How Long Does Filing Bankruptcy Take

Many people who consider filing bankruptcy worry about how long the process will take and how quickly they can get debt relief. The good news is that bankruptcy is a fairly straightforward process, providing temporary debt relief within days and permanent debt relief within months in many cases. The following are some guidelines on how long each step takes:

The bottom line is that filing bankruptcy and obtaining permanent debt relief does not take nearly as long as many people are afraid it will take. With an experienced team of bankruptcy lawyers guiding you through the process, you can make progress toward a fresh start.

Of course, the process will always go more smoothly if you work with experienced attorneys, especially those who take the time to provide personal service and attention.

At our firm, you can rely on the representation provided by attorney Ira D. Gingold, who has been a bankruptcy lawyer since 1971 and Court-appointed Bankruptcy Trustee from 1971-2013, and Jamie L. Gingold, who has practiced bankruptcy, business and real estate law since 2001.

How Your Creditors Are Paid

The official receiver will take control of your assets unless an insolvency practitioner is appointed. An insolvency practitioner is usually an accountant or solicitor.

The person who takes control of your assets is known as the trustee. The law says you must cooperate fully with them.

The trustee will sell your assets and tell the creditors how the money will be shared. Creditors must then make a formal claim. You cannot make payments directly.

If you have assets, money from the sale of these will be used to pay the costs of the bankruptcy process before creditors are paid. If your case is administered by the official receiver the following fees will all be deducted from the money realised:

- an administration fee of £1,990 if you applied for your own bankruptcy or £2,775 if someone else applied

- a general fee of £6,000

- 15% of the total value of assets realised

- a fee charged at an hourly rate where money is paid to creditors

If there are insufficient assets in your case the official receiver will still process your bankruptcy.

Next, money will be used for:

- certain debts in relation to employees, if you had any

- your other creditors

- interest on all debts

Any money left over will be returned to you. If everyone is paid in full you can apply to have your bankruptcy cancelled .

What Happens To Your Bank Account

When the bankruptcy order is made, you must:

- make sure you do not use your bank account

- give your cards and cheque books to the trustee

Your bank account will be frozen. Any money in your account will be an asset and claimed by the trustee. The trustee can ask to release some money:

- for your daily living needs

- to the other person in a joint account

The bank is allowed to use money from one of your accounts to pay your debts on another account you hold with them. This is called set off.

Otherwise, money owed to the bank is a bankruptcy debt, so you cannot pay this to the bank directly. The exception is if the bank has a charge on your home .

Open a new account

You can open a new bank account after the date of the bankruptcy order but you must tell the bank or building society that youre bankrupt. Some banks will let you use your old account after theyve spoken to the trustee.

You May Like: Does Filing For Bankruptcy Eliminate Debt

How Long Does A Bankruptcy Case Take

Whether a case is a Chapter 7 or Chapter 13, the basic steps in the process are the same. Generally, a Chapter 7 bankruptcy case will take approximately 4 to 6 months from the date when the case is filed until the case is closed. A Chapter 13 case will typically last 36 to 60 months from the date of filing.

