Find Ways To Improve Your Dti

Weve reviewed several sources of loans for high debt-to-income ratio consumers. The loan matching and debt consolidation services in this article can help you obtain loans despite a high DTI ratio, either directly or through .

Arranging a personal loan is easier if you can first pay down some of your debt and reduce your DTI ratio. You can also improve the ratio by finding ways to increase your monthly income, perhaps through a raise, a new job, or side gig. Economizing on your monthly spending, if possible, may allow you to pay down existing debt and keep it low.

Debt Consolidation Loans For High Debt

A debt consolidation loan allows you to scoop up some or all of your current loans and put them into one basket. This way, you only have to remember one loan payment per month, and your new monthly payment may be less than the sum of your current monthly payments.

A consolidation loan can be especially useful if it results in a lower APR. The following three companies offer debt consolidation and debt relief services to consumers with high DTI ratios.

| Yes | 9.5/10 |

Freedom Debt Relief specializes in debt relief services, including debt consolidation assistance. The company works with an external lender to provide debt consolidation loans to qualified customers with at least $10,000 of existing debt.

The company has helped more than 600,000 clients resolve $5+ billion in debt since 2002. Freedom Debt Relief doesnt handle collateralized debt, but rather concentrates on debt from credit cards, medical bills, personal loans, and other unsecured debt.

The Good And Bad Of Store Credit Cards

If youve ever been to a department store or chain retailer, the salesperson probably asked you if you wanted to open a store credit card, which is like a normal credit card except that, in most cases, you can only use it at participating stores and businesses. Some of the biggest chain outlets and retailers, such as Target, Home Depot, Walmart, Macys and other clothing retailers offer this option. But how do these cards work? And can they actually help you save money? Lets find out.

