To Achieve Credit Variety Start A Revolving Line Of Credit And One Installment Loan With Depth

- Prefer using old accounts, if you have any. Not using accounts means they become inactive after 120-180 days, and you start over. Also, dont close accounts. You need a long-term credit history of business with lenders. Having additional accounts does not improve your score and increases the risk you might go into default.

- Dont constantly apply for credit. The fewer accounts you have, the fewer the inquiries. So, dont fill out an application to get a special deal at Macys. It costs you more than the gifts they give out. Fewer inquires mean higher and good credit score, while too many inquiries show that you are desperate for credit.

- Pay your utilities with your credit card, and then pay the credit card with automated payments from checking. You wont forget to pay with a credit card if the payments are automated. You can average your utility bills while increasing your score. If there are no annual or monthly fees and you dont otherwise use the card, you will increase your credit scores.

How Does A Low Credit Score Affect Me

You may think that your credit rating is a theoretical number that has no impact on your everyday lifebut that’s not quite true. Lenders and other creditors use your credit score to determine your creditworthiness. The lower your score, the less likely you are to obtain credit, which could be anything from a store credit card to a personal loan or mortgage. It may even hurt your ability to obtain a job if your potential employer seeks permission to check your credit file.

What Bankruptcy Will Affect While On Your Credit Score

Your payment history, on-time payments, and recent credit reporting can all affect how lenders work with you.

Once you file bankruptcy and businesses see your credit report’s negative information, you may have concerns about:

- Getting a car loan

- Getting loans without a qualified co-signer

- Adding authorized users to some credit cards

- Security deposits and returns of safety deposits

You have options regarding all these concerns if you are having credit or debt issues. There are ways to address each concern by yourself or with professional help. Getting a fresh start is possible, especially after filing bankruptcy.

Also Check: How Long From Foreclosure To Eviction

Keep Credit Balances Low

You want high limits on the cards, but you dont want your credit accounts charged up to the limits. This is why it is important to have your credit limit and target your balances below 30%. Having low balances on your accounts credit history and not over-using accounts is 30% of your score. Keeping a small balance also wont cost you much in interest or fees.

Bankruptcy Will Likely Decrease Your Credit Score Be Listed On Your Credit Report And Make Getting New Credit Very Difficult

Filing for bankruptcy can offer relief from overwhelming debt, but it will likely have severe and long-lasting effects on your credit. Bankruptcy can remain on your credit report for seven to 10 years, and your score may take a significant hit in the immediate aftermath.

Rebuilding your credit after bankruptcy is possible, but it is often very difficult. Lenders may be hesitant to provide you with loans or credit cards, and taking on high-interest loans or credit cards could land you back in trouble with debt.

If youre considering filing for bankruptcy, or you already have, read on to learn how bankruptcy affects your credit, how your credit score could change, how bankruptcy appears on your credit report and what you can do to rebuild credit after filing for bankruptcy.

You May Like: What It Means To Declare Bankruptcy

File Chapter 11 Bankruptcy To Stop Judgment

Only individuals or businesses with $1,100,000 or more of secured debts or $390,000 or more of unsecured debts can file Chapter 11. Usually, only businesses can afford to qualify for filing Chapter 11. The process for filing Chapter 11 is essentially the same as when filing Chapter 13. However, your creditors will have the right to vote on your payment plan, and the legal fees are expensive.

How Long Do Bankruptcies Stay On Your Credit Report

The length of time that a bankruptcy filing stays on your credit report depends on what type of bankruptcy you filed. We took a look at Chapter 7 and Chapter 13, which are the two main types of consumer bankruptcies, and to see how their impacts on your credit score differ.

- Chapter 7 bankruptcy: Also known as liquidation bankruptcy, Chapter 7 is what Harrison refers to as “straight bankruptcy.” It’s the most common form of consumer bankruptcy and is usually completed within three to six months. Those who file for Chapter 7 will no longer be required to pay back any unsecured debt , like personal loans, credit cards and medical expenses, but they may have to sell some of their assets to settle secured loans. Chapter 7 bankruptcies stay on consumers’ credit reports for 10 years from their filing date.

