States With The Highest Foreclosure Rates

Going through a foreclosure can be devastating, and many communities still havent recovered emotionally or financially from the years of unusually high numbers of foreclosures following the financial crash of 2008.

If you’re concerned with the state of the economy and how it could impact your wealth, here are five things you should do before a recession.

The great news is that foreclosure rates in the United States have been steadily declining since 2011. The bad news is that after the pandemic-related foreclosure moratorium ended on July 31, 2021, the rate of foreclosures has been rising steadily month-over-month.

What Does This Mean For Home Buyers

- Email icon

There has been a big uptick in foreclosure filings, but the reasons may surprise you.

The number of foreclosure starts which is when the first public foreclosure notice happens is up 219% since the start of the year, according to real estate data analytics firm ATTOM Data Solutions midyear 2022 U.S. foreclosure market report. Whats more, the number of properties that had foreclosure filings is up 153% from the same time period last year.

Fully 96% of major metro areas saw an annual increase in foreclosure filings, with foreclosure rates highest in Illinois, New Jersey and Ohio. And when it comes to the number of foreclosure starts, California topped the list, followed by Florida, Tennessee, Illinois and Ohio.

Foreclosure activity across the United States continued its slow, steady climb back to pre-pandemic levels in the first half of 2022, says Rick Sharga, executive vice president of market intelligence at ATTOM. While overall foreclosure activity is still running significantly below historic averages, the dramatic increase in foreclosure starts suggests that we may be back to normal levels by sometime in early 2023, says Sharga.

What does this uptick in foreclosures mean for the housing market?

What does this mean for buyers?

The advice, recommendations or rankings expressed in this article are those of MarketWatch Picks, and have not been reviewed or endorsed by our commercial partners.

Delinquency And Foreclosure Rates Are Historically Low

Finally, rates of delinquency â the failure to make mortgage payments â and foreclosure â where a property is seized after a homeowner repeatedly misses mortgage payments â are both near record lows, according to Black Knight.

Although the national delinquency rate rose slightly by 0.05 percentage points in July, it’s just 0.14 percentage points higher than May’s record low of 2.75%, according to the report. Also, the number of 90-day delinquencies fell back below May levels in July after rising slightly in June.

Meanwhile, foreclosure starts receded by 25.6% in July to 17,700, which is still considerably below pre-pandemic levels â yet another healthy sign for the US housing market.

Don’t Miss: When Does Bankruptcy Fall Off Credit Report

The Foreclosure Process In 5 Steps

From the time of your first missed mortgage payment to the foreclosure sale of your home, there are several steps in the foreclosure process. These phases can vary by state, but generally follow this timeline. Each state has its own laws pertaining to the process of foreclosure and foreclosure sales. These can govern the borrowerâs relief options if already in foreclosure, how to go about posting a Notice of Sale, the sale timeline and other parts of the process.

Demographic And Household Statistics

We calculated the household and demographic statistics using 2019 American Community Survey data. The data are calculated using both the Public Use Microdata Area and pretabulated summary-level data when available.

Not all counties met the 100,000-person minimum population threshold to be identifiable in the public use data. For these smaller counties, we used a PUMA-to-county crosswalk to create county-level weighted estimates. To check that our estimates were reasonable, we compared a series of calculations from the crosswalked data with census summary data and found marginal differences. We indicate which variables were created this way under the PUMA tab with a Y.

Read Also: When Does Bankruptcy Fall Off Credit Report Canada

Job Market Affects Foreclosures

While job loss is a top reason for foreclosures, official unemployment rates by state from the Bureau of Labor Statistics dont correlate highly with the foreclosure rates currently. Since current official employment rates are so high in the United States, it is reasonable to assume that underemployment is a greater cause of foreclosures than full unemployment is in this specific economy.

The labor market has gone through massive changes during the pandemic, and one of those is people leaving the labor market voluntarily or working on a casual or part-time basis by choice. People choosing not to look for jobs or to be underemployed are at higher risk of foreclosure than are fully employed people, and they are also not reflected in unemployment figures.

