Definition Of Public Debt

Economists also debate the definition of public debt. Krugman argued in May 2010 that the debt held by the public is the right measure to use, while Reinhart has testified to the President’s Fiscal Reform Commission that gross debt is the appropriate measure. The Center on Budget and Policy Priorities cited research by several economists supporting the use of the lower debt held by the public figure as a more accurate measure of the debt burden, disagreeing with these Commission members.

There is debate regarding the economic nature of the intragovernmental debt, which was approximately $4.6 trillion in February 2011. For example, the CBPP argues: that “large increases in can also push up interest rates and increase the amount of future interest payments the federal government must make to lenders outside of the United States, which reduces Americans’ income. By contrast, intragovernmental debt has no such effects because it is simply money the federal government owes to itself.” However, if the U.S. government continues to run “on budget” deficits as projected by the CBO and OMB for the foreseeable future, it will have to issue marketable Treasury bills and bonds to pay for the projected shortfall in the Social Security program. This will result in “debt held by the public” replacing “intragovernmental debt”.

Tracking The Federal Deficit: March 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $658 billion in March 2021, the sixth month of fiscal year 2021. This months deficitthe difference between $267 billion in revenue and $925 billion in spendingwas $487 billion greater than last Marchs . The federal deficit has now swelled to $1.7 trillion in fiscal year 2021, 129% higher than at this point last year. While revenues have grown 6% year-over-year, cumulative spending has surged 45% above last years pacelargely a result of the COVID-19 pandemic, its economic fallout, and the federal governments fiscal response.

Analysis of Notable Trends: Adjusted for timing shifts, outlays in March 2021 were $517 billion greater than last March, an increase of 127%. Unemployment insurance, refundable tax credits, and the Small Business Administrations Paycheck Protection Program accounted for most of the increaseboth from March to March and from last fiscal year to this one. Spending on refundable tax credits was $346 billion higher in March 2021 than March 2020, mostly due to the payment of pandemic recovery rebates authorized by the Consolidated Appropriations Act and American Rescue Plan Act..

Also Check: What Is Considered High Interest Debt

Debt Held By Foreign Creditors

15. 26.16% of the US government debt was owned by foreign and international institutions in December 2021.

As of December 2021, the largest component of the US government debt 40.94% was owned by the federal reserve and government accounts. However, it is the foreign-held debt that could be a matter of concern. According to the national debt chart, 11.09% is held by mutual funds, 5.87% by depository institutions, 4.9% by state and local government, etc.

16. Japan is the largest holder of US treasury securities, valued at $1.3 trillion in May 2022.

Other countries with significant holdings are China , the United Kingdom , Ireland , and Luxembourg .

The large foreign holdings of the national debt of the United States leave the country vulnerable in the event of a shock, such as a collapse in housing prices or an extreme national security breach. There are other concerns, as well, when foreign countries, including potentially antagonistic ones, hold a large portion of the countrys securities.

17. China has held more than $1 trillion in US national debt since 2010.

You May Like: Are Personal Bankruptcies Public Record

Fiscal Year 2020 In Review

The federal government ran a deficit of $3.1 trillion in fiscal year 2020, more than triple the deficit for fiscal year 2019. This years deficit amounted to 15.2% of GDP, the greatest deficit as a share of the economy since 1945. FY2020 was the fifth year in a row that the deficit as a share of the economy grew. Revenues in FY2020 fell 1% from last year, while outlays surged 47%.

The FY2020 budget splits into two distinct halves: before and after COVID-19 and its economic fallout. In the first six months of the fiscal year , the deficit was running 8% above last years rate in the last six months , the deficit soared to eight times its level in those months last year.

