How Exactly Does An Fha Loan Work

A mortgage insured by the Federal Housing Administration, an FHA loan offers a minimum 3.5% down payment for borrowers with a of 580 or more. An FHA loan is especially popular among first-time homebuyers who have little savings or have poor credit.

The FHA insures mortgages that are issued by banks, non-banks, credit unions, and other lenders. The main reason for this insurance is to protect lenders if there is a default on the loan. Because of this setup, FHA lenders can offer more favorable terms to borrowers who would otherwise have more difficulty qualifying for a home loan.

Home Equity Loans In Richmond Hill

Home equity loans as the name suggests are given against the equity of a property. Equity is a simple measure obtained by the value of a home minus its debts. The main difference between home equity loans and bank loans is that approval for them does not depend on credit score or job security. Our team has years of experience in providing various home equity loans in Richmond Hill helping people who were turned down because of low credit.

Dont Miss: What Happens If You Consolidate Student Loan Debt

Chapter 7 Bankruptcy Means Test

The means test determines whether the petitioner meets the maximum income requirements. Petitioners can file a Chapter 7 bankruptcy and still keep home. Homeowners can reaffirm their mortgages. Reaffirming their mortgages means the petitioner will keep the home mortgage outside the bankruptcy and keep on making the monthly housing payments.

Don’t Miss: How Much Will Credit Score Increase When Bankruptcy Falls Off

Mortgage After Bankruptcy: Rules By Loan Type

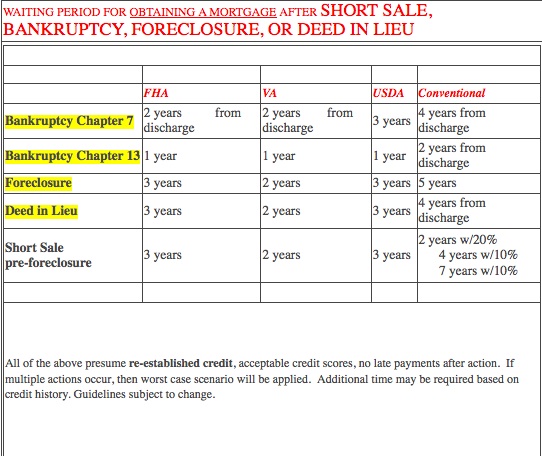

If youve filed for Chapter 7 or Chapter 13, youre still eligible for a broad portfolio of home loans. There arent any bankruptcy rules preventing you from getting a mortgage ever again. Youll need to observe mandatory waiting periods and meet any loan requirements that are normally in place. In addition, certain loan products will be easier to qualify for than others.

- Conventional mortgage: Waiting period of four years, but 3% down payment and 620 minimum credit score. You can usually stop paying mortgage insurance once you reach 20% home equity

- FHA mortgage: This loan type is likely more attainable for buyers with a Chapter 7 bankruptcy in their credit history. Popular with first-time home buyers, it features 3.5% down payment and 580 credit requirement. But youre on the hook for mortgage insurance premiums for the entire loan term, unless you refinance to a different type of mortgage, move, or pay off your loan

- VA mortgage: The Department of Veterans Affairs requires a minimum waiting period of two years from the date of your Chapter 7 discharge. To qualify for a VA home loan, you need to be an eligible veteran, service member, or member of an associated group

- USDA mortgage: The waiting period is three years, with some exceptions based on the bankruptcy filing. This type of loan generally requires a minimum credit score of 640 or higher to buy homes in eligible rural areas

How To Apply For A Mortgage After Bankruptcy

The mortgage application process is largely the same for Chapter 7 filers as for any other home buyer. But there are a few extra steps youll likely want to take before trying to buy a house.

- Improve your credit score. We dive into this step in more detail below, but bankruptcy is a blemish on your credit history, and one that you need to address before even considering homeownership. Improving your credit may take time. And, doing so can significantly increase the length of time youll need to wait to buy a home

- Write a letter of explanation. Writing a letter that explains your bankruptcy gives you an opportunity to address any red flags on your mortgage application. Include details about why you filed for bankruptcy and how your personal finances have improved. Also, explain the steps youre taking to ensure bankruptcy never happens again

- Get mortgage preapproval. Getting preapproved for a mortgage shows sellers and real estate agents that a lender has confirmed your ability to secure a mortgage. It will also reassure you of your home buying eligibility and establish your budget

Keep in mind that a bankruptcy filing stays on your credit reports for 7-10 years. Even after you become mortgage-eligible, your lender may still require legal documentation from the bankruptcy court to verify your status when you apply.