- Chapter 13 bankruptcy: Harrison refers to Chapter 13 as the “wage earner’s bankruptcy.” This form of filing offers a payment plan for those who have the income to repay their debts, just not necessarily on time. About a third of bankruptcies filed are Chapter 13 . Those who file are still required to pay back their debts, but instead over a three-to-five year time frame. Chapter 13 bankruptcies stay on consumers’ credit reports for seven years from their filing date.

You May Like: How Often Can Someone File Chapter 7 Bankruptcy

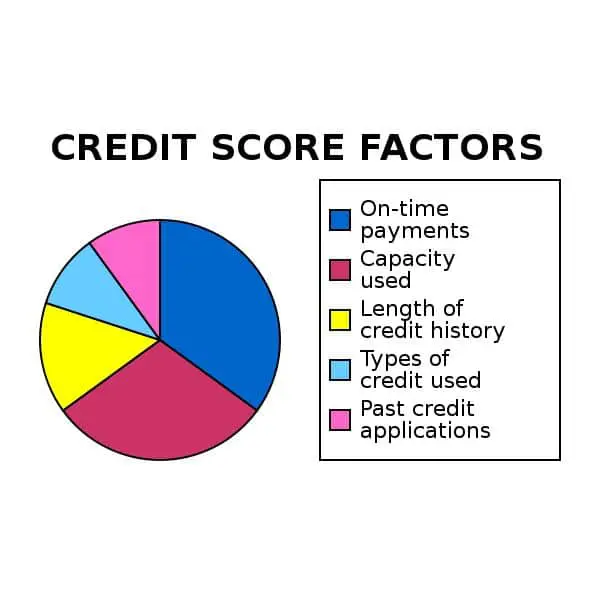

How Credit Scores Work

First, lets take a look at how your credit score is calculated in the first place. You have credit scores from each of the three major credit bureaus: TransUnion, Equifax, and Experian. These bureaus track all of your credit activity. That includes the use of your credit cards and whether you pay them in full, your student loans, mortgages, auto loans, and more. Each item the bureaus track is factored into your credit score, which ranges from 280 to 850.

The exact mechanism by which the bureaus arrive at an individuals credit score is proprietary they keep it secret so that, in theory, no one can game the system. However, FICO recently released some data about how much certain common events will affect your credit score, called damage points.

Your score affects your access to all sorts of things. It will show up when you want to get a credit card or a loan, for example. If you want to rent an apartment or get a cell phone plan, theyll check your credit. Some employers may even check your score when you apply for a job.

Accounts Included In Bankruptcy

The accounts included in your bankruptcy filing will also have status notations for filing.

- During your filing, account statuses will note included in bankruptcy

- After discharge, the status will change to discharged in bankruptcy and the balance show $0

These statuses and accounts remain on your credit report for seven years from the date that each account became delinquent. So, even if the bankruptcy record remains for ten years, the accounts included will drop off your report after seven.

You May Like: How To Buy Forclosures

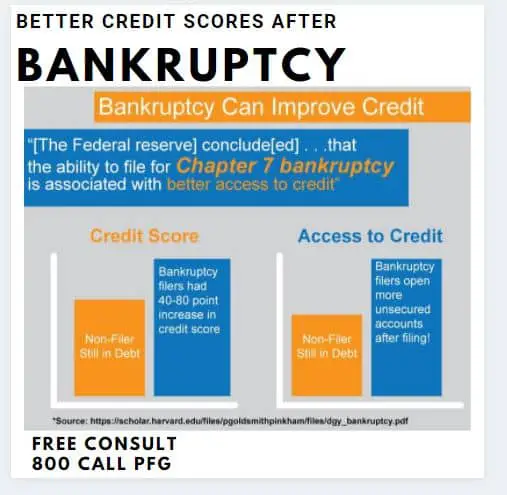

Bankruptcy Can Actually Help Your Credit

A study by the New York Federal Reserve shows that bankruptcy can actually help your credit. Here are some notable findings:

-

One year after filing, people who filed for bankruptcy opened up more unsecured accounts than people in the same financial situation who chose not to file. More than half of people who file for bankruptcy have new lines of credit one year after filing. Compare this with 30% of people in the same financial situation who choose not to file.

