Pensions And Retirement Accounts

New Jersey law provides blanket exemptions for certain government pensions. Federal law, on the other hand, does not protect those pensions, but does provide extensive protection for tax-exempt retirement accounts such as a 401, 403, SEP, or SIMPLE IRA. Federal exemptions also protect up to $1,283,025 in an IRA or Roth IRA.

At first glance, it appears that federal exemptions are more beneficial, and for most New Jersey residents, thats true. However, the best way to determine which exemptions to choose is to consult with an experienced bankruptcy attorney. The right choice depends on the assets a debtor is seeking to protect.

Get A Fresh Start With A New Jersey Bankruptcy

After your debts are discharged you will have a fresh start. Although many people think that filing for bankruptcy is a difficult and scary process, it generally is not. With the help of an experienced, honest, and compassionate NJ bankruptcy lawyer it becomes simple.

Filing bankruptcy is a major life decision that must be made with seriousness and in good faith. The attorneys at Levitt & Slafkes, P.C. can help advise you on a debt relief plan that best suits your needs, whether this means working with creditors or filing for bankruptcy relief. We work tirelessly to provide our clients with supportive, thoughtful representation.

Contact Levitt & Slafkes, P.C., at 323-2953, or reach us online to schedule a free consultation.

We are proudly designated as a debt relief agency by an Act of Congress. We have proudly assisted consumers in filing for Bankruptcy Relief for over 30 years.

Qualifying For Bankruptcy In New Jersey

If you’ve never filed for bankruptcy before, you’ll meet the initial requirement. Otherwise, check whether enough time has passed to allow you to file again. The waiting period varies depending on the chapter previously filed and the chapter you plan to file. Learn more about multiple bankruptcy filings.

You’ll also need to meet specific chapter qualifications.

You’ll qualify for Chapter 7 bankruptcy if your family’s gross income is lower than the median income for the same size family in your state. Add all gross income earned during the last six months and multiply it by two. Compare the figure to the income charts on the U.S. Trustee’s website .

Want an easy way to do this online? Use the Quick Median Income Test. If you find that you make too much, you still might qualify after taking the second part of the “means test.” If, after subtracting expenses, you don’t have enough remaining to pay into a Chapter 13 plan, you’ll qualify for Chapter 7.

Qualifying for Chapter 13 can be an expensive proposition because the extra benefits come at a hefty price, and many people can’t afford the monthly payment. To qualify, you’ll pay the larger of:

Find out more about calculating a Chapter 13 bankruptcy payment.

Read Also: What Is A Bankruptcy Petition Preparer

Contact A Dedicated Attorney

A New Jersey bankruptcy lawyer stops creditor harassment, protects your property, discharges debts, and delivers a fresh start. If that sounds good, reach out to an attorney today.

Note: State laws are always subject to change through the passage of new legislation, rulings in the higher courts , ballot initiatives, and other means. While we strive to provide the most current information available, please consult an attorney or conduct your own legal research to verify the state law you are researching.

Phase : Discharge Case Closed

Once the bankruptcy trustee has determined that thereâs no property they can sell for the benefit of creditors, theyâll file a Report of No Distribution. This lets everyone know that itâs a no-asset case and can happen anytime after the 341 meeting. No asset cases are typically closed by the court within 1 – 2 weeks or so.

If the trustee hasnât filed a Report of No Distribution, the case will stay open until the trustee signals to the court that theyâve completed their work on the case. How long this process takes can vary greatly, as it depends on what kind of property the trustee is selling and what else is going on in the case.

In some cases, all the trustee is waiting for is the filer’s tax return for the year their bankruptcy case is filed in. If no specific exemption for a tax refund exists, a portion of the refund may be used by the trustee to pay creditors.

Usually, not much else is required from the filer during this process. But, if the trustee asks for additional information or otherwise requests assistance with the sale of property, the filer has a duty to help.

Also Check: How Many Bankruptcies Has Donald Trump Filed

Will Bankruptcy Wipe Out All My Debts

Yes, with some exceptions.

Bankruptcy will not normally wipe out:

- Money owed for child support or alimony, fines, and some taxes

- Debts not listed on your bankruptcy petition

- Loans you got by knowingly giving false information to a creditor who reasonably relied on it in giving you the loan

- Debts resulting from willful and malicious harm

- Most student loans, except if the court decides that payment would be an undue hardship

- Mortgages and other liens that are not paid in the bankruptcy case

Days Before Your Bankruptcy

Youre not allowed to file for bankruptcy again within 180 days if your previous case was dismissed by the court. There is also a 180-day waiting period if you voluntarily dismissed your previous case.

You must also receive an individual or group briefing from an approved nonprofit budget and credit counseling agency. This must happen within the 180 days before filing for bankruptcy.

