Achieve Financial Control How Much Debt Do You Have

Or speak to a debt consultant

If your money problems are severe and you cant afford your debt payments, youre probably considering debt relief or bankruptcy. Debt settlement and bankruptcy are both drastic solutions for big money problems, and they can both reduce debt balances. When weighing debt relief vs. , youll look at four factors: privacy, control, tax consequences, and cost.

You Need Income For A Debt Management Plan And Chapter 13 Bankruptcy To Work

Debt management plans and Chapter 13 bankruptcy are both essentially structured repayment plans, so neither will work if you dont have at least some income to work with.

With a DMP, youll work with a nonprofit credit counselor to review your budget and determine what kind of repayment plan you can afford. With a Chapter 13 bankruptcy, the repayment plan is based primarily on your disposable income .

If you dont have any income and dont anticipate having income for the foreseeable future, you may be better suited for a Chapter 7 bankruptcy.

With All The Risks Outlined Above There Are Licensed Credit Not

The credit counseling professionals are certified and trained in consumer credit, debt management and budgeting. Your credit card statements may include a toll-free number that can help you locate a reputable non-profit counseling organization in your area. The U.S. Trustee Program which supervises all bankruptcy cases and trustees, and sits within the U.S. Department of Justice also maintains a list of government-approved not-for-profit credit counseling organizations.

Finally, Debt Consolidation Is a Type of Governed Program Offered By Not-For-Profit Licensed Entities, Which Allows An Individual To Consolidate or Combine Several Credit Cards Into a Single Payment Each Month, Typically At a Lower Interest Rate.

While debt consolidation may lower monthly payments, it may not cover all of your debts and it does not offer a discharge of debt, as offered in a Chapter 7 or Chapter 13 bankruptcy.

Read Also: How Often Can You Declare Bankruptcy

Who Its Best For

Simply put, if you have a mountain of unmanageable debt and bankruptcy is not an option you cant qualify for bankruptcy, or you absolutely cannot bear the stigma debt settlement could be your best option.

Thats certainly true if you have access to substantial sums of money , or you have the stomach for keeping creditors at bay while you amass the cash to make credible offers.

Debt Settlement Vs Bankruptcy

When the process works as intended, debt settlement can benefit everyone involved. Consumers get out of debt and save money, debt settlement firms earn money for providing a valuable service, and creditors receive more than they would if the consumer stopped paying altogether or entered chapter 7 bankruptcy. Chapter 7 bankruptcy involves liquidating the debtors non-exempt assets and using the proceeds to repay creditors. Exempt assets vary by state but often include household and personal possessions, a certain amount of home equity, retirement accounts, and a vehicle.

Compared to debt settlement, Detweiler says, if a consumer is eligible for chapter 7 bankruptcy, it may be a faster option. It is a legal process that can stop collection calls and lawsuits. Debt settlement doesn’t offer those guarantees. Still, he adds, there may be a variety of reasons why chapter 7 may not be a good option. A consumer may have to surrender property they may feel they need to keep. Or they may not want their financial troubles to be a matter of public record. Consumers could also find their employment options limited if they declare bankruptcy, as some professions evaluate workers credit histories.

Chapter 7 bankruptcy can be over and done after three to six months, versus years for debt settlement. It can be less stressful and may allow your credit score to recover faster, though bankruptcy will remain on your credit report for 10 years.

Recommended Reading: How To Fix Your Credit After Bankruptcy

Debt Consolidation Vs Bankruptcy: Pros And Cons

While debt consolidation means combining your debts into a new loan with new repayment terms, bankruptcy involves discharging or reducing it so you no longer have to pay back some of it .

There are a few ways to consolidate debt: You could use a personal loan, balance transfer credit card or home equity loan, for example. Most debt consolidation strategies require that you have good credit to qualify.

Bankruptcy, on the other hand, is typically considered a last resort for consumers who dont have the means to pay back their debts. While it can be a useful strategy in some circumstances, it can also cause long-lasting damage to your credit.

| Debt consolidation | |

|---|---|

|

Negatively impacts credit Must qualify through means testing Nonexempt assets can be liquidated |

Negatively impacts credit Borrowers cant exceed debt limits Takes at least 3 years to pay off |

How Chapter 7 Bankruptcy Works

In exchange for a discharge of your debts in a Chapter 7 bankruptcy, you agree that the trustee can take and liquidate some of your property to pay back debt. But you’re allowed to keep property that the law protects. Many Chapter 7 filers don’t own any nonexempt property, so you might not have to give up anything.

You May Like: Can Utility Bills Be Discharged In Bankruptcy

Bankruptcy Is Often Better Than Debt Consolidation/settlement

When people first realize that they may be in financial trouble they either ignore the warning signs, or consider many options for fixing it.

