How Bad Is It

Chinaâs debt is more than 250 percent of GDP, higher than the United States. It remains lower than Japan, the worldâs most indebted leading economy, but some experts say the concern is that Chinaâs debt has surged at the sort of pace that usually leads to a financial bust and economic slump.

Total debt to GDP

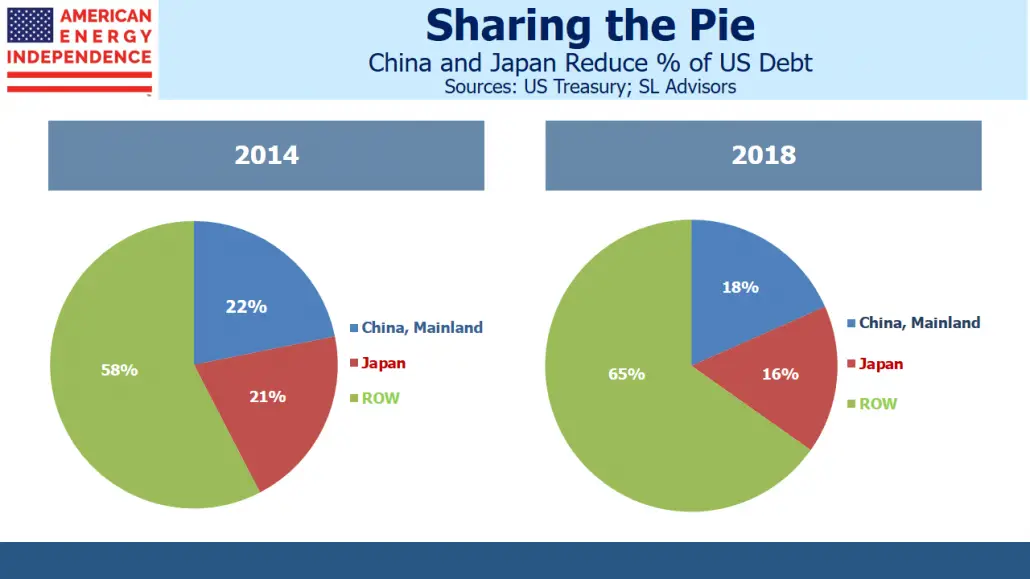

Who Owns The Most Us Debt

Around 70 percent of U.S. debt is held by domestic financial actors and institutions in the United States. U.S. Treasuries represent a convenient, liquid, low-risk store of value. These qualities make it attractive to diverse financial actors, from central banks looking to hold money in reserve to private investors seeking a low-risk asset in a portfolio.

Of all U.S. domestic public actors, intragovernmental holdings, including Social Security, hold over a third of U.S. Treasury securities. The secretary of the treasury is legally required to invest Social Security tax revenues in U.S.-issued or guaranteed securities, stored in trust funds managed by the Treasury Department.

The Federal Reserve holds the second-largest share of U.S. Treasuries, about 13 percent of total U.S. Treasury bills. Why would a country buy its own debt? As the U.S. central bank, the Federal Reserve must adjust the amount of money in circulation to suit the economic environment. The central bank performs this function via open market operationsbuying and selling financial assets, like Treasury bills, to add or remove money from the economy. By buying assets from banks, the Federal Reserve places new money in circulation in order to allow banks to lend more, spur business, and help economic recovery.

The biggest effect of a broad scale dump of US Treasuries by China would be that China would actually export fewer goods to the United States.

Scott Miller

The Chinese Debt Trap Is A Myth

The narrative wrongfully portrays both Beijing and the developing countries it deals with.

China, we are told, inveigles poorer countries into taking out loan after loan to build expensive infrastructure that they cant afford and that will yield few benefits, all with the end goal of Beijing eventually taking control of these assets from its struggling borrowers. As states around the world pile on debt to combat the coronavirus pandemic and bolster flagging economies, fears of such possible seizures have onlyamplified.

Seen this way, Chinas internationalizationas laid out in programs such as the Belt and Road Initiativeis not simply a pursuit of geopolitical influence but also, in some tellings, a weapon. Once a country is weighed down by Chinese loans, like a hapless gambler who borrows from the Mafia, it is Beijings puppet and in danger of losing a limb.

The prime example of this is the Sri Lankan port of Hambantota. As the story goes, Beijing pushed Sri Lanka into borrowing money from Chinese banks to pay for the project, which had no prospect of commercial success. Onerous terms and feeble revenues eventually pushed Sri Lanka into default, at which point Beijing demanded the port as collateral, forcing the Sri Lankan government to surrender control to a Chinese firm.