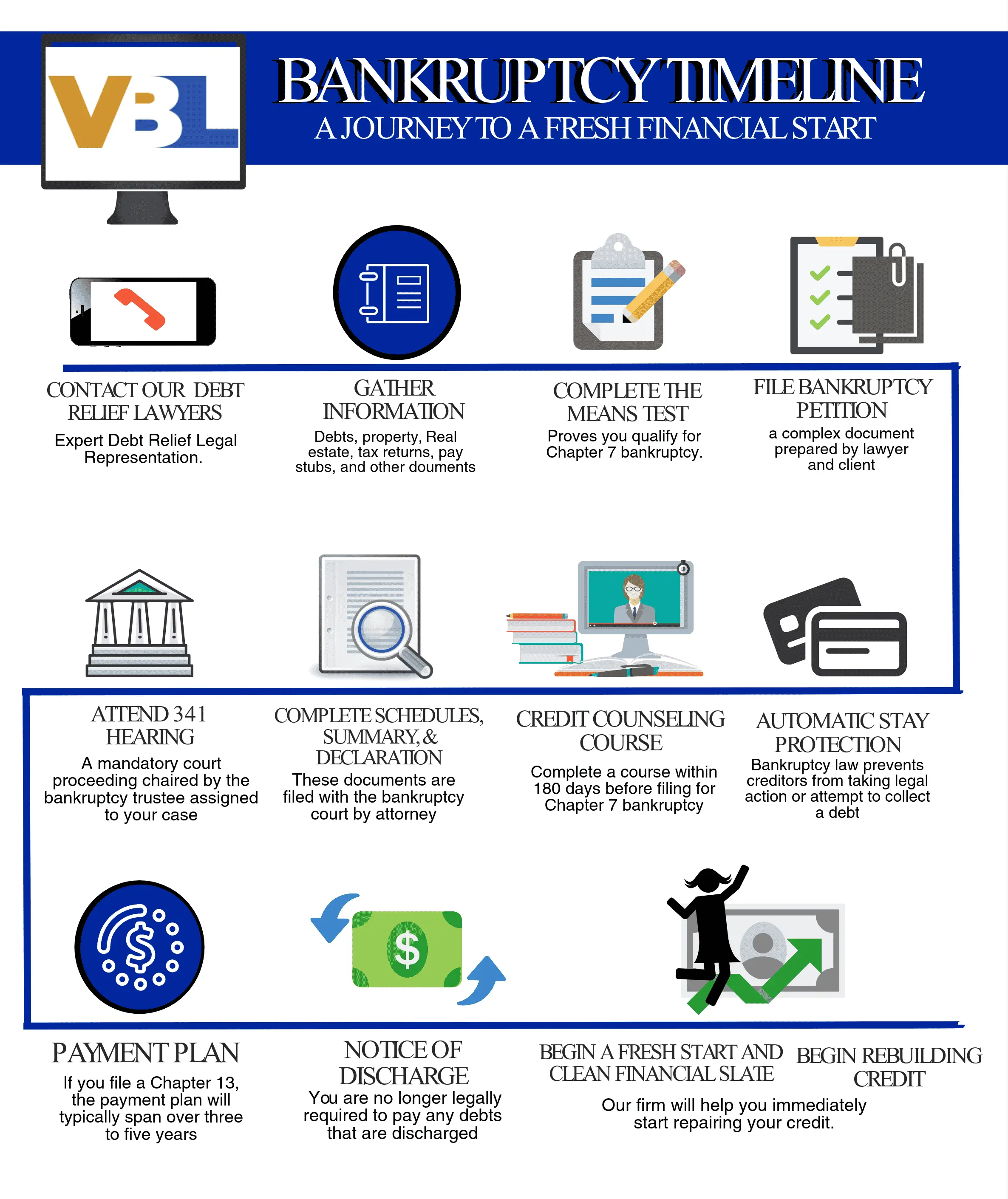

The sequence of events in a typical Chapter 7 case include the following:

- Client completes the first consumer credit counseling course.

- Bankruptcy documents reviewed by clients and attorney.

- Meeting scheduled with Trustee approximately 20 days after case is filed and Clerks Office mails the notice of the meeting of creditors.

- Client and attorney attend meeting of creditors together.

- Client completes the second consumer credit counseling course.

- Approximately 90 days after the meeting of creditors the Clerks Office will mail the discharge order demonstrating the termination of any personal liability on the debts included within the bankruptcy documents.

- Approximately 14 days after the discharge order is issued, then the Clerks Office will mail the final decree that signals the end of the bankruptcy case.

May The Debtor Pay A Discharged Debt After The Bankruptcy Case Has Been Concluded

A debtor who has received a discharge may voluntarily repay any discharged debt. A debtor may repay a discharged debt even though it can no longer be legally enforced. Sometimes a debtor agrees to repay a debt because it is owed to a family member or because it represents an obligation to an individual for whom the debtor’s reputation is important, such as a family doctor.

Don’t Miss: Average Credit Card Debt Usa

What’s The Difference Between Chapter 7 And Chapter 13 Bankruptcy

Chapter 7 and Chapter 13 are the two common types of bankruptcy that affect consumers. Either could help when you don’t have the means to pay all your bills, but there are important differences between the two.

A Chapter 7 bankruptcy can wipe out certain debts within several months, but a court-appointed trustee can sell your nonexempt property to pay your creditors. You also must have a low income to qualify.

A Chapter 13 bankruptcy allows you to keep your stuff and get on a more affordable repayment plan with your creditors. You’ll need to have enough income to afford the payments and be below the maximum total debt limits .

A court will approve the Chapter 13 repayment plan, which usually lasts three to five years, and your trustee will collect your payments and disburse them to your creditors. Once you finish the plan, the remainder of the unsecured debts is discharged.

The Extended Automatic Discharge

Individuals who have never filed for bankruptcy before will spend a total of twenty-one months in bankruptcy if they are required to pay surplus income to their bankruptcy trustee. If this is your second bankruptcy, your time in bankruptcy protection is automatically twenty-four months, and it will be extended to thirty-six months if you are required to pay a surplus income.

Also Check: Overstock Boxes For Sale

Our Legal Help Is Affordable

You can expect upfront, transparent quotes that include the courts filing fee. Our payment plans make legal services affordable for you. We know the financial pain because weve been there. Our founder had to climb back to financial freedom after filing for bankruptcy relief. Were here to help you on your journey and make the process affordable.