Another labor-related cause of foreclosures that isnt reflected in unemployment numbers is the effect that holding back the minimum wage artificially has had on the labor market and on home-buying behavior.

Without cost-of-living increases in the minimum wage and the corresponding COL increases in higher-waged jobs, buyers are less likely to have a down payment saved before buying a house, so they are more likely to enter into larger and riskier mortgage contracts at higher interest rates. This increases the precarity of the market and the mortgage default rate, which leads to foreclosures.

Based on data from ATTOM, these are the 10 states with the highest rates of foreclosures from the first three months of 2022.

Your Guide To Foreclosure Statistics 2020 And Facts

- Foreclosure Filings Up 13 Percent in January 2020

- Foreclosure Starts Down, but Not Everywhere in January 2020

- Homes in Foreclosure Drop to 282,800 in Q1 2020

- Two-Thirds of Default Servicers Expect Increase in Foreclosure

- NY Calls for 90-Day Suspension of Foreclosures

- Foreclosures Suspended for 60 Days Nationwide

- 65% of Mortgages Protected by Government Suspension on Foreclosures

Foreclosure Filings Up 13 Percent in January 2021

The beginning of the year saw a considerable increase in foreclosure filings. The 60,085 in foreclosure represented a 13 month-over-month jump from December 2019 and a 7 percent year-over-year increase from January 2019.

One in every 2,270 properties in the United States received a foreclosure filing in January. The states with the worst foreclosure rates in January were:

Other states fare much better with significant drops in foreclosure activity month-over-month. Foreclosures dropped 44 percent in Iowa, 28 percent in Oregon and Nevada, 24 percent in Louisiana, and 20 percent in Washington.

Foreclosure Starts Down, but Not Everywhere

At 26,858, foreclosure starts, when lenders start the foreclosure process on a property for the first time, were down less than one percent month-over-month in January 2020 and down 9 percent year-over-year.

This is just the national average, however. Some states saw significant increases in foreclosure starts, including:

- California

Homes in Foreclosure Drop to 282,800 in Q1 2020-2021

Don’t Miss: What Does Chapter 11 Bankruptcy Mean For Shareholders

Foreclosure Filings Are Up 132% From A Year Prior Heres What That Means For The Housing Market

What does the recent uptick in foreclosures mean for the housing market now?

When we were reading through real-estate data this month, three stats caught our eye. The first: that the number of active foreclosures edged up by more than 7,000 in March the first year-over-year increase in almost 10 years, according to mortgage technology, data and analytics provider Black Knight. Secondly, more than 78,000 U.S. properties had a foreclosure filing during the first quarter of 2022, which is up 39% from the previous quarter and up 132% from a year ago, according to real-estate analytics company ATTOM. And third, serious mortgage delinquencies those 90 or more days past due are 70% higher than they were pre-pandemic, according to Black Knight.

As for foreclosure filings, Rick Sharga, executive vice president of market intelligence at ATTOM, says that though foreclosure activity increased significantly in the first quarter of 2022 that doesnt indicate a sudden weakness in the housing market, or the U.S. economy. Mortgage servicers are essentially catching up on processing foreclosures on loans that were already in default or more than 120 days delinquent prior to the pandemic. Many of these loans are fairly old issued prior to 2009. And he adds: Were not expecting to see a huge wave of foreclosure activity anytime soon. Even with the dramatic increase in foreclosure activity, were still running at about 50% of the normal level.

Leverage Is At Record

One surefire sign of speculation in markets is a high rate of leverage, or the borrowing of money to invest in hopes of boosting returns. Real estate bubbles tend to burst when leveraged buyers enter a debt spiral because the properties they borrowed money to buy declined in value.

Real estate market leverage is currently at just 42% of mortgaged homes’ values, and that rate is “the lowest on record,” Graboske wrote.

