Best Mortgages For Self

Whether self-employed or not, multiple mortgage options are available to you. The type of mortgage that will best suit you depends on your credit, the amount you have saved for a down payment and where youre hoping to purchase a home. Some mortgages are backed or guaranteed by the federal government, while others are not. If youre self-employed and looking for a mortgage, consider these options:

Fha Definition Of Gross Income And Untaxed Income

When contacting a mortgage lender for your first home purchase, you’ll want to know the information they need so you are prepared to answer questions. Lenders often prequalify you over the phone to give you an idea of what you may be able to borrow. They ask a series of questions that help them determine your creditworthiness, liabilities and earnings. When asked how much you make, remember that they are interested in your gross income.

TL DR

Mortgage lenders use your gross income to determine whether you qualify for a mortgage and how much you can borrow.

How To Calculate Self

In calculating your income from self-employment, lenders use your net business income and not your gross sales or revenues before business expense deductions.

This is an inherent problem for self-employed borrowers. Most people want to pay less taxes. So, they maximize write-offs . But that means they have lower on-paper income with which to qualify for a mortgage.

> > MORE: Check My Credit Score and Report

If you plan to get a mortgage in the next two or three years, be mindful of how much you write off.

Lenders will add non-cash expenses like depreciation and amortization to your net income. However, they wont add back deductions taken for cellphones, internet, or business travel.

The lender will also average your self-employment income. For example, if your net self-employment income in 2020 was $50,000, and $70,000 for 2021, they will recognize your income to be $60,000, or $5,000 per month

This is calculated as follows:

$50,000 + $70,000 = $120,000 divided by 24 months = $5,000 per month

Get your personalized self-employed income analysis.

Also Check: What Are Some Of The Effects Of Declaring Bankruptcy

How Much Income Do I Need For A 500k Mortgage

The Income Needed To Qualify for A $500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fall between $165K and $200K.

The Bottom Line: How Much Home Can You Afford

So, what percentage of your income should go toward your mortgage? The answer will vary depending on your income and how much debt you have. But your income is only one of the many factors that determine how much home you can afford. Lenders look at everything from your credit score to your liquid assets when they decide how much to offer you.

If youre ready to get started on your mortgage application, you can apply online or give us a call at 452-0335.

Read Also: Can You File Bankruptcy For Tax Debt

Mortgage Qualifying Tips For Self

Self-employment can complicate the home buying process. If possible, avoid complicating your application in other areas. Be sure to:

Check your DTI ratio

The lower your monthly bills in relation to your earned income, the stronger your mortgage application will look.

Different lenders and loan types have different rules but shoot for a ratio thats less than 36 percent of your adjusted gross income. You can do this by paying off a few loans and lowering your credit card balances.

Monitor your credit

Your monthly income shows your ability to repay a loan your credit score shows your willingness to repay it based on your recent financial habits.

Minimum credit scores for mortgages tend to range from 580 to 640. But getting your score above 720 will strengthen your application a lot.

Just like with DTI, paying down some debt and making regular, on-time payments will help. Also, be sure to check your credit reports for errors that could be pulling down your score.

Keep business expenses separate

As a small business owner, your personal and business finances may be intertwined. If so, your mortgage lender will have a harder time distinguishing your money from your businesss money.

If possible, in the two years before applying for a mortgage, change your financial habits to keep your personal and business finances separate. A certified public accountant can help.

Is It Harder To Get A Mortgage When Youre Self

The self-employed borrower does endure more scrutiny that the standard paystub/W2 employee. If you go into your loan application with the proper expectations, youll close your mortgage loan with very few surprises.Click here to check your homebuying eligibility now

Tim Lucas

EditorTim Lucas is editor of MyMortgageInsider.com. He has appeared on Time.com, Realtor.com, Scotsman Guide, and more. Connect with Tim on Twitter.

Recommended Reading: Who Filed For Bankruptcy

Do Mortgage Lenders Use Gross Income Or Adjusted Gross Income

Do mortgage lenders use gross or net income? For taxpayers who earn wages or a salary, mortgage lenders typically look at gross income. That’s your income before state and federal income tax deductions, health insurance premiums, and Social Security or Medicare taxes. It’s different for self-employed borrowers.

What Is A Net Profit Mortgage

A net profit mortgage is based on the amount of net profit your business has generated. Unfortunately, its difficult to get a mortgage based on gross profit. That being said, getting a mortgage with net profits is possible whether youre a director or a sole trader.