Don’t Miss: Dti For Conventional Loan

Fha Loans After Chapter 7 Bankruptcy

If youve filed a Chapter 7 Bankruptcy, FHA says you can purchase a home after a two-year waiting period. Chapter 7 bankruptcy offers those filing it a fresh start, a clean slate when it comes to their debts. Chapter 7 Bankruptcies wipe out most of the debts you have obtained.

Typically the only type of debt that isnt discharged in a Chapter 7 bankruptcy are government debts such as student loans. Government debts are a lot like marriagetil death do you part.

Government debts typically not discharged:

Also, any debts obtained by committing fraud will not be discharged in bankruptcy either.

Qualifying For A Mortgage With Recent Late Payments

We can also help borrowers to see if we can work with the creditor. See if the creditor can help in getting the late payments removed. Or advise with some other credit repair alternative program to offset the late payments during the Chapter 13 Bankruptcy repayment period. If you had any late payments during and/or after a Chapter 13 Bankruptcy and cannot qualify for an FHA Loan with another lender please call us or apply and start your process of getting into you dream home

Don’t Miss: How Long Does The Foreclosure Process Take

Fannie Mae Finally Follows Fha By Lowering Mandatory Waiting Period For Mortgage Loans After Derogatory Credit Event

FHA Sets the Standard with the Back to Work ProgramFHA vs. Fannie Mae: Securing the Right Mortgage Loan for You and Your FamilyJoel R. Spivack, Esq. is a knowledgeable bankruptcy and real estate attorney who has helped countless clients get their lives back on track. If you are looking to buy or sell a home, contact him today so he can help guide you through the real estate transaction process.Fannie Mae Finally Follows FHA by Lowering Mandatory Waiting Period for Mortgage Loans after Derogatory Credit EventSpivack Law

Pick Your Loan First Then Go Shopping

Before you start to shop or go for a test drive, its a good idea to secure your financing first. Not only does this let you know much you can spend, it shows you are serious buyer. And it provides additional negotiating power since youve already got your financing in handmaking it one less hassle you need to haggle over.

Simply apply to get your loan approval and amount, if eligible. Once youve found your car and finalized all the details with the dealer/seller, youll be able to complete the financing and quickly get funding.

You May Like: How To File Bankruptcy In California

What Type Of Mortgage Can You Get After Bankruptcy

No rules are in place that permanently exclude you from getting a certain type of loan because youve gone through a bankruptcy. As long as you meet the appropriate waiting period discussed above, youre free to apply for any type of loan after a bankruptcy. But you can qualify for some types of mortgage loans much easier than others.

For example, FHA loan waiting periods are shorter than other types of loans. And if you have a Chapter 13 bankruptcy, theres no waiting period at all after a court dismisses or discharges your bankruptcy.

One of the major benefits of getting an FHA loan after a bankruptcy is its lower credit requirements. Even after a court dismisses or discharges your bankruptcy, your bankruptcy filing will still negatively influence your credit score. A Chapter 7 bankruptcy will stay on your credit report for 10 years, while a Chapter 13 bankruptcy will stick around on your credit history for 7 years.

During this time, your credit score will be much lower than before your bankruptcy. But with an FHA loan, you can buy a home with a credit score as low as 580 points. You may even qualify for a loan with a score as low as 500 points if you have a down payment of at least 10%. However, at Rocket Mortgage®, the minimum credit score is 580.

Get your free credit report and score.

Create a Rocket Account to see where your credit stands.

Iii Acquiring Financial Institution

All deposit accounts, excluding certain brokered deposits, have been transferred to The National Bank and Trust Company, Wilmington, OH and will be available immediately. The former American National Bank location will reopen as a branch of The National Bank and Trust Company during regular business hours.

