Why The Budget Deficit Matters

The federal deficit and debt are concerns for the country because the majority of the national debt is held by those who have purchased Treasury notes and other securities. A continuous deficit adds to the national debt, increasing the amount owed to security holders.

The concern is that the country won’t be able to pay its debt off. Debt holders demand higher interest to compensate for the higher risk when that happens. This increases the cost of all interest rates and can cause a recession.

Understand Inflation And How It Affects You

- Cost of Living: As food prices rise, eating is becoming increasingly expensive. We took a close look at five New Yorkers food and drink habits to see where the effects are most felt.

- Inflation Vanguard: Inflation has been worse in Southern cities. What can their struggles teach the rest of the country?

Rapidly growing deficits as far as the eye can see are not good for wages, economic growth or our ability to invest in the future for the next generation, said Michael A. Peterson, the chief executive officer of the Peter G. Peterson Foundation, which promotes deficit reduction.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, lamented that trillion-dollar deficits appeared to be here to stay and that by 2031 the annual shortfall would be back to $2 trillion, according to the C.B.O.

This is no time to break out the champagne glasses, Ms. MacGuineas said.

Which President Had The Highest Budget Deficit

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

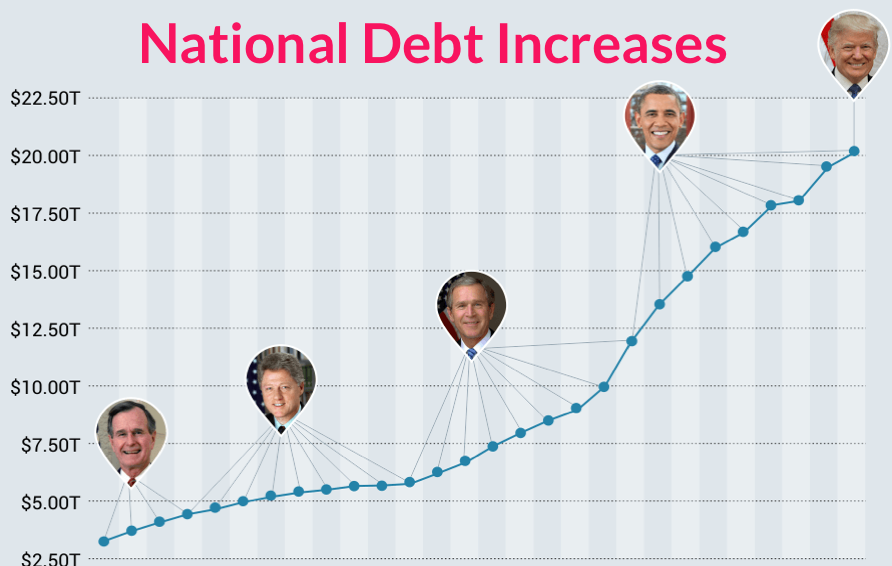

Which president ran the largest budget deficits? There are two ways to answer that question. The most popular way is to add up the deficits for each year the president was in office.

However, a president doesnt control the first years deficit. The previous presidents federal budget is still in effect for most of that year. The federal government’s fiscal year runs from October 1 through September 30. As a result, a new president has no influence on the deficit for January through September of that first year in office.

A better way to calculate the deficit is by looking at each presidents budget and then adding the deficits for those budgets.

You May Like: What Happens When A Person Declares Bankruptcy

Tracking The Federal Deficit: December 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $143 billion in December, the third month of fiscal year 2021. This deficitthe difference between $346 billion of revenue and $489 billion of spendingwas made greater because January 3 fell on a Sunday, causing some payments normally made on that day to instead be made in December. If it were not for this timing shift, Decembers deficit would have been $96 billion, still $55 billion greater than that of December 2019. The deficit so far in fiscal year 2021 has climbed to $572 billion, which is $215 billion more than at this point last year. While revenues in these months were nearly unchanged from last year, outlays have grown by 16% .

Analysis of notable trends: December extended the pattern of fiscal year 2021, with little year-over-year change in revenue but a 17% rise in spending. Of all outlays, unemployment insurance benefitswhich totaled $3 billion last December but $28 billion this Decembercontributed the most to the spending increase. This has been a trend: Unemployment insurance benefits have caused almost 40% of greater cumulative spending from this point last year, soaring from $7 billion in the first three months of fiscal year 2020 to $80 billion so far this fiscal year. Decembers spending on Medicaid and Social Security benefits further added to the deficit.

Revenues rose 3% from last December, thanks to greater individual income and payroll tax receipts.

