Phase : Discharge Case Closed

Once the bankruptcy trustee has determined that thereâs no property they can sell for the benefit of creditors, theyâll file a Report of No Distribution. This lets everyone know that itâs a no-asset case and can happen anytime after the 341 meeting. No asset cases are typically closed by the court within 1 – 2 weeks or so.

If the trustee hasnât filed a Report of No Distribution, the case will stay open until the trustee signals to the court that theyâve completed their work on the case. How long this process takes can vary greatly, as it depends on what kind of property the trustee is selling and what else is going on in the case.

In some cases, all the trustee is waiting for is the filer’s tax return for the year their bankruptcy case is filed in. If no specific exemption for a tax refund exists, a portion of the refund may be used by the trustee to pay creditors.

Usually, not much else is required from the filer during this process. But, if the trustee asks for additional information or otherwise requests assistance with the sale of property, the filer has a duty to help.

Your Interview With The Official Receiver

If your bankruptcy is approved, youll have an interview with the official receiver. If youve presented your own bankruptcy petition, this might happen directly after the bankruptcy order is made. Alternatively, your letter from the official receiver may invite you to an interview either in person or by telephone. If offered a telephone interview you can ask to be interviewed in person, if you prefer.

If youve been made bankrupt by one of your creditors the official receiver may also contact you by telephone to find out if there is anything that needs to be sorted out urgently.

You must attend the interview and cooperate with the official receiver. If you do not, your bankruptcy could be extended beyond the normal 12 months and you could face an examination in court. The more organised you are, the more straightforward the process will be.

Before the interview, telephone the official receiver to confirm or rearrange the appointment let them know if:

- you require special facilities

- there is anything that needs to be sorted out urgently

- you need more time to gather the paperwork for the meeting

If you have been sent a questionnaire, fill it in, and note down anything you do not understand. If youre having a telephone interview, return it by the date given.

Collect together all the paperwork youve been asked to take to the interview or have with you during the telephone call.

Face-to-face interviews may take 2 to 3 hours.

After you arrive:

The examiner will:

What Is A Discharge In Bankruptcy

A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged. The discharge is a permanent order prohibiting the creditors of the debtor from taking any form of collection action on discharged debts, including legal action and communications with the debtor, such as telephone calls, letters, and personal contacts.

Although a debtor is not personally liable for discharged debts, a valid lien that has not been avoided in the bankruptcy case will remain after the bankruptcy case. Therefore, a secured creditor may enforce the lien to recover the property secured by the lien.

Recommended Reading: United Airlines Filed For Bankruptcy

What Happens Once I File For Bankruptcy

A bankruptcy discharge is the ultimate goal for bankruptcy filings — no matter what type you choose. In a bankruptcy discharge, the debtor is no longer required to pay what they owe on debts covered under the filing. What is discharged depends on the type of bankruptcy that was filed and the determination of the courts.

Its important to note that bankruptcy wont eliminate all debts. Some types of debt including student loans, alimony, child support, and some back taxes cant be discharged in a bankruptcy filing.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Also Check: What Is A Bankruptcy Petition Preparer

Also Check: Can You Rent An Apartment If You File Bankruptcy

How To Get Your Michigan Bankruptcy Resolved Quicker

One of the most common reasons a persons bankruptcy gets delayed is because they filed it without the help of an experienced bankruptcy attorney. Working with a lawyer from the beginning can avoid objections and get your bankruptcy resolved faster, with fewer visits to court. At John A. Steinberger & Associates, P.C., we are a full-service bankruptcy law firm in Southeast MI. We help debtors and families in Southfield, throughout Metro Detroit, and in the surrounding communities see their Chapter 7 and Chapter 13 bankruptcies through from start to finish. If you are considering bankruptcy, call us toll-free at or contact us online to schedule a free initial consultation.

Limitations Of Chapter 7 Discharges

Section 523 of the Bankruptcy Code describes the types of debt that cant be discharged in Chapter 7 proceedings, including:

- Domestic obligations such child support, alimony, and debts owed under a marriage settlement agreement

- Certain fines, penalties, and restitution resulting from criminal activities

- Certain taxes, including fraudulent income taxes, property taxes that came due within the previous year, and business taxes

- Court costs

- Debts associated with a DUI violation

- Condo or other homeowners association fees that were imposed after you filed bankruptcy

- Retirement plan loans

- Debts that werent discharged in a previous bankruptcy

- Debts you failed to list on your bankruptcy petition

Don’t Miss: Leasing A Car During Chapter 13

Factors That May Delay The Closing Of Your Case

The process described above may be delayed at several points. In most cases, issues that come up during a Chapter 7 bankruptcy may add several months to a case. In very complicated situations, a case may remain open for several years.

The most common things that delay a case include:

- failure to submit your certificate of completion of the financial management course in a timely manner

- the trustee investigating or selling an asset of yours.