Recommended Reading: How To Choose A Bankruptcy Lawyer

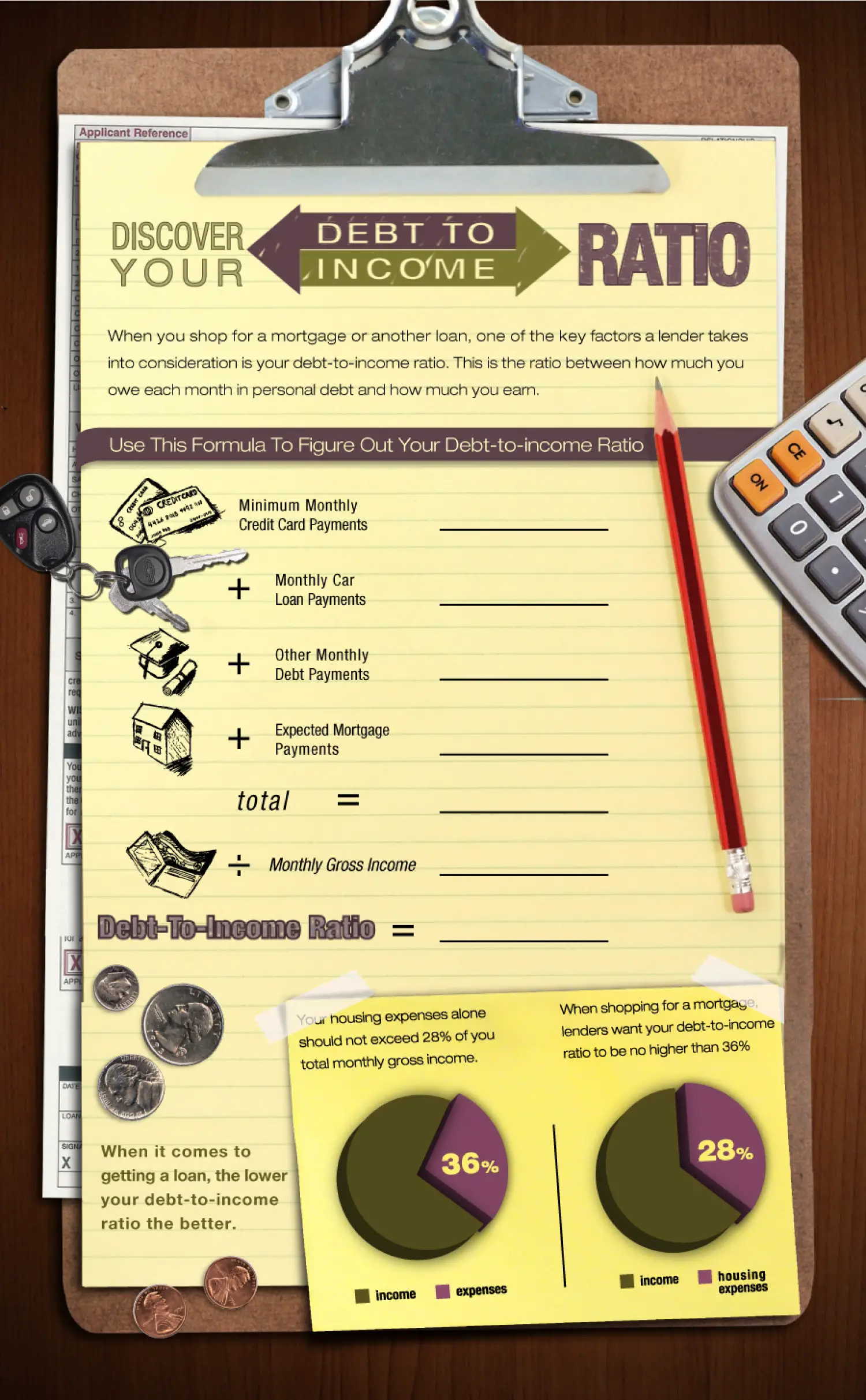

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

Looking For Help To Manage Your Debt Compare Debt Relief Companies

1 – 1 of 1

My personal loan application was rejected because of my DTI. What do I do?

If you dont need the loan right away, consider holding off on reapplying until youve taken steps to improve your DTI. Showing that you can repay your loan is one of the most important factors to a reputable lender.

If its an emergency, consider applying for a short-term loan, which often comes with more lenient eligibility requirements. Keep in mind theres no guarantee youll be approved for a short-term loan either. Even if you are approved, you could end up with astronomical interest rates that can send you into a debt spiral if youre unable to make your repayments on time.

Don’t Miss: Is Filing Bankruptcy A Good Idea

If Your Dti Is Less Than 36%

Youre in great shape. Approval for most loans, including car loans and consolidation loans should be easy. Even mortgage approval should go smoother with a DTI in the optimal range. However, a great DTI ratio does not guarantee the best loan terms . As such, in addition to ensuring that your debt-to-income percentage stays low, make sure your credit score is healthy by maintaining a low credit utilization rate, making on-time payments, and keeping credit inquiries to a minimum.

How Do I Improve My Debt

If your DTI ratio isnt as low as you hope it to be, its never too late to improve it. You can improve your DTI ratio by changing to healthy financial habits and making more conscious decisions as you plan out your finances.

You have one of two options: focus on decreasing some of your debts by paying more than the minimum or increase your household earnings by negotiating a salary increase or adding side work.

To pay down your debts, the snowball method can be used by paying off the smallest debts first before moving on to larger ones or an aggressive strategy such as the avalanche method can be used by paying off the highest-interest rate debt first, followed by next highest and so on.

Results dont happen overnight, so patience is important.

Read Also: How Soon Can You Refinance After Bankruptcy

What Are Lending Ratios

Lending ratios, or qualifying ratios, are ratios used by banks and other lending institutions in credit analysis. Financial institutions assign a credit score to borrowers after performing due diligence, which involves a comprehensive background check of the borrower and his financial history.

Lending ratios are extensively used in the underwriting approval processes for loans. Lending ratio usage varies across lenders. They apply different ratios in , and the choice depends on the borrowers goals and the projects where they plan to deploy capital.

The ratios help to define whether individual or institutional borrowers will be able to fulfill financial obligations after obtaining a loan. The credit analysis process consists of qualitative and quantitative methods. Lending ratios are an integral part of quantitative analysis.

How To Reduce Your Debt

Here are few things to consider if you want to reduce your debt-to-income ratio or learn how to use credit wisely:

Avoid Taking On New Debt

Avoiding debt can help build your financial well-being, according to the CFPB. And because your DTI ratio depends on your amount of debt versus your income, taking on more debt without growing your income will increase your DTI ratio. So itâs a good idea to apply only for the credit you need and avoid taking on new debt.

Pay Down Existing Debt

There are a few different strategies for paying off debt. The CFPB talks about the snowball and highest-interest-rate methods. But there are many more strategies for handling loan paymentsâsuch as consolidating debtâthat you might explore, too.

Before you make any decisions, consider talking to a qualified financial professional to figure out a debt management plan for your specific situation. You might even have access to some financial planning services through your employer or retirement plan administrator.