-

One quarter after they filed bankruptcy, individuals who filed bankruptcy had considerably higher than those who were newly insolvent who didn’t file. The same was true four quarters, or one year, after filing bankruptcy. Individuals are considered insolvent when their debts exceed their assets.

-

Within one quarter of filing for bankruptcy, filers’ credit scores improved by an average of 80 points over people in the same situation who didn’t file. This difference is 60 points after four quarters.

As you can see, most bankruptcy filers’ credit situations improve as time passes. This is true even in a relatively short period of time . Having a higher credit score means that you’ll save money in the long run because you won’t have to use alternative loan companies, like payday lenders or expensive personal loans. How much does good credit pay? One study showed that a 100 point loss in your credit score can cost you $200,000 over the course of your lifetime.

Bankruptcy And Your Co

All of the above is true with regard to you, the filer of the bankruptcy, and possibly your spouse, who may file the bankruptcy jointly with you.

What about non-filing co-signers and co-borrowers? How does your bankruptcy filing affect their credit scores?

In general, the answer is: generally, it doesnt.

Since the late 1990s, under consumer and regulatory pressure, the credit industry implemented a new reporting system for bankruptcy filings.

Where, prior to that time, anyone attached to an account implicated in a Chapter 7 or Chapter 13 bankruptcy would indeed have the bankruptcy filing annotated to their credit reports.

Since that change, a bankruptcy is now reported to the credit bureaus with regard to the specific individual filing the bankruptcy as identified by a single Social Security Number .

A non-marital, non-jointly filed bankruptcy case should not in most cases be reported to the credit report of your Aunt Sally who co-signed for your credit card 3 years ago. Aunt Sally has her own Social Security Number, and she did not herself file the bankruptcy.

However, some few creditors still utilize the old reporting system. In this case, mistakes can yet happen.

Likewise, if the account is delinquent or becomes delinquent, a creditor is entitled to report it as such regardless of whether or not any account-holder has filed for bankruptcy or not.

Don’t Miss: Can You File Bankruptcy After A Judgment

Be Careful With Cash Advances Before Filing

Cash advances on your credit card can also be a negative factor when you file for bankruptcy. The debt is not discharged if you take out over $950 in cash advances 70 days prior to filing for bankruptcy. This stands regardless if you use that advance for essentials or luxury purchases.

There is an exception for the cash advance penalty. For example, lets say you took out a cash advance to repay student loans. You then get diagnosed with a severe medical condition that renders you unable to work, so you file for bankruptcy. Because you are unable to repay this debt due to extreme hardship, it will be discharged. Note that if you took out the cash advance to pay your student loans intending to discharge the debt in bankruptcy, you can be sued for nondischargeability.

Connect with top-rated bankruptcy attorneys to make sure you avoid issues when you file.

However, if you can prove that the recent purchases are necessary items, such as heat for your home and medical expenses, those may qualify for discharge.

Read Also: Do It Yourself Chapter 7 Bankruptcy Kit

How Much Will Bankruptcy Affect Your Credit Score

In 2010, FICO released a report that showed examples for the average credit score after bankruptcy. The decrease when you started with a high score is more significant.

| Starting Credit Score | |

|---|---|

| 150 | 530 |

In both cases, you end up with a bad credit score. But the decrease from fair to bad is less than from excellent to bad. Essentially, you have more to lose when you have good or excellent credit. If you already have bad credit then the point-damage may not be that bad. Remember, FICO scores only go down to 300, but its rare to see anything below 500.

Recommended Reading: How To Find Out When Bankruptcy Was Discharged

Is Your Credit Rating Really Worth Stressing About

Are you current on all your debt payments? Yes? No? Maybe?

If youâre behind on any debt payments, your credit score could probably be better. So, rather than worrying about possibly making your already bad credit worse, think about how a bankruptcy discharge could help you build credit.

So, what happens to my credit score if I file bankruptcy?