Alternatives To Chapter 7

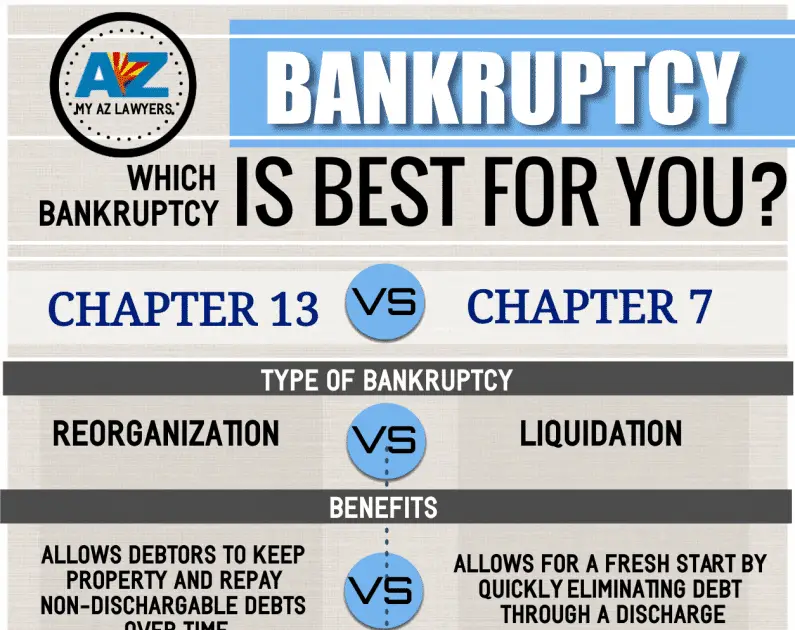

Debtors should be aware that there are several alternatives to chapter 7 relief. For example, debtors who are engaged in business, including corporations, partnerships, and sole proprietorships, may prefer to remain in business and avoid liquidation. Such debtors should consider filing a petition under chapter 11 of the Bankruptcy Code. Under chapter 11, the debtor may seek an adjustment of debts, either by reducing the debt or by extending the time for repayment, or may seek a more comprehensive reorganization. Sole proprietorships may also be eligible for relief under chapter 13 of the Bankruptcy Code.

In addition, individual debtors who have regular income may seek an adjustment of debts under chapter 13 of the Bankruptcy Code. A particular advantage of chapter 13 is that it provides individual debtors with an opportunity to save their homes from foreclosure by allowing them to “catch up” past due payments through a payment plan. Moreover, the court may dismiss a chapter 7 case filed by an individual whose debts are primarily consumer rather than business debts if the court finds that the granting of relief would be an abuse of chapter 7. 11 U.S.C. § 707.

Debtors should also be aware that out-of-court agreements with creditors or debt counseling services may provide an alternative to a bankruptcy filing.

Recommended Reading: How To File Bankruptcy For Free In Ohio

Wait For The Adjudicator’s Decision

After you submit your application, the adjudicator will decide either to make a bankruptcy order or reject your application. The adjudicator has 28 days to make their decision.

If they need more information about your case, they will contact you. If they do need to contact you, they will have 14 more days to make a decision.

If they decide to reject your application, you can ask them to review their decision. If they confirm their decision to reject your application after the review, you can appeal to the court against the decision.

To request an appeal, you need to submit form N161 to your local court that deals with bankruptcy. You can find form N161 on the GOV.UK website.

When Does The Discharge Occur

The timing of the discharge varies, depending on the chapter under which the case is filed. In a chapter 7 case, for example, the court usually grants the discharge promptly on expiration of the time fixed for filing a complaint objecting to discharge and the time fixed for filing a motion to dismiss the case for substantial abuse . Typically, this occurs about four months after the date the debtor files the petition with the clerk of the bankruptcy court. In individual chapter 11 cases, and in cases under chapter 12 and 13 , the court generally grants the discharge as soon as practicable after the debtor completes all payments under the plan. Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing. The court may deny an individual debtor’s discharge in a chapter 7 or 13 case if the debtor fails to complete “an instructional course concerning financial management.” The Bankruptcy Code provides limited exceptions to the “financial management” requirement if the U.S. trustee or bankruptcy administrator determines there are inadequate educational programs available, or if the debtor is disabled or incapacitated or on active military duty in a combat zone.

Recommended Reading: Wisconsin Bankrupcy Court

The Benefits Of Hiring A Bankruptcy Lawyer

While you may represent yourself when declaring bankruptcy, hiring a bankruptcy lawyer can help make the Chapter 7 bankruptcy process more manageable. An attorney from our firm will answer any questions and concerns you have as you go through the process. We can also handle any complexities your case involves.

Our attorney will do the following once you become our client:

- Help you understand the benefits and limitations of filing bankruptcy

- Recommend the best bankruptcy chapter for your financial situation

- Provide information on dischargeable and nondischargeable debts

- Review the bankruptcy consequences for your vehicle, home, and other property

- Define how bankruptcy could affect your taxes, credit report, etc.

Our bankruptcy lawyer will also help you complete and file necessary forms, advise you about continuing to pay debts, and familiarize you with relevant laws and procedures. While youre not required to have an attorney present at the Chapter 7 creditors meeting, we can represent you at this legal proceeding and any others during your case.

