When You Apply For A Loan Like A Mortgage Auto Loan Or Personal Loan Lenders Often Want To Know How Much Debt You Have Compared To How Much Money You Earn In Other Words They Want To Know Your Debt

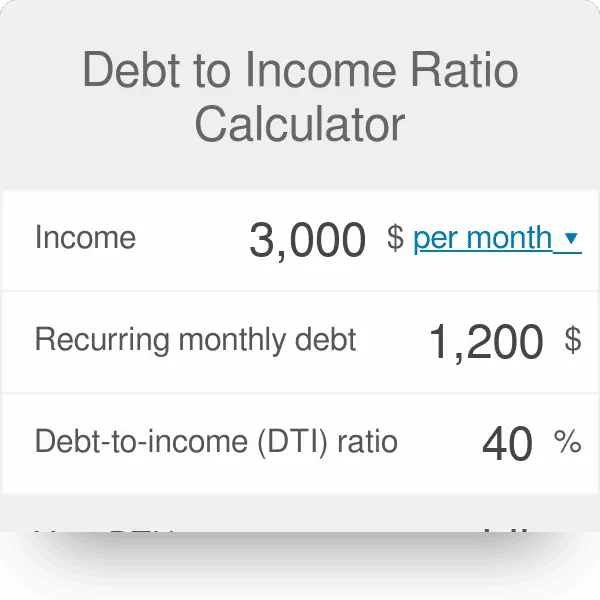

Your debt-to-income ratio, or DTI, is a calculation of your monthly debt payments divided by your gross monthly income.

Lets take a look at how to calculate your debt-to-income ratio, learn why your DTI matters, understand what a good debt-to-income ratio looks like and how to lower your DTI ratio.

What Should Your Debt

Creditors will also consider your DTI ratio when applying for a mortgage refinance. As with mortgage loans, a higher DTI will make it much harder to get approved for refinancing your home loan. Check our refinance calculator to determine if refinancing your mortgage is the right choice for you.

- For cash-out refinance, Chase recommends that consumers have a DTI of 40% or lower.

- Rocket Mortgage states that most lenders prefer consumers which have a DTI of 50% or lower when applying for mortgage refinance.

Example 4 Dscr + Fill Out Income Statement

In this example, we will calculate the Debt Service Coverage Ratio of Company D. Use the following information and the partial income statement:

Information:

The tax rate is 50%.

R& D Expense is $10M less than half of the firms SG& A Expense.

Principal Payments are double the Pre-Tax Profit.

Cost of Goods Sold is 60% of Sales.

Net Income is 25% of the Lease Payments.

SG& A Expense is 30% of the companys Sales.

Lease Payments are double the Interest Expense.

Answer

Step 1: Write out the formula

DSCR = Net Operating Income / Debt Service

Step 2: Fill out the income statement

To find the firms Net Operating Income, since most line items are blank, we must first fill out the income statement with the information we have:

Lease Payments

Starting with the Interest Expense of $20M , we can figure out the Lease Payments since they are double the Interest Expense.

Lease Payments = 2 x $20M = $40M

Net Income

We can now figure out the Net Income .

Net Income = 25% x $40M = $10M

Pre-Tax Profit & Tax Expense

The 50% tax rate implies that the tax expense is 50% of the Pre-Tax Profit. The firm keeps 50% of the Pre-Tax Profit as Net Income. Therefore, we can conclude that the Pre-Tax Profit is double the Net Income.

Pre-Tax Profit = 2 x $10M = $20M

Tax Expense = Pre-Tax Profit Net Income

Tax Expense = $20M $10M = $10M

Principal Payments

Principal Payments are double the Pre-Tax Profit

Principal Payments = 2 x Pre-Tax Profit

Principal Payments = 2 x $20M = $40M

Operating Income

Don’t Miss: Mecklenburg County Tax Foreclosures

Income That Goes Into The Debt To Income Formula

The income that you will use for the debt-to-income ratio is your gross monthly income. This means your income before taxes are taken out.

If your pay varies monthly, divide your annual income by 12 for an average monthly income.

What Not to Include

Don’t include other income like alimony or child support payments.

Why Does Your Dti Ratio Matter

Lenders may consider your DTI ratio as one factor when determining whether to lend you additional money and at what interest rate. Generally speaking, the lower a DTI ratio you have, the less risky you appear to lenders. The preferred maximum DTI ratio varies. However, for most lenders, 43 percent is the maximum DTI ratio a borrower can have and still be approved for a mortgage.

