Is All Debt Treated The Same In My Debt

Ultimately, your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. The ratio doesnt weigh the type of debt differently. The more debt you have, the higher your DTI and the harder it may be to qualify for a great loan.

How Does A High Or Low Debt

A high debt-to-income ratio directly affects a consumers ability to secure a loan. A debt-to-income ratio of around 6 is generally considered high. Different institutions have different rules around what they consider, but if you have a debt-to-income ratio of 9 or above you likely wont be considered for a loan with the major institutions.

A low debt-to-income ratio is generally under 3.6, and is often viewed favourably by lenders. Having a low debt-to-income ratio can help show an ability to successfully manage debt. Consumers with a low debt-to-income ratio may be more likely to be offered lower fees and rates by prospective lenders and may also have more loan options to choose from.

Related article: Interest rate ranges: How is your rate determined?

Tips To Lower Your Dti

If you arent happy with your current DTI, remember it isnt a fixed number, and you can lower it by either increasing your monthly income or decreasing your existing debt. Whether youre having trouble getting approved for a loan or are facing high interest rates, trying out these tips to reduce your DTI may help.

- Compare your credit card interest rates and pay down ones with the highest rates first.

- Use the 50/30/20 rules to create a budget you can stick to, that will help you manage your spending.

- Pay all bills on time to avoid piling on late fees.

- Get a side hustle like ridesharing, tutoring online, selling clothes in the resale market, or a part-time restaurant or retail position.

Don’t Miss: Does Bankruptcy Take Your Tax Return

How Does A Heloc Work

Unlike a home equity loan, which provides you with a lump-sum disbursement that you’ll pay back over a fixed period of time, a HELOC has two separate stages:

- Draw period: During this time, which can last up to 10 years, you can take draws from your line of credit as needed. You can only borrow up to the limit, similar to a credit card, but you typically only have to pay interest during this time unless you want to pay more.

- Repayment period: Once the draw period ends, the repayment period begins. During this time, your remaining balance at the end of the draw period will be amortized over a fixed term, which can be as long as 20 years, during which time you’ll make regular monthly payments.

HELOCs typically have variable interest rates, which means that your rate will fluctuate over time. However, some lenders may allow you to convert some or all of your HELOC balance to a fixed interest rate and a fixed repayment term, even while you’re still in your draw period. They may also come with upfront closing costs and annual fees.

Maximum Dti By Type Of Loan

Your lenders maximum DTI limit will depend, partly, on the type of loan you choose:

- Conventional loan: Up to 43% typically allowed

- FHA loan: 43% typically allowed

- USDA loan: 41% is typical for most lenders

- VA loan: 41% is typical for most lenders

These rules dont always apply to all borrowers in the same way.

For example, even if your DTI meets your loans requirements, you wont be guaranteed approval. Your credit score, down payment amount, or income could still undermine your eligibility.

And it works the other way around, too: Some borrowers whose DTI ratios come in a little too high may still qualify if they have excellent credit or can make a larger-than-required down payment.

Read Also: Max Debt To Income Ratio Mortgage

It Shows Lenders You Can Handle Paying Back Lenders

Having some debt on your credit report is still really important because lenders need “clues” about how good you are at managing different forms of debt. So having a student loan that you paid off on your credit report can be a green flag to lenders.

Or, maybe you’ve been managing two credit cards really well over the last five years this is another positive trade line that will show up on your credit report and help you appear less risky as a borrower.

If you don’t have any history of managing debt even one credit card lenders may not feel comfortable giving you such a large loan because you lack those clues about your debt management habits.

Review Your Credit Report

Your credit is one of the first factors lenders will look at when determining your eligibility for a home loan. It’s important to monitor your credit regularly to make sure it’s accurate and up-to-date. The last thing you want are surprises on your report, such as past negative hits that have since been resolved but haven’t been corrected on your credit report that still make you seem like a risky borrower. You can receive a free weekly credit report through the end of this year by visiting AnnualCreditReport.com. Also, set up alerts that notify you the moment your credit score drops.

Recommended Reading: Buying Foreclosed Homes From Bank

Who Is Affected By Debt

On face value, it makes sense that lenders would want to limit how much they allow you to borrow based on your income-to-debt ratio.