Meanwhile, outlays in the first half of FY2020 grew 7% from last years rate. Then, from April through September, outlays almost doubled their level from those months last year, a $2 trillion increase. The character of spending increases also changed from the first to the second half of the year. From October through March, higher spending was driven by mandatory programsSocial Security, Medicare, and Medicaid. In the next six months, spending ballooned because of emergency responses to the pandemic and recession. Compared to the same months in FY2019, spending increased in April through September 2020 by:

Us National Debt Growth Statistics

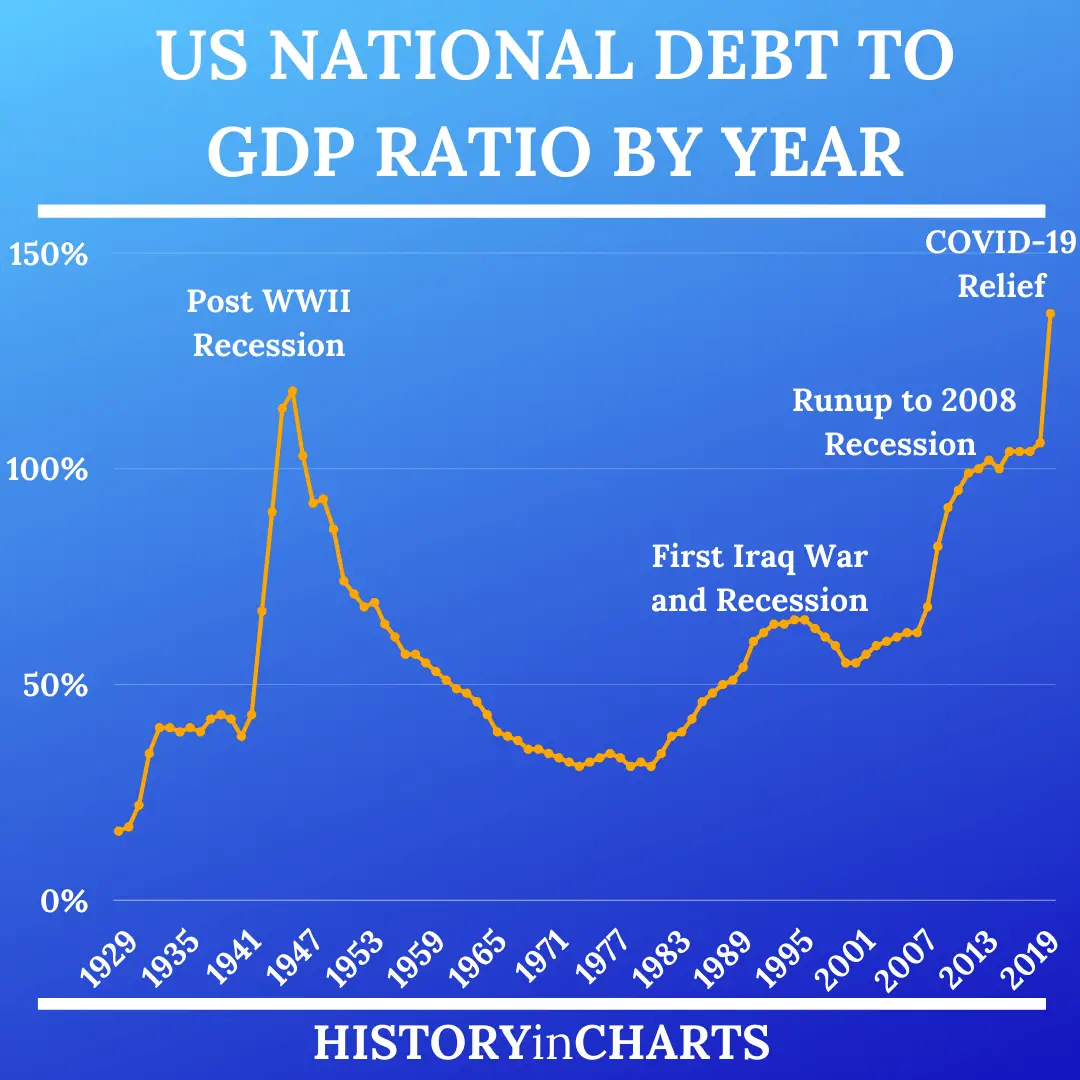

23. The ratio of US national debt held by the public to the US GDP is expected to reach nearly 127.41% by 2027.

According to the US debt graph based on CBOs baseline projections, which assume that the current laws on taxation and spending will not change, the federal budget deficit is expected to increase substantially over the next few years.

