How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

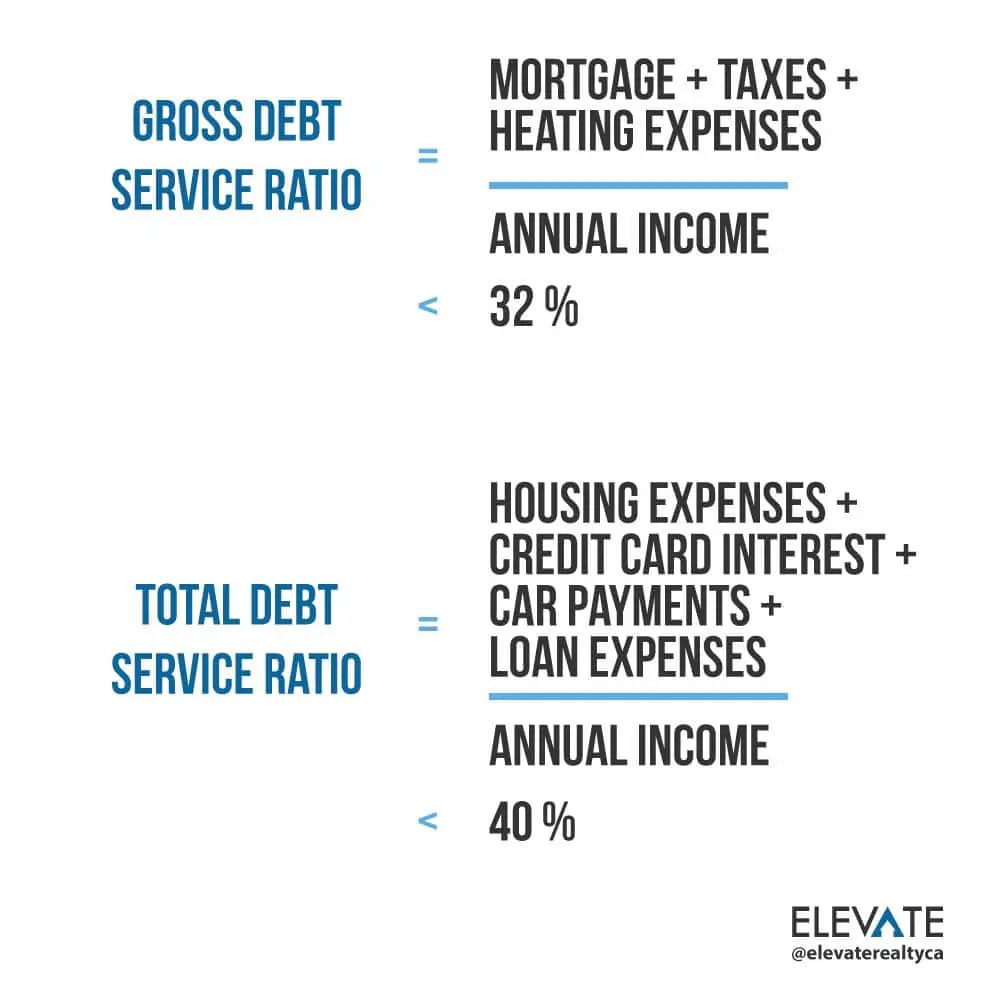

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Refinance Debt To Pay It Down Faster

One of the other popular ways to reduce debt is to refinance outstanding loans. If your credit score has improved since you originally took out your loans, you could qualify for a lower interest rate now. This is true for private student loans or other personal loans you may have taken out.

When you refinance your debt, you take out a new loan at a lower interest rate and use the funds from that loan to repay your old debt. Youll still have the same original amount of outstanding debt, but youll save money with the lower interest rate. The money that you save can be directed toward repaying your loan faster. The sooner you remove debts from your credit report altogether, the sooner your debt-to-income ratio will improve.

If you go this route, dont forget to factor in costs like origination fees on the new loan or prepayment penalties on the old loan. These could add up and detract from the savings youd potentially get with a lower interest rate.

Also, although you could get a lower monthly payment by opting for a longer term when you refinance, this could also work to keep you in debt for longer, which means youd pay more in interest over the life of the loan. If you decide to refinance debt such as student loans, compare refinancing rates online to make sure youre getting your best deal.

