higher than 43%, though there are exceptions. You can sometimes still get a loan with a high DTI, but you will likely need to have other factors working in your favor to balance out the larger amount of debt, such as a significant amount of savings or a high credit score.

If your DTI is low enough to qualify you for a loan but still on the higher end, keep in mind that you might qualify for higher interest rates than someone with less debt. The lower your score, typically, the better loan you will qualify for.

Don’t Miss: Can Student Loans Be Part Of Bankruptcy

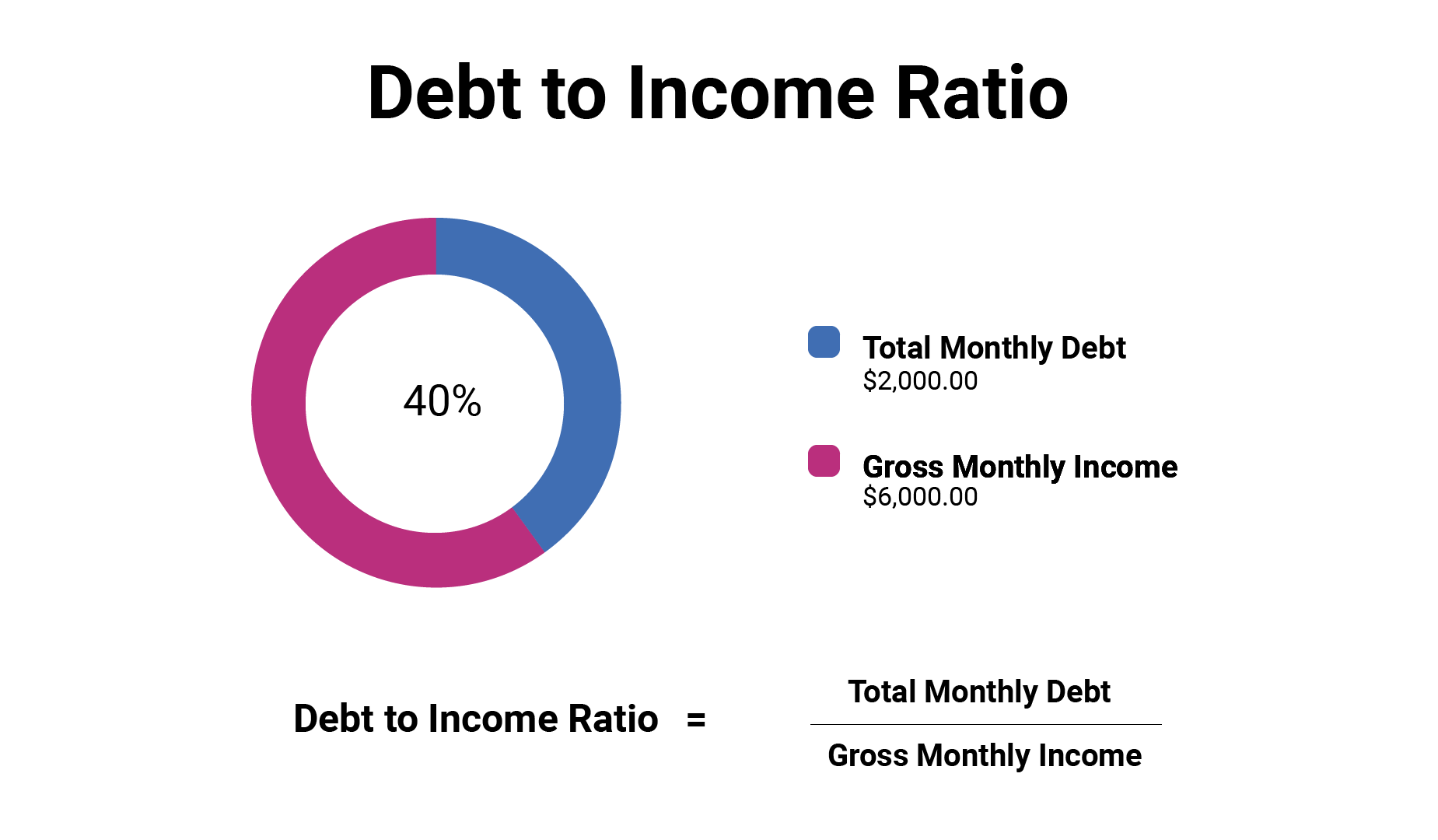

How Is Dti Calculated

To determine your back-end DTI ratio, add up all those monthly expenses listed above and any other recurring monthly expenses that arent listed and divide that number by your gross monthly income. If youre unsure about what gross monthly income is, its the amount that you earn each month before taxes and other deductions are taken out of your paycheck.

Its very important to know that your DTI ratio does not include or acknowledge how much you spend each month on items that dont appear on your credit report, including living expenses like groceries, and entertainment.

Lets look at an example. Lets say your monthly gross income is $6,000 and your monthly recurring expenses are $2,000. To calculate your back-end DTI, divide $2,000 by $6,000 and you get a DTI ratio of 33.3%.

Tips To Improve Your Debt

Reducing your debt-to-income ratio may seem self-explanatory, but paying down debt is often easier said than done. Follow these tips to make a meaningful, timely impact on your debt-to-income ratio before you apply for a mortgage or another major loan:

Recommended Reading: How Long Does Ch 13 Bankruptcy Stay On Credit Report

Dti Ratio And Home Equity

DTI ratio affects how much of your home equity you can access. In addition to loan-to-value and combined loan-to-value ratios, lenders will consider your DTI when you apply for a home equity loan or line of credit.