Tracking The Federal Deficit: February 2020

The Congressional Budget Office reported that the federal government generated a $235 billion deficit in February, the fifth month of fiscal year 2020. Februarys deficit is a $1 billion increase from the $234 billion deficit recorded a year earlier in February 2019. Februarys deficit brings the total deficit so far this fiscal year to $625 billion, which is 15% higher than the same period last year . Total revenues so far in FY2020 increased by 7% , while spending increased by 9% , compared to the same period last year.

Analysis of Notable Trends inThis Fiscal Year to Date: Through the first five months of FY2020, individual income tax refunds fell by 6% , increasing net revenue, as the timing of refund payments varies annually. Customs duties rose by 14% , partly due to tariffs imposed by the current administration, primarily on imports from China. On the spending side, net interest on the public debt increased by 6% even amidst historically low interest ratesbecause the overall debt burden has risen. Outlays for the Department of Veterans Affairs rose by 7% because of rising participation in veterans disability compensation, growing average disability benefits, and increasing spending on a program that helps veterans receive treatment in non-VA facilities.

Also Check: When Did My Bankruptcy Get Discharged

What Are The Options To Reduce The Deficit

President Trump has promised to reduce the trade deficit, though the administrations plans remain unclear. Trumps original suggestion, slapping high tariffs on Chinese goods, would likely be ineffective, but some economists say negotiating better access to the Chinese market for U.S. exporters could help. He also promised to label China a currency manipulator, a designation that experts say would have had few concrete effects, but ultimately changed his mind. Commerce Secretary Wilbur Ross has argued that the problem is high tariffs, subsidies, and other barriers facing U.S. goods in China and Europe. He says that U.S. policy will focus on stepping up trade remedy actions under WTO rules and making better deals with trade partners.

CFRs Alden has written that unilateral measures to block imports like steel due to concerns over foreign subsidies would likely anger U.S. allies and harm many U.S. industries. However, he says, there is a history going back to Presidents Richard Nixon and Ronald Reagan of U.S. leaders threatening such measures to induce other countries to back off their own trade-distorting policies that Trump might learn from. Nixon and Reagan both threatened allies like Japan and Germany with unilateral tariffs to persuade them to revalue their currencies.

The Tax Cuts And Jobs Act

Trump decided to spur the growth rate by announcing a strategy used by many other presidents, particularly Republican administrations. The outline for what would become the Tax Cuts and Jobs Act was released within his first 100 days in office, and was signed into law on December 22, 2017.

This cut the corporate tax rate from 35 to 21 percent beginning in 2018. The top individual income tax rate dropped to 37 percent. It doubled the standard deduction but eliminated personal exemptions.

Unfortunately for President Trump, his tax cuts won’t stimulate the economy enough to make up for lost tax revenue. The Laffer curve indicates that tax cuts only stimulate economic growth when tax rates are above 50 percent.

Trumpâs second promise was to eliminate waste in federal spending. Trump and the National Debt He certainly lent credibility to this argument in the way he ran his campaign. By using social media and his numerous campaign rallies, he achieved as much exposure, if not more, than other candidates who had to gain visibility using expensive ad buys.

Trump wasnât wrong in wanting to attack waste in federal spending. Both Presidents George W. Bush and Barack Obama had similar goals.

Don’t Miss: How To Qualify For Bankruptcy In California

Is That Considered A Large Deficit

Yes. By any measure, the projected 2020 deficit is very large. Deficits over the last 50 years have averaged just 3% of GDP. Even during the Great Recession, the largest deficit recorded was just 9.8% of GDP. Even though the economy was reasonably strong before the pandemic hit, the deficit was already elevated by historical standards, largely because of the big 2017 tax cut. The COVID-19 recession and the congressional response to it have caused it to balloon.

Impact Of Tcja Cuts Becoming Permanent

Congress could choose to make the individual cuts permanent before they expire. If that happens, the cost of the tax cuts would rise to $2.3 trillion instead of $1.5 trillion over the next 10 years.

A separate analysis found that while the TCJA would result in increased economic growth, all of the revenue from this growth would go toward paying for the cuts. The cost is too high for the tax cuts to pay for themselves. Instead, the deficit and debt would continue to grow.

Read Also: How To Find Out When Bankruptcy Was Discharged

How Has The Us Trade Deficit Changed Over Recent Decades

Todays $621 billion deficit, representing about 3 percent of gross domestic product , is down from a 2006 peak of more than $760 billion, which at the time was over 5 percent of GDP. The deficit has averaged $535 billion since 2000, much higher than in previous decades, when it accounted for well below 2 percent of GDP. The United States ran either a surplus or a small deficit through the 1960s and 1970s, after which a large deficit opened in the 1980s and continued to expand through the 1990s and 2000s.