Like all negative information reported to the credit bureaus, filing any type of bankruptcy will have a negative impact on your credit score. Since a bankruptcy filing is public record, they will find out, even if theyâre not directly notified by the bankruptcy court.

But, unlike other things that have a negative effect on your FICO score, a bankruptcy filing is often the first step to building a good credit score.

You May Like: Do Bankruptcies Show Up On Background Checks

Balance Transfer Credit Card

If you have credit card debt on a card with a high APR, try transferring the balance to a card that offers 0% interest APR. This lets you pay down the balance without being charged any interest.

Most of these special APR offers last between 12 and 20 months, depending on the cards terms. When the special offer is over, a regular interest rate will kick in, so its best to make as many payments as you can during the introductory period.

Using a balance transfer credit card to address debt can both help and hurt your overall credit score. It can help your score by reducing your overall credit utilization rate, which is the amount of your available credit in use. This is important because your credit utilization rate accounts for 30 percent of your credit score.

If you add more available credit without increasing the total amount of debt you owe, that lowers your credit utilization rate, which increases your credit score, says Sullivan. So, if you do a balance transfer and keep the old cards open but do not use them, your credit score will start to improve.

However, opening a new credit card can also negatively impact your score. When you apply for a credit card, there will be a hard inquiry on your credit report, which can reduce your score. Hard inquiries may stay on your report for as long as two years, though their impact on your credit score will likely decrease before then.

Don’t Miss: Can You Get A House After Filing Bankruptcy

Check Your Credit Report

When you file bankruptcy, chances are your accounts have been reported as delinquent. But once you file, the creditors should report the accounts as closed. If they do not do this , you keep racking up late payments and your balances appear to be months past due. This adds to the damage of a bankruptcy filing.

According to Equifax, The accounts that were discharged in bankruptcy or foreclosure should be closed. If that information is not updated on your credit history, your credit scores may be penalized more than necessary. If you see something you believe is inaccurate or incomplete on your credit reports, contact your creditor or file a dispute with the credit bureaus.

How To Repair Your Credit Score

While debt payment history makes up 35% of your score, you canstart repairing your credit score by reducing your debt-to-income ratio.

Even though filing bankruptcy will reduce and/or eliminate existing consumer debts, you must keep all future debts low and pay your bills on time. Also, do not close any of your old accounts as this lowers your credit score.

Finally, obtain a credit report fromevery year and review it to ensure accuracy and consistency.

Don’t Miss: How Do You File For Bankruptcy In Ohio

How Filing For Bankruptcy Can Help Your Credit Scores

Even if you have high credit scores, if you find yourself in a position where you must file bankruptcy, then your credit scores probably aren’t as important as the reasons for having to file bankruptcy. Getting a new loan or credit card is not as pressing as, for instance, a pending wage garnishment or mortgage foreclosure. Nevertheless, after you get bankruptcy relief, you might find that the bankruptcy could actually help your credit, even though the bankruptcy will remain on your credit report for up to ten years.

How To Rebuild Your Credit After Bankruptcy

Attempting to recover and rebuild your credit after you file bankruptcy can be an intimidating task. However, it may be less of a challenge than you think as the most significant action it requires is patience. Time and responsible financial choices can help you attain a credit score you never thought youd be able to reach again.

There are a few helpful things you can do in the aftermath of bankruptcy that will build stability in your credit and overall finances. Here are some suggestions for the first couple years after you file bankruptcy:

Complete Credit Counseling

All those who have filed for bankruptcy are required to complete the free credit counseling course provided by the legal system. It is important to get every bit of knowledge that you can out of these credit counseling sessions. This information will help you learn how to reintegrate credit in a responsible manner so that you dont end up in the position you were in before.

If you have the ability and resources, you can also pursue further financial education with a nonprofit credit counseling agency to equip yourself with knowledge that will help you attain better stability. Additionally, there is an abundance of free online resources you can utilize to improve your financial literacy.

Avoid Applying for New Credit

Check Your Credit Report Often

Use Credit-building Products

Begin Using Credit Responsibly and Sparingly

References:

You May Like: How To Claim Bankruptcy In Illinois