The public debt-to-GDP ratio has dropped since its drastic increase in 2020 when it reached 134.24%. However, the projections show the ratio will start rising again from 2024.

24. Data on the US national debt by year show that gross federal debt will grow to $45.3 trillion by 2032.

For the 2022 fiscal year, the gross federal debt, which includes both public and intragovernmental debt, is expected to be $30.6 trillion, with the current levels showing that the actual figures might overshoot this estimate. The current estimate of $45.3 trillion for 2032, therefore, might prove conservative unless future administrations take measures to curb the budget deficit.

25. The gross domestic product is expected to reach $36.68 billion by 2032, as per the latest national debt by year chart.

You May Like: How Does Filing Bankruptcy Affect Child Support

Cbos Projections Of Debt Held By The Public Net Of Financial Assets

Billions of Dollars

a. Includes other cash and monetary assets , offset by liabilities such as interest accrued but not yet paid to the public.

Most of the growth in financial assets over the coming decade is projected for the outstanding balances on education loans. CBO estimates that, under current law, the Treasury would hold $1.8 trillion in student debt in 2030. The rest of the assets would consist of cash balances and other loans and guarantees held by the government. The outstanding value of those other credit activities is projected to decrease from $186 billion to $89 billion over the 20192030 period, as interest receipts and principal repayments exceed disbursements.

Us National Debt To Gdp

Thegross domestic product of a country is a measurement of economic activity. This can be further defined as the value that goods and services of the United States holds. The debt of the country is how much the country has borrowed to fund its sectors and activities. Debt-to-GDP is a measure of what a country owes compared to what it produces, and is an indicator of how a country might be able to pay back its debt. If a country is able to continuously pay interest on its debt without refinancing or hampering with economic growth, it is considered stable. The higher the debt-to-GDP ratio, the more trouble a country will have paying off public debt to external lenders.

The U.S. debt-to-GDP ratio was110% in the first quarter of 2020. This number is the U.S. national debt divided by the nominal GDP. The nominal GDP is the economic production with the current prices of goods and services considered. According to theWorld Bank, a debt-to-GDP ratio that exceeds 77% can slow down economic growth. Some consequences of this include lower wages, increased inflation, and higher taxes.

Don’t Miss: Federal Debt Collection Agency

Tracking The Federal Deficit: August 2019

The Congressional Budget Office reported that the federal government generated a $200 billion deficit in August, the eleventh month of Fiscal Year 2019. This makes for a total deficit of $1.067 trillion so far this fiscal year, 19 percent higher than over the same period last year. Total revenues so far in FY 2019 increased by 3 percent , while spending increased by 7 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Trends in the major categories of revenue and spending continued from previous monthscompared to last year, individual income and payroll taxes collectively rose by 3 percent , while spending for the largest mandatory programs collectively increased by 6 percent . Revenues from customs duties increased by 72 percent , primarily due to new tariffs imposed on certain imports from China. Estate tax revenue decreased by 25 percent due to the 2017 tax cuts which doubled the value of the estate tax exemption. Additionally, Fannie Mae and Freddie Mac remitted $16 billion more in payments to the Treasury this year. Finally, net interest payments on the federal debt continued to rise, increasing by 14 percent versus last year due to higher interest rates and a larger federal debt burden.

Comparison Of Actual Budgetary Outcomes To Projected Results

The $90.2-billion deficit recorded in 202122 was $23.6 billion lower than the $113.8-billion deficit projected in Budget 2022.

Overall, revenues were $18.9 billion, or 4.8 per cent, higher than forecast, primarily due to higher tax revenues driven by an economic recovery that exceeded expectations. Program expenses, excluding net actuarial losses, were $4.1 billion lower than expected, largely a result of lower-than-anticipated spending on COVID-19-related programs, including COVID-19 income supports for businesses, such as the Hardest-Hit Business Recovery Program, and COVID-19 income supports for workers. Public debt charges were $0.4 billion lower than projected, primarily due to a lower-than-expected stock of interest-bearing debt. Net actuarial losses were $0.2 billion lower than projected.