How Long Does Bankruptcy Last In Canada

If you complete the duties assigned to you during your bankruptcy and your trustee, your creditors, or the Superintendent of Bankruptcy do not make any objections to your discharge, you may get out of bankruptcy in as little as 9 months. Your duties during bankruptcy also include attending two counselling sessions to help you understand why you went bankrupt and to assist you in managing your financial affairs in the future.

See below for a summary of the time periods to obtain your discharge under various situations. The number of months indicated below start counting from the day you are officially bankrupt:

For 1st time bankruptcy:

- 9 months if you do not have earnings in excess of the income guidelines set out by the government based on the size of your household

- 21 months if you have surplus income and pay it to the trustee for your creditors

For 2nd time bankruptcy:

- 24 months if no surplus income

- 36 months if you have surplus income

In the above situations, your discharge happens automatically provided you fulfill all of the duties imposed on you.

There are situations where the court has to decide when you are discharged from bankruptcy, such as the following:

- If you owe personal income tax debt of $200,000 or higher and it represents at least 75% of your total unsecured proven debt

- If a creditor, the Superintendent of Bankruptcy, or your trustee oppose your discharge

In both of the scenarios, a court hearing will determine when you will be discharged from bankruptcy.

Recommended Reading: Filing For Bankruptcy In Il

The 6 Stages Of Bankruptcy

While most people know that bankruptcy is a way to discharge or eliminate debt, few know how it happens.

Not knowing what to expect during the bankruptcy process can make the idea more intimidating than it has to be. In reality, the filing for bankruptcy protection is not overly burdensome. And with help from an experienced and committed , you can usually go through the whole process with ease.

To discuss if bankruptcy is the right option for you, call today and set up a free and confidential consultation.

Filing The Bankruptcy Petition

The bankruptcy petition is the most complicated part of this process. The petition is an intricate document that describes and categorizes all of your outstanding debts using a strict format.

Generally, a bankruptcy lawyer will create this document for you after asking you questions about your financial situation and looking over your financial documents.

Once your lawyer collects the information and drafts the document, you formally file the petition with the courts. This officially starts the bankruptcy timeline.

Also Check: How Many Times Did Donald Trump File For Bankruptcy

Who Can Be Made Bankrupt

A bankruptcy order can be made for one of three reasons:

- you cannot pay what you owe and want to declare yourself bankrupt

- your creditors apply to make you bankrupt because you owe them £5000 or more

- an insolvency practitioner makes you bankrupt because youve broken the terms of an individual voluntary arrangement

How Do You File For Business Bankruptcy

Sole proprietors are the only business entity that can legally file for business bankruptcy without an attorney. Still, no business owner should file for bankruptcy on their own. The filing process is too arduous to be handled by someone simultaneously trying to run a business.

Step one is filing an official bankruptcy petition in https://www.uscourts.gov/about-federal-courts/court-role-and-structure your businesss local jurisdiction of the US Bankruptcy Court and paying the filing fee for your type of bankruptcy. This is followed by a slew of paperwork that depends on the type of bankruptcy and your business entity.

Dont Miss: How To Become A Bankruptcy Petition Preparer

Read Also: File Bankruptcy In Illinois

When Can I Start To Build Credit Again After Bankruptcy

You can begin to rebuild your credit as soon as you are discharged from your bankruptcy. This signals to lenders that you can manage your finances and are creditworthy.

You can apply for a credit card after you have been discharged from bankruptcy. Your financial institution may require that you apply for a secured credit card. With a secured credit card, you have to put down a deposit on the credit card amount. After paying your balance regularly for a period of time determined by your financial institution, you can get your deposit back and apply to have an actual credit card. The decision to give you a credit card is made by the bank or other company issuing the credit card.

Additionally, after your discharge, you should review your credit report and address any errors. For example, any debts discharged during bankruptcy cannot be reported on as debts you still owe, or are outstanding, etc. If they appear on your report, you should contact the credit agency and have them correct the information. Going forward, you can check your credit report on a yearly basis.

Get Your Certificate After Taking Financial Management Courses

You will have to take two financial management courses to receive your debt discharge. The second course must be completed within 60 days of your 341 Meeting of Creditors. After successful completion, youll receive a certificate. Even with a discharge, the case isnt closed until the court settles any outstanding issues.

Recommended Reading: Can You File Bankruptcy On Sba Loan

Making The Most Of The Time Before The Process Of Filing Bankruptcy Begins

The process of filing bankruptcy starts well before your case is opened in court. When you consider how long a bankruptcy takes from beginning to end, you need to consider the time spent gathering all your information and putting your paperwork together.

The process starts with an initial consultation with an experienced Michigan bankruptcy attorney. They will review your situation, including what you owe and what you earn, to help you determine whether to file a Chapter 7 bankruptcy or a Chapter 13 bankruptcy payment plan. Once that choice is made, you will be set on one of two timelines that could take as little as a few months, or as much as several years.

Then, you and your bankruptcy attorney will work together to gather the documentation needed to file the bankruptcy petition. You can help make the most of this time by gathering the documents needed to file even before your consultation, and by promptly responding to your lawyers questions. It will also be up to you to complete both the pre-filing credit counseling and the post-filing debtor education course, to make sure your bankruptcy is discharged on time.