Government Debt Relief Programs

There are times that the federal government steps in to help consumers with a specific type of debt. These programs usually have a limited lifespan. Congress will set them up during a crisis and continue to renew them until consumers recover. Many of the programs you see outlined below started after the housing crisis of 2008 and the Great Recession of 2009.

How Were Different From Other Debt Settlement Companies In Pennsylvania:

No Upfront Fees. A Debt Settlement company should not charge you any fees unless or until they settle your debt. Period. This is not only the most ethical way to do business per an FTC ruling effective October 27, 2010, its also the only legal way to charge fees.

- No add-on fees. Some debt settlement companies try to get around the law by charging administrative fees, signing fees, consultation fees and various other excuses to get money from you. Good guy debt settlement companies such as New Era charge only a settlement fee, which you do not pay until your debt is settled.

- End-to-end service. Some debt settlement companies you may talk with are only sales groups who will sell or pass your account off to a different company to handle your settlement. This means your financial data is being passed around and the sales person has no control over or interest in how your debt is settled. Look for a company such as New Era who will handle your program from beginning to end.

- Experience. With the crash of the sub-prime mortgage industry in Pennsylvania many new debt settlement companies headed by prior mortgage industry people suddenly popped up. These companies do not have nearly the experience or the relationships that lead to your best settlement deals. Look for companies who have been around long enough to amass a solid settlement track record. For example, New Era has been settling debts since 1999, and weve settled more than $250,000,000 in debt for our clients.