Table 3| 23.6 |

|

Note: Numbers may not add due to rounding. 1 Certain Budget 2022 amounts have been reclassified to conform to the current year’s presentation in the consolidated financial statements, with no overall impact on the projected 202122 annual deficit. |

Don’t Miss: Chapter 7 Bankruptcy Laws

Federal Debt Held By Federal Reserve Banks

Observation:

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

The data is presented by the source as Public debt securities: Public issues held by Federal Reserve banks on TABLE OFS-1Distribution of Federal Securities by Class of Investors and Type of Issues.Public issues held by the Federal Reserve banks have been revised to include Ginnie Mae and exclude the following Government-Sponsored Enterprises: Federal National Mortgage Association, Federal Home Loan Mortgage Corporation, and the Federal Home Loan Bank System.

Suggested Citation:

U.S. Department of the Treasury. Fiscal Service, Federal Debt Held by Federal Reserve Banks , retrieved from FRED, Federal Reserve Bank of St. Louis https://fred.stlouisfed.org/series/FDHBFRBN, December 22, 2022.

Debt Held By The Public 1940 To 2019

Trillions of Dollars

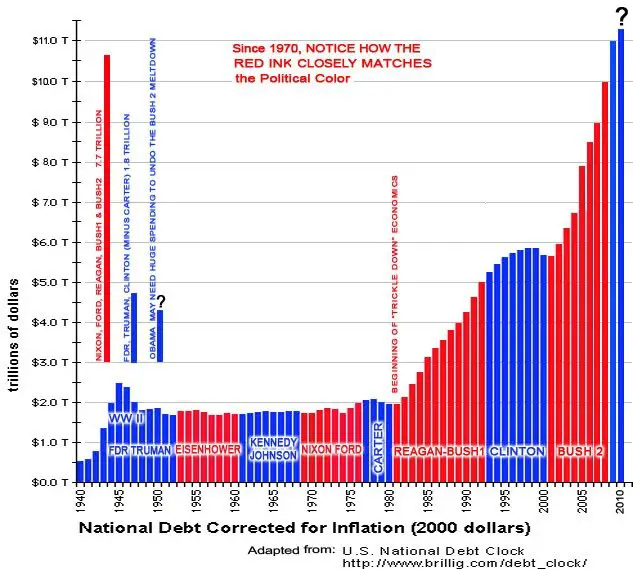

That trend ended in the 1970s. Federal budgets were in deficit for the decade, and the amount of debt held by the public more than doubled, reaching $712 billion in 1980. Because GDP also increased during that time, the ratio of debt to GDP rose only slightlyto 26 percent by 1980.

Between 1980 and 1993, lower revenues and higher spending relative to GDP in most of those years resulted in deficits that averaged close to 4 percent of GDP, causing growth in debt held by the public to outpace nominal GDP growth: By 1993, the debt totaled $3.2 trillion, having risen from 26 percent of GDP in 1980 to 48 percent of GDP in 1993. It remained close to that ratio through 1997.

From 1998 through 2001, the United States experienced strong economic growth, revenues rose rapidly, and outlays declined relative to GDP. As a result, the federal government recorded surpluses for four years, which caused debt held by the public to decline by more than $450 billionto 32 percent of GDP, its lowest level since the early 1980s. Between 2002 and 2007, debt remained fairly steady at about 35 percent of GDP deficits boosted debt held by the public by more than $1.7 trillion, but economic growth boosted GDP as well.

Also Check: Overstock Phone Number For Orders

Debt Held By The Public

In CBOs January 2020 baseline budget projections, debt held by the public grows at an average annual rate of 5.9 percent and reaches $31.4 trillion by 2030.1 The debt rises from 79 percent of GDP in 2019 to 98 percent in 2030 . Most of that increase stems from continued large budget deficitsaveraging about $1.3 trillion a year. CBO estimates that in order to finance deficits through 2030, the Treasury would need to borrow an additional $14.1 trillion from the public.