For example, if you earn $100,000, you generally cannot borrow more than $600,000.

For standard homeowners, this is a responsible lending practice, but for an investor, its not always reasonable when you consider their long-term plans.

For example, they may be making for the first 3 years so they can maintain their for further investment opportunities.

Alternatively, they may be pursuing a negative gearing strategy.

The bottom line is that LTI caps dont make sense for property investors because they can simply sell one of their investment properties if they are unable to afford their mortgage repayments.

Which Dti Ratio Matters More

While mortgage lenders typically look at both types of DTI, the back-end ratio often holds more sway because it takes into account your entire debt load.

Lenders tend to focus on the back-end ratio for conventional mortgages loans that are not backed by the federal government.

For government-backed mortgages, such as FHA loans, lenders will look at both ratios and may consider DTIs that are higher than those required for a conventional mortgage.

You May Like: Over Stock Phone Number

Focus On Increasing Your Income

Boosting your income can also help you work toward an ideal debt-to-income ratio. If youre overdue for a raise, it might be time to ask your boss for a salary increase. You could also pick up a side job, such as tutoring, freelancing in a creative field or working as a virtual admin, to increase your earnings. Those looking to make a more extreme change might seek out a new company or career path.

Finding ways to make more money will not only help you get the right debt-to-income ratio for a personal loan, mortgage or another type of financing, it can also give you more financial stability. You may have more wiggle room in your budget to build an emergency fund and avoid taking on new debts.