What Is A Good Way For Someone To Rebuild Their Credit After A Bankruptcy

The best way to rebuild credit after a bankruptcy is to get a non-collateralized credit card. If a person can only qualify for a collateralized credit card, then theyll deposit the sum of the credit limit with the credit card issuer and then use the card like a regular credit card. After about six months to a year, their credit will be somewhat rehabilitated and the credit issuer will send back the initial deposit that the client made.

Don’t Miss: Foreclosure Rates By Year

How Long Does It Take To Go Through A Chapter 7 Bankruptcy

Once a case has been filed, it typically takes 30 to 40 days to have a 341 creditors meeting. If everything is acceptable to the trustee at the creditors meeting, then the court will issue a discharge 45 days after that meeting. From start to finish, the shortest amount of time that it could take is about 90 days.

Contact A Skilled San Diego Bankruptcy Lawyer

Do you have questions about filing for bankruptcy, including how long it will take before your bankruptcy is finalized? If so, the experienced lawyers at Bankruptcy Law Center are here to help. Contact our San Diego Bankruptcy Law Firm today to learn more about how we can help you get a fresh financial start.

You May Like: How To Find Foreclosed Homes

Will A Bankruptcy Actually Resolve My Debts

Bankruptcy does not resolve all debt indiscriminately. Some debts, such as student loans, cannot be discharged in bankruptcy. If you’re having trouble making payments toward debts that bankruptcy won’t cover, you should speak with your creditors to determine your options.

About the Author

What Is Chapter 7 Bankruptcy

Itâs a type of bankruptcy that erases your debts, to give you a fresh start. To file bankruptcy under Chapter 7 of the United States Bankruptcy Code you have to pass the means test. The means test shows the bankruptcy court that youâre eligible for debt relief because your monthly income isn’t enough to pay your unsecured debts in a Chapter 13 bankruptcy.

Unsecured debt includes credit card debt, medical bills, and personal loans. Not all unsecured debts are dischargeable. Filing Chapter 7 does not erase child support or alimony. Student loans are only dischargeable if an undue hardship exists. If you own nonexempt property, the Chapter 7 trustee sells it and uses the funds to pay your creditors.

Most peopleâs belongings are fully protected by state or federal bankruptcy exemptions. Nothing is sold and no money is paid to creditors. Thatâs called a no-asset case.

Don’t Miss: Does Bankruptcy Clear Tax Debt In Canada

Delay In Completing The Financial Management Course

Failure to complete the financial management course within 45 days after your 341 meeting can delay your discharge and the closure of your case.

In the worst case, the court will close your case without granting your discharge. This means that you leave your bankruptcy still owing your debts. Although you can usually reopen your case to file the certificate showing that you completed the financial management course, you’ll have to pay an additional filing fee. Your attorney will likely charge you an additional fee, too. Some courts also require that you appear before the judge to explain why you delayed filing your financial management certificate.

Three: Trustee’s No Asset Report

During the 60-day period after the 341 meeting, the trustee will review your case to determine whether you have any nonexempt assets. Most individual bankruptcy filers are able to protect all of their assets and don’t have to be concerned that they’ll be required to turn anything over to the trustee. If your estate has no assets for the trustee to administer, the trustee will file with the court a “no asset” report. This signals to the court that the trustee has no issues with the case and considers the case ready to close.

Recommended Reading: What Is Non Exempt Property In Bankruptcy

Objections To A Chapter 7 Bankruptcy Discharge Can Delay

The court can issue a discharge, ending a Chapter 7 bankruptcy process approximately 60 days after that First Meeting. However, that 60 day waiting period is designed to give creditors an opportunity to file objections to their claims being discharged. If they do, the bankruptcy will be converted to an adversarial proceeding regarding that specific creditor, to resolve the claim. This will delay the final closing of the case. The court will still issue a discharge for all remaining creditors, though. This permanently bars them from coming after the debtor for collections.

The Trustee may also file an objection or hold the case open to collect assets, such as a non-exempt tax refund or a personal injury payment. However, the Trustee keeping the case open should have little effect on the debtor, since the assets should be paid directly into the Trustees care and distributed to the creditors. For the debtors purposes, most Chapter 7 bankruptcies resolve in about 90 days.

Should I Pay Back Any Family Or Friends I Owe Prior To Filing For Bankruptcy

When someone goes to the 341 bankruptcy creditors meeting, the trustee will ask them whether or not they have paid any creditor within the last six months. If they have, then the trustee can basically move to recapture those funds as preferential payments to a certain creditor. A trustee wouldnt want someone to pay a $1000 debt to a family member instead of to their credit card company. So, one of the jobs of the trustee is to make sure that all of the creditors are treated equally.