How Does A Debt Relief Program Work

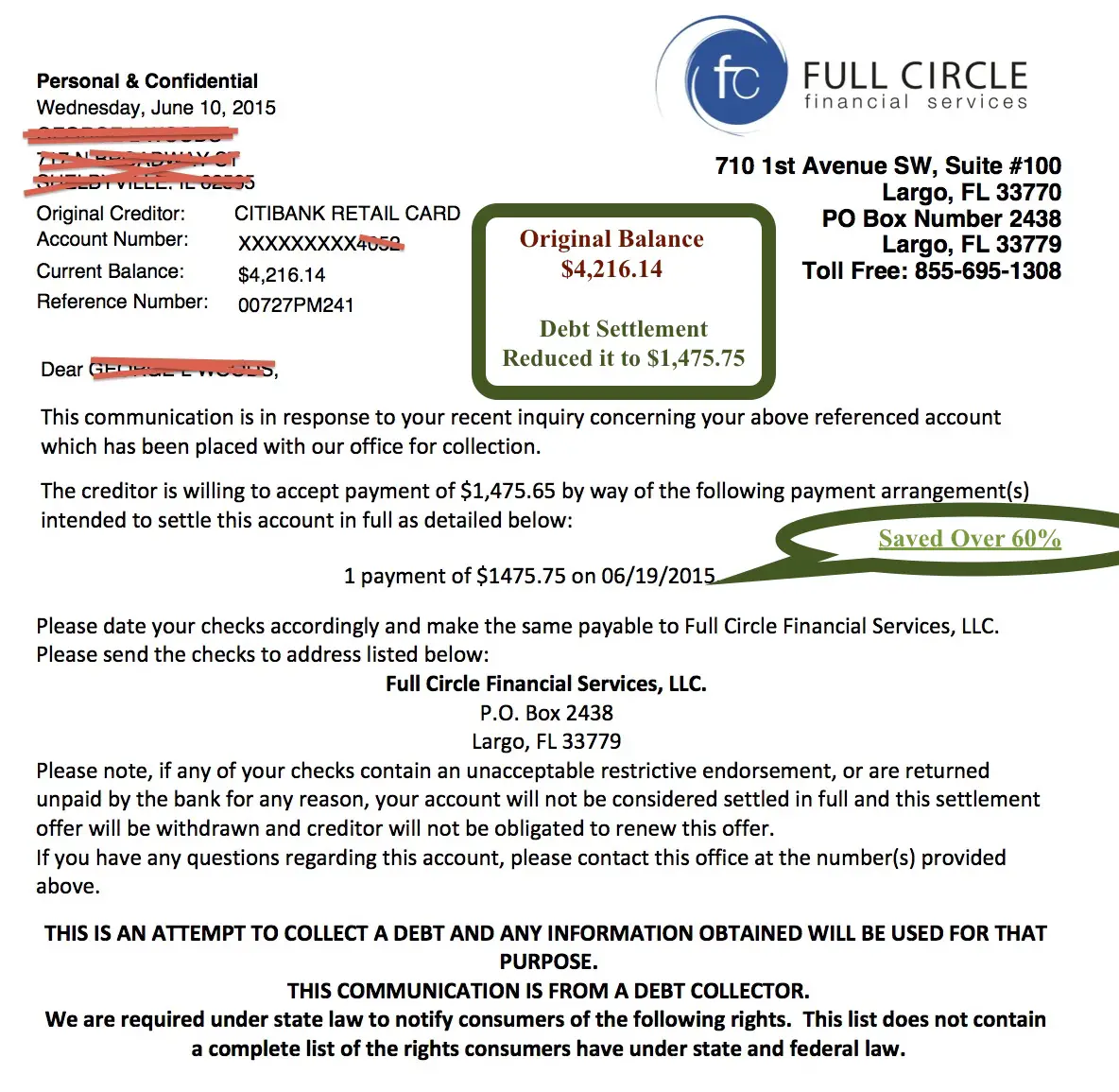

Debt relief typically works this way: you enroll your unsecured accounts into a debt relief program with a debt settlement company. You stop making payments to your creditors. You and your debt consultant come up with an amount that you can afford, and you put that money into a debt settlement savings account each month. Debt relief programs can help you get out of debt faster.

Negotiations begin with creditors when your debt consultant feels that you have saved enough. You continue to make your monthly payments into your debt settlement savings account as your accounts are settled one by one. You pay no fees to a debt settlement company until it settles a debt for you.

You can speed up the settlement process by cutting expenses or selling things you dont need to reach your savings goal faster.

Read Also: Can Utility Bills Be Discharged In Bankruptcy

Your Licensed Experts In Pa Debt Relief

Pennsylvania residents tend to have above average student loan debt and below average credit scores, both of which can make financial planning difficult and bring about severe debt. If that sounds similar to your situation, and youre currently experiencing a financial hardship thats making it difficult to pay off your debt, our licensed debt settlement consultants may be able to help.

Starting with your free consultation, well work directly with you and your creditors to negotiate a lower debt repayment amount. Dont struggle with high monthly payments and building interest rates. If you have credit card debt, personal student loans, medical bills, and other forms of unsecured debt, work with us today and experience some relief.

Is A Debt Relief Program A Good Idea

programs arent for everyone. They are a solution for serious debt problems, not a get-out-of-jail-free card for people who just dont want to pay what they owe. Consider both the pros and cons of debt relief before committing to a program.

A debt relief program may help you get out of debt if you cant afford the minimum payments on your debt or if your debt is creating hardship for your family. It can be a better solution than bankruptcy if you dont want a public filing, if you have a previous bankruptcy, or if you dont want a bankruptcy court taking total control of your finances.

Also Check: Mortgage Payment To Income Ratio

You Don’t Have To Pay For Assistance To Receive Student Loan Relief Through The Slrn Program

There are companies misrepresenting the facts about themselves to get your business and your money. Be aware of the warning signs that a company may not have your best interest in mind. Be cautious of companies that:

- Request a fee before they will assist you with your loans and ask you to provide them your credit card information or debit card information.

- Use taglines such as “New Laws Forgiving Federal Student Loans” and “Get Rid of Student Loan Debt!” and urge you to act quickly because the loan forgiveness program is ending soon and you will forfeit your rights to the benefits.

- Ask you to sign over power of attorney or other third-party authorization so they can make changes to your account.

- Request you do not contact PHEAA while they are working on your behalf.

- Promise to cancel your student loan debt, lower your monthly payment immediately, or provide instant relief from wage garnishment or default.

- Ask you to provide your logon credentials to access your account online.

PHEAA will not contact you regarding the information listed above.

Pennsylvania Debt Statistics & Laws

Despite being in one of the most expensive areas of the United States, the average income per household in Pennsylvania is over $2,000 lower than the average across the country. The state has close to 7% unemployment and a 15% rate of poverty among its citizens. Philadelphia and Allentown both have an unemployment rate that is over 10%, where Pittsburghs rate is lower than 8%.

Compared to the national average, Pennsylvanians carry around $600 less in credit card debt and have better credit scores. Consumers in Pennsylvania owe less than the national average in almost every type of debt other than student loan debt.

Pennsylvania has specific laws in regard to debt relief and collection that include consumer protections such as:

- 100% Wage Protection.

- A maximum rate of interest that a collection agency can charge is 6%.

- Statute of Limitations of 4 years for oral agreements, written contracts, promissory notes, and 6 years for open credit card accounts.

- Original and collecting creditors must adhere to all aspects of the Fair Debt Collection Practices Act , with the exception being for provisions dealing with required disclosures. One example of this is that the original creditor is not required to verify the validity a debt.

Read Also: What Property Can You Keep In Chapter 7 Bankruptcy

Whats The Difference Between The Pacific Debt Relief Program And Other Pa Debt Relief Programs

One thing that separates us from the rest of our Pennsylvania competition is that we have some of the best customer services in the industry and our reviewsprove it.