As Michael Ondaatje, one of Sri Lankas greatest chroniclers,once said, In Sri Lanka a well-told lie is worth a thousand facts. And the debt-trap narrative is just that: a lie, and a powerful one.

Also Check: How Many Times Did Donald Trump File Bankruptcy

Hidden Debts And Hidden Risks

Failing to account for these hidden debts to China distorts the views of the official and private sectors in three material ways. First, official surveillance work is hampered when parts of a countrys debt are not known. Assessing repayment burdens and financial risks requires detailed knowledge on all outstanding debt instruments.

Second, the private sector will misprice debt contracts, such as sovereign bonds, if it fails to grasp the true scope of debts that a government owes. This problem is aggravated by the fact that many Chinese official loans have collateral clauses, so that China may be treated preferentially in case of repayment problems. As a result, private investors and other competing creditors may underestimate the risk of default on their claims.

And, third, forecasters of global economic activity who are unaware of surges and stops of Chinese lending miss an important swing factor influencing aggregate global demand. One could look to the lending surge of the 1970s, when resource-rich, low-income countries received large amounts of syndicated bank loans from the U.S., Europe, and Japan, for a relevant precedent. That lending cycle ended badly once commodity prices and economic growth slumped, and dozens of developing countries went into default during the bust that followed.

National Debt Of The United States

| This article needs to be . Please help update this article to reflect recent events or newly available information. |

| This article is part of a series on the |

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms “national deficit” and “national surplus” usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

During the COVID-19 pandemic, the federal government spent trillions in virus aid and economic relief. The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945.

Recommended Reading: Debt Relief Credit Card

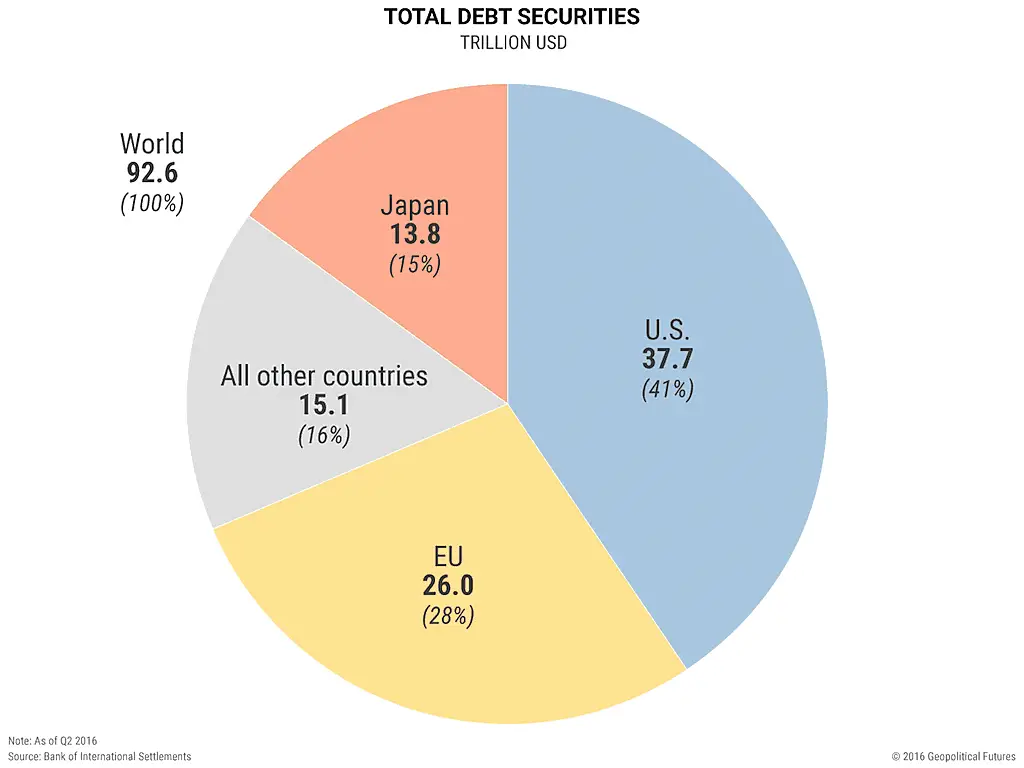

Us Debt: How Big Is It And Who Owns It

US federal debt is still a record high. This week it passed a milestone: the fourth straight year the deficit has passed the $1tn mark. As of today, the national debt stands at $16,066,241,407,385.80 .

It’s an issue that’s sure to come up in the first presidential debate this Wednesday.

