Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

What Is A Credit Report

Your is created the first time you apply for credit or borrow money. It will contain information such as details about your credit cards and loans, including when you opened your accounts, how much you owe, when you make or miss payments, and if you go over your credit limit. A credit report also contains personal information such as if you have ever filed for bankruptcy.

What To Do If A Late Payment Is Late On Credit

In most cases, if the error was due to the fault of the lenders, they will refund the late payment penalty and remove the late payment from your credit report. However, this is not always the case. If they refuse to remove the late payment, you can proceed to the next step. 2. Start a dispute with Schufa.

Don’t Miss: How To File For Bankruptcy In Ri

Consumers Can Seek Chapter 7 Or Chapter 13 Bankruptcy

There are two types of bankruptcy that consumers can choose if their financial situation warrants it: Chapter 7 or Chapter 13 bankruptcy. The type of bankruptcy you choose will ultimately determine how long it remains on your credit report.

Chapter 7 bankruptcy essentially means any unsecured debt will be wiped out with certain limits and restrictions. The other type is Chapter 13 Bankruptcy, which calls for people to continue paying their debt for several years and afterward, a portion of that debt is discharged.

What Is Chapter 7 Bankruptcy

If you file a Chapter 7 bankruptcy, youll probably have to wait the full 10 years for the derogatory mark to drop off your credit reports.

Debts included in your bankruptcy can also negatively impact your credit reports any discharged debts are likely to be listed as included in bankruptcy or discharged, with a balance of $0. In a Chapter 7 bankruptcy, these accounts should fall off your reports seven years from the date you filed, unless the accounts were delinquent before the bankruptcy filing date .

Recommended Reading: Has Tom Steyer Ever Filed Bankruptcy

Make Payments On Time

On-time payments are the most important factor that affects your credit score. By making payments on time consistently over a period of months and years, you can raise your credit score and demonstrate to lenders that youâre able to pay your bills on time. Some services, like Experian Boost, even let you report on-time utility bill payments in order to further increase the amount of on-time payments present on your credit report.

Why Checking Your Credit Reports Is Important

Obviously, as you near the date that your bankruptcy filing youll want to check your credit fairly routinely. Unfortunately, you cant check your credit reports often without paying for them, but you can begin tracking your credit scores and, when you see a jump in your score, youll know that positive changes are beginning to happen. This may be the perfect time to get your free credit report at AnnualCreditReport.com or pay for it with the individual credit reporting agencies to see if those negative marks have all been removed.

Also Check: Which Bankruptcy Chapter Is Right For Me

How Bankruptcy Affects Your Credit

Filing for bankruptcy makes it challenging to receive credit cards or lower interest rates because lenders will consider you risky. These consequences could occur immediately, affecting any short-term needs such as getting affordable interest rates or approval from prime lenders.

Rebuilding your credit as soon as possible is paramount. One way to increase your credit score is to pay all your bills on time each month, creating and sticking to a budget and not incurring more debt.

You should also avoid overuse of credit cards and failing to pay balances in full each month. Having a good credit score gives consumers access to more types of loans and lower interest rates, which helps them pay off their debts sooner.

Make Sure You Pay All Your Bills Early Or On Time

Your payment history is the most important factor that makes up your FICO score, accounting for 35 percent. With that in mind, youll want to make sure you pay every bill you have early or on time. Set a reminder on your phone if you have to, or take the time to set up each of your bills on auto-pay. Whatever you do, dont wind up with a late payment that will only damage your credit score further and prolong your pain.

You May Like: Legit Debt Relief Programs

File A Verification Request

If the credit bureaus claim that your bankruptcy is accurately reported, the next step is to make them confirm where they got their information about the bankruptcy.

Under the Fair Credit Reporting Act , the credit bureaus are required to tell you the source of their information when it comes to the items on your credit report.

In your letter or communication requesting verification, ask the credit bureaus to confirm the following information:

- Name and address of the courthouse

- Phone number of the courthouse they contacted

- Name of the person who verified the disputed information

- Any documentation used to verify the dispute

Chances are, the credit bureaus will claim they verified the bankruptcy with the court.

But heres the thing: the federal bankruptcy courts explicitly state that they do not provide information to the credit reporting agencies.

We will use this bit of information to our advantage!

What Can Do To Repair Your Credit History While You Wait

The golden rule to a good credit score is to make sure all your credit accounts are paid on time and any past due accounts have been brought up-to-date. Try to reduce your credit balance where possible and keep the balances on revolving accounts low.

Avoid applying for credit if you think there is any chance you may be declined, by checking your credit score and running pre-approved applications you can get a good idea if it will be successful and this reduces the number of checks on your file. Fewer checks mean an improved score.

