What Are The Primary Drivers Of Future Debt

The main drivers are still mandatory spending programs, namely Social Securitythe largest U.S. government programMedicare, and Medicaid. Their costs, which currently account for nearly half of all federal spending, are expected to surge as a percentage of GDP because of the aging U.S. population and resultant rising health expenses. Yet, corresponding tax revenues are projected to remain stagnant.

Meanwhile, interest payments on the debt, which now account for nearly 10 percent of the budget, are expected to rise, while discretionary spending, including programs such as defense and transportation, is expected to shrink as a proportion of the budget.

President Trump signed off on several pieces of legislation with implications for the debt. The most significant of these is the Tax Cuts and Jobs Act. Signed into law in December 2017, it is the most comprehensive tax reform legislation in three decades. Trump and some Republican lawmakers said the bills tax cuts would boost economic growth enough to increase government revenues and balance the budget, but many economists were skeptical of this claim.

The CBO says the law will boost annual GDP by close to 1 percent over the next ten years, but also increase annual budget shortfalls and add another roughly $1.8 trillion to the debt over the same period. In addition, many of the provisions are set to expire by 2025, but if they are renewed, the debt would increase further.

When Will The Debt Limit Be Breached

The United States hit its technical debt limit on Thursday, prompting the Treasury Department to begin using extraordinary measures to continue paying the governments obligations. Those are essentially fiscal accounting tools that curb certain government investments so that the bills continue to be paid.

Those options could be exhausted by June, Ms. Yellen told Congress last week. The Bipartisan Policy Center, which closely tracks the debt limit deadline, estimates that the Treasury will really run out of cash whats known as the X-date sometime around the middle of the year.

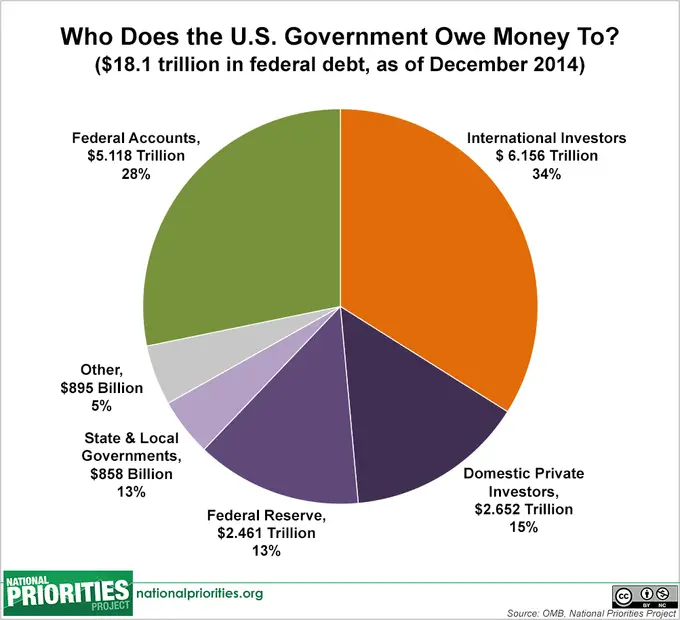

Who Owns The National Debt Held By The Public

Of the $23.6 trillion of debt held by the public, we estimate about 34 percent is owned by foreign entities, 43 percent by private and public domestic entities, and 23 percent by the Federal Reserve Bank. The Federal Reserve has significantly expanded its Treasury holdings since the COVID-19 public health and economic crisis began in 2020.

Foreign holdings come from a mixture of foreign individuals, businesses, banks, and governments. Of the roughly $7.9 trillion of foreign-held debt, 17 percent is held by Japan and 14 percent is held by China. The next largest holders are the United Kingdom, Ireland, and Luxembourg, who each hold between $320 billion and $560 billion of U.S. debt. On a combined basis, the Eurozone holds about $1.3 trillion, and Organization of Petroleum Exporting Country member nations together hold about $250 billion.

Read Also: File For Bankruptcy Credit Card Debt

Who Owns $215 Trillion Of The Us National Debt

At this writing, the U.S. national debt has nearly reached $22 trillion, rising by nearly $500 billion since the U.S. governments 2018 fiscal year ended on September 30, 2018.

But to whom does the U.S. government owe all that money? Heres an answer to that question, as if it were asked before the U.S. governments 2019 fiscal year began.

From the end of its 2017 fiscal year to the end of its 2018 fiscal year, the U.S. governments total public debt outstanding increased by $1,271 billion, or $1.3 trillion, to reach a total of $21,516 billion, or $21.5 trillion. Put a little bit differently, the U.S. national debt grew at an average rate of nearly $3.5 billion per day on every day of the governments 2018 fiscal year.

Thats a very large number, but 2018 was only the sixth largest annual increase for the U.S. national debt in terms of nominal U.S. dollars. Larger increases were recorded during President Obamas tenure in office in 2012 , 2010 , 2011 , 2009 , and 2016 .

