Rights Of Tenants During A Foreclosure

If there are tenants in the house that was foreclosed on, the new owner must honor the existing lease. BUT when the tenants have a month-to-month lease or the owner/landlord also lives in the home that is being foreclosed on, the new owner can evict the tenants or former owner/landlord. In these cases, the new owner may either offer the existing tenants a new lease or rental agreement or begin eviction proceedings. If the new owner chooses to evict existing tenants , the new owner must give the tenants at least 90 days notice before starting eviction proceedings.

- There are other rights that tenants have in eviction cases done after a foreclosure. If a tenant is not named in the complaint for the eviction, he or she may be able to challenge the eviction at any time during the case or even after the judgment for eviction is made. If you are an occupant of a foreclosed property where the new owner filed an eviction case, talk to a lawyer or call the Tenant Foreclosure Hotline at 1-888-495-8020 to learn about your rights.

Tenants in some California cities may still have a right to stay in their buildings. Cities with eviction or rent control laws prohibit new owners from using foreclosure as a reason for evicting tenants.

Help for tenants during a foreclosure

Initiation Of A Nonjudicial Foreclosure

When you take out a loan in a state that allows nonjudicial foreclosures, you will likely sign a deed of trust or a mortgage, which contains a power of sale clause. This clause gives the trusteea third party that manages the nonjudicial foreclosure process in certain statesthe right to sell the home though an out-of-court process if you stop making payments.

Final Thoughts On Bank Foreclosures In Canada

This is not an ideal situation. Actually, its scary and stressful. However, not panicking, taking action, and learning more about the process is the best you can do to try to get out of it without losing your home.

Foreclosure Solution #3: Speak with your lender or mortgage specialist to see if there are any options for loan modification to give you some relief in the short-term.

If you face a bank foreclosure or power of sale in Canada, be sure to consult with experts, and most importantly, dont do nothing!

You May Like: When Does A Bankruptcy Fall Off Your Credit Report

S Of A Nonjudicial Foreclosure

Some states permit nonjudicial foreclosure processes. Nonjudicial foreclosures have fewer steps and are quicker. When a borrower misses mortgage payments, the servicer will send notice of the breach. The lender may be required to send the breach letter when the borrower is 30 days behind. In some states, the lender is required to send a pre-foreclosure notice. Federal law usually requires the mortgage servicer to wait at least 120 days before it can start a nonjudicial foreclosure proceeding. They must also allow the borrower an opportunity to seek loss mitigation.

A nonjudicial foreclosure action begins when a mortgage servicer files a notice of default with the county recorder. State law will determine how much time the lender has to wait between filing the notice of default and scheduling the foreclosure sale.

After You Get Formal Notice Of The Foreclosure

Even if you don’t contest the foreclosure action, the sale usually won’t take place until around a month after the judge issues a foreclosure order. So you’ll probably have a couple of months from the first notice of the case to the date the court orders the sale to take place. You’ll probably have at least double that amount of time, possibly more, if you decide to oppose the foreclosure in court.