Also Check: Is Forever 21 Filing For Bankruptcy

Jones County North Carolina Has One Of The Highest Foreclosure Rates In The Nation

- Samuel Stebbins, 24/7 Wall St. via The Center Square

The worst inflation in 40 years has led to cascading effects, with consumer sentiment declining and gross domestic product decreasing in the first quarter of this year. While the Federal Reserve has been raising rates to tame inflation, this has resulted in higher mortgage rates. Combined, these factors appear to be cooling the U.S. housing market after white-hot demand in the past two years sent prices skyward.

So far, the number of foreclosure filings in the first six months of the year is still slightly lower than it was in the same period in 2020. But these filings are up 153% from the first half of last year, according to property data provider Attom Data Solutions.

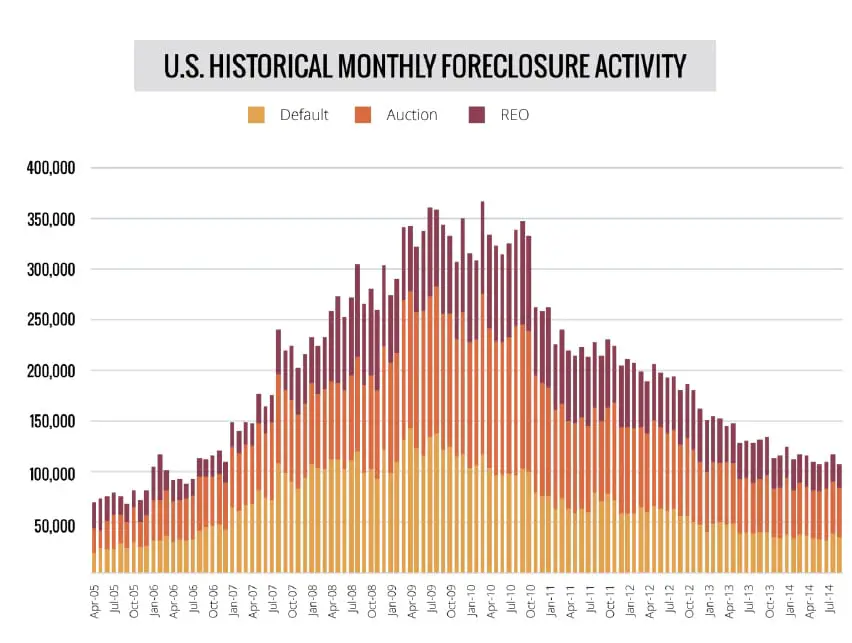

Home foreclosure filings include default notices, bank repossessions, and scheduled auctions and are used as a measure to gauge the health of housing markets at local, state, and national levels.

Jones County, North Carolina – located in the New Bern metropolitan area – has one of the highest foreclosure rates of any U.S. county. According to a recent report from Attom, a total of 16 housing units were in foreclosure in the first half of 2022, up 33.3% from the first half of last year.

The foreclosure rate in Jones County of one in every 290 homes ranks as the 11th highest of the more than 1,700 counties and county equivalents reviewed.

Foreclosure Statistics 2022 2021

When we think about foreclosure, we may associate it with things like stress and financial difficulty. The 2008 financial fiasco proved how stressful and disappointing foreclosure could be for everyone. However, the rate of foreclosure actually became lower and lower after the financial crisis ended.

Now that the pandemic has hit the whole world, were once again seeing changes in foreclosure rates. Look at the foreclosure statistics below to see how theyll affect the future:

Don’t Miss: What Is A Chapter 13 Bankruptcy Trustee

Historical Foreclosure Rates Vs Future Trends

Analyzing foreclosure rates by year helps us gain insight into what has happened and what we are yet to expect.

10. Foreclosure rate in 2006 was 0.58%.

The total number of annual foreclosures just before the economic crisis started hitting hard was 717,552. In the year after that, the numbers almost doubled. And the year after that, they almost doubled again.

11. Foreclosure rates peaked in 2010 when they hit 2.23%.

2010 was arguably the worst year for homeowners. Foreclosures skyrocketed in the aftermath of the financial crisis. The mind-blowing rate of 2.23% and a total of 2,871,891 foreclosed properties were unthinkable just a few years prior.