Pay More Than the Minimum

The CFPB recommends paying more than the minimum payment on your credit cards whenever possible. This may help you reduce your credit card debt faster and minimize charges. It can also help your , which can be an important factor in calculating your credit scores.

Use a Budget

Read Also: How Do I Stop Foreclosure

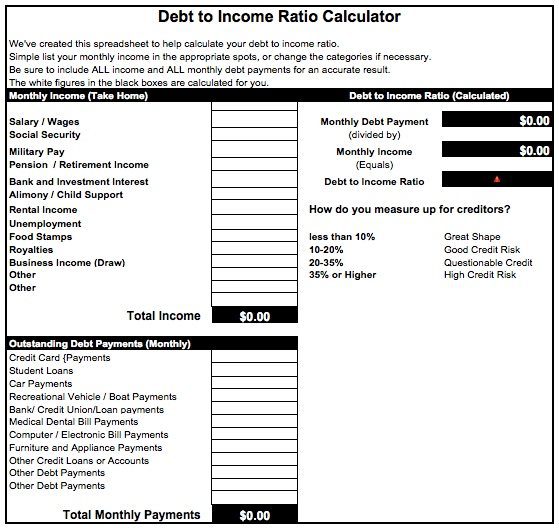

Calculate Your Dti Ratio

Divide your total monthly debt payments by your monthly net income. To convert this into a percentage, multiply it by 100 this number is your DTI ratio.

For example:

The DTI ratio youll need to qualify for a loan will depend on the type of loan you get as well as the lender. For example, if you want to take out a personal loan, your DTI ratio should be no higher than 40% though some lenders might require lower ratios than this.

If your DTI ratio seems to be in good shape and you want to apply for a personal loan, be sure to consider as many lenders as possible to find the right loan for you. Credible makes this easy you can compare your prequalified rates from multiple lenders in two minutes.

Ready to find your personal loan? Credible makes it easy to find the right loan for you.

- Free to use, no hidden fees

- One simple form, easy to fill out and your info is protected

- More options, pick the loan option that best fits your personal needs

- Here for you. Our team is here to help you reach your financial goals

What If My Dti Ratio Is Too High

Remember, requirements for DTI arent set in stone. Lenders will also look at your credit score, assets you have like money in savings and checking accounts and what youre willing to put down on a home loan or auto loan. Certain types of loans, like first-time homebuyer mortgages backed by the federal government or low down payment programs, can accept a DTI that is higher than the normal maximum.

Recommended Reading: How To Claim Bankruptcy In Texas

What Types Of Payments Are Included In Dti

A front-end DTI ratio only includes housing-related costs such as rent, mortgage payments , home insurance payments, property taxes, or HOA fees. This ratio is typically only used by mortgage lenders when you buy a home. A back-end ratio includes all financial obligations like car payments or student loans and is used by most lenders. The DTI calculation does not include expenses such as food, utilities, insurance, or cellphone bills even if they are recurring.

An easy way to determine which types of debt payments are included in DTI is to consider the types of payments that affect your credit score. A missed credit card payment would definitely be noted on your credit score. Forgetting to pay your cell phone service provider, however, wouldnt carry the same credit penalties. That phone payment wouldnt be immediately reported to a credit bureau and therefore doesnt need to be included in your debt-to-income calculation.

Other types of payments to include in a DTI calculation are:

- Any other monthly installment loans

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

Recommended Reading: Is It Hard To Rent A House After Bankruptcy

Have Home Equity Cash

If youve been in your home for several years or more, chances are you have what is known as home equity, which means youve paid off a substantial part of your mortgage loan. You can turn your home equity into cash with a cash-out refinance or a home equity loan. Refinancing your mortgage may also allow you to lock in a lower interest rate, helping you save money in the years to come.

Difference Between Secured And Unsecured Loan

If youre in the market for a consumer loan, you may have the option of choosing between whats known as a secured loan and an unsecured loan. Both types of loans will give you access to funds that you will need to pay back at a later date, but they come with clear differences that every borrower should be aware of. Learn more about the difference between secured and unsecured loans so that you can find the right type of loan for your needs.

You May Like: How To File Bankruptcy And Keep Car

Dti Calculator: Try Our Debt

- Copied link to Clipboard!

If youre hoping to get a home loan, auto loan or debt consolidation loan, theres one important number lenders will want to take a close look at. That number is your debt-to-income ratio Even if your credit report is squeaky clean, your DTI is a good indicator of whether or not youre overextended and might have trouble with additional monthly debt payments like house or car loans.