Don’t Miss: Can You File Bankruptcy On Just Credit Cards

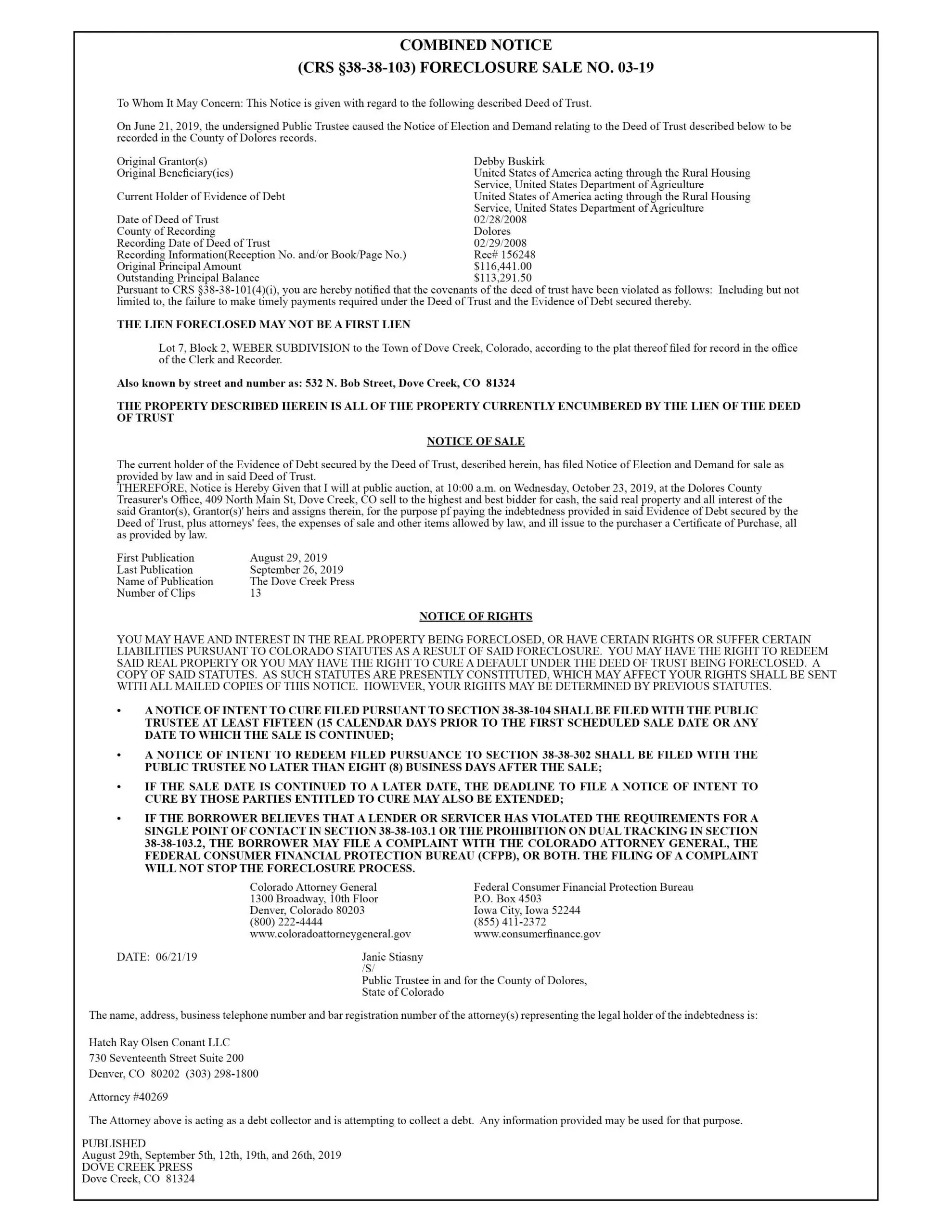

Phase : Notice Of Default

A notice of default is sent after the fourth month of missed payments . This public notice gives the borrower 30 days to remedy past due payments before formally starting the foreclosure process.

Most lenders will not send a notice of default until the borrower is 90 days past due . Thus, many times a borrower can fall behind a month or two without facing foreclosure.

Generally, federal law prohibits a lender from starting foreclosure until the borrower is more than 120 days past due.

How To Fill Out California Notice Of Foreclosure Sale

US Legal Forms – one of the most significant libraries of legal forms in the States – offers a variety of legal document themes you are able to download or produce. While using web site, you can find a huge number of forms for company and individual purposes, sorted by types, says, or key phrases.You can find the newest versions of forms just like the California Notice of Foreclosure Sale – Intent to Foreclose within minutes.

If you already have a registration, log in and download California Notice of Foreclosure Sale – Intent to Foreclose through the US Legal Forms library. The key can look on every develop you look at. You gain access to all earlier saved forms within the My Forms tab of your respective profile.

If you wish to use US Legal Forms for the first time, here are straightforward directions to help you get started:

Every format you added to your bank account lacks an expiration day and is also your own for a long time. So, if you would like download or produce an additional copy, just visit the My Forms segment and click on the develop you need.

Get access to the California Notice of Foreclosure Sale – Intent to Foreclose with US Legal Forms, the most considerable library of legal document themes. Use a huge number of professional and express-specific themes that fulfill your organization or individual demands and demands.