12. The pre-recession quarterly average of foreclosed properties between Q1 2006 and Q3 2007 was 278,912.

Right now, we are doing better than before the 2008 crisis. According to foreclosure stats The number of foreclosed properties dropped by 90% to 27,016 in Q3 of 2020.

The third quarter of 2020 is the 21st consecutive period where the average is going down.

13. Foreclosures by state dropped by up to 99% compared to the pre-recession average.

In Colorado and Nevada, there are now 99% fewer properties that receive a foreclosure warning. Compared to pre-recession data, foreclosures in Massachusetts and Michigan have decreased by 98%. Even South Carolina, which is currently rocking through a foreclosure rate surge, has seen a drop of 25% compared to the pre-recession period.

14. Mortgage debt reached $9.86 trillion in Q3 2020.

+ Foreclosure Statistics To Give You Hope In 2021

Imagine this:

You cant pay your mortgage. The lender takes it back. Cue stress and disappointment.

Unfortunately, this scenario is all too real, and foreclosure statistics show that millions of Americans experienced it during the 2008 financial crisis.

A decade after the recession, things were finally looking up. The foreclosure rate was at an all-time low and then the pandemic hit.

Unemployment skyrocketed due to stay-at-home orders, and high unemployment usually leads to foreclosures. Fortunately, despite millions of delinquent mortgages, the rates are still low, and the numbers are actually improving.

Foreclosure moratoriums helped a lot with this, so even millions of delinquent mortgages arent in danger of becoming foreclosures. At least not yet.

So lets look at some important statistics and how theyll impact our future:

Read Also: How Does Insolvency And Bankruptcy Code Work

Historical Rate Of Mortgage Foreclosures

One important gauge of the real estate market is the foreclosure rate: the number of homes in foreclosure expressed as a percentage of the entire stock of privately owned homes. This rate is often quoted in economic reports to show the condition of the housing market and the overall U.S. economy. The higher the foreclosure rate, the more serious an economic downturn, if one exists. However, researchers should approach historical comparisons with caution.

How The Tax Is Calculated

Property tax is calculated based on the:

- general municipal tax rate and any additional municipal tax rates for special services provided by your municipality

- property value

Municipal tax rate

Municipal tax rates are established by your municipality and can vary, depending on the type of property you own.

Each year, municipalities decide how much they want to raise from property taxes to pay for services and determine the tax rate based on that amount.

To learn about the tax rates in your municipality, contact the finance or treasury department of your local municipality. Some municipalities may have a property tax calculator available on their website.

Education tax rate

Education taxes help fund elementary and secondary schools in Ontario. Education tax rates are set by the provincial government.

All residential properties in Ontario are subject to the same education tax rate. The education tax rates can be found in Ontario Regulation 400/98.

Also Check: What Can You Include In Chapter 7 Bankruptcy

Illinois New Jersey And Ohio Show Highest Foreclosure Rates

ATTOMs Midyear 2022 U.S. Foreclosure Market Report shows there were a total of 164,581 U.S. properties with foreclosure filings default notices, scheduled auctions or bank repossessions in the first six months of 2022. That figure is up 153% from the same time period a year ago but down just 1% from the same time period two years ago.

Foreclosure activity across the United States continued its slow, steady climb back to pre-pandemic levels in the first half of 2022, says Rick Sharga, executive vice president of market intelligence at ATTOM. While overall foreclosure activity is still running significantly below historic averages, the dramatic increase in foreclosure starts suggests that we may be back to normal levels by sometime in early 2023.

Bucking the national trend with decreasing foreclosure activity compared to a year ago in the nations most populated metros during the first half of 2022, were only seven of the 223 metro areas analyzed. Those metros included Lake Havasu, Ariz. Eugene, Ore. Springfield, Ill. Shreveport, La. and Brownsville, Texas .

Nationwide 0.12% of all housing units had a foreclosure filing in the first half of 2022.

States with the highest foreclosure rates in the first half of 2022 were Illinois , New Jersey , Ohio , Delaware and South Carolina .