Don’t Miss: Can You File Bankruptcy On Alimony

How Long Does It Take To File Bankruptcy: Chapter 13

Chapter 13 bankruptcy takes longer to complete than Chapter 7 bankruptcy. This is because the court needs to arrange a monthly repayment before issuing a discharge. The process may take up to five years to complete.

The best thing about Chapter 13 is that the court will set, a payment schedule and you will also have a finishing date. The court will create a payment schedule and that is also the time you will have a finishing date. Like Chapter 7 bankruptcy, Chapter 13 will leave a negative mark on your credit report for 7 years.

Regardless how long it takes to complete your filing, both file types leave a credit damage.

The Timeline For Chapter 7

A Chapter 7 bankruptcy is the person filing type that is most commonly filed first is Chapter 7. However, it can be a faster way to get a fresh start. The process of filing Chapter 7 bankruptcy petitions can take up to four months or one year.

The exact time it takes depends on how many assets you need to liquidate and the details of your case.

Fail: About 2/3rd of all filings in the third quarter of 2014 were Chapter 7.

If you have only a tiny amount of assets to liquidate and all other filings go smoothly, you may be done in a matter of months. If there are complications or problems with asset liquidation, however, your filing could take longer. Most Chapter 7 filings are completed in six months. However, some may take as long as one year.

Remember that the Chapter 7 bankruptcy filings, once completed and all outstanding balances have been discharged, create a negative item on your credit report that will remain there for ten years.

You May Like: What Is An Executory Contract In Bankruptcy

Chapter 13 Bankruptcy Repayment Plan

In Chapter 13 bankruptcy, the debtor proposes a repayment plan to manage a portion of their debts over three to five years. The remaining debts are typically discharged at the end of the repayment plan. Monthly payment amounts vary greatly, as one of the factors they are based on is disposable income.

Whether you go with a 36-month or 60-month repayment plan depends on your average income the six months prior to your bankruptcy filing. If it is above your states median income, you will most likely go on a three-year plan. If it is under, a five-year plan is more likely. Your lawyer will advise you on the plan length you should propose based on your financial situation.

Note that Chapter 13 bankruptcy and other forms of bankruptcy primarily involve unsecured debt, like credit card debt. If you wish to retain assets like home, car, or other secured debts, you will need to make your required monthly payments to the respective lender. In some instances, those payments may be rolled into your repayment plan. Once repayment is done chapter 13 bankruptcy can remove remaining debt as well.

What Happens To Your Pension

Most pension schemes are not included in your bankruptcy and they cannot be claimed by the trustee.

The pension scheme must be a UK state pension scheme or a scheme approved or registered by HM Revenue & Customs. Approved or registered pension schemes are usually:

- occupational pension schemes approved for tax purposes

- personal pensions approved for tax purposes

- stakeholder pensions

- retirement annuity contracts

If your pension scheme is not an approved or registered scheme you might be able to exclude it from your bankruptcy by:

- applying to the court for an exclusion order, or

- making a qualifying agreement

If your pension is part of the bankruptcy, it can be used to make payments to your creditors.

Pension Payments

Payments made to you from your pension scheme, including any lump sums, before the end of your bankruptcy can be used as part of an Income Payments Agreement or Income Payments Order . This will involve you paying some of your debt with your income.

If you are able to take money from your pension following changes to the law in April 2015, but have chosen not to do so, the trustee may look at the value of your available pension fund. If this would give you access to enough money to make a different arrangement to pay your creditors, the trustee can ask the court to cancel the bankruptcy.

Death benefits

Bankruptcies before May 2000

You May Like: How Does Bankruptcy Affect Your Credit

Make Sure Bankruptcy Is The Right Option For You

Bankruptcy can offer you a fresh start if you cant see any other way out of your debt problems. However, going bankrupt may have a serious impact on your day-to-day life, so it isnt for everyone. Make sure youve done your research, taken advice and are sure its the best option for you.

How Long Does It Take For A Chapter 13 Bankruptcy To Be Discharged

If you are dealing with significant debt and are looking to file bankruptcy, filing under Chapter 13 could be the right decision for you.

Chapter 13 bankruptcy allows debtors to repay their debts over a set amount of time. The application process, repayment plan, and discharge schedule may feel overwhelming at first for someone looking to improve their financial health, so it may help to have a timeline in mind.

While the repayment process typically takes a number of years, it only takes a matter of weeks for a Chapter 13 bankruptcy to be discharged once the payment plan has been completed to the satisfaction of the court. To learn more, contact a Florida Chapter 13 bankruptcy lawyer who can help.

You May Like: How Bad Is A Bankruptcy On Your Credit