Your transferred deposits will be separately insured from any accounts you may already have at The National Bank and Trust Company for six months after the failure of American National Bank. Checks that were drawn on American National Bank that did not clear before the institution closed will be honored as long as there are sufficient funds in the account. If you have questions about your account transferred to the assuming bank, you may speak to an FDIC representative by calling 1-800-823-3215.

For general questions about FDIC deposit insurance coverage, please call 1-877-275-3342 or visit EDIE, the FDICs Electronic Deposit Insurance Estimator.

You may withdraw your funds from any transferred account without an early withdrawal penalty until you enter into a new deposit agreement with The National Bank and Trust Company as long as the deposits are not pledged as collateral for loans. You may view more information about The National Bank and Trust Company by visiting their web site.

On March 7, 2015, The National Bank and Trust Company merged with Peoples Bank.

Read Also: How To Buy Foreclosed Homes In Ohio

Fha Chapter 13 Bankruptcy And Late Payments

Lenders require borrowers to have been timely with all of their monthly payments during and after their Chapter 13 Bankruptcy Process. The past 24 months of the repayment period will be looked at very carefully with regard to monthly timely payments. Late payments during the Chapter 13 Bankruptcy repayment plan will be carefully looked at and it will not be viewed favorably. Same with late payments after a Chapter 13 Bankruptcy discharge.

What Is The Fnma Conventional Loan Foreclosure Waiting Period

The waiting period after a loan foreclosure for either a Fannie Mae or a Freddie Mac conventional conforming loan is seven years, three years if you have extenuating circumstances. However, if you qualify due to extenuating circumstances, you will have to pay a 10% down payment to be eligible for a new mortgage.

Also, if you are putting less than 20% down on the new mortgage after qualifying due to extenuating circumstances, you will have to pay PMI insurance on your loan. PMI has its own requirements after foreclosure, so you will want to have your lender check those requirements to see if you qualify.

Also Check: Can You Declare Bankruptcy And Keep Your House

What Are 5 Reasons For An Fha Loan

One of the main reasons for an FHA loan is to help anyone who might not qualify for a conventional mortgage buy a home. There are also many benefits that come with an FHA loan, from competitive FHA rates to low down payment requirements.

While there are both advantages and disadvantages to FHA loans, lets look at 5 reasons getting an FHA loan might be a good idea:

Lets take a deeper dive into the 5 reasons for an FHA loan:

1. Easy credit qualification

Compared to conventional loans, FHA loan requirements are less strict. In fact, an FHA loan is one of the easier loans you can qualify forespecially if you have poor credit. But while the minimum credit score for an FHA loan is 500, your required loan-to-value ratio must be 90%. Keep in mind, though, that lenders can set their own minimum credit score, which are called overlays. For instance, an FHA credit score of 620 is a common lender overlay.

Compensating factors also make qualifying for an FHA loan even easier, meaning that you can provide proof of your creditworthiness and additional factors to bolster your application. Some examples of these compensating factors include:

- Substantial non-taxable income

2. Short qualifying time after bad credit

While past foreclosures and bankruptcies can make a mortgage more difficult, FHA loans offer the chance to get a mortgage after you have had a negative credit event.

3. Low down payment

Is Buying A House After Bankruptcy Possible

Yes, you can buy a house after bankruptcy. If youre not paying cash upfront for a new home, borrowing from a mortgage lender can be challenging. But its not impossible. Conventional loan programs and government-backed mortgages have processes in place to help bankruptcy filers recover from their financial missteps and become homeowners again.

Read Also: Chapter 7 Bankruptcy Vs 11

Borrower Current At The Time Of Short Sale

A borrower is considered eligible for a new FHA-insured mortgage if, from the date of loan application for the new mortgage, all

- mortgage payments on the prior mortgage were made within the month due for the 12-month period preceding the short sale, and

- installment debt payments for the same time period were also made within the month due.

Loan Program With No Seasoning On Derogatory Events

The non-QM or portfolio mortgage loan program allows borrowers who had a recent derogatory event, such as a foreclosure, short-sale, deed-in-lieu, mortgage loan charge off, chapter 7 or chapter 13 bankruptcy to purchase a home, cash out, or refinance. There is no seasoning required for derogatory events, but the derogatory event must be completed prior to the application date.

- 30 year fixed rates, 5/1 and 7/1 ARMS.

- Low minimum FICO of 500 required.