A common thing is for people to panic and then attempt to work with a debt consolidation or debt settlement company.

This sounds like a good idea in theory, doesnt it?

However, in practice filing for Chapter 7 Bankruptcy or Chapter 13 Bankruptcy in Minnesota is often much better, for several reasons.

Bankruptcy Vs Debt Relief: Which Is The Better Way Out

April 20, 2021 By wrlaw

Debt can be mildly stressful at best, and absolutely crippling at worst. And unfortunately, after the coronavirus pandemic rocked the world and the American economy throughout the past year, thousands of Americans found themselves knee-deep in seemingly insurmountable financial troubles.

After a year or more of watching your balances increase and interest accumulate on your loans, you may be desperate for an easy way out. There are options but for many Americans, the solutions often feel scarier than the debt itself. Words like debt relief and bankruptcy can dredge up a whirlwind of emotions and preconceived opinions, and for good reason. There is no one-size-fits-all, easy solution to debt . Debtors would do well to acknowledge this.

Nonetheless, two of the most popular options for escaping debt a debt relief program and bankruptcy have their benefits, so long as they are kept in their proper place. Bankruptcy is an extreme, last-resort option that can get you out of debt, but also leave a lasting mark on your credit. On the other hand, debt relief programs provide a less extreme recourse, but can often be costly and pose obstacles for some consumers especially those with poor credit.

You May Like: Why Do Companies File For Bankruptcy

Types Of Debt Settlements Through Bankruptcy Cibik Law Can Help With:

Chapter 7 Are the most common types of bankruptcies. Also known as a liquidation bankruptcy, Chapter 7 bankruptcies are for those who dont have much in terms of assets or property.

Types of unsecured debt, normally suited for a chapter 7:

- Remaining Balances On Auto Loans After A Repossession

- Past Utility Bills

Understand How Chapter 13 Bankruptcy Works

Chapter 13 is another way to get rid of your outstanding debt, but it takes much more time and is more involved. Since a Chapter 7 bankruptcy can be completed in under 1 year, a Chapter 13 bankruptcy can take up to five years. There are also limits as to how much debt you can include.

When you file a Chapter 13 bankruptcy, it can be similar to a structured settlement plan in a debt settlement in that you have to pay some or all of your debts. The amount that you pay typically depends on the type of debts included in the bankruptcy and how much you owe to your creditors. There is also a waterfall of payment priority with the first payments made to your lawyer and the lowest priority to your unsecured creditors.

The benefit of a Chapter 13 bankruptcy is that you may get to keep some of your assets, as there are some protections by state.

A few points to note:

- A Chapter 13 bankruptcy can last three or five years, but the majority will be five years.

- Theres an incentive to stay in the bankruptcy. If you fail to make the payments to the trustee, the case can be dismissed, leaving you to owe your creditors again, and the fees to your legal assistance, trustee, etc. would generally not be refunded.

- The Chapter 13 payment plan is highly inflexible, meaning that unexpected emergencies can mean a dismissal of the bankruptcy.

Read Also: What Happens When You File Bankruptcy For Credit Card Debt

What Does It Mean To File For Bankruptcy

At its core, bankruptcy is a legal proceeding where the judge evaluates a persons assets who believes they are unable to pay their debts. During the proceedings, the judge comes up with a method to repay the individuals creditors and resolve their debts.