The deficit with China expanded dramatically beginning in the early 2000s from an average of $34 billion in the 1990s. Some economists refer to this as the China Shock and attribute it to the unexpectedly rapid growth of Chinas export manufacturing sector in the late 1990s. This happened as Beijing undertook deep economic reforms and implemented policies to subsidize production, accelerate industrialization, and boost exports. In the process China earned the moniker the worlds factory. Economists also note the acceleration of Chinese export growth after the countrys entry into the World Trade Organization in 2001.

How Does Us Debt Compare To That Of Other Countries

The United States debt-to-GDP ratio is among the highest in the developed world. Among other major industrialized countries, the United States is behind only Japan.

The pandemic has sharply increased borrowing around the world, according to the International Monetary Fund. Among advanced economies, debt as a percentage of GDP has increased from around 75 percent to nearly 95 percent, driven by double-digit increases in the debt of the United States, Canada, France, Italy, Japan, Spain, and the United Kingdom .

The United States has long been the worlds largest economy, with no record of defaulting on its debt. Moreover, since the 1940s it has been the worlds reserve-currency country. As a result, the U.S. dollar is considered the most desirable currency in the world.

High demand for the dollar has helped the United States finance its debt, as many investors put a premium on holding low-risk, dollar-denominated assets such as U.S. Treasury bills, notes, and bonds. Steady demand from foreign creditorslargely central banks adding to their dollar reserves, rather than market investorsis one factor that has helped the United States to borrow money at relatively low interest rates. This puts the United States in a more secure position for a fiscal fight against COVID-19 compared to other countries.

Don’t Miss: Can A Home Equity Loan Be Discharged In Bankruptcy

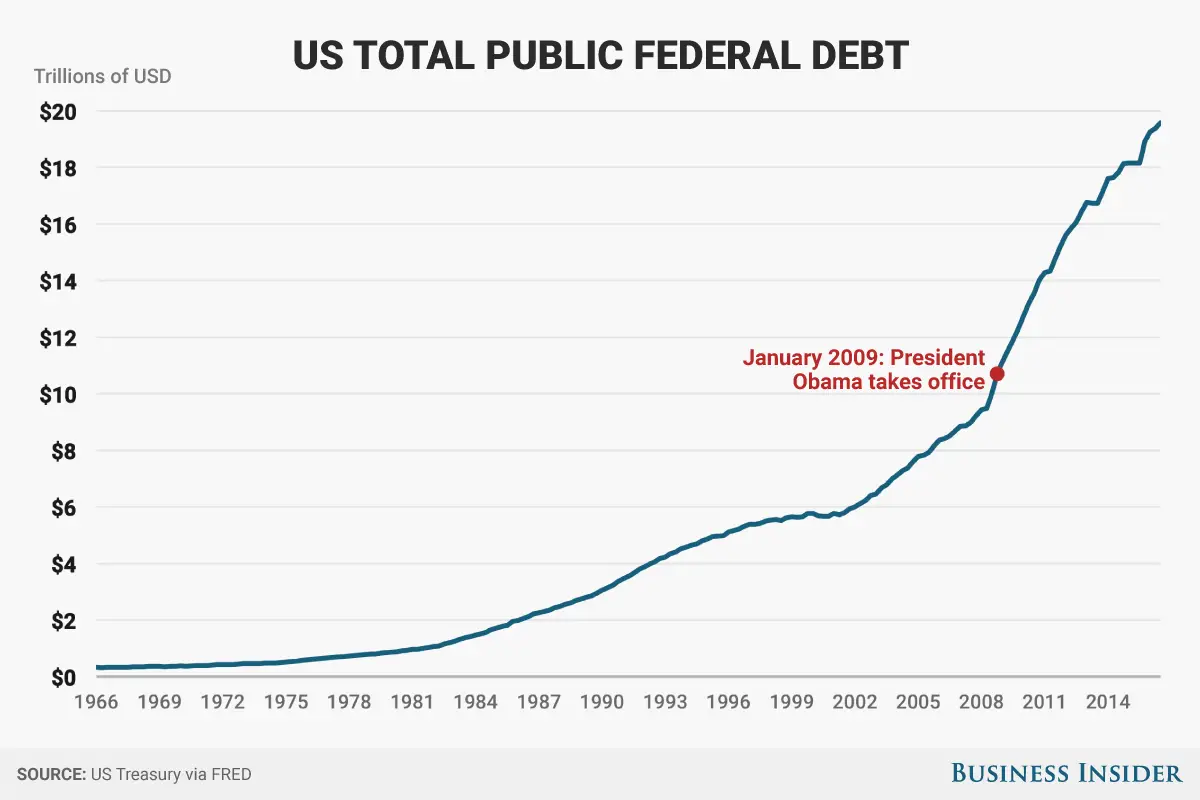

National Debt Of The United States

| This article needs to be . Please help update this article to reflect recent events or newly available information. |

| This article is part of a series on the |

|

|

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms “national deficit” and “national surplus” usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

During the COVID-19 pandemic, the federal government spent trillions in virus aid and economic relief. The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945.