So, how does the US borrow money? Treasury bonds are how the US – and all governments for that matter – borrow hard cash: they issue government securities, which other countries and institutions buy. So, the US national debt is owned mostly in the US – but the $5.4tn foreign-owned debt is owned predominantly by Asian economies.

Under President Obama’s first term, that figure has gone up from $3tn, a rise of 74.1%. Under George W Bush, it went up too – by 85% over the whole two terms – and 64% in his second term alone.

Holders of US Treasury bonds, $bn

The US Treasury releases the figures on this every quarter – we have made them more useable. So, who has the most?

It reflects a US national debt which has grown starkly, from $7.8tn in 2005 to busting through the US debt ceiling of $14.294tn last year – according to these day by day figures.

The full data is below. What can you do with it?

China’s Need For A Weak Renminbi

Chinas strategy is to maintain export-led growth, which aids in generating jobs and enables it, through such continued growth, to keep its large population productively engaged. Since this strategy is dependent on exports , China requires RMB in order to continue to have a lower currency than the USD, and thus offer cheaper prices.

If the PBOC stops interferingin the previously described mannerthe RMB would self-correct and appreciate in value, thus making Chinese exports costlier. It would lead to a major crisis of unemployment due to the loss of export business.

China wants to keep its goods competitive in the international markets, and that cannot happen if the RMB appreciates. It thus keeps the RMB low compared to the USD using the mechanism that’s been described. However, this leads to a huge pileup of USD as forex reserves for China.

Also Check: Best Place To Buy Liquidation Pallets

Negative Real Interest Rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt, meaning the inflation rate is greater than the interest rate paid on the debt. Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk. Economist Lawrence Summers states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness.

In the late 1940s through the early 1970s, the U.S. and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay this low. Between 1946 and 1974, the U.S. debt-to-GDP ratio fell from 121% to 32% even though there were surpluses in only eight of those years which were much smaller than the deficits.

Top 10 Countries The Us Owes Money To

In 1989, New York real estate investor Seymour Durst spent $120,000 to erect a “National Debt Clock” in Times Square to track the exact amount of money that the U.S. federal government was borrowing to pay its bills. At the time, the country had run up a $2.7 trillion tab, but that figure seems almost quaint today. In 2008, the clock briefly ran out of available digits when the debt topped $10 trillion. By June 2021, the upgraded clock which can now display up to a quadrillion dollars registered more than $28 trillion .

Now, it’s important to understand that U.S. doesn’t owe that entire $28 trillion to its creditors, which include individuals, businesses and foreign governments who purchased U.S. Treasury bonds and securities. More than 20 percent of the national debt, or $6.2 trillion, is incurred for intragovernmental holdings, which are funds the U.S. government owes itself, mainly for the Social Security and Medicare trust funds . In June 2021, these two trust funds alone accounted for some $2.4 trillion of the national debt.

But the question we want to answer today is, who owns the bulk of that $28 trillion in public debt? You can find out by perusing our global parade of America’s biggest sugar daddies, according to the U.S. Department of the Treasury.

Contents

You May Like: Can You Get A Car Loan After Bankruptcy

Should The Us Refuse To Pay Back Its $1 Trillion Debt To China

The recent intensification of President Donald Trumps hard line on China has included a wide-ranging grab bag of policies and proposals that touch on everything from student visas to soybean purchases. But the most explosive might be the suggestion floated by some right-wing lawmakers and commentators that the country could choose to default on some of the nearly $1.1 trillion in U.S. Treasury bonds held by China.

The proposal alarms analysts, who say even entertaining the idea is dangerous in an economic environment characterized by a pandemic-driven recession and a massive increase in the national debt.

Sen. Lindsey Graham, R-S.C., a close Trump ally, said on Fox News, They should be paying us, not us paying China, and expressed support for a suggestion from Sen. Marsha Blackburn, R-Tenn., that the U.S. should cancel its sovereign debt held by China.

John Yoo, a law professor at the University of California, Berkeley, and visiting scholar at the American Enterprise Institute, said in an article that the U.S. could make China pay for COVID-19 by reneging on its commitment to bondholders. Conceivably, Washington could even cancel Chinese-held treasury debt and us the proceeds to create a trust fund that would compensate Americans harmed by the pandemic, he wrote.

While Yoo allowed that this would roil financial markets, others say even that acknowledgement vastly understates the scope of economic calamity this would trigger.