Read The Following 8 Ways To Lower Your Debt To Income

Read Also: Maximum Debt To Income Ratio For Mortgage

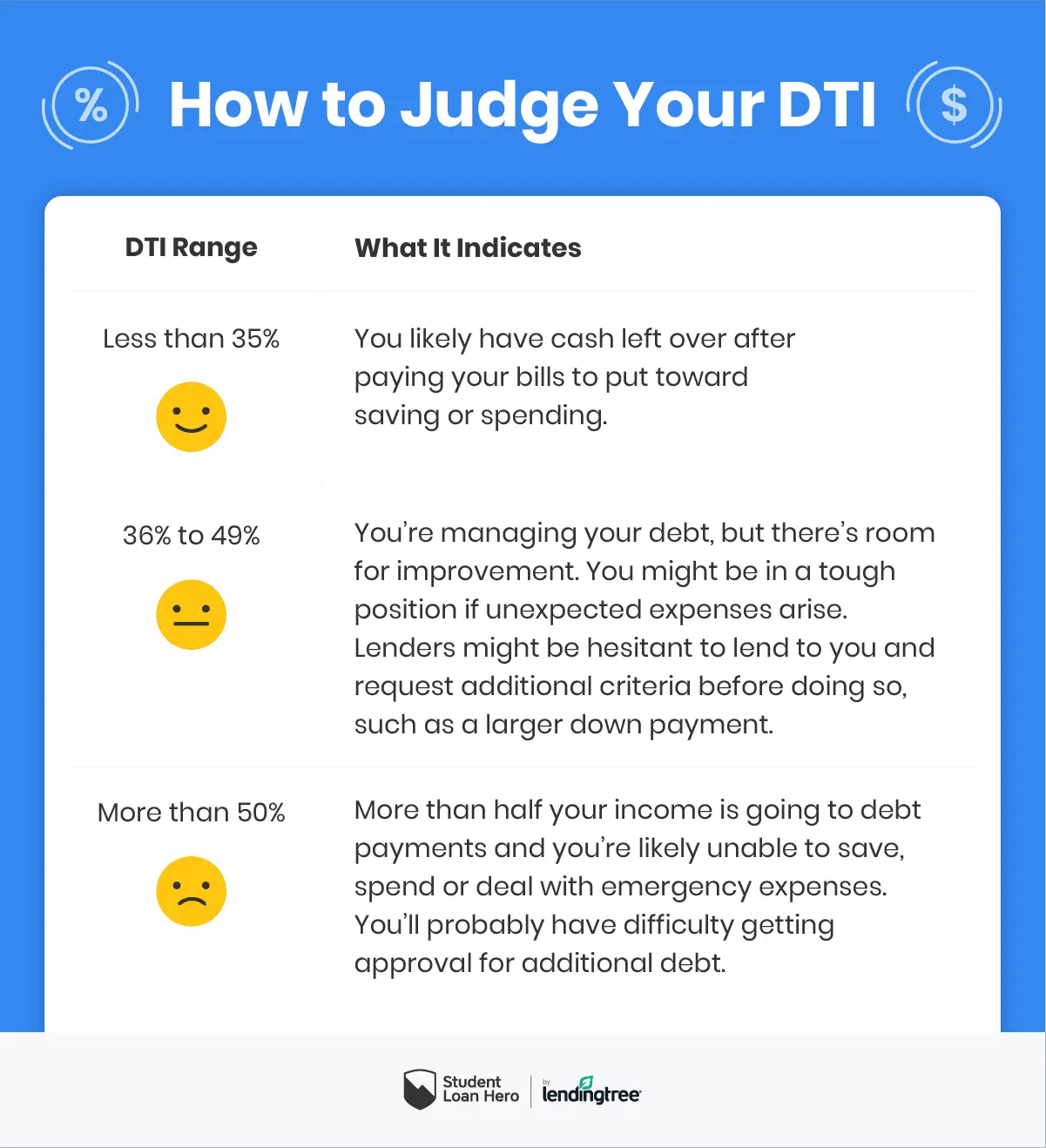

Should You Worry About Your Dti

No. Instead of worrying about your debt-to-income ratio, you should work towards lowering the number to a more favorable percentage. The DTI is an important tool for lending institutions, but it is only one of the many barometers they use to gauge how safe it would be to lend you money.

However, when it comes to buying a home, your DTI sits front and center on the negotiation table. You will certainly incur higher interest rates with a high DTI, and you may be required to slap down a heftier down payment.

Seasoned lenders know that a ratio above 40 percent means you’re treading on the slippery slope to fiscal collapse. It says you’re making ends meet, but just barely. Lenders will assume that any additional loan you take on might be the last straw.