Recommended Reading: What Are 4 Advantages Of Filing Bankruptcy

Why Is The Dscr Important

The DSCR ratio indicates the financial health of an entity. A lower ratio indicates an increased probability of default or bankruptcy. However, a low ratio does not necessarily mean the company is at risk. A companys DSCR should be compared to the DSCR of other companies operating in the same industry and evaluated relative to the industry average. It would be inappropriate to compare an airline company with a software company .

How Much Do Debt Ratios Affect A Credit Score

Your income does not have an impact on your credit score. Therefore, your DTI does not affect your credit score.

However, 30% of your credit score is based on your credit utilization rate or the amount of available on your current line of credit. Generally, your utilization rate should be 30% or lower to avoid having a negative effect on your credit score. That means that in order to have a good credit score, you must have a small amount of debt and actively pay it off.

You May Like: How To File For Bankruptcy In Ms

A Detailed Look At Debt

Like many other financial measurements, the debt-to-income ratio is all about balance. More specifically, having a low DTI represents a good balance between your personal debt and income, as the lower your DTI, the less money youre typically spending on your debts each month.

As such, your DTI ratio is represented as a percentage to show the portion of your average income spent on debts. For example, if your DTI ratio was 23%, that number would indicate that you dedicate 23% of your gross income to debt payments each month.

Ideally, youll want your DTI ratio to be as low as possible. After all, a high DTI of 60% would leave you little income to spend on groceries, events, or hobbies. In fact, a high DTI ratio is a huge red flag for investors and lenders, as the percentage will suggest that a borrower cannot handle taking on any more loans.

As a result, its no surprise that the debt-to-income ratio will usually affect what borrowers can finance as banks and other lenders will analyze it before deciding to lend money.

Understanding Your Financial Goals

Your DTI ratio is a valuable financial measurement that can help shine some light on your current financial situation. After all, we cant expect to make tangible financial goals if we dont have a grasp on where we currently stand.

Think about where you see yourself in a year, or even five years. Do you want to own a house? Or trade in your used car for a new one? If you have a specific financial goal in mind, its important to make plans that will help you achieve that goal.

For instance, if youre currently renting an apartment but youre interested in buying a house, you can use your DTI ratio to plan for the future.

First, calculate your current DTI. Afterward, the percentage you receive will not only allow you to understand your current financial situation but also make it easier to assess whether or not you need a different job, need to pay off some debts, or even how long it might take to save the money you need for a proper down payment.

In other situations, knowing your financial goals can also allow you to make intelligent investments, as well as avoid falling victim to the most negative side effects of interest or inflation.

Ultimately, no matter what your current circumstances may be, its never too late to start looking into aspects of your financial situation, such as your DTI ratio, in order to plan for the future.

How useful was this post?

Also Check: What Happens When A Business Declares Bankruptcy

Breaking Down The Dti Ratio

Lenders often evaluate two different DTI ratios: the front-end ratio and the back-end ratio.

The front-end ratio, sometimes called the housing ratio, shows what percentage of a borrowerâs monthly income is used for housing expenses. This ratio could include monthly mortgage payments, homeowners insurance, property taxes and homeowners association dues.

The back-end ratio is the amount of a borrowerâs income that goes toward housing expenses plus other monthly debts. And it can include revolving debts such as credit card or car payments, student loans and child support.

Lenders typically say the ideal front-end ratio should be no more than 28%, and the back-end ratio, including all expenses, should be 36% or lower. In reality, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios, depending on the type of loan youâre applying for.

What Do Those Numbers Mean

Now that you know how to calculate debt to income ratio, what do the numbers actually mean? In the first example, you have a DTI of 83%. This means that 83% of your income covers your total monthly debt payments.

In the second example, 125% DTI, means that you are spending more on your total monthly debt payments than you have a gross monthly income.

In the third example, 33%, you are spending 1/3 of your gross monthly income on debts.

The higher your debt-to-income ratio, the lower the probability that you will be able to repay a new loan.

Recommended Reading: Overstock Phone Number For Orders

What Does Your Debt

| DTI | What it means |

|---|---|

| Less than 36% | You have a good amount of debt relative to your income, which should make it easier to maintain financial stability. If you apply for new financing, you should have little trouble getting approved, as long as your credit score is high enough to qualify. |

| 37-41% | This is within a normal range of how much debt you should have relative to your income. However, you may need to eliminate some debt before you apply for your next loan or line of credit. This will make it easier to ensure you can get approved. |

| 41-45% | Having this much debt will make it difficult to find a lender that will extend you a new line of credit. You should take action to reduce debt and stop making new charges on your credit cards until youve paid off some of your balances. Consider options, like debt consolidation, that can make it easier to pay off your balances. |

| More than 50% | This much debt is bad for your financial health and you need to get help immediately. This much debt may make it difficult to pay off on your own, since you have too much debt to qualify for do-it-yourself options, like debt consolidation loans. Call to review your options for relief with a trained credit counsellor. |

How lenders use debt-to-income ratio during loan underwriting

Talk to a trained credit counsellor to find the best way to eliminate debt for your needs and budget.