Other states with first-half foreclosure rates among the 10 highest nationwide, were Florida , Nevada , Indiana , Georgia and Michigan .

Its Not All Rosy On The Foreclosure Market

To recap: everything is amazing, and the housing market is healthier than ever?

Well, yes, but actually no.

There are still plenty of problems that were dealing with, and were still not sure whats gonna happen when moratoriums on foreclosures end.

In addition, foreclosure statistics for Florida, New Jersey, and South Carolina show rates that are significantly higher than the national average. Families in these states are at a much greater risk of foreclosure.

Is it serious? Probably.

The national average doesnt tell us everything, and the gap between South Carolina and Vermont is pretty staggering.

So what does the gap look like?

6. South Carolina has the highest foreclosure rate, with one foreclosure per 2,339 housing units.

Illinois and New Mexico are next with one foreclosure per 3,031 and 3,079 housing units, respectively. Of the three, Illinois has the highest number of housing foreclosures at 1,764, it is followed by South Carolina with 965 total foreclosures, and New Mexico is last with 303 foreclosed properties.

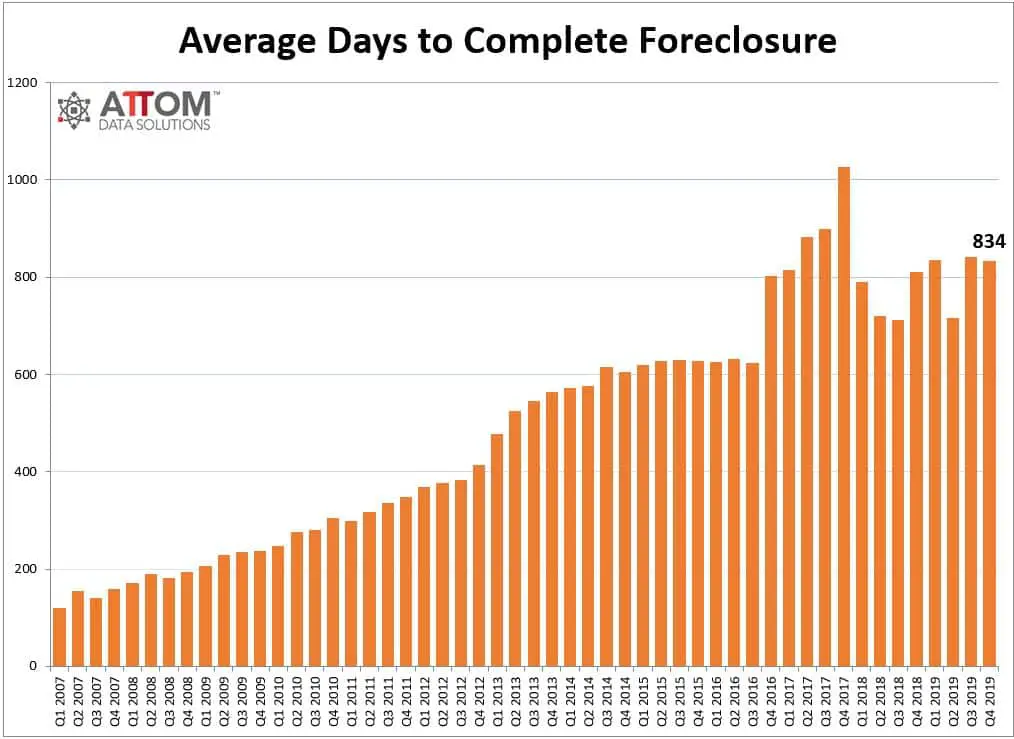

7. Foreclosure timelines are shortest in Virginia, Minnesota, and Alaska.

While the national average is 830 days, some states have exceptionally short foreclosure timelines. According to foreclosure data, in Virginia, Minnesota, and Alaska, its possible to lose ones home in 180, 208, and 213 days respectively.

8. Without the moratoriums, foreclosures could increase by over 100%.

9. Mortgage delinquency rate is 89% higher than at the end of 2019.

Recommended Reading: How Long Chapter 7 Bankruptcy On Credit Report