Recommended Reading: How To Get Bankruptcy Off Credit Report Early

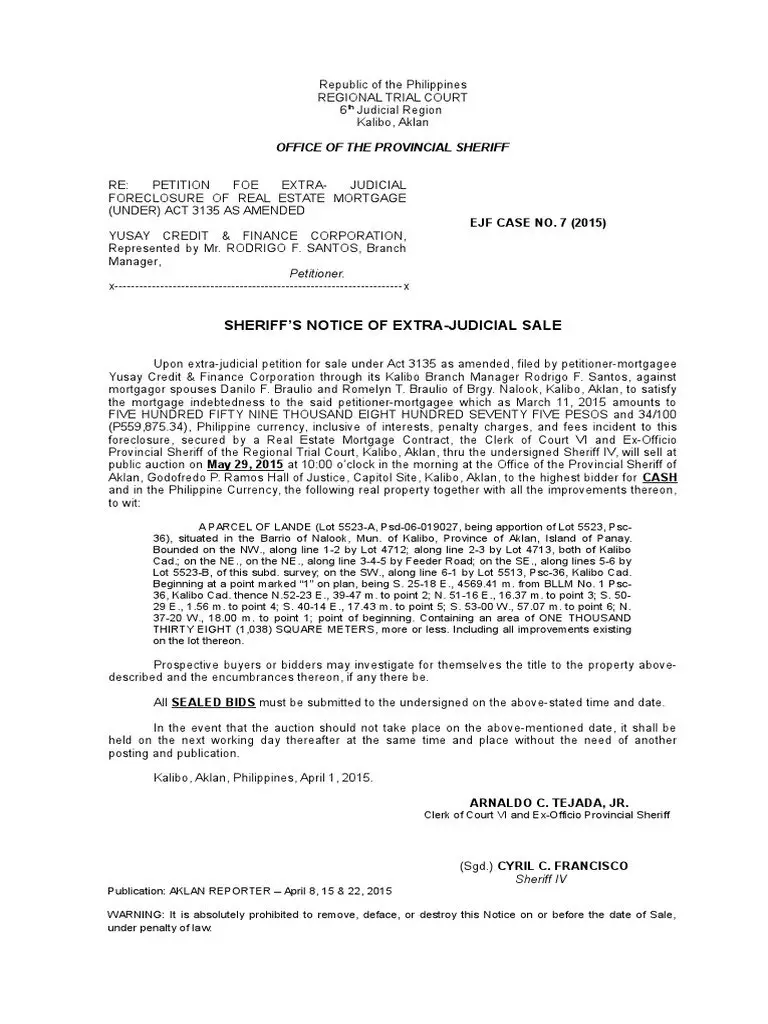

Phase : Trustees Sale

The property is now placed for public auction and will be awarded to the highest bidder who meets all of the requirements. The lender will calculate an opening bid based on the value of the outstanding loan and any liens, unpaid taxes, and costs associated with the sale.

When a foreclosed property is purchased, it is up to the buyer to say how long the previous owners may stay in their former home.

Once the highest bidder has been confirmed and the sale is completed, a trustees deed upon sale will be provided to the winning bidder. The property is then owned by the purchaser, who is entitled to immediate possession.

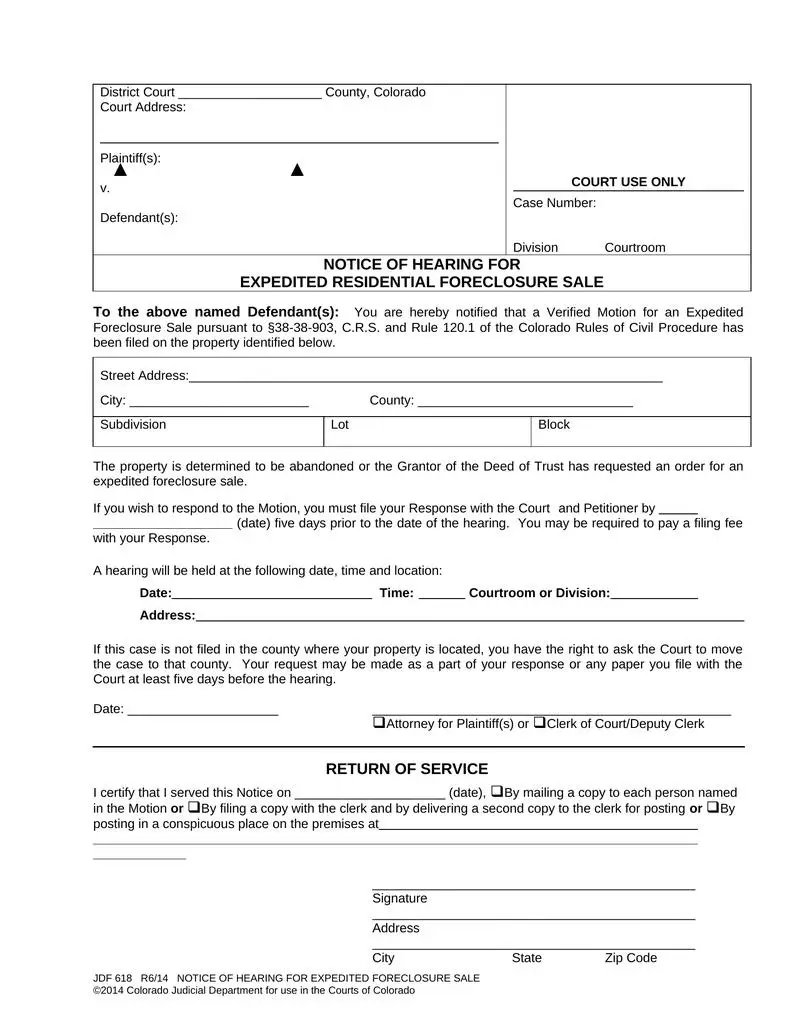

Providing Notice Or Filing The Lawsuit

In non-judicial and expedited foreclosures, the homeowner will be sent a notice letting them know the loan or obligation is in default. This notice is often referred to as a “Notice of Default.”