We have been awarded The Best Debt Settlement Company of 2020 from both Bankrate, and US News & World Reports.

Take a look at some recent PA debt relief reviews listed on this page, you can also take a look at our debt relief testimonialsand reviewspages to read more customer feedback from Pennsylvania residents.

Getting Sued For Credit Card Debt In Pennsylvania

The Pennsylvania Statute of Limitations on written contracts, including credit cards, medical bills, and personal loans, is four years ). This four-year statute of limitations in Pennsylvania also includes open-end accounts, oral contracts, and promissory notes. Below, we will explain the difference between open-end and closed-end accounts.

If a creditor is trying to sue you over an unpaid credit card debt in PA and its been over four years since you last paid it, legally, the collection agency can no longer sue you over the debt. Of a matter fact, you can now sue the debt collector for illegally attempting to collect on the debt, and under the Fair Debt Collection Practices Act , you could receive up to $1,000 per violation.

Golden Financial Services can advise you on what options you have and set you up with a debt validation plan to help you dispute any debts where your creditors may be illegally trying to collect on the debt. Merely Call Toll-Free for Assistance!

Don’t Miss: Credit Collection Services Customer Service

Consider Working With A Credit Counselor

If you decide hiring a debt settlement company is not the right option for you, do not give up hope. There are other options for learning how to get debt relief in Pennsylvania. For example, you can work with a respected and reputable credit counseling company.

Many nonprofit credit counselors offer assistance to people by teaching you about different debt paydown strategies and guidance on how to create a monthly budget tailored to your income and expenses. They will also provide advice on how to be disciplined and follow that monthly budget. Most importantly, they can show you ways to avoid overspending each month.

When you meet with a credit counselor, they will typically conduct an initial examination of your monthly income, fixed expenses, fluid expenses and debt owed. The credit counselor will then help you develop a customized short-term and long-term financial plan with realistic goals.

Debt Consolidation Loan: Marcus

Why Marcus stands out: If youre approved for a debt consolidation loan from Marcus, the company will send direct payments to up to 10 creditors, making it easy to pay off multiple debts at once. Since the money is sent directly to your creditors, you wont be tempted to use it for something other than debt repayment.

- Good credit required Youll likely need good credit to qualify for a loan with Marcus. Most Marcus customers have a FICO® credit score of 660 or above.

- Fees Marcus doesnt charge application, origination, prepayment or late fees, which can add to the amount you have to repay.

- Ability to apply for prequalification Marcus uses a soft credit inquiry that lets you see potential loan options without affecting your credit scores. Note: Prequalification doesnt guarantee youll be approved for a loan. And if youre approved, your actual interest rate and loan term can differ from your preapproval terms.

- Competitive rates Marcus offers competitive rates on its personal loans. If approved, your exact rate will be determined based on multiple factors, including the loan amount, term and your credit history. Rates are typically higher for longer-term loans.

Read our Editorial review of .

Recommended Reading: Can You Buy A House After Bankruptcy

Pennsylvania Debt Statistics And Laws

Pennsylvania is an average state when it comes to debt, according to a study by Lending Tree. Pennsylvania was in the middle of the pack when it came to total number of credit cards , average debt per cardholder , average utilization rate , percentage of cardholders at least 30 days late with a payment , percentage of cardholders with a maxed-out credit card . If Pennsylvanians have a lot of company, then its true that misery loves company.

Pennsylvania law does provide some consumer protection. The Fair Credit Extension Uniformity Act prohibits unfair or deceptive practices by debtors or collection agencies. It also limits how you can be located and where and when collectors can contact you. Threatening behavior and lying are banned. Pennsylvania allows wage garnishment, but strictly limits the percentage of your earnings that can be affected.

Pennsylvania Debt Statistics:

Debt Consolidation Balance Transfer: Us Bank Visa Platinum Card

Why U.S. Bank Visa® Platinum Card stands out: This credit card comes with a long intro APR offer for balance transfers. Theres an equally long intro offer on purchases, which could be tempting, but any new purchases could just add to your debt.

- Long intro offer The U.S. Bank Visa® Platinum Card offers an intro 0% APR for the first 18 billing cycles on balance transfers . Thats one of the longest intro periods out there. Note that once the intro periods are over, youll be charged a regular variable APR of 18.24% – 28.24% for each.

- Time limit To qualify for the intro APR for balance transfers, transfers must be completed within 60 days from account opening.

- Fees This card doesnt charge an annual fee, but youll have to pay a balance transfer fee: Either 3% of the amount of each transfer or $5 minimum, whichever is greater.