LESSON CONTENTS

Your DTI ratio has several components:

The front end ratio is generally composed of housing expenses and includes:

- Mortgage or rent payment

- Private mortgage insurance

- Property taxes

The back end ratio is composed of the above housing costs plus all other monthly expenses and debt payments including:

- Minimum payments for credit card debt

- Auto loan payments

- Monthly alimony or child support payments

- Payments that show on your credit report for other debt

- The loan payment you are applying for

Both ratios are calculated by dividing your monthly expenses by your monthly gross income.

For example, if your monthly income is $6,000, and you have a housing payment of $1,500, your front-end ratio is 25%. If your other monthly debts total $1,000, the back-end ratio is 41%. You can use our debt-to-income calculator below to arrive at your own DTI.

Lenders use your DTI to determine how well you manage your monthly obligations. The higher your DTI is, the higher the risk lenders feel they are taking on when they loan you money.

What Should You Do If You Have A High Debt To Income Ratio

For your own knowledge, you should at all times monitor your debt to income ratio. It is a part of good financial planning to have a tab on your finances. When your income rises or when you are considering the idea of availing a new loan, it is a good idea to re-check your debt-income ratio and assess your financial position.

If you notice that your Debt to Income Ratio is high then there are things you can do to lower it. You can:

- Postpone a purchase if it is not essential.

- Increase your EMI and pay off the loan quicker this will temporarily raise your debt-income ratio but make it lesser in the long run.

- Not take more debt until your ratio has stabilized to below 35%.

- Look for ways in which you can increase your income

- If possible, foreclosing any existing loans would also be a good idea.

You May Like: How To File Bankruptcy In Oklahoma

Open A Debt Consolidation Loan Or Balance Transfer Credit Card

Debt consolidation may help you get a better interest rate and pay down your balances sooner, ultimately helping you bring down your debt-to-income ratio.

Two common strategies of consolidating debt is with a personal loan or a balance transfer credit card:

| Debt consolidation vs. balance transfer |

| Debt consolidation loan |

Spring Cleaning With The Help Of A Home Equity Line Of Credit

Spring is right around the corner, and that means its time to get your home in shape. Spring cleaning is a time for cleaning, organizing and improving your living space. From adding a new deck to renovating your kitchen, there are so many projects to consider. However, spring cleaning home improvements can be costly. Depending on the size and scope of your project, you might need to borrow money. You can use a HELOC to help finance your spring cleaning plans. Learn more about how to use a HELOC to improve your home.

Recommended Reading: How To Get A Mortgage After Bankruptcy And Foreclosure

If I Have A High Debt

These ratios are indicators of the position you typically need to be in to get financing. If your debt-to-income ratio is too high, you may be turned down. However, depending on your financial situation, you may still qualify for a loan.

Your file will be examined by your bank in order to evaluate your situation and your profile as a whole, taking into account several elements such as:

How much do you make? What field do you work in? How long have you been in your current job? Why are you applying for a loan? What are your assets and your liquidity? How is your credit report?

A lender could also ask you to find a co-borrower or an endorser in order to reduce the risks related to granting you a loan.

If you want to get a loan, you should not exceed the limits on these ratios they are critical thresholds, and indicators of a high debt load. Getting close to that maximum not to mention exceeding it is dangerous. You may find yourself in a precarious situation if an unexpected event should arise, like if youre faced with unexpectedly high interest rates, lose your job, or encounter a health issue.

If Your Dti Is Greater Than 50%

This is a sure sign of financial distress. If you spend over half your income paying bills, youre probably struggling elsewhere and have a low likelihood of being able to contribute towards your savings. This sort of financial situation isnt sustainable and you could potentially be headed for bankruptcy. Consider seeking professional help to reduce debt levels as quickly as possible.

Get professional help to clean up errors in your credit report. |

Recommended Reading: How Bad Is It To File Bankruptcy Twice

How Is Your Dti Ratio Calculated

To calculate your DTI ratio, divide your total recurring monthly debt by your gross monthly income the total amount you earn each month before taxes, withholdings and expenses.

For example, if you owe $2,000 in debt each month and your monthly gross income is $6,000, your DTI ratio would be 33 percent. In other words, you spend 33 percent of your monthly income on your debt payments.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

Recommended Reading: What Happens At The End Of Chapter 13 Bankruptcy