Home equity loans have more stringent requirements than mortgages. Borrowers must have a 43% DTI or lower to qualify, in most cases, and some lenders may even require DTIs as low as 36%. Here are some examples:

- Because of the stricter requirements for home equity loans, Quicken Loans recommends that potential borrowers maintain a DTI of 43% or lower.

- Veterans United does not impose a maximum DTI ratio for Veterans and military members. However, those with a DTI above 41% may encounter additional financial scrutiny.

- Rocket Mortgage will not offer home equity loans to anyone with a DTI higher than 43%.

Does Your Dti Ratio Affect Your Credit Score

The short answer is no, your DTI ratio doesnt impact your . However, there are factors on your credit report that play into your DTI ratio. Your minimum payments, which are reported to the credit bureaus by your creditors and lenders, are used to help calculate your DTI ratio. So the less debt you owe, the lower your DTI ratio is likely to be, which may even lead to a higher score.

What does affect your credit score is the amount of debt you owe accounting for 30% of your score calculation. Specifically, your , which is the percentage of your available credit thats in use, can impact your score. Similar to your DTI ratio, the lower your credit utilization ratio, the better. Its wise to use no more than 30% of your available credit on each account and altogether.

You May Like: Car Refinance Usaa

Also Check: When Will Chapter 7 Bankruptcy Come Off Credit Report

What Goes Into A Debt

Debt-to-income ratios come in two forms: the front-end DTI and the back-end DTI. Lenders look at both of these when considering your loan application.

Heres how those break down:

- Front-end DTI: Also called a PITI ratio , this number reflects your total housing debt in relation to your monthly income. If you take home $6,000 per month and are trying to buy a home that would require a $1,500 monthly payment, your front-end DTI would be:

- Back-end DTI: Your back-end DTI encompasses all your monthly debts in relation to your income. For example, if you make $6,000 a month, have a $600 car payment, a $400 student loan payment, and an expected $1,500 mortgage payment, your back-end DTI would look like this:

For most lenders, the back-end DTI is most important, as it more accurately reflects what you can afford each month.

Multiply That Number By 100 To Get A Percentageand Thats Your Debt

Lets look at an example:

Bob pays $600 a month in minimum debt payments plus $1,000 per month for his mortgage payment. Before taxes, Bob brings home $5,000 a month. To calculate his DTI, add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 0.32. Multiply that by 100 to get a percentage.

So, Bobs debt-to-income ratio is 32%.

Now, its your turn. Plug your numbers into our debt-to-income ratio calculator above and see where you stand.

Recommended Reading: Who Qualifies For Bankruptcy Chapter 13

Avoid Taking More Credit

Keep your debt from growing by avoiding more debt. Do not take a car loan or personal loan before getting a mortgage. This increases your DTI ratio, which is apparent when lenders review your profile. Also avoid making large credit card purchases before applying for a mortgage. If you know something can wait, be patient before taking out another loan for a large expense. Again, having too many debts on your profile is a red flag for lenders.

Max Dti Ratio For Fha Loans

- General guideline is max ratios of 31/43

- Though it can potentially be much higher

- Based on the findings from an automated underwrite

- Potentially as high as 55%

The max DTI for FHA loans depends on both the lender and if its automatically or manually underwritten. Some lenders will allow whatever the AUS allows, though some lenders have overlays that limit the DTI to a certain number, say 55%.

These limits can also be reduced if your credit score is below a certain threshold, such as below 620, a key credit score cutoff.

For manually underwritten loans, the max debt ratios are 31/43. However, for borrowers who qualify under the FHAs Energy Efficient Homes , stretch ratios of 33/45 are used.

These limits can be even higher if the borrower has compensating factors, such as a large down payment, accumulated savings, solid credit history, potential for increased earnings, a minimal housing expense increase , and so on. Yet another reason to build credit and save up money before applying for a mortgage!

To sum it up, if you can prove to the lender that youre a stronger borrower than your high DTI ratio lets on, you might be able to get away with it. Just note that this risk appetite will vary by mortgage lender.

Also note that mortgage insurance premiums are included in these figures.

You May Like: How To Get A Car Loan After Bankruptcy Discharge

How Do You Calculate Debt

Calculating your DTI is a fairly simple process, as long as you know the right numbers. In the simplest terms, you can calculate your DTI by dividing your total debt each month by your total income. But what expenses actually count toward your total debts? Lets break down what you should include when estimating your DTI.

While you can calculate this manually, you can also use the debt-to-income calculator in this article to calculate your DTI ratio quickly.

Purchase A Cheaper Home

If you have low interest student loans which will take many years to extinguish it may make sense to start your housing journey with a cheaper home that is a bit smaller or a bit further from work in order to get started on the housing ladder.

Some people view renting as throwing money away, but even if you put 20% down on a home you are 5X leveraged into a single illiquid investment. Getting laid off during a recession can lead to forclosure.

Over the long run other financial assets typically dramatically outperform real estate. Buying a home for most people is more about investing in emotional stability instead of seeking financial returns.

Real Estate Price Appreciation

Real estate can see sharp moves in short periods of time, though generally tends to keep up with broader rates of inflation across the economy over long periods of time. In 2006 near the peak of the American housing bubble the New York Times published an article titled This Very, Very Old House about a house on the outskirts of Amsterdam which was built in 1625. They traced changes in property values in the subsequent nearly 400 years to determine it roughly tracked inflation.

Longterm Stock Market Returns

Read Also: How Will Bankruptcy Affect My Job