Also Check: Taco Bell Bankruptcy Closing

Protection Under The Automatic Stay

The minute your bankruptcy petition is filed, the automatic stay goes into effect. This provides immediate emotional relief to the often-endless phone calls and other harassment from your creditors. The automatic stay also stops all collection activities including phone calls, wage garnishment, lawsuits, and car repossessions. During the automatic stay, your creditors are only allowed to contact your bankruptcy attorney. All the never-ending, harassing collection calls should stop.

Have You Previously Filed A Bankruptcy

- Why have you filed a chapter 7 bankruptcy? What has brought you into financial difficulty?

- Do you own any property? Have you transferred any property or given any property away within the last 1 year? Does anyone hold any property belonging to you?

- Do you have a claim against anyone or a right to sue anyone? Does anyone owe you any money?

- Do you have any domestic support obligations?

- Have you closed any bank accounts in the last 1 year?

- Will you be inheriting any money in the next 6 months?

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

What If I Forget To List A Creditor In My Bankruptcy

If you forget to list a creditor, you should contact your attorney as soon as you realize the creditor has been left out. At that time you can provide your attorney with the name and address of the creditor and the type and amount of the debt. Omitted creditors can often be added to the bankruptcy, however, your attorney will advise you on how things will proceed. Our experienced New Jersey bankruptcy lawyers can help you handle this issue if it arises.

Approximately 6 Weeks After Filing

Currently, in New Jersey, it typically takes about 6 weeks after the filing of your bankruptcy petition to have a date set for the meeting of creditors. Seven days prior to this meeting, you are required to provide the trustee with your tax returns for the previous 3 years and proof of your income. Our firm obtains this information prior to filing and provides the trustee with the information within the required timeframe.

Review our page Chapter 7 Court Hearing for more information on the hearing.

Read Also: Shark Tank Bankruptcies

New Jersey Bankruptcy Exemptions

Exemption laws determine what property is protected from your creditors. Unlike many other states, you can choose between using New Jersey bankruptcy exemptions or federal bankruptcy exemptions for your case. A lot of folks filing a Chapter 7 bankruptcy in New Jersey choose the federal exemptions that are available. This is especially important if you own a home as New Jersey does not have a homestead exemption.

Approximately 15 Days After Filing

Within approximately 15 days after filing, the court will send out the Notice of Commencement of Case to you. All of the creditors listed in your petition will also receive this Notification. This notice will state the date set by the court for the meeting of your creditors. It also includes deadlines for your creditors to object to your case and file their claims against you.

Read Also: What Is Epiq Bankruptcy Solutions Llc

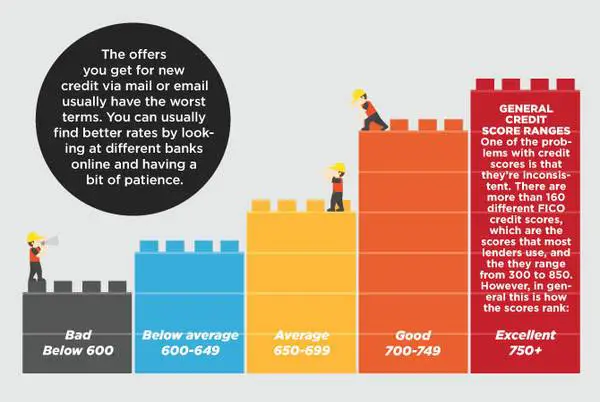

How Does Business Bankruptcy Affect Credit

Compared to other business entities, sole proprietors will take the biggest hit to their personal credit after filing for bankruptcy. Unlike registered entities like LLCs and corporations, sole proprietors have no legal distinction between personal and business debts. After all, you cant expect to have your debts discharged without paying some price. Sole proprietors should expect to see their scores go down by at least 120 points, and the bankruptcy will stay on their credit report for at least seven years.

Owners of registered business entities are not personally responsible for business debts. Hence, their personal credit scores may take little if any damage from bankruptcies. The unpaid debts and bankruptcy also wont show up on their personal credit reports. They will, however, show up on your business credit report. Individual financial institutions might review your business credit before approving financing. Vendors and suppliers will look at your business credit score before deciding to work with you as well.

But, there is one condition in which business debts can affect registered business entities personal credit scores.

Print Your Bankruptcy Forms

If you are filing bankruptcy in New Jersey without an attorney, you will have to bring your bankruptcy forms to the court in person. The court provides this overview of all documents that are needed to commence a Chapter 7 case, complete with helpful notes and guidance. It’s best to print out three copies all at once: two for the court, and one to keep for your own records. Even though the documents are legal documents, print everything on regular-sized plain white paper. Some of the information on the forms is time-sensitive, so do this when you know you will be able to go to court to file your Chapter 7 bankruptcy in New Jersey within the next few days.

Also Check: Has Mark Cuban Ever Filed For Bankruptcy

Foreclosure In New Jersey: How Long Does It Really Take

October 16, 2015by veitlaw

Of the New Jersey homeowners who are at risk of foreclosure in the near future, most of them need more reliable information about the NJ foreclosure timeline. Just the word foreclosure is enough to incite panic in any struggling homeowner. Sometimes, that panic is so profound that it causes people to make less than ideal decisions during the pre-foreclosure time period.