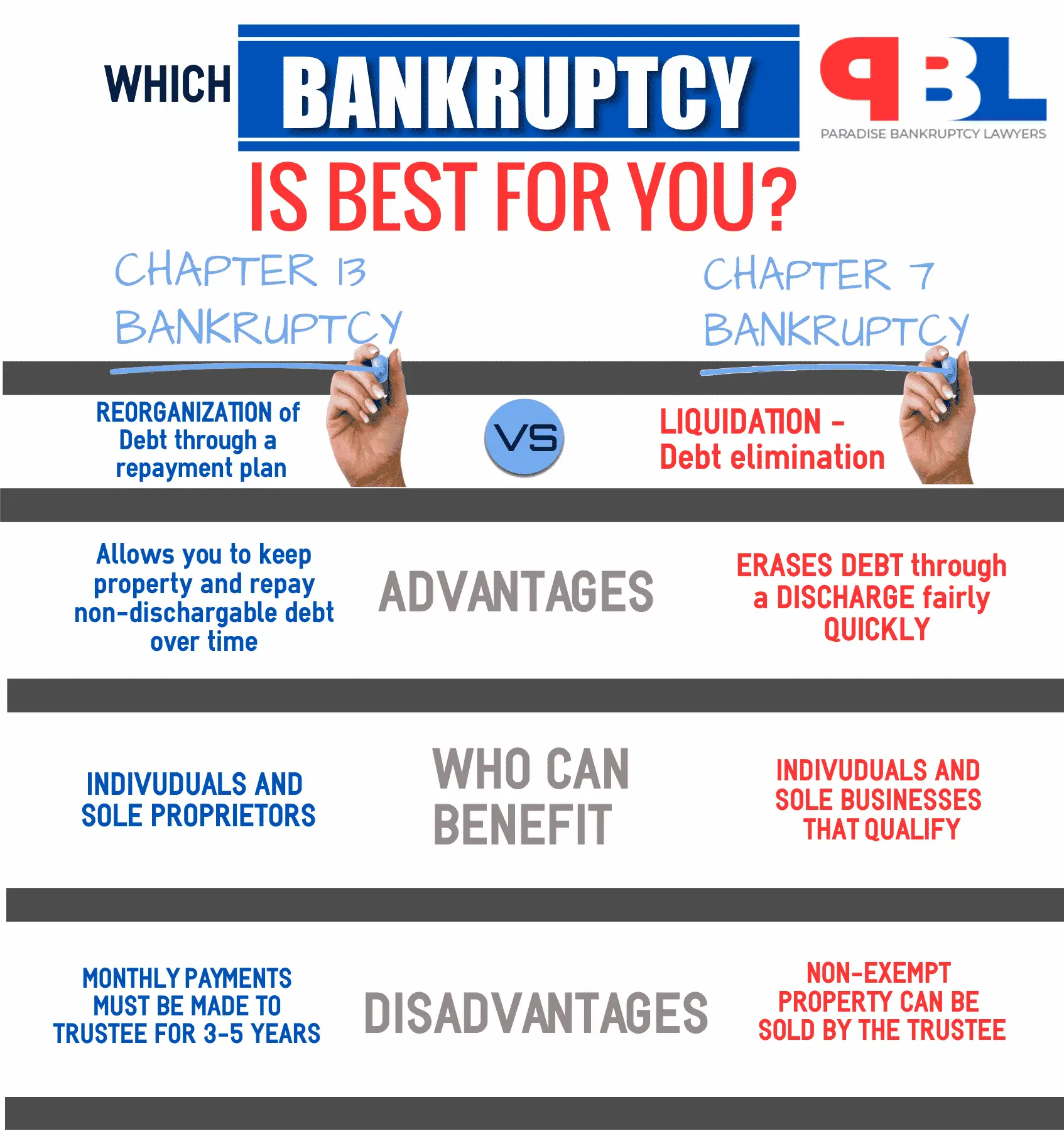

Keep in mind that there are two common forms of bankruptcy, and its important to understand the differences between them.

Will It Take Longer To Pay Off Your Debt If You Consolidate

Even if you get a lower interest rate, don’t assume that your payment went down solely for that reason. If your new monthly obligation is substantially lower, it usually means a longer repayment term. And if you extend your repayment term, it will probably take you significantly longer to pay off your debt. While it could be nice to have a more manageable monthly payment, you’ll most likely pay more interest over the life of the loan.

Also Check: Home Affordable Unemployment Program

What Do Each Do To Your Credit

This is a frequently asked question that has a very complex answer. The reason the answer is complex is because there is no absolute standard that applies to future credit ratings.

Technically, a Chapter 7 stays on your credit report for 10 years while a Chapter 13 is reported for 7 years in most cases. However, what the law says can or cannot be reported on your credit report has little to do with your future credit. Ordinarily, and ironically, filing a Chapter 7 is a better way to go if you want to reestablish your credit rating faster.

The reason for this is that creditors are looking for how long your case has been Discharged. Chapter 7 cases get discharged within four months or so whereas Chapter 13 discharges are delayed 3 to 5 years. Again, the type of bankruptcy that is filed is usually much less important as to future credit ratings versus a slew of many other factors, such as the amount of your income post-bankruptcy and your new debt to income ratio.

Slowly but surely, credit rating increases post-bankruptcy if the former debtor does not create financial conditions that again put his or her cash flow at risk by taking out too much debt at one time. On the other hand, avoiding all debt, post-bankruptcy, will likely severely damage your future credit rating. You must appear on the credit radar screen every now and then to allow a new rating to be developed.

S A Person Should Take Before Seeking Additional Debt Relief Options

First, try to contact your creditors and come to an agreement for a payment plan to bring your account back in good standing and before any collection efforts.

If you already tried to reach out to your creditors and could not come to an agreement, or your debt is too overwhelming to handle, there is another option. Bankruptcy. We know there can be a negative connotation , but the reality is that for some people, a Chapter 7 or Chapter 13, could be their best option for ridding themselves of their current debt and moving forward in life with a clean slate.