If any negative information has been put on your file by mistake you can contact the credit agency and ask them to remove it, this is called a notice of correction. When they receive your query they will contact the company who provided the data you are querying and let you know the outcome within 28 days. The credit agency is not legally allowed to change the information on your credit report without permission from the company who originally provided it to them.

Having a low credit score doesnt mean you cant get credit. There are some lenders that specialise in approving loans for borrowers with poor credit. However, those loans typically come with higher interest rates and less favourable terms.

Read Also: B& p Liquidation Pallets

Second Or Subsequent Bankruptcies

If you have gone bankrupt two or more times in Canada , please take note that the bankruptcy will remain on your credit report for at 14 years. I heard that the first bankruptcy can or will reappear on your credit report if you have a second or subsequent bankruptcy.

DISCLAIMER: Each credit bureau can make up its own rules, which are subject to change. If in doubt, please consult Equifax and TransUnion directly if in doubt.

Some interesting information from the Equifax Canada website:

Public records include information on tax liens, lawsuits, bankruptcies and judgments that relate to the consumers debt obligations. Most public record items are listed for seven years including successfully completed bankruptcies. A second bankruptcy can remain on your file indefinitely.

So that means a second bankruptcy could stay on your credit report FOREVER! Be careful and make sure you dont have to file for bankruptcy more than once in your lifetime!

Between all of these possible scenarios, you should know why your bankruptcy is still showing up on your credit reports, and what to do if it should have been purged already. I look forward to my bankruptcy dropping off my credit reports. Less than three years to go. Yep, Im throwing a party the day my bankruptcy drops off my credit reports!

Donât Miss: How Many Times Has Donald Trump Filed For Bankruptcy

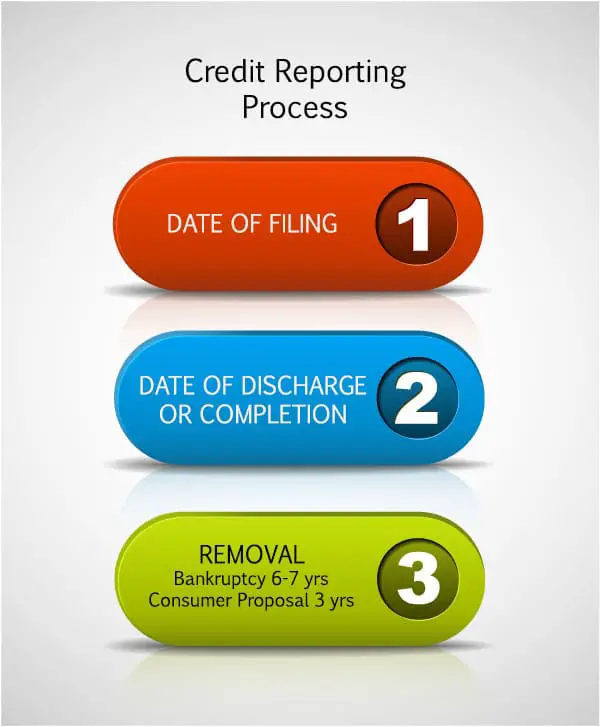

How Long Does Bankruptcy Stay On Credit Report

Your payment history is one of the most important elements the major credit bureaus use to determine your credit score. Therefore, filing bankruptcy can have a huge impact on your credit report. The good news is that a bankruptcy filing does not stay on your record forever. The amount of time it takes to get it removed from your credit report depends on which of the two types of bankruptcy you file.

Also Check: How Long Does Bankruptcy Stay On Your Credit Report

How Long Can Bankruptcy Affect Your Credit Score

Depending on the type of bankruptcy you file for, it can affect your credit score for 7 to 10 years. After this period of time has passed, the bankruptcy will automatically fall off your credit report. In most cases, thereâs nothing a consumer can do to remove bankruptcy from their credit report sooner.

What If Your Bankruptcy Has Been Discharged But Is Still Showing Up On Your Credit Report

Credit bureaus are required to stop showing a bankruptcy seven years after the filing date for Chapter 13 and 10 years after the filing date for Chapter 7. If you notice that your bankruptcy hasn’t been removed from the public records area of your credit reports, you should treat this like any other reporting error and dispute it with the credit bureaus. The credit bureaus are required to respond within 30 days.

As for the accounts included in your bankruptcy? They wont be erased at your filing day, either, according to the three major credit bureaus Experian, Equifax and TransUnion. You can expect closed accounts with delinquencies to be deleted from your credit history about seven years after the account went delinquent and was never brought current. Closed accounts without a negative payment history can stay on your reports for up to 10 years.

Read Also: How To Qualify For Home Loan After Bankruptcy

What Happens When Bankruptcy Is Removed From My Credit Report

Once your bankruptcy has been removed, however, it should be easier for you to obtain credit again and you can also start rebuilding your credit rating sensibly with small amounts and on time repayments.