If youve fallen behind on your payments and have reason to believe that your mortgage lender may file for foreclosure on your home, the number one thing you need to do is get familiar with how the entire foreclosure process works in New Jersey. Youd be wise, especially if you wish to keep your home, to reach out to a foreclosure defense attorney as well.

Because the foreclosure process in NJ is judicial, mortgage lenders must proceed through the court system. You cannot be kicked out of your home until many, many steps have transpired, and every single step will be documented by the court. Also, you will receive certified notification via the US mail system every step of the way. Your lender cannot remove you from the home until the entire foreclosure process is complete and the home has been sold via Sheriffs Sale. Take note: It is within your rights to remain in the home throughout the duration of the foreclosure case.

Keep in mind that the following steps have to happen before youll need to move out:

Image credit: Dafne Cholet

If I File Bankruptcy Will Creditors Stop Harassing Me

As soon as you come to our office for a free consultation and hire us as your New Jersey bankruptcy lawyer, creditors will no longer be permitted to contact you or your friends and family members. After hiring our firm, you will be able to give our firms name and number to any future creditors who call. The sooner you come to our office and meet with one of our New Jersey bankruptcy lawyers the sooner the harassment will stop.

Also Check: How To File Bankruptcy In Ky

Filing For Bankruptcy In New Jersey

When people think about filing for bankruptcy, it is often a fear of the unknown that prevents them from taking advantage of the many benefits bankruptcy has to offer. An experienced New Jersey bankruptcy lawyer can help you through the bankruptcy process in Ocean County and remove a lot of the doubt that could be keeping you from financial freedom.

You are not alone! Millions of people file for bankruptcy every year. We can help you get the relief you need. Call for a free bankruptcy consultation in Monmouth or Ocean counties.

At the law offices of Oliver & Legg, we provide consumer and business bankruptcy solutions to clients throughout the state. We will take the time to explain the entire process to you so you know what to expect as your case moves forward. The following is a brief overview of the typical life cycle of a bankruptcy at our firm.

We understand that people have many questions when considering bankruptcy as a debt relief option. Click on the links below for more information:

Please Talk To A Consumer Credit Attorney Before You File For Either A Chapter 7 Or Chapter 13 Bankruptcy

Please, Talk to a Consumer Credit Attorney before you file for bankruptcy to understand what type of loans , and other lines of credit you have that would be forgiven in a chapter 7 bankruptcy or a chapter 13 bankruptcy. A bankruptcy lawyer would rather talk to you prior to filing for bankruptcy than after filing for bankruptcy when issues may arise. No matter what company you keep, or how much credit card debt you have. Talking to an attorney for free cant hurt. Between the amount of knowledge it takes to understand to file for a bankruptcy to save a home and the amount of bad information on the web. You need to reach outside of the internet and relying on websites to make an informed decision about your rights to save your home.

All of your personal options should be discussed with one of our experienced bankruptcy attorneys. Who will be able to guide you through the process. To help you work towards your goal of keeping your home. We value your privacy and the privacy of your family. It is our policy to keep all maters discussed with one of our bankruptcy attorneys confidential. Knowing your legal rights is important. You can not always rely on blog articles or financial websites to get the most current information related to bankruptcy law or foreclosure law practice.

You May Like: Filing Chapter 7 In Texas

If The Us Is Named As A Defendant In A New Jersey Foreclosure The Foreclosure Takes Longer To Complete

After these 30 days, the bank will proceed, depending on how organized and efficient they are with submitting documents to their attorneys , with filing the summons and complaint. Once filed, they will attempt to serve all the Defendants in the case. Once a party is served, they have 35 days to respond. Failure to respond will result in the Plaintiff filing for default so they can continue. An interesting point here is that if the United States is included as a defendant, the bank must wait 60 days instead of the standard 35. There is a possibility that the Plaintiff will default all parties together in 60 days, rather than 35, but that may not be the case .

Timing To File Bankruptcy

Choosing when to file for bankruptcy is just as important as choosing which chapter to file under. Filing too early can cause several issues like having too much monthly income to pass the means test, or having the entire case dismissed for filing too soon after a previous bankruptcy proceeding. Other issues like recent luxury purchases or divorce can also provide reasons to delay filing.

On the other hand, waiting too long to file can delay the start of the automatic stay, and keep debt collections and foreclosure proceedings going longer than they may need to.

You May Like: How Do You Claim Bankruptcy In Canada

Eliminating Judgement Liens After Nj Bankruptcy

On Behalf of Law Office of Robert Braverman, LLC, | May 25, 2016 | Personal Bankruptcy |

Sometimes a bankruptcy is filed after a judgement has already been entered. If the debtor owns real estate then the judgement will be a lien on the real estate. If there is not excess equity and the equity is claimed as exempt, then the judgement can be voided during the bankruptcy. But what if no action is taken to void the lien during the bankruptcy. That is where NJSA 2A:16-49.1 comes into play.