Lenders will calculate your affordability in their own unique way. As a result, you may be able to borrow more from one lender as opposed to another. Furthermore, some lenders will consider retained profits in a business, whereas other lenders wont. This is why applying with the most suitable lender can increase your chances of approval and allow you to borrow more.

Ultimately, your mortgage will be assessed on your declared net profits. This can sometimes be problematic as you can perhaps afford a lot more than your accounts show. This is why mortgages for the self-employed arent as straightforward as mortgages for those that are employed.

Learn more: How to get a mortgage when self-employed

You May Like: Can You Look Up Bankruptcies Online

Required Documentation For Self

If you are self-employed, you will have to hand over more documentation than a salaried borrower would. Here are a few extra items youll need to provide:

- 2 years personal tax returns with all schedules

- Year to date profit and loss statement showing current income is on track with previous years

- CPA letter stating you are still running your self-employed business

- Explanation letter if you receive most of your income at a specific time of year. In this case, it can look like your profit and loss statement is on track for lower income than in previous years.

If you are part of a business that has many owners, make sure all controlling parties agree that you can have access to business tax returns and can turn them over to a lender.Click here to see if you can buy a home now

How Will Lenders Evaluate Self

Lenders evaluate salaried and self-employed borrowers the same way: on the size of their down payment and on their ability to repay the mortgage. But there is a difference. Salaried borrowers must verify gross income through paycheques or a letter from an employer. Self-employed borrowers must verify net income, or whatâs left after business deductions are subtracted from gross earnings.

For example, if a self-employed person makes $120,000 annually in gross earnings but writes off $40,000 for business expenses, they have net earnings of $80,000. Unless they have documentation to convince lenders their net income is higher, theyâll be treated the same way as a salaried employee making $80,000 annually.

Also Check: How To Find Out If Bankruptcy Is Discharged

Gross Income Vs Net Income

When determining how your debt relates to your income, lenders use your gross monthly income, not your net monthly income. Net monthly income is your monthly income after all taxes, Social Security payments and deductions for retirement accounts are taken out of your paycheck.

Gross monthly income is the amount of money you earn each month before these items are deducted from your paycheck. Your gross monthly income can also include other income streams, such as rental income, alimony or dividends. If you have an annual salary of $36,000 and no other regular income sources, your gross monthly income is $3,000. Your net monthly income, though, could be far lower depending on how much money you contribute to Social Security, taxes and retirement accounts.

Our Recommended Percentage Of Income For Mortgage

At Rocket Mortgage®, the percentage of income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, its important to remember that you dont need to spend up to your monthly limit. Think of 28% as the ideal amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes, insurance and homeowners association dues in your total before you sign on a loan.

Don’t Miss: What Are The Downfalls Of Filing Bankruptcy

Good Credit Purchase Under $1000000 With 10% Down Payment

The first review that I do when I meet my self-employed clients is to determine if they qualify for a traditional mortgage. What I mean is that if my self employed client shows enough income on her income tax return to qualify for the mortgage she wants. I check her credit and credit score, that’s also important.

Once we determine that a traditional mortgage, like an employee would, at best rates with 5% or 10% or 20% or whatever amount down doesn’t work, then I look at other options.

The next option for a self-employed client is an insured self-employed mortgage. With an insured program, the minimum requirement is 10% down and good credit .

The insured program can be set up with 10% to 35% down and any amount in between. The premium charged reduces the more down payment is applied to the purchase. The insured program is not available for refinancing an existing mortgage.

Qualification calculations are made based on gross and net business income and are compared to personal taxable income. The lenders asks the self-employed client how much income they “actually” earn. This number is also compared to industry averages to evaluate how reasonable that income is.

There are a number of lenders who will qualify you for a mortgage under the self employed insured programs. However, only 2 of the 3 insurers offer specific insured programs for self employed applicants.

Let’s compare a couple of situations to see how a lender may evaluate your income.

How We Make Money

The listings that appear on this page are from companies from which this website and the data provider may receive compensation, which may impact how, where and in what order products appear. Compensation is higher for featured placements. This table does not include all companies or all available products.

Recommended Reading: Has Tom Steyer Ever Filed Bankruptcy

Do I Have To Report Self

Yes, you should report self-employment income to your lender. If youre self-employed but you earn most of your income from a salaried or wage-earning job, you may not need to apply as a self-employed borrower. However, to use your self-employment income to qualify for your loan, youll still need to provide tax forms and other documents.

What Does It Mean To Be House Poor

House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. An example would be if you had $100,000 in savings and used all of it to finance a $500,000 property with a $2,500 monthly mortgage payment when your net income is $3,000 per month.