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

Read Also: Where To Buy Returned Pallets

Other Factors That Matter When Qualifying For A Mortgage

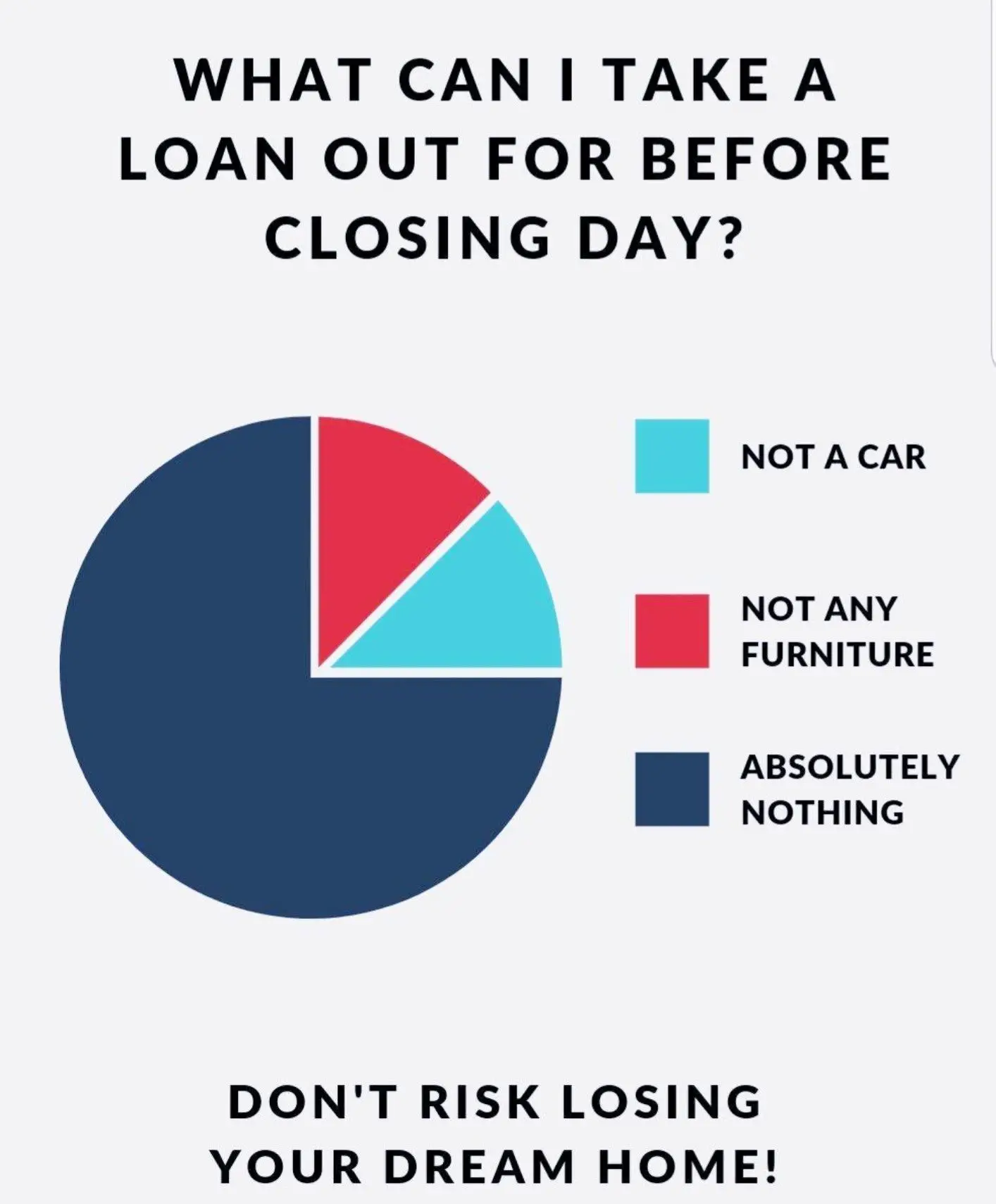

Income isnt the only thing that matters when you buy a home. You should be mindful of other factors lenders take into consideration when qualifying borrowers for a home loan:

- Most mortgage programs have a minimum credit score requirement, which can range from 580 to 620 for an FHA and conventional loan, respectively and 640 for USDA loans. VA loans dont have a set credit score minimum

- Your recent credit history also determines whether you qualify for a home loan. Most programs dont allow more than one 30-day late payment within the previous 12 months. You can also expect a waiting period after a foreclosure or bankruptcy, which can range from two to seven years depending on the home loan

- Down payment The size of your down payment also affects your qualifying amount. Borrowers with a bigger down payment have greater purchasing power

- Existing debt load Too many existing debts also reduces purchasing power. Paying down a car loan, a student loan, and credit cards can increase affordability.

- Assets/cash reserve Your cash reserve amount also affects qualifying. You must have enough funds in reserves for your down payment and closing costs

What Is The Maximum Dti For Va Loan

The VA doesn’t set a maximum DTI ratio but does provide lenders with the guidance to place additional financial scrutiny on borrowers with a DTI ratio greater than 41%.

The VA views the DTI ratio as a guide to help lenders, and it doesn’t set a maximum ratio that borrowers must stay under. But the VA doesn’t make home loans, and mortgage lenders will often have in-house caps on DTI ratio that can vary depending on the borrower’s credit, finances and more.

Also Check: Amazon Pallets For Sale Denver

What Debt And Credit Facilities Are Considered In Your Debt

The debt and credit that financial institutions may look at when calculating your debt-to-income ratio include:

- Investment loans, lines of credit and/or margin loans

As a general guideline, if information doesnt show on your credit report, its not factored into your debt-to-income ratio by lenders. Your credit report contains details about your credit history, with the information used to calculate your credit score. Also known as a credit rating, your credit score is a number thats calculated by a credit bureau to suggest how trustworthy you are as a borrower.

Check your credit score for free with Canstar

How Much Should Your Debt

Whether you are taking out a mortgage for the first time or refinancing a loan you already have, lenders examine your DTI to assess the level of risk they will incur by lending to you. Typically, the higher your DTI the riskier you are to lenders, because it indicates you may be less financially able to make your mortgage payments. In turn, this can affect how much lenders are willing to let you borrow and at what interest rate.

Lenders usually prefer conventional loan borrowers to have a debt-to-income ratio of 36% or below meaning roughly a third of your gross monthly income goes toward fixed debt payments and the rest is yours to spend on remaining wants and needs. Depending on the state of your financial health in other aspects, like your , you may qualify for a loan with a DTI up to a maximum of 50%. Loans backed by the government, like FHA loans, typically accept borrowers with DTI ratios up to 43% and may go up to 57% in certain cases.

Don’t Miss: Wake County Tax Foreclosures

How To Calculate Your Front End Debt

| Front End Ratio Example |

|---|

| Back End Ratio | 33% |

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn’t necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.