How To Understand Your Dti Ratio

Your DTI can help you determine how to handle your debt and whether you have too much debt.

Heres a general rule-of-thumb breakdown:

-

DTI is less than 36%: Your debt is likely manageable, relative to your income. You shouldnt have trouble accessing new lines of credit.

-

DTI is 36% to 42%: This level of debt could cause lenders concern, and you may have trouble borrowing money. Consider paying down what you owe. You can probably take a do-it-yourself approach two common methods are debt avalanche and debt snowball.

-

DTI is 43% to 50%: Paying off this level of debt may be difficult, and some creditors may decline any applications for more credit. If you have primarily credit card debt, consider a . You may also want to look into a debt management plan from a nonprofit credit counseling agency. Such agencies typically offer free consultations and will help you understand all of your debt relief options.

-

DTI is over 50%: Paying down this level of debt will be difficult, and your borrowing options will be limited. Weigh different debt relief options, including bankruptcy, which may be the fastest and least damaging option.

Debt-to-income ratio, or DTI, divides your total monthly debt payments by your gross monthly income. The resulting percentage is used by lenders to assess your ability to repay a loan.

To calculate debt-to-income ratio, divide your total monthly debt obligations by your gross monthly income.

You May Like: How Much Is It To File Bankruptcy

How To Lower Your Debt

How Much Does Your Debt

Your DTI never directly affects your or . may know your income but they dont include it in their calculations. Your is still factored into your home loan application. However, borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score. Lowering your credit utilization ratio will help boost your credit score and lower your DTI ratio because you are paying down more debt.

Don’t Miss: How To Start Building Credit After Bankruptcy

Should I Apply For A Home Loan With A High Dti

In limited instances, high debt-to-income ratios mean lenders may be less willing to give you a mortgage loan or may ask you to pay a higher interest rate for the loan, costing you more money. While you can still apply for and receive a mortgage loan with a high DTI, its best to look for ways to lower the ratio if possible so you can get a better interest rate.

Multiply That Number By 100 To Get A Percentageand Thats Your Debt

Lets look at an example:

Bob pays $600 a month in minimum debt payments plus $1,000 per month for his mortgage payment. Before taxes, Bob brings home $5,000 a month. To calculate his DTI, add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 0.32. Multiply that by 100 to get a percentage.

So, Bobs debt-to-income ratio is 32%.

Now, its your turn. Plug your numbers into our debt-to-income ratio calculator above and see where you stand.

Also Check: Where To Go To File Bankruptcy

Establish Your Estimated Monthly Mortgage Payment

Use the PITI calculation to figure out your estimated monthly mortgage payment. The PITI acronym stands for principal, interest, taxes and insurance.

Pull your estimated monthly mortgage payment from your loan estimate. The amount you see should be based on your:

- Principal and interest payment

This list doesnt include your utility bills or any miscellaneous expenses.

If Your Dti Is Between 36% And 50%

A DTI between 36% and 50% is still considered OK for the most part you can likely still qualify for a loan fairly easily with a DTI ratio in this range. If your DTI is closer to 50%, however, it may require taking action to reduce debt if you plan on applying for a mortgage soon and hope to get a favorable rate.

If you can afford to do so, you should practice strategies like the snowball method to attempt to pay down some of your debts before applying. While you may have no issues getting a loan, getting rid of some of your debts might help you achieve a lower interest rate going forward.

Also Check: Will Filing For Bankruptcy Stop A Judgement

Why Your Mortgage Dti Ratio Matters

Your debt-to-income ratio helps to determine whether you can afford to repay a mortgage. A low DTI ratio demonstrates your ability to manage your existing debt and a new home loan. But a higher DTI ratio can make it harder to qualify for a mortgage because it shows your budget is stretched too thin. In other words, you dont have enough income to cover more debt.

Mortgage lenders establish maximum DTI ratios as part of their loan approval process. The often-cited rule of thumb is to keep your back-end ratio at or below 43%, according to the Consumer Financial Protection Bureau.

Here are the maximum back-end DTI ratios by loan type:

- Federal Housing Administration : 43%

- U.S Department of Agriculture : 41%

- U.S. Department of Veterans Affairs : 41%

Some lenders may allow a slightly higher DTI ratio up to 50% in many cases if you have compensating factors, such as a higher credit score or larger down payment.

How To Calculate Your Debt

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, you’d then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, you’d take 0.3 and multiply it by 100, giving you a DTI of 30%.

Recommended Reading: Is My Ira Protected From Bankruptcy