Such a situation can give the illusion of economic prosperity but quickly unravel to foreclosure if things turn sour.

Recommended Reading: Which Of The Following Statements Is True Regarding Bankruptcy

What Is Needed As Proof Of Income For A Mortgage

For proof of income, typically, lenders will need to collect:

- Employment pay stubs

Stay in the know with our latest home stories, mortgage rates and refinance tips.

In your inbox every Thursday

- A valid email address is required.

- You must check the box to agree to the terms and conditions.

Thanks for signing up!

How To Find The Best Mortgage Deals For The Self

A mortgage is a huge financial commitment and the difference between a good deal and a bad deal can add tens of thousands of pounds to what you end up paying. A difference of just 0.5% can add almost £2,000 to your repayments over three years on a £200,000 mortgage.

Remember that every time you apply for a mortgage the lender will perform a credit search. If the lender rejects you, this will be recorded on your credit file and can damage your â making it harder to get accepted by other mortgage lenders.

This means it can be a good idea to use a mortgage broker. They know the market and know which lenders are likely to accept a self-employed application, so they can help you find the best possible deal.

If your mortgage application is rejected donât panic, it isnât the end of the road. Read our guide to what to do if youâre refused a mortgage to find out what to do next.

Don’t Miss: How Long Does Bankruptcy Take Once You File

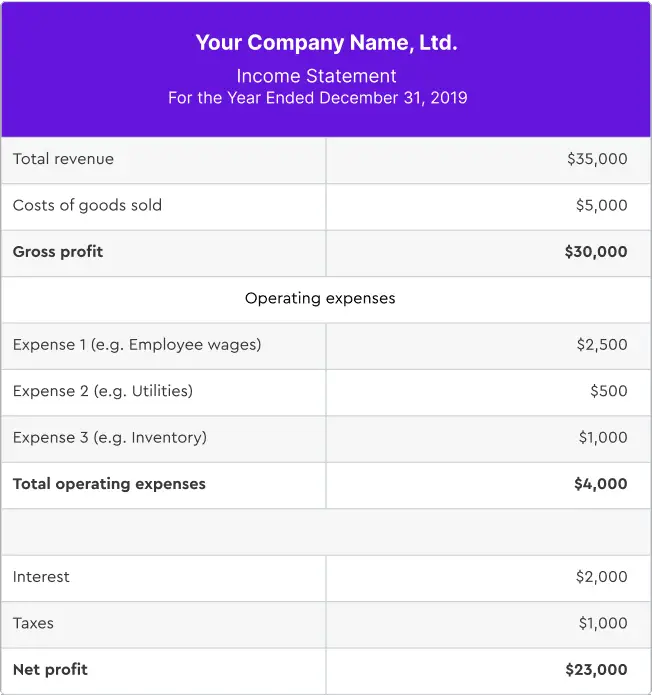

What Does Gross Profit Tell You

Gross profit is a measure of how efficiently an establishment uses labor and supplies for manufacturing goods or offering services to clients. It is an important figure when checking the profitability and financial performance of a business.

Gross profit helps you understand the costs needed to generate revenue. When the value of the cost of goods sold increases, the gross profit value decreases, so you have less money to deal with your operating expenses. When the COGS value decreases, there will be an increase in profit, meaning you will have more money to spend for your business operations.

There Are A Number Of Factors To Consider

A Tea Reader: Living Life One Cup at a Time

Purchasing real estate with a mortgage is often the most extensive personal investment most people make. How much you can afford to borrow depends on several factors, not just what a bank is willing to lend you. You need to evaluate not only your finances but also your preferences and priorities.

Here is everything you need to consider to determine how much you can afford.

Recommended Reading: How To Find The Right Bankruptcy Attorney

What Is A Debt

Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow.

Different loan products and lenders will have different DTI limits. To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000. If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

How Long Do You Have To Be Self

Most lenders will require you to provide two to three years of accounts. But if you havenât been self-employed for that long, it is still possible to get a mortgage. It may help if before you were self-employed, you were doing a similar full-time job to what you are now. Be prepared to show the accounts you do have, and to answer some extra questions.

Also Check: How To Claim Bankruptcy On Student Loans

How To Calculate A Down Payment Amount

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

How Do You Get Self

There isnât a specific product called a self-employed mortgage. You will be applying for the same mortgages as anyone else. The difference is, youâll have to provide more evidence you have a reliable income when youâre self-employed.

Getting a mortgage when you are self-employed can be challenging but it certainly isnât impossible. Donât assume you are going to be rejected simply because of your employment status.

Read Also: How Many Years Does Bankruptcy Last