- The maximum loan-to value is 90%, minimum down payment 10%, and loan amounts of up to $2,000,000 for a purchase transactions.

- The down payment is determined by the credit score and the amount of reserves.

Cash out and debt consolidation options available up to 80% and maximum loan amount of $750,000. The maximum loan-to-value is determined by credit score and reserves.

Read Also: How Do You Know When Bankruptcy Is Discharged

Mortgage Manual Underwriting Guidelines On Chapter 13 Bankruptcy

Chapter 13 bankruptcy is the second type of consumer bankruptcy which is filed by consumers who are employed or have income and assets or consumers who want to protect their assets. Petitioners need income in order to qualify for Chapter 13 bankruptcy Petitioners with no income will not qualify for a Chapter 13 bankruptcy. In the following paragraphs, we will cover and discuss the mortgage process after Chapter 13 and Chapter 7 Bankruptcy guidelines and requirements.

Is it possible to refinance my house after bankruptcy?

The requirements are the same whether youre refinancing a house or borrowing money for the first time. You may be able to obtain a cash-out refinance following a bankruptcy as well.

What credit score do you need after bankruptcy?

The credit score required for a mortgage after bankruptcy will differ by lender. The higher your credit score is, the more likely you are to be accepted, but a 620 FICO score is the minimum recommended. However, certain of our subprime lenders can help borrowers with lower scores.

What is the duration of time that must pass before you may take out a mortgage following a Chapter 13 bankruptcy?

If you have a chapter 13 bankruptcy, you will most likely have to wait at least two years before receiving your loan. You wont have to wait if you obtain a subprime loan.

Which lenders would give me a loan if I declare bankruptcy?

Is it true that I must obtain a job in order to get a mortgage after declaring bankruptcy?

What Is The Va Waiting Period After Foreclosure

The VA waiting period after a foreclosure is two years if you can prove that you have reestablished good credit, and one year if you have extenuating circumstances. However, if the loan you defaulted on was a VA loan, you may not have any VA entitlement credit left until you repay your original VA loan in full.

Recommended Reading: Liquidation.com Customer Service

What Is Home Equity

Home equity is the difference between how much you owe on your mortgage and how much your home is worth. You can build equity as you pay down your loan balance and as the market value of your home increases.

Heres an example of how you build equity in a home:

- You make a $20,000 down payment and take out a $180,000 mortgage loan to purchase a home with a sales price of $200,000.

- After 5 years, your monthly loan payments have reduced your mortgage balance down to $167,000.

- During this same time, your homes market value has increased to $230,000.

- To calculate your homes equity, subtract your mortgage balance of $167,000 from the current market value of $230,000.

- You have $63,000 in equity.

You may or may not be able to borrow your full amount of equity. Most lenders use Loan-to-Value , Combined Loan-to-Value , and Debt-to-Income ratios, along with other factors when determining your interest rate and how much youre eligible to borrow.

Rbfcu Home Equity Loan

With a home equity loan from Randolph-Brooks Federal Credit Union, you can borrow a single lump sum against your homes available equity. Youll pay this installment loan monthly over several years . Rates are as low as 4.961%, depending on the repayment term you choose.

As with HELOCs, RBFCU allows you to borrow up to 80% of your primary homes appraised value, but the actual dollar limit depends on factors including your credit score, current debt obligation, and remaining mortgage balance.

For loans up to $175,000, youll pay no appraisal or application fees. You can expect to pay higher upfront costs for loans over $175,000. RBFCU will disclose the exact amounts during the underwriting process.

| RBFCU home equity loan terms |

| Rates |

| 1.36 out of 5 stars | 50 |

Ratings collected on November 30, 2022.

Researching a lenders products, services, and company history is an important first step. Next, its wise to see what customers say about their own experiences with the company.

The Better Business Bureau is one of the most reliable consumer review and industry rating organizations. Randolph-Brooks Federal Credit Union is not accredited through the BBB, but it has issued the credit union an A+ rating.

However, between the 50 consumer reviews posted on the platform, RBFCU has a poor rating of 1.36 out of 5 stars on BBB. Most reviews center around negative experiences with customer service representatives, and many are from banking customers, not home equity borrowers.

Don’t Miss: How Often Can You File Bankruptcy In Tennessee