At Cibik Law, we will go above and beyond to ensure every avenue has been exhausted before we recommend the best solutions to settle your debts. Stop the harassing collection calls, cease any legal actions against you or your property and build a plan together, to start rebuilding your finances, your credit and your financial freedom. Most importantly is clearing your mind and body of the stress that comes with having debt.

BE AWARE: when researching the area of debt settlement companies, you may find many who offer the perfect solution to get you more money today and consolidate your debts into one monthly payment. I always recommend all of my clients first ensure the efficacy of any debt solution offered to them and taking on more debt is generally NEVER the right option for most.

To ensure you are working with with a Pennsylvania State Certified Debt Settlement Agency under the Certified PA Bankruptcy Court,

You May Like: How Many Years Until Bankruptcy Comes Off Credit Report

Debts Not Covered By A Dro

Not all debts are covered by a DRO. You’ll still need to pay:

- magistrates court fines and confiscation orders relating to criminal activity

- child support and maintenance

- compensation for death and injury

If you have any of these debts they don’t count towards the £30,000 limit.

If youre unsure whether a debt would be covered by a DRO, check with your DRO adviser. If they arent youll still need to pay them if you get a DRO.

If you forget to include any debts in your DRO you cant add them after. If any missed debts would have taken you over the £30,000 limit then your DRO might be cancelled. Its important that you tell the DRO adviser about all of your debts.

What Is Debt Consolidation

Debt consolidation is the combining of multiple high-cost loans or credit card accounts into a single debt with a more affordable interest rate.

Imagine you have three credit cards with borrowing limits of $6,000 each, respective balances of $2,000, $5,000 and $3,000, and variable annual percentage rates . For simplicity’s sake, let’s assume that the APR on each card is the current national average of 17.5%.

If APRs don’t increase and you don’t make any additional charges on the cards, paying them off in four years’ time would require average total monthly payments of about $291. That would mean paying about $3,975 in interest on top of the $10,000 combined balance.

In contrast, if you use a 48-month $10,000 personal loan to pay off the accounts, at a fixed rate of 7%, your monthly payment after a 7% origination fee would be about $253, and your total loan cost would be $2,874, or about $1,100 less than you’d have paid in credit card interest.

Aside from saving you money, this approach has several other advantages:

Debt consolidation doesn’t just apply to credit card debt, of course. You can use it to roll up medical bills, loans from friends or relatives and other obligations into a single, manageable monthly bill.

Don’t Miss: Land Up For Auction

Is Bankruptcy Or Debt Relief Right For Me

Have an attorney explain your state’s exemptions and bankruptcy laws, and give you honest feedback on your financial situation. A debt settlement program could be the right step for you if your debt is not very large or you have a steady income. In many cases, filing a bankruptcy case is the fastest way to bring down your total debt.

Chapter 13 bankruptcy requires a repayment plan, so it may not be the right type of bankruptcy if you do not have a steady income. It can help people who want to stop creditor harassment and need more time to pay down their debt. Chapter 7 bankruptcy will dismiss unsecured debts, and you do not need to pay them back. It also requires creditors to follow bankruptcy laws, helps control asset repossession, and can rebuild creditworthiness as you make new payments on time.

Many people think hiring a bankruptcy lawyer will increase their debt. While you must pay filing fees and attorney’s fees , it can be cost-effective in the long run as your debts are fully discharged faster.

Which Type Of Bankruptcy Is Right For You

To help summarize the descriptions in the preceding sections, the following table shows how these bankruptcy types apply to different situations:

| Bankruptcy Type | |

|---|---|

| Any | High – above the limits for Chapter 13 bankruptcy |

Bankruptcy is a complicated process with long-lasting consequences. A simple table cannot fully describe all of the factors that should go into deciding whether to pursue it. This is intended just as a starting point for further research.

Don’t Miss: Can You Be Denied A Job Because Of Bankruptcy

When Chapter 13 Bankruptcy May Be Best

Some people view a Chapter 13 bankruptcy as the alternative to a Chapter 7 bankruptcy. However, Chapter 13 bankruptcies carry advantages over Chapter 7 bankruptcies.

A Chapter 13 bankruptcy lets you keep your personal property. If you dont want to give up your home or car, and you can come up with enough income to make monthly payments, a Chapter 13 bankruptcy may work for you.

So Whats Better Bankruptcy Vs Debt Consolidation

If youre considering debt settlement or debt consolidation, you owe it to yourself to consider bankruptcy. Dont end up like my clients who throw away tens of thousands of dollars to debt consolidation before filing bankruptcy. Bankruptcy vs. debt consolidation? No contest. Call us now so we can review your situation with you and see if bankruptcy is right for you.

Don’t Miss: Will Filing Bankruptcy Affect My Car Loan