It is best to wait until your bankruptcy has been completely removed before you start applying for credit again though, to ensure you dont impact your credit rating further.

Can I cancel my bankruptcy?

Yes, you can cancel your bankruptcy. Cancelling your bankruptcy can lift its restrictions and its impact on your credit rating sooner but you can only do this if the following reasons apply:

- All of your debts and fees for your bankruptcy have been paid in full, by a third party.

- Youve set up an IVA with your creditors instead.

- The bankruptcy shouldnt have been set up in the first place.

Before you apply for bankruptcy, its a good idea to consider how long it stays on your credit report and how this will impact you, your family and even your job. There are a number of alternative debt solutions such as an IVA or Debt Management Plan that may be better for you, so its a good idea to explore these first.

Talk to a member of our expert team here at PayPlan today, for free impartial advice that can help you get back on track, point you in the right direction and living life again without worry.

Your Credit Report After Bankruptcy

How long does bankruptcy ruin my credit?

If you are considering getting a clean slate and filing for Chapter 7 bankruptcy or Chapter 13 bankruptcy in North Carolina, you have probably heard that bankruptcy will ruin your credit for 10 years.

Fortunately, this is not true as long as you are taking the necessary steps to care for your credit post-bankruptcy.

Recommended Reading: How To Build Credit Score After Bankruptcy

How Can I Get A Copy Of My Credit Record

There are two ways to get your credit report : either through the mail or via the internet. If you want to obtain your credit report for free, you must use the mail. It is also important to do what you can to make sure your credit report shows a history of reliable credit repayments, and as few unfavorable repayment incidents as possible.

For more detailed information related to credit reporting, visit Equifax Canada or Trans Union website. Talk to a licensed trustee today. We have trustees everywhere from Calgary to Montreal and more. Get a free consultation today!

Do I Still Have To Pay A Debt That Fell Off My Credit Report

Your debt isnt simply erased once it falls off your credit reports, but your liability for owing it might vary if the debt is past its statute of limitations.

If you never paid off the debt and the creditor is within the statute of limitations, youre still liable for it and . The creditor can call and send letters, sue you or get a court order to garnish your wages.

If you never paid off the debt, but its past its statute of limitations, the debt is now considered time-barred. How you choose to act on a time-barred debt thats fallen off of your credit report is your choice. According to the FTC, you can do one of the following:

- Pay part of the debt

- Pay the total outstanding debt

Regardless of which option youre considering, talk to an attorney about your best path forward before contacting a debt collector.

Depending on the state you live in, debt collectors might be allowed to call you to try to collect on a time-barred debt. However, creditors and debt collectors cant sue you or threaten a lawsuit to collect on a debt thats outside of the statute of limitations.

If youre looking to put your debt behind you and move on with a clean slate, a surefire way is to pay what you owe, or at least an agreed-upon part of what you owe. Before making the phone call, make sure you know:

- That the debt is legally yours

- The date of the last payment on the account

- How much you owe the creditor

- What you can realistically afford to pay per month or in a lump sum

You May Like: Best Site For Foreclosures

Simple Ways To Remove A Bankruptcy From Your Credit Report

Correcting Misreported Discharged Debt

Disputing errors is relatively straightforward. Youll do so by using the online procedure provided by each of the three major credit reporting agencies.

A creditor who repeatedly refuses to report your discharged debt properly might be in violation of the bankruptcy discharge injunction prohibiting creditors from trying to collect on discharged debts. If you take steps to remedy the misreporting, and the creditor refuses to fix the error, talk to a bankruptcy attorney.

Read Also: Can You Get Student Loans After Bankruptcy

Bankruptcy & Your Credit Report

IMPORTANT INFORMATION: The Bankruptcy Court has no jurisdiction over credit reporting agencies and does not report information to any of the credit reporting agencies. The credit reporting agencies collect information regarding bankruptcy cases directly from the courts public records. Bankruptcy petitions, schedules, and other documents are public records. Regardless of the disposition of your case the credit reporting agencies can report your case on your credit report for up to ten years.

The Bankruptcy Court is unable to assist you with removing or correcting information listed on your credit report.

1. How long does a bankruptcy remain on my credit report?

The Fair Credit Reporting Act, Section 605, regulates credit reporting agencies. The law states that credit reporting agencies may not report a bankruptcy case on a persons credit report after ten years from the date the bankruptcy case is filed.

Debtors must directly contact credit reporting agencies to discuss information on a credit report. Under the Fair Credit Reporting Act the credit reporting agency are required to correct inaccurate or incomplete information on a credit report. The credit bureau will verify the item in question with the creditor at no cost to the consumer.

There are a number of educational publications that the Federal Trade Commission has on its website to help consumers.

2. How do I get a free copy of my credit report?