Tracking The Federal Deficit: December 2018

The Congressional Budget Office reported that the federal government generated an $11 billion deficit in December, the third month of Fiscal Year 2019, for a total deficit of $317 billion so far this fiscal year. If not for timing shifts of certain payments, the deficit in December would have been roughly $32 billion, according to CBO. Decembers deficit is 52 percent lower than the deficit recorded a year earlier in December 2017. Total revenues so far in Fiscal Year 2019 increased by 0.1 percent , while spending increased by 9.4 percent , compared to the same period last year.

Analysis of Notable Trends in December 2018: Revenue from customs duties spiked by 83 percent from October-December 2018, relative to the same period in 2017, due to the administrations imposition of new tariffs. Conversely, corporate income tax revenue declined by 15 percent from October-December 2018 relative to the same period in 2017. This dip mainly reflects the reduction of corporate tax rates enacted in the Tax Cuts and Jobs Act of 2017. On the spending side, interest payments on the federal debt in December 2018 rose by 47 percent relative to December 2017.

You May Like: How To Find Bankruptcies On Public Records

Tracking The Federal Deficit: January 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $165 billion in January, the fourth month of fiscal year 2021. This months deficitthe difference between $552 billion of spending and $387 billion of revenuewas $132 billion greater than last Januarys. But federal finances deteriorated more than the raw numbers suggest. Adjusting for shifts in the timing of some payments, the deficit this January would have been $211 billion greater than last Januarys. The federal deficit has now reached $738 billion so far this fiscal year, an increase of 120% over the same point last year . Compared to the same point last fiscal year, cumulative revenues have ticked up 1%, but cumulative spending has surged 27%mostly due to the COVID-19 pandemic and the federal response to it.

Increased spending so far this fiscal year has likewise mostly resulted from pandemic relief. About 60% of the increase in cumulative year-to-date spending has come from refundable tax credits and unemployment insurance benefits . Outlays from the Public Health and Social Services Emergency Fund are also up $26 billion compared to the first four months of fiscal year 2020, and Medicaid spending is $29 billion greater.

Revenues rose 4% from last January, thanks to greater revenue from individual income, payroll, and corporate income tax revenue.

Tracking The Federal Deficit: June 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $173 billion in June, the ninth month of fiscal year 2021. Junes deficit was the difference between $450 billion in revenue and $623 billion in spending.

So far this fiscal year, the federal government has run a cumulative deficit of $2.2 trillion, the difference between $3.1 trillion in revenue and $5.3 trillion in spending. This deficit is nearly triple the shortfall over the same period in FY2019 , but is 19% lower than at the same point in FY2020. This is the first time in FY2021 that the cumulative deficit has decreased year-over-year.

Analysis of Notable Trends: Thus far in FY2021, year-over-year comparisons of deficit levels have largely reflected the trajectory of the COVID-19 pandemic and subsequent federal response. BPC expects this trend to continue through the rest of the fiscal year.

Cumulative year-to-date outlays are up 6% compared to the first nine months of FY2020 and are 58% greater than at this point in FY2019. These changes are indicative of continued spending towards COVID-19 relief programsin particular, refundable tax credits and supplemental unemployment compensationas every month to date in the current fiscal year has contained pandemic-related expenditures, whereas only March-June did for the relevant period last year.

Don’t Miss: What Is Exempt In Chapter 7 Bankruptcy

Tracking The Federal Deficit: November 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $193 billion in November, the second month of fiscal year 2022. This deficit was the difference between $474 billion of spending and $281 billion of revenue. Novembers deficit was 33% larger than the deficit recorded in November 2020. However, spending last November was artificially lowered by the fact that November 1 fell on a weekend, shifting $63 billion worth of payments into late October. If not for the timing shift, this Novembers deficit would have been 7% less than that of November last year.

Analysis of notable trends: Through the first two months of FY2022, the federal government has run a deficit of $358 billion$71 billion less than at this point last yearas spending rose 4% and revenues surged 24% this year, reflective of the nations ongoing economic recovery.