So its not an accident that the U.S. national debt has risen to $21.5 trillion, where these six years combined account for 37% of the official U.S. national debt. But to whom does the U.S. government owe all that money?

The following chart breaks down who the U.S. governments major creditors were at the end of its 2018 fiscal year, which is based on preliminary data that will be revised in upcoming months.

Heres the chart:

Craig Eyermann

Why The National Debt Matters To Americans

Over the past 12 years, U.S. debt has grown over 400%, while the U.S. income has only grown 30%, according to the Federal Reserve Bank of St. Louis.

As the national debt continues to skyrocket, some policymakers worry about the sustainability of rising debt, and how it will impact the future of the nation. Thats because the higher the US debt, the more of the countrys overall budget must go toward debt payments, rather than on other expenses, such as infrastructure or social services.

Those worried about the increase in debt also believe that it could lead to lower private investments, since private borrowers may compete with the federal government to borrow funds, leading to potentially higher interest rates and lower confidence.

In addition, research shows that countries confronted with crises while in great debt have fewer options available to them to respond. Thus, the country takes more time to recover. The increased debt could put the United States in a difficult position to handle unexpected problems, such as a recession, and could change the amount of time it moves through business cycles.

Don’t Miss: How Does Bankruptcy Affect Your Life

National Debt Of The United States

| This article needs to be . Please help update this article to reflect recent events or newly available information. |

| This article is part of a series on the |

|

|

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms “national deficit” and “national surplus” usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

During the COVID-19 pandemic, the federal government spent trillions in virus aid and economic relief. The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945.

Debt Held By The Public

Debt held by the public is the amount that the Treasury has borrowed from outside lenders through financial markets to support government activities. Economists view DHBP as the most meaningful measure of debt high levels of such debt, typically measured as a percentage of gross domestic product , can crowd out private investments in the economy, make it more difficult to respond to economic crises, and generate other concerns.

As of December 2021, DHBP was $23.1 trillion, or 96 percent of GDP. That borrowing came from both domestic and foreign creditors, with the former holding about two-thirds of it.

Read Also: What Are The Negatives Of Filing For Bankruptcy

Why Is Raising The Debt Limit So Difficult

For many years, raising the debt ceiling was routine. But as the political environment has become more polarized, brinkmanship over the debt ceiling has increased. The House used to employ the Gephardt Rule, which required the debt limit to be raised when a budget resolution was passed, but that was for the most part phased out during the 1990s.

During the 2011 debt ceiling battle, some argued that President Barack Obama had the power to unilaterally lift the debt ceiling. Former President Bill Clinton said at the time that if he were still in office, he would invoke the 14th Amendment, which says the validity of U.S. debt shall not be questioned, raise the debt ceiling on his own and force the courts to stop him.

Mr. Obama and his lawyers disagreed and opted against that approach. After leaving office, Mr. Obama acknowledged that he and Treasury officials considered several creative contingency plans, such as minting a $1 trillion coin to pay off some of the national debt. In a 2017 interview, he described the idea as wacky.

Ms. Yellen dismissed the idea of minting such a coin to deal with the debt limit at a House Financial Services hearing, arguing that the only way to address the borrowing cap is to for Congress to lift or suspend it.

Is The National Debt A Problem

Economists and lawmakers frequently debate how much national debt is appropriate. Most agree that some level of debt is necessary to stimulate economic growth and that there is a point at which the debt can become a problem, but they disagree about where that point is. If the debt does get too big, it can result in cuts to government programs, tax hikes, and economic turmoil.

You May Like: What Is A 341 Meeting In Bankruptcy

Servicing The National Debt

This is the first post in a two-part series about the national debt.

Most people consider the national debt in the same way they would the debt of a household, in which high levels of debt and deficit spending are not sustainable and must be paid back or renegotiated at some point.

But are these two items similar? At the national level, U.S. federal debt reached $20.5 trillion by the second quarter of 2020. What does increasing debt mean to the U.S., whose income has only grown by 30% in the past 12 years, while the debt has ballooned by 400% in the same period?

Senior Vice President and Economist David Andolfatto examined this issue in a recent Regional Economist article titled Does the National Debt Matter? To begin to answer that question, Andolfatto first looked at the topic from the perspective of debt issuance, debt as currency and debt service.

The Last Couple Of Years Have Been Expensive

A deficit is what happens when the government spends more money in a fiscal year than it brings in through taxes and the last couple of years have been expensive.

Several large bills with hefty price tags have been approved since the start of the pandemic, including the American Rescue Plan Act, which cost $1.9 trillion, and $750 billion for student debt relief, all adding to the deficit, which then adds to the debt.

And though the Inflation Reduction Act, which was passed in August, is expected to reduce the deficit by $240 billion, policies and programs brought in by the Biden Administration are expected to add trillions more over the next decade.

The Committee for a Responsible Federal Budget, a non-profit that addresses federal budget and fiscal issues, estimates that $4.8 trillion will be added to the deficit by 2031.