Are There Income Limits For A Mortgage

Some mortgage programs have income limits, meaning your income cannot exceed a certain percentage of the areas median income to qualify.

Standard conventional loans, VA loans, and FHA loans dont have income limits.

But household income limits are typical with USDA loans and some specialized programs.

USDA loans, backed by the U.S. Department of Agriculture, are used to purchase homes in eligible rural areas. To qualify, though, your income cannot exceed 115% of the area median income.

Likewise, if you apply for Fannie Maes HomeReady mortgage, your income must remain below 100% of the area median income and your income must remain below 80% of the area median income for Freddie Macs Home Possible mortgage.

Keep in mind, too, many down payment assistance programs have income limits. These limits vary depending on the program. Typically, your income cannot exceed 100% to 115% of the median area income.

You May Like: Houses For Sale At Auctions

Calculating Debt For A Mortgage Approval

For most mortgage applicants, calculating debt is more complex than calculating income. Not all debt on a credit report should be included in your DTI, and some debt which is not listed on a credit report should be used.

Lenders split debts into two categories: front-end and back-end.

- Front-end ratio: Includes debts that relate to housing expenses: your mortgage payment, property taxes, and homeowners insurance premiums, for example

- Back-end ratio: Includes minimum payments to your credit card companies, car payments, and student loan payments as well as your total monthly housing payment

Review Fees And Rate Caps

While one lender may charge a lower rate, it may make up for it with costly closing fees, so make sure you compare more than just the interest rate. Additionally, each lender will have different caps on how much the interest rate can go up over time. Lenders with lower rate caps can help you limit your costs regardless of what the current interest rate is.

Read Also: How Many Times Can You File Bankruptcy In North Carolina

The Va Interest Rate Reduction Refinance Loan

The VA Interest Rate Reduction Refinance Loan is another refinance program that waives traditional DTI rules.

Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W-2s and pay stubs.

The VA Streamline Refinance is available only to military borrowers who already have a VA loan. Homeowners must also show theres a benefit to refinancing their existing home loan either in the form of a lower monthly payment or a change from an ARM to a fixed-rate loan.

How Do Lenders Use Your Debt

While there are variations between the different types of debt-to-income ratios that lenders will accept when assessing prospective borrowers, banks and financial institutions generally apply the debt-to-income ratio as part of the credit analysis process.

This process determines the amount of credit risk a borrower has which the lender can use to decide whether to accept or decline their loan request and to pinpoint the amount they will allow the customer to borrow. If a customer has a low debt-to-income ratio, this means that a bank will be more likely to accept their request as they have the income and ability to successfully make the repayment.

Some lenders, particularly non-banks, have their own ways to measure whether a customer will be able to make repayments, such as the Net Service Ratio which assesses serviceability. To calculate the Net Service Ratio, lenders take into account a prospective borrowers after-tax income, and then subtract expenses and other liabilities to work out the loan amount the customer may be able to repay.

Also Check: How To Get A Dismissed Bankruptcy Off Your Credit Report

Dealing With High Dti Ratio

Having too high of a DTI ratio can force borrowers to make tough decisions.

One is to hold off on buying a home until they have a better balance of debts and income. Another option is to seek a lower loan amount.

For example, if your DTI ratio is too high with a $300,000 loan, you might be able to move forward with a $250,000 mortgage. Readjusting your homebuying budget is often disappointing, and it might not be realistic depending on your real estate market, needs, and other factors. But it’s an option for dealing with a high DTI ratio.

Talk with a Veterans United loan specialist if you have questions about your debts, income, and purchasing power.

Having A Good Dti Isnt Too Hard

Your debt-to-income ratio is one of the most important factors in qualifying for a mortgage.

DTI determines whether youre eligible for the type of mortgage you want. It also determines how much house you can afford. So naturally you want your DTI to look good to a lender.

Luckily, thats not too hard. Todays mortgage programs are flexible, and a wide range of debt-to-income ratios fall in or near the good category. So theres a good chance you can get approved as long as your debts are manageable.

In this article

Recommended Reading: Can You File Bankruptcy Single If Your Married

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.