Tracking The Federal Deficit: March 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $191 billion in March 2022, the sixth month of fiscal year 2022. This shortfall was the difference between $315 billion in receipts and $506 billion in spending. The March 2022 deficit was $469 billion smaller than the March 2021 deficit, largely a result of the winding down of most pandemic relief spending that was in place during March 2021.

Analysis of notable trends: Halfway through fiscal year 2022, the cumulative deficit has fallen relative to last year and is now comparable to pre-COVID deficits. Through the first six months of FY2022, the federal government ran a deficit of $667 billion, 61% less than at the same point in FY2021 and in the ballpark of the FY2019 and FY2020 deficits, which stood at $691 billion and $743 billion, respectively.

Revenues remained strong, rising $418 billion from the same period in FY2021 to a total of $2.1 trillion during this fiscal year to date. Increases in individual income and payroll tax receipts rose by $357 billion and drove much of the overall surge in receipts. Higher total wages and salaries, especially among upper-income workers who are subject to higher tax rates, contributed to the increase in those tax revenues, as did the receipt of some payroll taxes that pandemic relief legislation authorized companies to defer from 2020 into 2021. Corporate income tax revenues rose by $22 billion year-over-year.

You May Like: What Is Chapter 7 Bankruptcy Mean

Chapter : Other Measures Of Federal Debt

Several measures of federal debt other than debt held by the public identify the effects of the governments borrowing on financial markets and inform assessments of the governments financial condition: debt held by the public net of financial assets, gross debt, and debt subject to statutory limit. Another measure, general government net liabilities, is used by the Organisation for Economic Co-operation and Development for international comparisons of its member countries debt .

Us National Debt Tops $31 Trillion For First Time

Americas borrowing binge has long been viewed as sustainable because of historically low interest rates. But as rates rise, the nations fiscal woes are getting worse.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

By Alan Rappeport and Jim Tankersley

WASHINGTON Americas gross national debt exceeded $31 trillion for the first time on Tuesday, a grim financial milestone that arrived just as the nations long-term fiscal picture has darkened amid rising interest rates.

The breach of the threshold, which was revealed in a Treasury Department report, comes at an inopportune moment, as historically low interest rates are being replaced with higher borrowing costs as the Federal Reserve tries to combat rapid inflation. While record levels of government borrowing to fight the pandemic and finance tax cuts were once seen by some policymakers as affordable, those higher rates are making Americas debts more costly over time.

So many of the concerns weve had about our growing debt path are starting to show themselves as we both grow our debt and grow our rates of interest, said Michael A. Peterson, the chief executive officer of the Peter G. Peterson Foundation, which promotes deficit reduction. Too many people were complacent about our debt path in part because rates were so low.

Also Check: Where Can I Buy Pallets

The Late 19th Century: 1850

But then the Civil War happened.

Leading up to the Civil War, America fought a war with Mexico to annex Texas and California. That added more than $63 million to the national debt .

But the bigger picture is, America has never really stopped paying for the Civil War. Whether or not you approve of government debt, those five years were the first time that the national debt truly spiked. Between 1860 and 1866 the debt rose from $64.8 million to more than $2.7 billion, approximately $42 billion by today’s standards.

To keep the nation whole, President Abraham Lincoln pushed debt to nearly 30% of gross domestic product and introduced the first income tax in American history. This was the first time America would experience the one-way ratchet of debt that follows each of the country’s major wars.

Each major conflict in U.S. history has been accompanied by a sharp rise in debt as the government raises funds to pay for the fighting. This wartime debt establishes a new normal, setting the baseline around which debt will fluctuate until the next major war pushes borrowing higher. In the wake of the Civil War, the U.S. debt rose to more than $2 billion and never dipped below $1.5 billion afterward, although a rapidly growing economy did quickly reduce the debt’s share as a portion of GDP after the end of the Civil War.

Yet neither of these events triggered the usual cycle of crisis-fueled borrowing. Instead, government debt ticked marginally down in 1893.