In a judicial foreclosure, the lienholder will file a petition with the district or county court and the homeowner would then be served with the paperwork, usually by a process server or county constable.

In most cases involving a home loan, federal regulations state the foreclosure action cannot begin until the loan is over 120 days delinquent.

Recommended Reading: How To File Bankruptcy Chapter 7 Yourself In Colorado

What Does A Foreclosure Notice Mean

5 minute read â¢Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

If you miss several mortgage payments, you will be at risk of losing your home through a foreclosure sale. If you receive a notice of foreclosure, itâs a good idea to take steps to save your home. Learn more about foreclosures, what happens when you receive a foreclosure notice, and what steps you can take to save your home from a foreclosure sale.

Written byAttorney Kimberly Berson.

Many homeowners struggle to make their monthly mortgage payments on their home loans. An unexpected financial hardship can quickly cause you to miss several mortgage payments. Homeowners who miss mortgage payments risk foreclosure. Fortunately, help is available if you are behind in making your mortgage payments. This article outlines three important things you need to know:

What happens if you fall behind on mortgage payments to your lender

What a foreclosure notice means

How to avoid a foreclosure

How To Publish A Legal Notice Of A Foreclosure Sale

Reading Time: 4 minutes

In every foreclosure action, the foreclosing lender will be required to publish some sort of legal advertisement or notice in a newspaper . Whenever a legal advertisement, publication, or notice relating to a foreclosure proceeding is required to be placed in a newspaper, it is the responsibility of the to place such advertisement, publication, or notice.Fla. Stat. § 702.035. Since publishing a legal notice concerning a foreclosure action is inevitable, it is imperative for lenders to know how to do so properly.

When is a Foreclosing Lender Required to Publish a Legal Notice?

All foreclosing lenders are required to publish the date of the public auction in a newspaper in the county where the sale is to be held. Fla. Stat. § 45.031. The notice of sale must include:

A description of the property to be sold The time and place of sale A statement that the sale will be made pursuant to the order or final judgment The caption of the action The name of the clerk making the sale and A statement that any person claiming an interest in the surplus from the sale, if any, other than the property owner as of the date of the lis pendens must file a claim before the clerk reports the surplus as unclaimed. Fla. Stat. § 45.031.

Who is Responsible for Having the Legal Notice Published?

Does It Matter Which Newspaper the Notice is Published?

How Often Does the Notice Have to Be Published?

You May Like: How To File For Bankruptcy In Indiana Without A Lawyer

Can I Stay In My Home During Foreclosure

You do not have to move out on the sale date. If you are still living in the home after a foreclosure, the new owner will have to evict you. Youll get a notice to vacate before an eviction is filed. Some lenders will pay moving expenses in order to avoid the time and expense of an eviction proceeding .

Foreclosure Notice Of Sale What Are The Requirements

After final judgment is entered, the court will usually set a sale date that may not be less than 20 days or more than 35 days after the date of judgment. However, a sale may be held more than 35 days after the date of final judgment if the plaintiff or plaintiffs attorney agrees to such time. This is why it is important to hire an attorney to help you negotiate more time with the plaintiff and get an extended sale date.

The notice of sale must be published once a week for two consecutive weeks in a newspaper of general circulation and published in the county where the sale is to be held. The second publication must be at least five days before the sale. Florida Statute 45.031 states that the notice must contain:

A description of the property to be sold.

The time and place of sale.

A statement that the sale will be made pursuant to the order or final judgment.

The caption of the action.

The name of the clerk making the sale.

A statement that any person claiming an interest in the surplus from the sale, if any, other than the property owner as of the date of the lis pendens must file a claim within 60 days after the sale.

You May Like: How Far Back Does A Solicitors Bankruptcy Search Go

What Happens After Receiving An Auction Notice From A Foreclosure

Foreclosure is the legal process which occurs when the borrower cannot pay his mortgage. The lender sells the property at auction to recover the monies owed on the property. Your first indication that the lender intends to auction the property is the Notice of Default. The Notice of Default serves as your official notice from the county that the lender is pursuing foreclosure. Approximately 90 days after you receive the Notice of Default, you will receive the auction notice.