Fannie Mae And Freddie Mac Obligations Excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of Fannie Mae and Freddie Mac has made the U.S. government reluctant to incorporate them into its own books. When the two mortgage companies required bail-outs, White House Budget Director Jim Nussle, on September 12, 2008, initially indicated their budget plans would not incorporate the government-sponsored enterprise debt into the budget because of the temporary nature of the conservator intervention. As the intervention has dragged out, pundits began to question this accounting treatment, noting that changes in August 2012 “makes them even more permanent wards of the state and turns the government’s preferred stock into a permanent, perpetual kind of security”.

Also Check: Are Bankruptcy Courts Affected By Government Shutdown

Risks To Economic Growth

Debt levels may affect economic growth rates. In 2010, economists Kenneth Rogoff and Carmen Reinhart reported that among the 20 developed countries studied, average annual GDP growth was 34% when debt was relatively moderate or low , but it dips to just 1.6% when debt was high . In April 2013, the conclusions of Rogoff and Reinhart’s study came into question when a coding error in their original paper was discovered by Herndon, Ash and Pollin of the University of Massachusetts Amherst. Herndon, Ash and Pollin found that after correcting for errors and unorthodox methods used, there was no evidence that debt above a specific threshold reduces growth. Reinhart and Rogoff maintain that after correcting for errors, a negative relationship between high debt and growth remains. However, other economists, including Paul Krugman, have argued that it is low growth which causes national debt to increase, rather than the other way around.

Commenting on fiscal sustainability, former Federal Reserve Chairman Ben Bernanke stated in April 2010 that “Neither experience nor economic theory clearly indicates the threshold at which government debt begins to endanger prosperity and economic stability. But given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time.”

Why Do Countries Accumulate Foreign Exchange Reserves

Any country that trades openly with other countries is likely to buy foreign sovereign debt. In terms of economic policy, a country can have any two but not three of the following: a fixed exchange rate, an independent monetary policy, and free capital flows. Foreign sovereign debt provide countries with a means to pursue their economic objectives.

The first two functions are monetary policy choices performed by a countrys central bank. First, sovereign debt frequently comprises part of other countries foreign exchange reserves. Second, central banks buy sovereign debt as part of monetary policy to maintain the exchange rate or forestall economic instability. Third, as a low-risk store of value, sovereign debt is attractive to central banks and other financial actors alike. Each of these functions will be discussed briefly.

Don’t Miss: New Foreclosure Law In California

How Much Us Debt Does China Own

Nations borrowing from each other may be as old as the concept of money. Foreign debt provides the opportunity for countries to secure the financing they ordinarily wouldn’t have access to and to stimulate their economy.

However, the concept of foreign debt carries a negative connotation, especially when it concerns large amounts owed to nations embroiled in controversy. For example, the huge amount of debt that the U.S. government owes Chinese lenders has been the subject of countless debates, headline news stories, and political platforms for decades.

Why Is The Us In Debt To China

The U.S. doesn’t restrict who may buy its securities. China invests in U.S. debt because of the positive effect these low-risk, stable investments can have on its economy. By investing in dollar-denominated securities, the value of the dollar increases relative to the value of China’s currency, the yuan. This, in turn, makes Chinese goods cheaper and more attractive than U.S. goods to buyers. That increases sales and strengthens the economy.

Also Check: Which Chapter Of The Bankruptcy Code Applies To Municipalities

Is The National Debt A Problem

Economists and lawmakers frequently debate how much national debt is appropriate. Most agree that some level of debt is necessary to stimulate economic growth and that there is a point at which the debt can become a problem, but they disagree about where that point is. If the debt does get too big, it can result in cuts to government programs, tax hikes, and economic turmoil.

Us Debt Held By China Drops To Lowest In 12 Years

The total U.S. debt held by China has reportedly dropped to its lowest rate in 12 years, according to data released by the Treasury Department.

The data published Monday found that Chinas holding of U.S. debt dropped to $980.8 billion in May, down $23 billion since April.

As of now, Japan is the leading holder of U.S. debt, with $1.2 trillion, data noted.

CNBC reported that this is the first time since 2010 that Chinas debt holding has fallen below the $1 trillion mark. The news outlet added that the drop can be attributed to Chinas government working on issues to diversify its foreign debt portfolio.

The new data release comes as the Federal Reserve has been raising interest rates to curb the rise of inflation in the U.S.

Last month, the Fed issued a 0.75 percentage point hike in interest rates, the largest increase in nearly 30 years.

Speaking at a Senate Banking Committee hearing, Federal Reserve Chairman Jerome Powell acknowledged that the recent battle with inflation could tip the country into another recession.

Read Also: How Long Does It Take For Bankruptcy To Discharge