Can you lower your DTI? Of course! Lowering your ratio is almost as easy as calculating it. Then again, it will take you a lot longer. Fortunately, it’s easier and quicker than improving your credit score, but it does require a major shift in your way of thinking.

Can you reduce your DTI to zero? Maybe or maybe not, but that’s still a goal worth setting. Use the following tips to put your best foot forward for lenders.

What Is A Good Dti Ratio

A good target for a front-end DTI ratio is below 28%, and a good target for a back-end DTI is below 36%.

But you can qualify for a mortgage with a higher DTI. The requirement will vary by the lender and type of mortgage.

Ideally, though, youll want to keep your DTIs as low as possible, regardless of lenders limits. Paying down debt will help improve your, and a higher credit score and lower DTI ratio will help you get a better mortgage interest rate.

» MORE:The best lenders for low credit score borrowers

You May Like: Which Bankruptcy Do You Pay Back

Finding A Side Hustle

Side hustles have become increasingly more common over the last few years. More than 57 million Americans had a source of side income last year, which has helped close the income gap.

Working a side hustle is a bit different, as it increases income rather than reducing debt. It is perhaps one of the easiest means of raising income. Securing a side hustle may be easier than getting a raise or promotion at work. Its also a more short-term, immediate solution compared to waiting for a raise or bonus.

Even earning an extra couple hundred bucks a week can help if you have high DTI. Increasing your income also puts extra funds in your pocket that you can use to pay down your existing debt.

Find Ways To Decrease Your Debt And Increase Your Income

Your debt-to-income ratio can make or break your application for a loan. Plus, its closely connected to your credit utilization, which makes up 30% of your FICO credit score.

A high DTI also is burdensome from month to month, because it means your loan payments are eating up a large portion of your income.

If you see your paycheck disappear toward loans and credit card payments, take steps to reduce your debt and increase your income.

If youre concerned about your credit, you can check your three credit reports for free once a year. To track your credit more regularly, is an easy-to-understand breakdown of your credit report information that uses letter gradesplus you get a free credit score updated every 14 days.

You can also carry on the conversation on our social media platforms. Like and follow us on and leave us a tweet on .

Read Also: Where Can I Buy Pallets

Whats The Maximum Dti For A Home Loan

Be mindful that each mortgage lender may have its own eligibility requirements and maximum DTI. Generally, though, a good debt-to-income ratio is around 36% or less and not higher than 43%.

Here are the common maximum DTI ratios for major loan programs:

- Conventional loans : 45% to 50%

- VA loans: No max DTI specified, but borrowers with higher DTI could be subject to additional scrutiny

- USDA loans: 41% to 46%

- Jumbo loans: 43%

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

Recommended Reading: Liquidation Lots For Sale

Target Debt With A High Bill

When youre trying to improve your debt-to-income ratio, your biggest priority will be lowering your monthly debt obligations in relation to your income. So it makes sense to target debt not based on its overall size, but on the size of your monthly payments for that debt.

For example, lets say you owe $1,000 on a line of credit and your minimum monthly payment is $100, so 10% of the debt. At the same time, you owe $500 on a credit card and your minimum monthly payment comes to $125, so 25% of the debt.

Even though the overall debt on your credit card is much smaller, paying it off will do more to improve your debt-to-income ratio because your payment represents a larger portion of the balance.

What Is Considered A Good Debt

Lenders consider different ratios, depending on the size, purpose, and type of loan. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and guidelines vary, most lenders like to see a DTI below 3536% but some mortgage lenders allow up to 4345% DTI, with some FHA-insured loans allowing a 50% DTI. For more on Wells Fargos debt-to-income standards, learn what your debt ratio means.

Read Also: Debt To Income Ratio Calculator For Mortgage

How Lenders Use Dti

Lenders use DTI to make decisions on whether to approve a loan and what the size of the loan will be. Your credit score tells lenders how you’ve managed loan payments in the past, but your DTI tells lenders if you have enough money available to pay back a new loan.

Each lender may have its own threshold for what is an acceptable DTI from loan applicants. Lenders want to be confident you’ll be able to repay the loan, and a low DTI can show you’ll have enough money to take on a new payment.