Learn more about the U.S. Bank Visa® Platinum Card and browse other balance transfer card options on Credit Karma.

You May Like: How Much To File Bankruptcy In Tennessee

Debt Relief Programs In Pennsylvania

Pennsylvania debt relief is available through banks, credit unions, online lenders and debt-relief companies .

Most people who seek debt consolidation in Pennsylvania are looking for help paying down high-interest credit card debt, but debt relief can also be used for other unsecured debt, like medical bills and personal loans.

The most common debt consolidation options in Pennsylvania are debt management, debt consolidation loans, for-profit debt settlement, nonprofit debt settlement and bankruptcy. Which one is best for you depends on your financial situation they all have pros and cons.

Here is a look at debt consolidation in Pennsylvania:

How Do I Know I Can Trust New Era For Debt Relief In Pennsylvania

We always recommend checking with the Better Business Bureau to see a companys rating and complaint history with consumers in Pennsylvania as a preliminary step. New Era Debt Solutions has an A+ rating with the BBB. Another important thing you can do is ask these 14 important questions that will help you determine if they are a legitimate debt settlement firm or just giving you the run around.

New Era has been helping Pennsylvanians relieve debt for nearly 20 years now. Weve settled more than $250,000,000 in debt and worked with many clients to help them with debt settlement in Philadelphia, Pittsburg, Allentown, and many other cities from around the state. But you dont have to take our word for it. Visit our Testimonials page to read or listen to what past clients from Pennsylvania have had to say about our debt settlement services.

Also Check: Does Bankruptcy Affect Your Tax Refund

How Does A Debt Relief Program Affect My Credit

Most debt relief programs require you to stop making payments to your creditors and instead pay into a debt settlement savings account. Every missed payment will lower your credit score.

If you currently have a high credit score, this can be devastating. Those who have more to lose will lose more. But if youre having trouble paying your bills and already missing payments, the damage is less obvious.

What happens to your credit score after you graduate from a debt relief program? A study by the American Fair Credit Council concluded that clients typically improve their credit scores by 60 points within six months after settling their last debt and continues to rise after that. Its not guaranteed, though, and your result depends on how you choose to manage your debts in the future.

Your life should be more affordable after getting rid of debt. With a bit of luck and sound financial management, you should be able to pay your bills on time and continue to improve your credit rating.

Review Your Pennsylvania Debt Consolidation Options

Your debt consolidation loan options are personal loans, credit card balance transfers, home equity loans, or mortgage refinances. Unsecured personal loans are the least risky option as long as you use a reputable lender. Home equity loans and refinancing your mortgage are risky because if you default, you could lose your home. Since these are secured loans, they should be the lowest interest rates. Pay close attention to origination fees and the overall expense when using these loans though. A mortgage refinance is for a much longer loan term and you could end up paying much more over the long run even though it isn’t costing you as much monthly. Real estate appraisal costs and origination fees can make personal loans less expensive even if the home equity or mortgage refinance has a lower interest rate. A credit card balance transfer is good if you can pay off your debt before the introductory low-interest-rate expires. If you don’t pay it off in time, you’re still in good shape if your credit score is high enough to get another low-interest credit card with a high enough credit limit to transfer all of your credit card balances over to the new card. There is no guarantee that you’ll be able to get this second low-interest card.

You May Like: Can One Spouse File Bankruptcy In Illinois

Pennsylvania Statute Of Limitations

Pennsylvanias statute of limitations lays out maximum time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent.

For debts taken out in Pennsylvania, the following are the statutes of limitations for different types of debt.

- Oral agreements: 4 years

Is Debt Settlement A Simple Form Of Debt Relief In Pennsylvania

Debt settlement is not your typical debt relief solution. Your level of commitment to staying the course, especially when the slope seems too steep, often determines how successful the program is in helping the debtor achieve freedom from debt. For those who are willing to see it through to the end, Pennsylvania debt settlement can give you the fastest & least expensive solution to becoming debt free.

Also Check: When To File Bankruptcy Chapter 7

Tip No : Check The Bbb

All debt relief companies should be rated by the Better Business Bureau. You want a company thats rated by the BBB, preferably with an A or A+ rating thats been maintained for several years.

When you visit a companys BBB page to check their rating, dont just check the letter grade. See how many complaints they have and how those complaints were handled. Keep in mind that any business is almost certain to have at least one or two bad customer experiences. But its how they handle those experiences that matter. You want to know if things go wrong, you want a company that will do everything they can do to make it right.

Also, check to make sure the company is not tied to any organization thats the subject of a class-action lawsuit by a state Attorney Generals office. Class action lawsuits are a bad sign.