How Does A Foreclosure Sale Work In Ct

Connecticut is one of only three states that uses strict foreclosure. A strict foreclosure does not involve a judicial sale of the property. Instead, each of the individuals or entities that holds an interest in the property being foreclosed are assigned Law Days. Law Days are assigned in inverse order of priority.

Read Also: How To Claim Bankruptcy In Ontario Canada

What Can You Do About A Foreclosure Notice

Homeowners have a few options to avoid a foreclosure sale.

A Chapter 13 case involves a repayment plan. You can pay back your missed mortgage payments in the plan over three to five years. You will also need to keep up with the mortgage payments that are due after you file for bankruptcy. Loss mitigation may be an option in bankruptcy as well.

What Is A Foreclosure

Most people buy a home by borrowing part of the purchase price usually from a bank or a mortgage company. Other times, a homeowner borrows money against the equity in the property after the home is purchased, and this is called a home equity loan. Sometimes people refinance their mortgage loan and combine it with a home equity loan. In all these situations, the lender usually has a lien against the home to secure repayment of the loan. When a buyer fails to make the payments due on the loan the lender can foreclose, which means that the lender can force a sale of the home to pay for the outstanding loan.

For more information about foreclosure laws:

The law on foreclosure is changing often. Make sure you read the most updated laws.

Recommended Reading: How Long After Filing Bankruptcy Can You Buy A Home

How Do You Buy A Foreclosed Home In Ct

Contacting a real estate agent based in CT. Scanning through local newspapers. Checking Bank of America’s foreclosure database. Reviewing the options available on homesales.gov….The following three websites are a great place to start:Zillow Foreclosures in CT.RealtyTrac Foreclosures in CT.Homes.com Foreclosures in CT.

Before You Lose Your Home To A Foreclosure Sale You’ll Get Some Sort Of Notice

Before a bank can sell your house at a foreclosure sale, you’ll get some sort of formal notice about the foreclosure. The kind of notice you’ll get generally depends on whether the foreclosure is judicial or nonjudicial and what your state’s foreclosure laws require.

With both judicial and nonjudicial foreclosures, most people some type of preforeclosure notice, like a breach letter or notice of intent to foreclose. Then, in a judicial foreclosure you’ll get notice of the lawsuit that begins the foreclosure process. In a nonjudicial foreclosure, the notice you’ll get depends on state law, which varies widely.

Don’t Miss: How To Declare Bankruptcy On Credit Cards

Learn More About Financing Your Home

Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. If you wish to report an issue or seek an accommodation, please let us know.

Zillow, Inc. holds real estate brokerage licenses in multiple states. Zillow , Inc. holds real estate brokerage licenses in multiple provinces. A list of our real estate licenses is available here.

How To Fill Out Connecticut Notice Of Foreclosure Sale

Choosing the right legitimate papers template can be quite a battle. Naturally, there are a lot of layouts available on the Internet, but how can you get the legitimate type you will need? Use the US Legal Forms website. The service delivers thousands of layouts, like the Connecticut Notice of Foreclosure Sale – Intent to Foreclose, that can be used for organization and private needs. All of the varieties are examined by pros and fulfill state and federal demands.

In case you are presently authorized, log in in your profile and click on the Down load key to get the Connecticut Notice of Foreclosure Sale – Intent to Foreclose. Make use of profile to look from the legitimate varieties you might have bought in the past. Check out the My Forms tab of the profile and get another version from the papers you will need.

In case you are a whole new end user of US Legal Forms, listed here are easy directions that you can follow:

US Legal Forms is the largest library of legitimate varieties for which you can find different papers layouts. Use the service to acquire skillfully-manufactured documents that follow condition demands.

All forms provided by US Legal Forms, the nations leading legal forms publisher. When you need a legal form, don’t accept anything less than the USlegal brand. “The Forms Professionals Trust

Recommended Reading: How To File Bankruptcy Without An Attorney

Section 1: Oreclosure Under Power Of Sale Procedure Notice Form

The following form of foreclosure notice may be used and may be altered as circumstances require but nothing in this section shall be construed to prevent the use of other forms.

MORTGAGEE’S SALE OF REAL ESTATE.

Deeds, Book…………, page…………, of which mortgage the undersigned is the present holder,………….

for breach of the conditions of said mortgage and for the purpose of foreclosing the same will be sold at Public Auction at…………o’clock,………… M. on the………… day of………… A.D. ,………… ………… all and singular the premises described in said mortgage,

To wit: ââ

Terms of sale:

Other terms to be announced at the sale.

_______________________________________________________________

Present holder of said mortgage.____