Excessive borrowing will lead to continued inflationary pressures, drive the national debt to a new record as soon as 2030, and triple federal interest payments over the next decade or even sooner if interest rates go up faster or by more than expected, says the CRFB.

Much of the borrowing in the past couple of years happened while interest rates were historically low, but now that theyre not, with inflation rising at the fastest pace in decades, the cost of this debt will be amplified.

And when the government owes a lot, it makes it harder for corporations to borrow money.

You May Like: Can An Employer Fire You For Filing Bankruptcy

Does Government Borrowing Create New Money

In most cases the process of government borrowing does not create any new money. While most individuals and businesses accept bank deposits in payment, the UK government does not they require that the purchasers of new bonds settle the transaction by transferring central bank reserves into a government-owned account at the Bank of England. This means that new money is not created in the process of government borrowing.

For example, lets say a pension fund holds an account at MegaBank, and wishes to buy £1 million in government bonds. The fund asks MegaBank, which is one of the Gilt-Edged Market Makers , to buy £1 million of new government bonds. MegaBank decreases the pension funds account by £1 million and then purchases the bonds on behalf of the pension fund. To settle its transaction with the government, it transfers £1 million of reserves to the governments account at the Bank of England. The balance of MegaBanks account at the Bank of England will drop by £1 million. The government now has £1 million of central bank reserves in its account at the Bank of England, which can be used to make payments. It has borrowed the money without any additional deposits being created.

To spend the money it could now transfer the reserves to Regal Bank where an NHS hospital holds an account. Regal bank would then receive £1 million of central bank reserves, and could increase the account balance of the hospital by £1 million.

Who Owns The Most Us Debt

To satisfy the U.S. government’s need for revenue, Washington collects taxes and fees. What happens if this isn’t enough? What happens if the federal government needs more? That is the subject of this article in which we’ll reveal who owns the most U.S. debt and how much of it is owned by foreign nations. We’ll begin by explaining, in simple terms, how the debt market functions.

Debt 101

An individual takes on debt when they finance a new car, house, etc. The U.S. government does so when it issues securities. Specifically, the federal government issues Treasury bills, notes, and bonds. The primary difference is in their maturity. For example, Treasury bills have a maturity less than one year. Treasury notes mature in one to ten years. Treasury bonds have maturities greater than 10 years.

To issue its debt, the government holds periodic Treasury auctions. A successful auction indicates a strong demand for U.S. Treasury securities. If the auction doesn’t go well, it means demand for Treasuries is weak. Who owns the most Treasury’s?

Owners of U.S. Debt

You May Like: How To Declare Bankruptcy In Nc

Debt Ceiling: America’s Budget Crisis Of Its Own Creation

Fire up the giant digital billboards with their ever-increasing dollar displays. Start calculating how much every American man, woman and child owes. Cue the comparisons to a family budget, or credit-card spending or running a small business.

The national debt – and the legally mandated cap on the amount of new debt the federal government can issue – are back in the headlines.

First, a bit of context. The US government is in the enviable position of being able to issue new debt pretty much whenever it wants. American Treasury securities have been viewed as one of the safest, most stable investments in the modern world. In times of economic turbulence, US debt is a harbour in the storm.

If the US issues new government debt in the form of Treasury bonds, bills, notes and securities, there will be investors, both in the US and abroad, who are interested buyers.

While the current figures for the US debt – $31tn and growing – are astounding in both numerical and comparative terms, they do not represent an impending crisis.

The US debt-to-gross-domestic-product ratio, typically a more illuminating measure of a nation ability to manage its debt, sits at 121%.

This is lower than dozens of countries, including the United Kingdom, Germany, Australia and Greece.

That debt limit cap was first instituted by Congress in 1917, but increasing the amount was a formality for nearly a century.

Breakdown By Original/initial Maturity

The debt survey aims to provide detailed information on the time structure of government debt based on its original maturity. The maturity is subdivided into several maturity brackets: less than one year, one to five years, five to seven years, seven to ten years, ten to fifteen years, fifteen to thirty, and more than thirty years, as well as the summary category of more than one year. For some countries, which did not provide the complete breakdown, only two categories are shown: less than one year and more than one year . For the other 17 countries, a detailed debt maturity breakdown is available. The share of short-term debt to total debt is illustrated in Figure 5.

General government gross debt classified by maturity reveals a common pattern: between 75.1 % and nearly 100 % of the outstanding debt was incurred on a long-term basis. Short-term debt levels of less than or equal to 1 % were recorded in Lithuania and Bulgaria .

The short-term debt ratio was significant in Sweden , Portugal , Denmark , Italy and Germany as well as Norway , while the short-term debt ratio also exceeded 10 % in France and Finland.

The countries providing a detailed long-term debt breakdown showed very different structures. This is shown in Figure 6.

Don’t Miss: Where To Find Foreclosure Listings