There are a few generally accepted targets for an ideal DTI, however. As a general rule, mortgage lenders require a DTI under 43%, but may prefer a DTI below 36% on conventional loans. For FHA mortgages and other unconventional home loans, your front-end DTI should be no greater than 31% and the back-end DTI no higher than 43%though lenders may allow back-end DTIs as high as 50% depending on your credit score.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

Read Also: How Fast Can I File Bankruptcy

Lowering Your Dti Ratio For Better Success With Lenders

Whether youre a first-time homebuyer entering the real estate market or someone looking to take out a personal loan, there’s a good chance that your lender will evaluate your DTI ratio.

A DTI ratio is a strong measure of financial health, as it indicates how much of your monthly income goes toward debt. When applying for a new loan, lenders will consider the likelihood of repayment when offering your rate and term length. The lower the DTI ratio, the higher likelihood you have of securing the best rate.

There are ultimately only two ways to lower your DTI ratio. You can either increase your income or lower your debt. Lowering your debt is often easier in the short term. Doing so also helps build credit.

If you have credit card balances causing high monthly debt payments, be sure to look into Tally. Tally is a credit card payoff app that automatically pays off your credit cards with a low-interest line of credit in the most efficient way possible. By doing so, you free up cash that you can use to pay off other debts, thereby lowering your DTI.

Should I Apply For A Home Loan With A High Dti

In limited instances, high debt-to-income ratios mean lenders may be less willing to give you a mortgage loan or may ask you to pay a higher interest rate for the loan, costing you more money. While you can still apply for and receive a mortgage loan with a high DTI, its best to look for ways to lower the ratio if possible so you can get a better interest rate.

Recommended Reading: Pre Foreclosure Homes Zillow

Getting A Mortgage With High Dti

Credit cards, student loans, car payments most of us walk through our lives carrying some amount of debt, and sometimes, quite a lot of it. Per Experians 2020 State of Credit report, the average American carries more than $25,000 in debt, not including mortgages. While hard to avoid, those debts can serve as anchors, making it difficult to achieve loftier financial goals.

When you apply for a mortgage, your lender will collect information about your credit history and financial status to determine whether or not you qualify for a loan and if so, what your interest rate and other loan parameters will be. One of the calculations theyll perform as part of this assessment? Your DTI, or debt-to-income ratio, which is a key metric in determining your eligibility for mortgages and other loans.

While a high DTI can make it harder to qualify, it doesnt mean a mortgage is out of reach. Heres a breakdown of how debt-to-income ratios can affect mortgage eligibility, and options for mortgage seekers with higher DTIs to consider.

How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johnâs income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

Read Also: Cheap Bankruptcy Lawyers In Cleveland Ohio

What Is A Good Debt

What does that mean for you? 50% is a pretty high DTI ratio and will disqualify you for a mortgage, refinance, or personal loan with most traditional lenders.

Here are some general rules of thumb in understanding DTI numbers:

- 20% is an excellent level

- 36% is a good level

- 43% is acceptable but at the limit for most lenders

50% is the Federal Housing Administration limit, and youll have to scramble to find any other high debt-to-income ratio mortgage lender.

How To Lower Your Dti Ratio

There are two key ways to lower your DTI ratio: reducing your debt and increasing your income.

Here are some tips for decreasing your DTI ratio.

- Ask for a raise at work to boost your income

- Take on a part-time job or freelance work on the side

- Make extra payments to your credit card to lower the balance

- Reduce your day-to-day expenses so you can make a bigger dent in your debts, such as your student loan or auto loan balances

- Avoid making large purchases on credit that arent absolutely necessary

- Avoid taking out any new loans or lines of credit

You May Like: How Long After Bankruptcy Can You Get A Mortgage

Recommended Reading: How Much Does Bankruptcy Cost To File

Who Benefits From The Higher Dti Ratio Limit

Borrowers who have strong credit scores and a steady income but live in expensive housing markets are likely to benefit the most from the DTI change, says Michael Fratantoni, chief economist with the Mortgage Bankers Association.

Thats because they otherwise wouldnt qualify for a conventional loan, and theyd have to take out a jumbo loan, he adds.

Jumbo loans are also called nonconforming loans because the loan amount exceeds the limits established by Fannie Mae and Freddie Mac.

While most properties in the U.S. have a loan limit of $548,250, some in higher-cost areas have a higher limit of $822,375, according to the Federal Housing Finance Agency.

That said, the average borrower wont suddenly have more access to mortgage credit because of a higher DTI ratio limit, Fratantoni says.

After all, he notes, lenders may also look at your credit payment history, FICO score, income and credit utilization to determine if you can repay your loan.